New Zealand Dollar fell significantly in today’s Asian session, establishing itself as the day’s most underperforming currency at this point. The decline was sparked by RBNZ’s decision to maintain interest rate at 5.50%, a move that dashed the hopes of a small segment of the market that had anticipated a rate hike.

Momentum of the selloff gained further strength following comments from RBNZ Governor Adrian Orr during the post-meeting press conference. Orr pointed out that a rate hike was discussed, the committee reached a “strong consensus” on the current level of interest rates being sufficiently restrictive. This stance was bolstered by more optimistic economic data observed since November, which gave the committee additional confidence in the economic and inflation outlook.

Amidst these developments, Australian Dollar also found itself on a pressured, emerging as the session’s second weakest, following lower than expected monthly CPI readings. Conversely, Dollar is having a notable rebound, leading the pack in terms of performance, tailed by Japanese Yen and Canadian Dollar. European majors are mixed, with Swiss Franc trading on the weaker side.

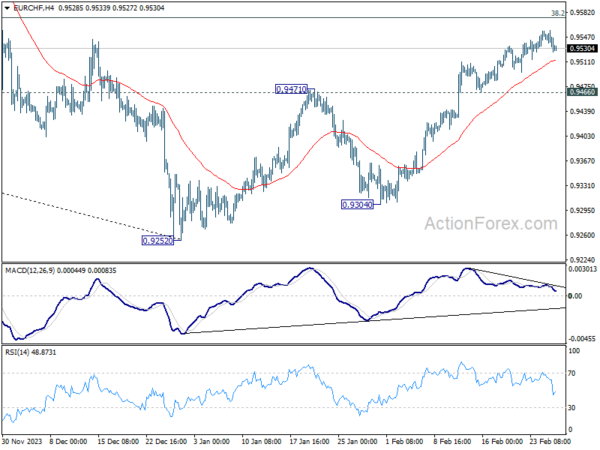

Technically, EUR/CHF continued to lose upside momentum as seen in bearish divergence condition in 4H MACD. Considering that it’s reasonably close to 38.2% retracement of 1.0095 to 0.9252 at 0.9574, strong break of 55 4H EMA (now at 0.9513) will raise the chance of short term topping. Further break of 0.9466 will argue that rise from 0.9252 has completed as a three-wave corrective move, and turn outlook bearish for this support.

In Asia, at the time of writing, Nikkei is down -0.02%. Hong Kong HSI is down -0.62%. China Shanghai SSE is down -0.38%. Singapore Strait Times is down -0.28%. Japan 10-year JGB yield is up 0.003 at 0.698. Overnight, DOW fell -0.25%. S&P 500 rose 0.17%. NASDAQ rose 0.37%. 10-year yield rose 0.016 to 4.315.

RBNZ keeps OCR at 5.50%, door still open for another hike

RBNZ decided to hold Official Cash Rate unchanged at 5.50%. The central bank expressed its confidence that the current OCR level is effectively restraining demand. However, it underscored the need for a “sustained decline in capacity pressures” to ensure that inflation re-aligns with 1 to 3% target range. This necessitates maintaining OCR “at a restrictive level for a sustained period of time”.

The updated economic forecasts in the MPS projects that CPI inflation will return to the target band by Q3 this year, then falls further to 2% midpoint by Q4 2025. These projections indicate a “slightly lower” inflation rate over the forecast period compared to previous estimates made in November.

Regarding future movements, the central bank anticipates OCR path to echo the trajectory outlined in the November MPS. It suggests OCR could peak at 5.6% in Q2 this year, leaving room for a marginal possibility of another rate hike.

Absent further increases, interest rate reductions are expected to commence in the Q2 2025, with OCR gradually decreasing to 3.2% by Q1 of 2027.

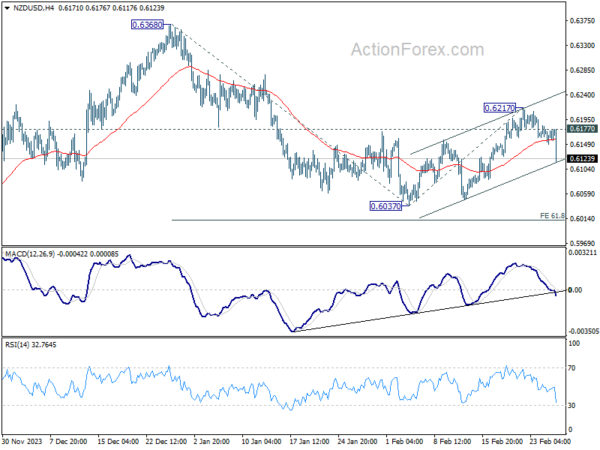

NZD/USD dives after RBNZ, heading back to 0.6

NZD/USD’s fall from 0.6217 accelerates after RBNZ left OCR unchanged. Current development affirms the case that corrective recovery from 0.6037 has completed at 0.6217 already. Further decline is in favor as long as 0.6177 minor resistance holds. Firm break of near term channel support will bring retest of 0.6037 will argue that decline from 0.6368 is ready to resume through 0.6037 to 61.8% projection of 0.6368 to 0.6037 from 0.6217 at 0.6012.

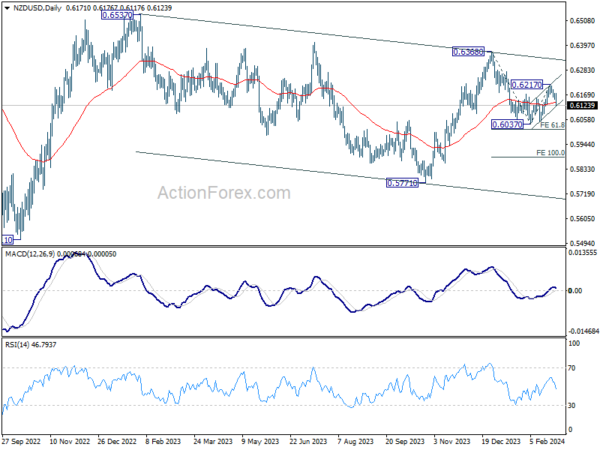

In the bigger picture, fall from 0.6368 is seen as the third leg of the corrective pattern from 0.6537 (2023 high). Deeper decline would be seen to 0.5771 (2023 low) in the medium term, and possibly below. But break of 0.5511 long term bottom (2021 low) is not envisaged.

Australia monthly CPI unchanged at 3.4% in Jan, trimmed mean CPI down to 3.8%

Australia monthly CPI was unchanged at 3.4% yoy in January, below expectation of a rise to 3.6% yoy. CPI excluding volatile items and holiday travel slowed from 4.2% yoy to 4.1% yoy. Trimmed mean CPI also slowed from 4.0% yoy to 3.8% yoy.

The detailed breakdown reveals that the main inflationary pressures came from specific sectors: Housing costs rose by 4.6%, food and non-alcoholic beverages by 4.4%, alcohol and tobacco by a significant 6.7%, and insurance and financial services saw the highest increase at 8.2%.

These increases were somewhat mitigated by a decrease in the recreation and culture sector, notably a -1.7% drop, primarily driven by a -7.1% fall in Holiday travel and accommodation, which provided a counterbalance to the overall annual inflation rate.

Fed’s Bowman: Not time for rate cuts yet

Fed Governor Michelle Bowman articulated that Fed is “not at that point” to initiate rate cuts. Additionally, she expressed readiness to increase rates further if progress on inflation “has stalled or reversed”.

“Should the incoming data continue to indicate that inflation is moving sustainably toward our 2% goal, it will eventually become appropriate to gradually lower our policy rate to prevent monetary policy from becoming overly restrictive,” Bowman said in a speech overnight.

However, “in my view, we are not yet at that point,” she emphasized. “Reducing our policy rate too soon could result in requiring further future policy rate increases to return inflation to 2 percent in the longer run.”

“While the current stance of monetary policy appears to be at a restrictive level that will bring inflation down to 2 percent over time, I remain willing to raise the federal funds rate at a future meeting should the incoming data indicate that progress on inflation has stalled or reversed,” Bowman added.

Looking ahead

Swiss Credit Suisse economic expectations and Eurozone economic sentiment indicator will be released. Later in the day, Canada will release current account. US will release Q4 GDP revision and goods trade balance.

AUD/USD Daily Report

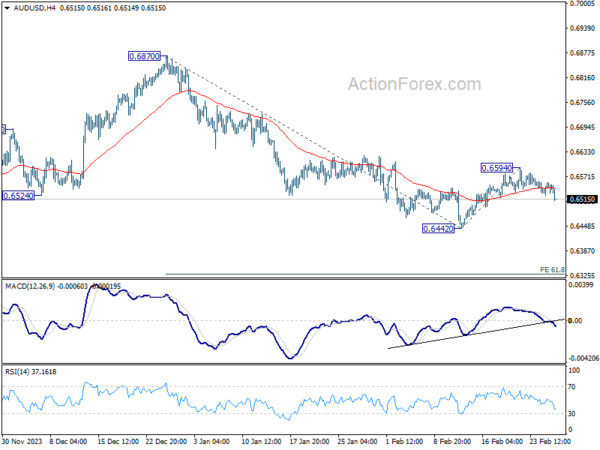

Daily Pivots: (S1) 0.6527; (P) 0.6542; (R1) 0.6560; More…

AUD/USD’s break of 0.6520 minor support suggests that corrective rebound from 0.6442 haws completed at 0.6594 already, after rejection by 55 D EMA. Intraday bias is back on the downside for retesting 0.6442 low first. Firm break there will resume whole decline from 0.6870, and target 61.8% projection of 0.6870 to 0.6442 from 0.6594 at 0.6329 next. For now, risk will stay on the downside as long as 0.6594 resistance holds, in case of recovery.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Monthly CPI Y/Y Jan | 3.40% | 3.60% | 3.40% | |

| 00:30 | AUD | Construction Work Done Q4 | 0.70% | 0.80% | 1.30% | |

| 01:00 | NZD | RBNZ Interest Rate Decision | 5.50% | 5.50% | 5.50% | |

| 09:00 | CHF | Credit Suisse Economic Expectations Feb | -19.5 | |||

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Feb | 96.6 | 96.2 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Feb | -9.2 | -9.4 | ||

| 10:00 | EUR | Eurozone Services Sentiment Feb | 9 | 8.8 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Feb F | -15.5 | -15.5 | ||

| 13:30 | CAD | Current Account Q4 | -1.9B | -3.22B | ||

| 13:30 | USD | GDP Annualized Q4 P | 3.30% | 3.30% | ||

| 13:30 | USD | GDP Price Index Q4 P | 1.50% | 1.50% | ||

| 13:30 | USD | Goods Trade Balance (USD) Jan P | -88.1B | -87.9B | ||

| 13:30 | USD | Wholesale Inventories Jan P | 0.20% | 0.40% | ||

| 15:30 | USD | Crude Oil Inventories | 3.1M | 3.5M |