The Union Budget 2024-25, presented by Finance Minister Nirmala Sitharaman, introduces significant tax changes aimed at providing relief to taxpayers and simplifying the tax structure. While measures like increased standard deductions and pension benefits offer substantial relief, other changes, such as the hike in capital gains tax and Securities Transaction Tax (STT), have raised concerns among investors. Here’s a detailed breakdown of the major proposed changes.

Income Tax Reliefs

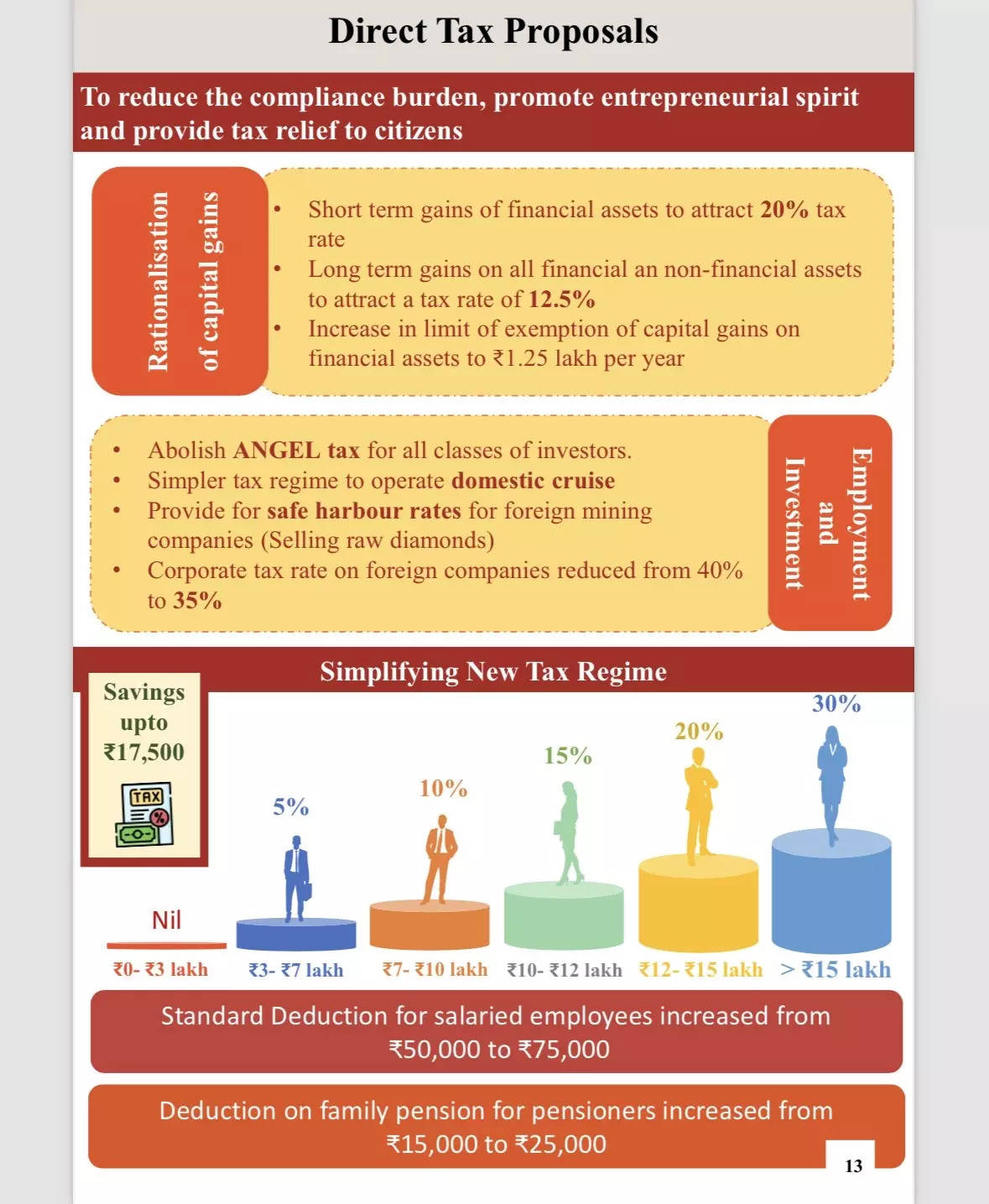

One of the most notable changes is the increase in the standard deduction for salaried employees opting for the new tax regime, which has been raised from Rs 50,000 to Rs 75,000. This move is expected to benefit around 4 crore salaried individuals and pensioners, allowing them to save up to Rs 17,500 annually in taxes. Additionally, the deduction on family pension for pensioners has been enhanced from Rs 15,000 to Rs 25,000.

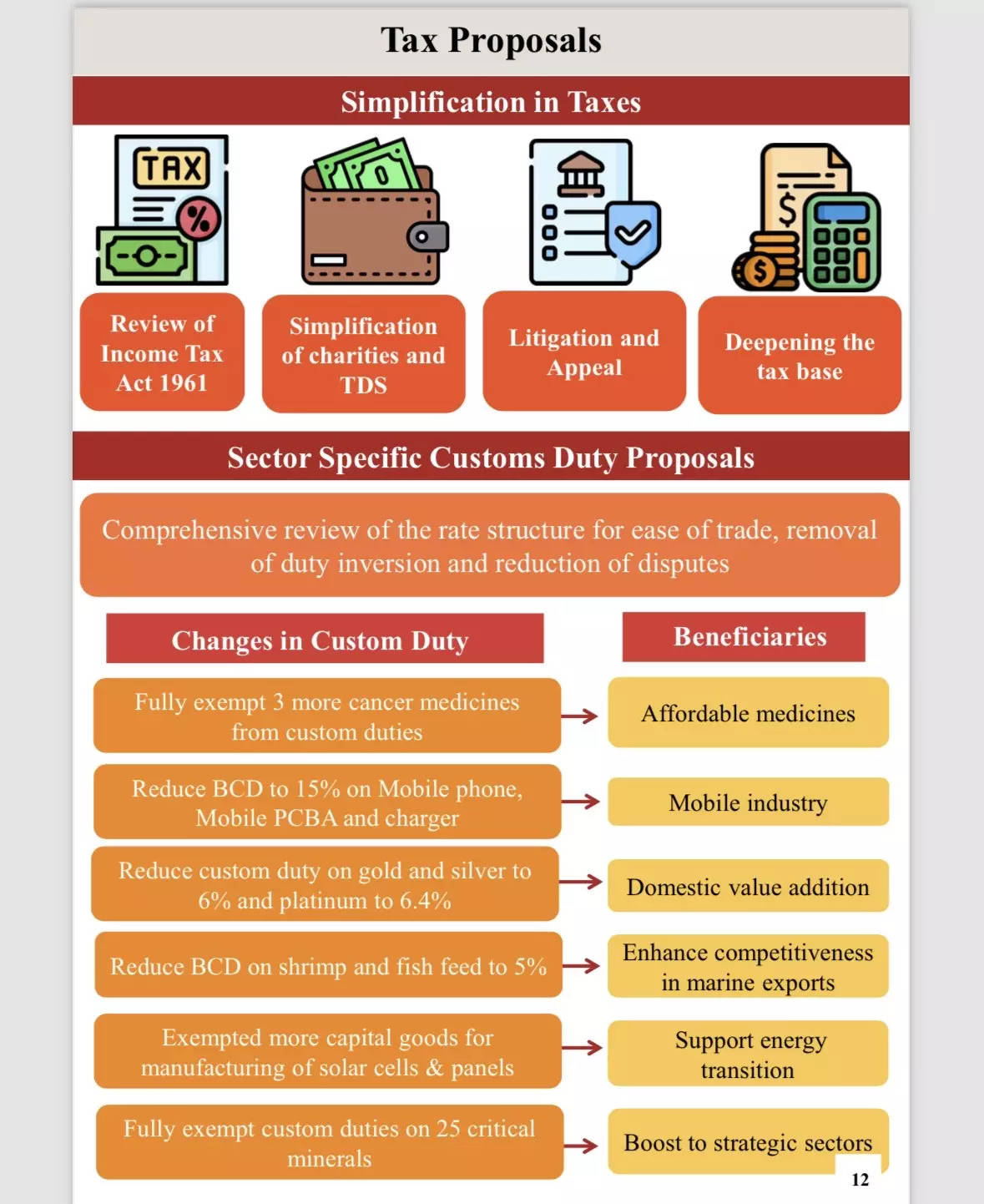

The Finance Minister also announced a comprehensive review of the Income Tax Act to simplify it. This is a significant step as more than two-thirds of individuals have opted for the new tax regime.

The revised tax slabs for the new regime are: income up to Rs 3 lakh will be tax-free; Rs 3-7 lakh will be taxed at 5%; Rs 7-10 lakh at 10%; Rs 10-12 lakh at 15%; Rs 12-15 lakh at 20%; and income above Rs 15 lakh will be taxed at 30%.

Krishan Arora, Partner at Grant Thornton Bharat, notes, “The Finance Minister in her speech announced further simplification and rationalisation of the GST regime, including its extension to other sectors in the near future. This suggests the government’s intent to rationalise GST rates and possibly include petroleum products, a long-standing request from the industry.”

Pension Boost

The government has increased the deduction limit for the employer’s contribution to the National Pension System (NPS) from 10 percent to 14 percent. This increase will cover government employees as well as private companies in the NPS. Additionally, the 2 percent equalisation levy has been withdrawn.

Securities Transaction Tax and Capital Gains Tax

The Securities Transaction Tax (STT) on Futures and Options contracts has been increased to 0.2% and 0.1%, respectively. Furthermore, income received on the buyback of shares will now be taxed in the hands of the recipient. Sanjay Sinha, Founder at Citrus Advisors, commented, “The raising of STCG to 20% and LTCG to 12.5% is a body blow. We need to brace ourselves for a negative reaction in the short term.”

Also read: What are the income tax changes for companies in Budget 2024-25?

The capital gains taxation structure has also been simplified. Short-term gains on some financial assets will now attract 20%, while those on other assets will continue to attract current rates. The limit of exemption on some financial instruments for capital gains has been increased to ₹1.25 lakh a year. However, unlisted bonds and debentures, debt mutual funds, and market-linked debentures will attract tax on capital gains irrespective of the holding period.

Akhil Chandna, Partner at Grant Thornton Bharat, explains, “The limit of exemption of capital gains on certain financial assets has been increased to INR 1.25 lakh per year, but the savings would be offset by the increase in rate of tax on short-term and long-term gains, resulting in higher tax flows for such taxpayers. Overall, it’s a pragmatic move with a lot to offer for the crucial middle-class taxpaying constituency.”

TDS and Tax Appeals

To ease compliance, the government will release standard operating procedures for TDS defaults and work to simplify and rationalize the compounding of such offences. The TDS rate on e-commerce transactions will be reduced to 0.1%. Delays in TDS payments up to the tax filing date will be decriminalized. The monetary limit for filing tax appeals has been raised to Rs 60 lakhs for ITAT, Rs 2 crore for high courts, and Rs 5 crore for the Supreme Court.

GST and Customs Duty

The government has expressed its intent to rationalize the GST structure further. Krishan Arora noted that the government aims to include petroleum products in the GST regime, a long-standing request from the industry. Additionally, a comprehensive review of the customs duty structure will be undertaken over the next six months.

Also Read: Budget 2024 Top Highlights: Capex surge, MSME aid, tax changes, IBC reforms & more

Angel Tax and Corporate Tax

The so-called Angel Tax for investors has been abolished to bolster the Indian startup ecosystem. The corporate tax rate for foreign companies will be reduced from 40 percent to 35 percent.

“Some of the changes from a direct tax perspective like the removal of angel tax, peak rate of taxation for foreign banks etc are welcome from a financial services perspective,” Keyur Shah, Partner and Leader — Financial Services Tax, EY India, remarked.

However, he echoed with other experts and noted that the change in the capital gains tax regime especially the increase in the securities and transaction tax, tax rates for both long-term and short-term (listed securities) and the removal of indexation benefits especially on housing sector could have a short term effect on the capital markets though it does result in simplification of the overall capital gains regime.

On a different note, the comprehensive review of the Income Tax Act, leveraging the Direct Taxes Code (DTC) proposed in the Budget, presents a strategic opportunity for a modern and efficient direct tax regime. Jiger Saiya, Partner at MSKA & Associates, emphasized this point, stating that it could pave the way for simplification of tax law, automating compliance, reducing litigation, and enhancing the ease of doing business in India.