Central banks in Canada and the United States will be closely watching labour market data on Friday after May inflation numbers sent some mixed signals, broadly surprising to the upside in Canada and the downside in the U.S.

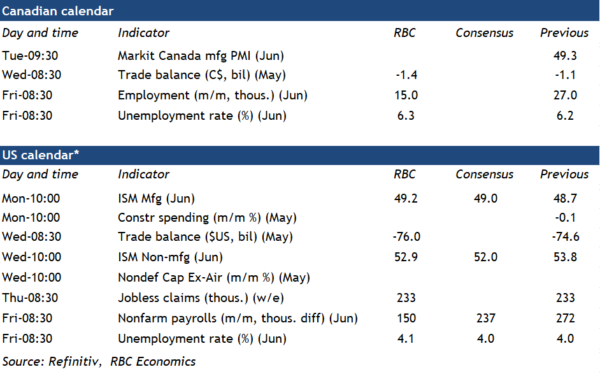

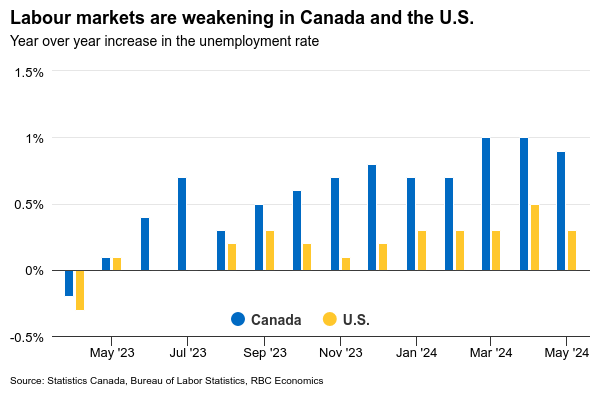

The tick-up in Canadian inflation in May followed a string of downside surprises this year, and further signs of softening in labour markets would help to reassure the Bank of Canada that inflation pressures are more likely to drift lower going forward. We expect employment continued to inch higher, but alongside another increase in the unemployment rate to 6.3% in June as labour force growth outpaced hiring again because the population continued to surge. Wage growth in the labour force survey has remained persistently high, but other estimates of wages from business payrolls have been showing more signs of softening. The combination of fewer job openings – which continued to decline into June – and higher unemployment is tilting bargaining power in wage negotiations away from workers. Overall, a softer labour market report should take some of the heat away from the upside CPI surprise in May. We continue to expect inflation will drift broadly lower this year and look for another 25 basis point cut from the BoC at its next meeting in July to build on the first cut in June.

We expect U.S. labour market data will also start to show more signs of cooling in June. Payroll employment growth has remained strong, but job openings, hire and quits rates have all been showing persistent slowing in labour demand for months. The unemployment rate—albeit rising slower than in Canada—has increased by 0.6% from a recent trough in April 2023 and wage growth has also slowed. Overall, we think payroll employment growth will stay at a stronger 237,000 in June, similar to the average gain of 250,000 in the three months before but expect the unemployment rate will rise again to 4.1%. Gradually cooling labour market conditions, however, are not expected to prompt an immediate response from the Fed, who is still expected to cut rates in December, contingent on a trail of slower inflation readings from now.

Week ahead data watch

We expect Canada’s trade deficit widened to $1.4 billion in May from a $1.1 billion shortfall in April with a 7% drop in oil prices weighing on exports. Imports also likely declined with domestic demand remaining soft. Machinery and equipment import volumes have been running ~4% below year-ago levels in a sign amid sluggish business investment.

Advance estimates in the U.S. showed a 2.7 billion widening in the goods trade deficit in May that we expect will be broadly reflected in a wider overall trade balance for the month. The advance indicators report pointed to a 2.7% drop in goods exports and a 0.7% drop in imports.