The initial trend in the third quarter results season reflects sustained year-on-year double-digit growth in aggregate revenue and net profit, driven by banking and finance companies.

For a sample of 215 companies that have so far declared October-December results, revenue grew by 11.2%, while net profit rose by 14.2%.

In the year-ago quarter, revenue expansion was 19% and profit growth stood at 6.5%.

Third quarter growth for this fiscal was lower than in July-September, when revenue and profit had risen by 12.1% and 24.5%, respectively.

A stellar performance by the lending sector drove overall growth of the sample. At the aggregate level, revenue and profit of banks that have declared results for the quarter so far shot up on-year by 50.5% and 39%, respectively. For finance companies, revenue and profit grew 33.1% and 59.2%, respectively.

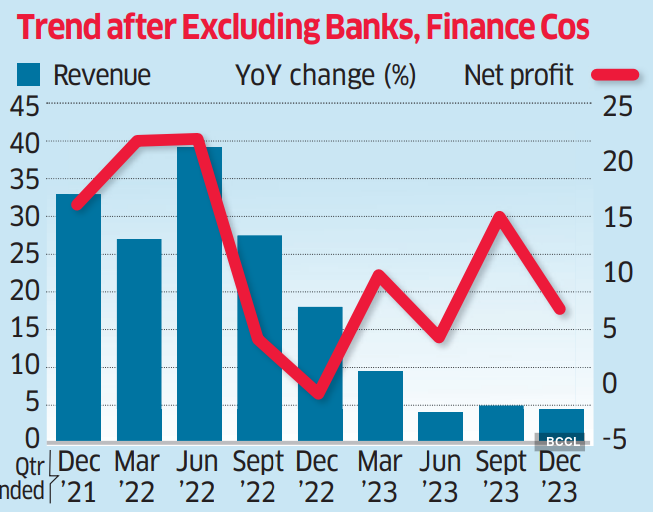

Excluding the banks and finance companies, the sample’s revenue and profit growth for the December quarter moderated to 4.5% and 6.8%, respectively.

Lenders reported pressure on the margin front though. The net interest margin (NIM) was squeezed as deposit rates rose at a faster pace than the lending rates.

This pulled down the overall sample’s operating margin by 70 basis points year-on-year to 20.9% in the latest December quarter, the lowest in five quarters. Excluding lenders, the sample’s operating margin improved by 60 basis points year-on-year to 17.8%. A basis point is 0.01 percentage point.

Reliance Industries (RIL), the country’s largest company based on revenue and market cap, influenced the overall performance, as it contributed 33% and 19.9% to the revenue and net profit of the total sample.

RIL’s revenue from operations grew by 3.6% year-on-year to Rs 2.3 lakh crore, while net profit rose by 10.3% to Rs 19,641 crore. Excluding RIL, the sample’s revenue and profit growth improved to over 15%.

At the beginning of the quarterly results season, analysts had predicted that a handful of sectors would propel growth. “Overall earnings growth is anticipated to be driven once again by domestic cyclicals, such as automobiles and BFSI, which are expected to post 35% and 17% YoY growth,” Motilal Oswal Financial Services said in a preview report. The brokerage estimated a 20% growth in aggregate profit for the companies under its coverage in the December quarter.

In the coming weeks, as more companies from across sectors declare quarterly performance, the trend in India Inc’s quarterly results will gain clarity.