This past week showcased a rollercoaster of economic revelations and market responses. Despite a mix of apprehensions, especially surrounding inflation and monetary policies, the prevailing mood remained decidedly risk-on. That culminated in DOW and S&P 500 reaching unprecedented highs, even though both concluded the week on a relatively subdued note.

Inflation data stood at the heart of market speculation, particularly in the US, where stronger-than-anticipated consumer and producer price indices prompted traders to reassess the likelihood of an early Fed rate cut. Expectations for a rate reduction in the first half were dampened. Yet, confidence in the underlying strength of the US economy served as a counterbalance, maintaining an optimistic outlook among investors.

European markets echoed this positive investor sentiment, with DAX and CAC setting new records. ECB is seen as having more flexibility in initiating earlier policy easing, due to comparatively lower inflationary pressures in Eurozone. Meanwhile, Nikkei’s ascent was underpinned by reassurances of prolonged accommodative monetary policy in Japan, and the softened verbal intervention by officials on Yen’s depreciation.

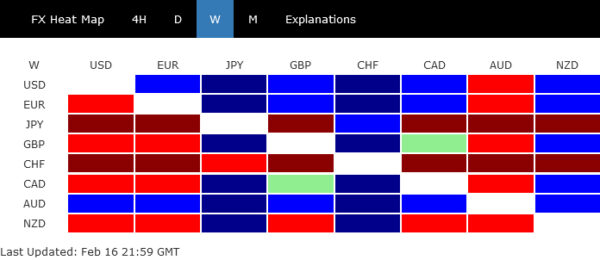

In the currency arena, Dollar maintained its dominance throughout most of the week, until Australian Dollar edged ahead, lifted by the global risk-on wave. Euro emerged as the third strongest performer. Conversely, Swiss Franc and the Yen found themselves at the bottom, affected additionally US yields’ extended rebound. British Pound presented a mixed picture, buffeted by a slew of confusing economic indicators from wage growth to recession signals and retail sales spikes. Meanwhile, Canadian Dollar’s failed to carve a clear path and ended mixed too.

Fed’s First Cut Possibly Pushed to Latter Half, But Markets Display Resilience

US stock markets snapped a five-week winning streak, despite reaching new record highs within the week for both DOW and S&P 500. The modest intra-week pullback suggests a strategic realignment by investors, likely characterized by profit-taking rather than a comprehensive market reversal. Investors taking time to digest the mixed mixed economic data released over the week and the complicated picture they present.

On one front, consumer inflation stubbornly persisted at elevated levels. The latest CPI data revealed a slower than anticipated deceleration, with headline CPI easing to 3.1% in January and core CPI remaining static at 3.9%, signaling a pause in disinflation progress. Similarly, PPI readings exceeded expectations, indicating enduring upstream inflationary pressures. These inflationary trends, coupled with January’s sharp decline in retail sales, suggest that the high interest rates and inflation are starting to weigh on consumer expenditure. In contrast, regional Federal Reserve surveys indicated notable improvement in manufacturing sentiment, injecting a measure of optimism into the economic outlook.

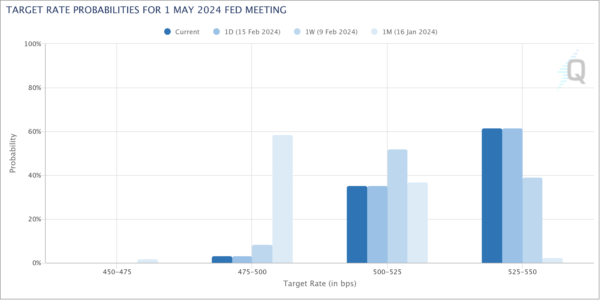

Market expectations for a Federal Reserve rate cut in May have been significantly adjusted. Fed fund futures now show more than 60% likelihood of a hold, a stark contrast to the mere 2.5% chance seen just a month ago. Some analysts now speculate that the initiation of rate cuts could be postponed to the latter half of the year, given the current inflation stickiness and economic resilience.

Despite these challenges, overall market sentiment remains buoyed the prevailing optimism that the US economy’s resilience could endure prolonged periods of high interest rates. From a technical perspective, DOW’s consolidation from 38927.08 short term top should be relatively brief as long as 55 D EMA (now at 37469.60) holds. Another rally should be seen to 40000 handle, or further to 138.2% projection of 28660.94 to 34712.28 from 32327.20 at 40690.15 before starting forming a major top.

10-year yield extended the rebound from 3.785 to close at 4.295, responding to higher than expected inflation data and adjust Fed expectations. Current development argues that fall from 4.997 has completed at 3.785 already. Rebound from there is seen as the second leg of a three wave corrective pattern from 4.997. Further rise is expected as long as 55 D EMA (now at 4.155) holds. Next target is 61.8% retracement of 4.997 to 3.785 at 4.534 and above.

Dollar index also extended the rebound from 100.61. Current rally is seen as the third leg of the pattern from 99.57. Further rise is expected as long as 102.90 support holds, towards 107.34 resistance.

Record Highs for DAX and CAC, Nikkei to Follow Soon

Risk sentiment was also robust in market in other regions, with DAX and CAC reaching new record highs This upbeat mood is buoyed by strong corporate earnings and a growing consensus among investors that ECB possesses greater latitude for earlier interest rate reductions compared to its counterparts, Fed and BoE. This perception is underpinned by relatively subdued inflationary pressures within the Eurozone.

ECB officials, including President Christine Lagarde, have confirmed that inflation is on track to return to the target. While the first rate cut is still anticipated in April or June, one of the Governing Council members suggest March as a possibility, contingent on the upcoming economic projections to be published at that meeting.

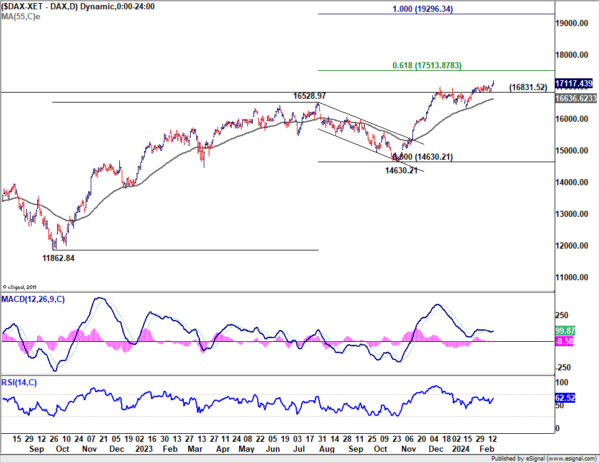

Technically, further rise is now expected in DAX as long as 168.31 support holds. Next target is 61.8% projection of 11862.84 to 16528.97 from 14630.21 at 17513.87. The question now is whether DAX would pick up momentum through this projection level to the next at 100% projection at 19296.34 later in the year.

As for CAC, near term outlook will stay bullish as long as 7598.02 support holds. Next target is 61.8% projection of 5628.41 to 7581.25 from 6773.81 at 7980.66. Upside momentum is more promising as seen in D MACD. Sustained break of 7890.66 will pave the way to 100% projection at 8726.65 later in the year.

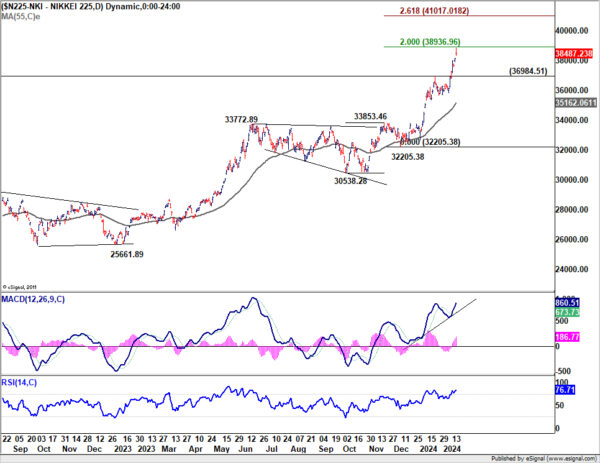

Japan’s stock market is not left behind in this trend, as Nikkei’s bullish run continues unabated. A new record high now looks imminent. This optimism is partly due to reassurances from BoJ Governor Kazuo Ueda about maintaining accommodative monetary policy even post the cessation of negative interest rates. Finance Minister Shunichi Suzuki’s also softened the tone of his verbal intervention, by acknowledging the merits and demerits of Yen’s depreciations. These forward looking development overshadowed the weak Q4 GDP data which indicated that Japan was in recession last year.

Technically, some initial setback could be seen as Nikkei challenges record high of 39260.00, and possibly 40000 psychological level. But near term outlook will stay bullish as long as 36985.41 resistance turned support holds. Next target is 261.8% projection of 30538.28 to 33853.46 from 32205.38 at 41017.01.

Sterling Faces Confusion Amid Contradictory Economic Data

Sterling had a tumultuous week, leaving traders in a quandary over its direction amidst a backdrop of conflicting economic indicators. Unexpectedly high wage growth data for December hinted at persistent inflationary pressures, raising eyebrows among market participants. January’s CPI and core CPI figures, although not surging as anticipated, stayed stubbornly high at 4% and 5.1%, respectively. Adding to the complex picture, GDP data revealed that UK had slipped into recession last quarter, contracting more significantly than forecasted with a -0.3% qoq dip. Yet, January witnessed a robust 3.4% mom surge in retail sales, injecting a dose of optimism.

Nevertheless, BoE Chief Economist Huw Pill’s remarks on Friday could have offered a semblance of clarity amidst the confusion. He suggested that a cut in the Bank Rate was “still some way off”, emphasizing the necessity to wait “several more months” to be assured that inflation’s persistent components were being effectively addressed. These comments should lend the Pound some support for the near term.

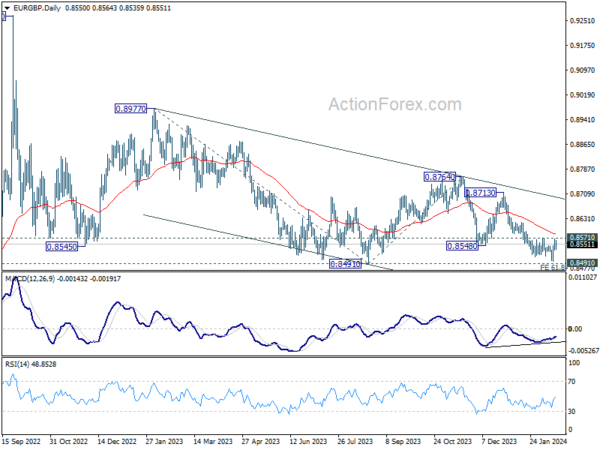

Technically, an immediate focus in EUR/GBP is whether it could draw important support from 0.8491 to break through 0.8571 resistance to confirm short term bottoming. Or, it would break through 0.8491 to resume the medium term down trend from 0.9267.

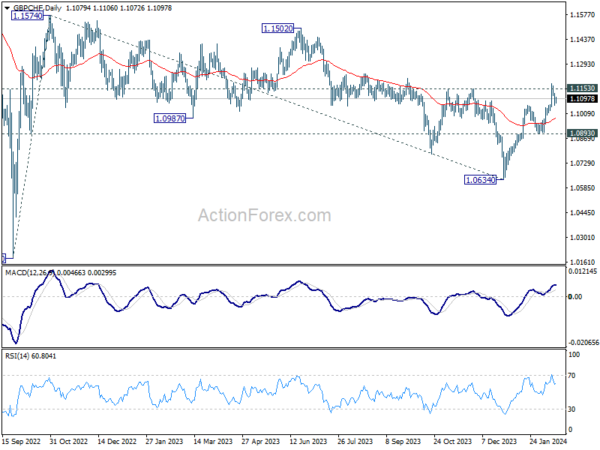

As for GBP/CHF, focus remains on 1.1153 resistance. Decisive break there will affirm the case that correction from 1.1574 has completed with three waves down to 1.0634. Further rise should then be seen to 1.1502/1153 resistance zone.

AUD/USD Weekly Report

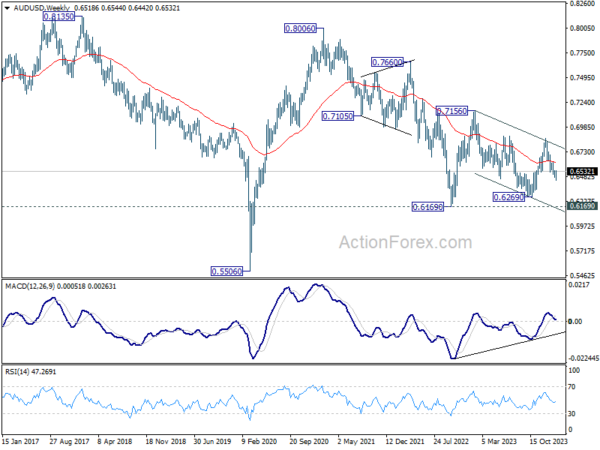

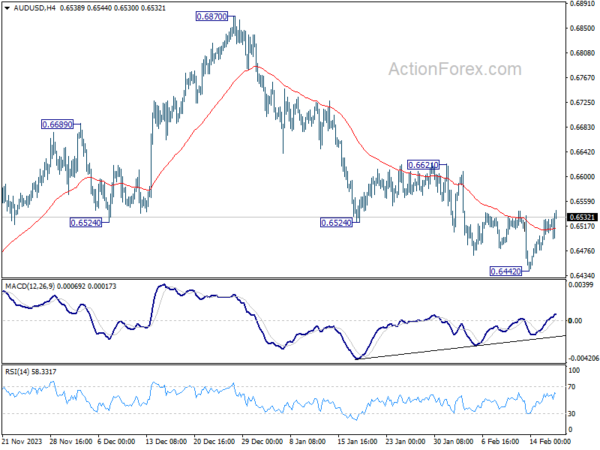

AUD/USD edged lower to 0.6642 last week but recovered since then. Initial bias stays neutral this week first. More consolidation would be seen and stronger recovery cannot be ruled out. But outlook will remain bearish as long as 0.6621 resistance holds. Break of 0.6642 will resume the decline from 0.6870 towards 0.6269 low.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

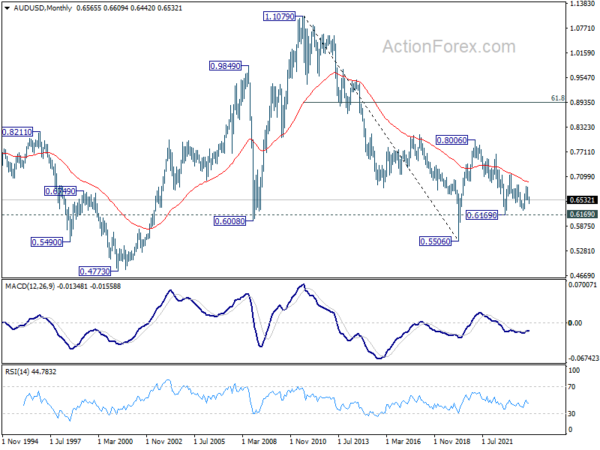

In the long term picture, the down trend from 1.1079 (2011 high) should have completed at 0.5506 (2020 low) already. It’s unsure yet whether price actions from 0.5506 are developing into a corrective pattern, or trend reversal. But in either case, fall from 0.8006 is seen the second leg of the pattern. Hence, in case of deeper decline, strong support should emerge above 0.5506 to bring reversal.