London based brokerage technology solutions provider MahiMarkets has announced the introduction of MFXTradeHaven, a one-stop trading solution designed exclusively for ambitious brokers handling monthly volumes of less than approximately $5 billion.

Users can now reduce their hedging costs, streamline their pricing, risk management, and bridging technology requirements, all with access to detailed trading analytics at an affordable monthly fee.

MahiMarkets said that as the financial brokerage industry continues to mature, smaller A-book and B book brokers face a myriad of challenges. A-book brokers are finding commissions under pressure, making it all the more painful to be passing on the spread in their flow. However, as the B-bookers know, the limited offset in smaller volumes makes for uncomfortable Sharpe ratios with volatile cash flows. Both face costly connectivity and hedging solutions.

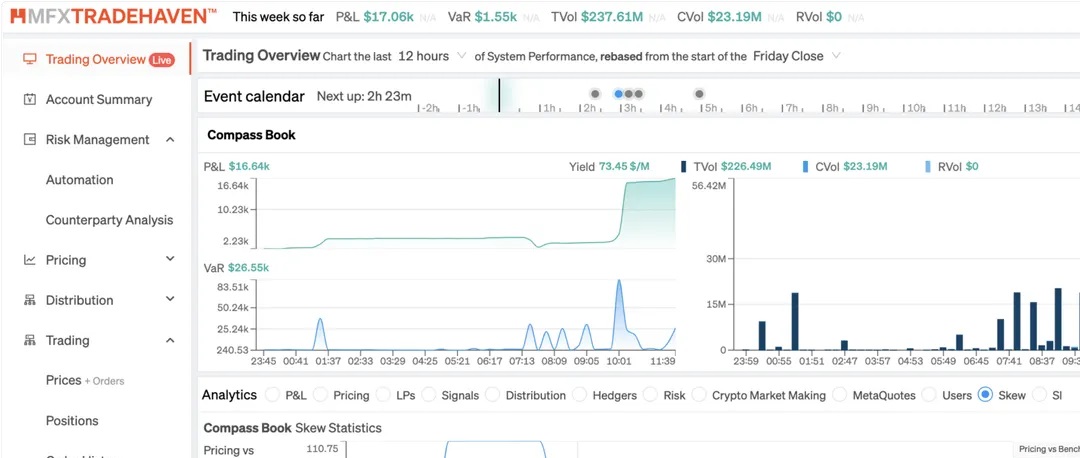

The company stated that this latest package is a small but mighty version of bigger sister MFX Compass, which brokers use at scale. It still grants users access to a range of benefits and features, including:

Optimised Flow Management

MFXTradeHaven leverages cutting-edge technology and methods to categorise and cleanse flow efficiently, ensuring that even smaller brokers with limited flow can benefit from advanced strategies.

Cost-Effective Hedging

Users of MFXTradeHaven have access to a specially crafted dark pool, allowing trades to be matched with other ‘residents’ backed by MFXTradeHaven’s specially selected partners. This allows smaller B book brokers to enjoy the benefits of efficient hedging without breaking the bank.

Comprehensive Multi-Tenant Trading Package

MFXTradeHaven offers a comprehensive package with excellent pricing, execution, risk management, and bridging technology – all in one streamlined solution hosted in one multi-tenant environment with automatic failovers. This integrated approach ensures that brokers can focus on growth without the burden of managing multiple tools.

Revenue Boosting Strategies

MFXTradeHaven members gain access to strategies that can help them achieve an additional revenue stream of $10-20 per million and a host of other cost savings.

Competitive Monthly Fees

With monthly fees starting from $15,000, MFXTradeHaven provides cost-effective access to powerful tools and strategies.

Robust Protection Measures

Our platform has robust protection measures, safeguarding businesses from coordinated trading and unforeseen risks.

Risk management

Intelligent hedgers using highly optimised signal information refine the approach much faster than humans, ensuring efficient and effective hedging.

Advanced Bridging Technology

Access an advanced ultra-low latency connectivity bridge.

Co-founder and Co-CEO Susan Cooney proudly welcomes the new addition to the MahiMarkets product suite, saying,

Co-founder and Co-CEO Susan Cooney proudly welcomes the new addition to the MahiMarkets product suite, saying,

“We are fully aware of the challenges retail brokers face as the retail user becomes more sophisticated. We created MFXTradeHaven because we believe everyone should have access to the protective tools, advanced pricing, and risk management methods that genuinely make a difference in revenue and reduce the barrier to entry. Dark pools are common in the institutional space, so we are excited about bringing this benefit to retail brokers.”

About MahiMarkets

Established in 2010, MahiMarkets combines extensive trading knowledge and robust engineering to provide technology solutions for various market participants across asset classes. Clients can implement and utilise sophisticated signal-driven software to craft their rates, protect their business from arbitrage and manage risk effectively, driving PnL and lowering costs.