It was a dramatic week in the global financial markets with rapid shifts in investor sentiment triggered by heightened geopolitical tensions in the Middle East. While calm was eventually restored somewhat, the volatility served as a clear indicator of the underlying vulnerability in investor confidence.

Amidst this geopolitical backdrop, the narrative from Fed hawks solidified the expectations of a later and smaller smaller scale of interest rate cuts this year. For some FOMC members, even the possibility of an additional rate hike has not been completely dismissed.

As the week concluded, Dollar held a middle ground in the currency rankings. But it’s positioned to capitalize should geopolitical tensions flare up anew, or risk sentiment turns sour further.

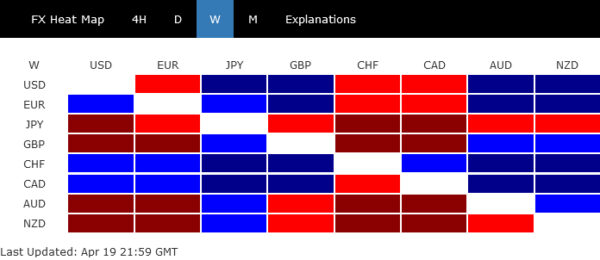

Overall in the currency markets, Swiss Franc affirmed its status as a prime safe-haven asset, outperforming other major currencies throughout the week. Canadian Dollar and Euro also stood out with strong performances. Conversely, Japanese Yen remained the week’s weakest link, even though it showed signs of deceleration in its decline against Dollar. New Zealand and Australian Dollars, along with the British Pound, rounded out the lower end of the performance spectrum.

Bearish Turn in US Stocks Continue to Take Shape, Supporting Dollar

The bearish reversal in US stock markets became increasingly apparent last week. S&P 500 logged its most substantial weekly decline since March of the previous year, with a loss exceeding -3%. NASDAQ wasn’t spared either, enduring -5.5% drop, marking its steepest weekly fall since November 2022. Although DOW managed a slight increase of 0.01%, this marginal gain did little to counteract the broader losses it faced earlier in the month.

Investor sentiment has been dampened by a combination of delayed expectations for Fed rate cuts and ongoing geopolitical tensions in the Middle East. Initial hopes for a rate cut as early as mid-year have been pushed back with market consensus now pointing towards an adjustment no sooner than September. This shift comes in response to persistently high inflation rates that have tempered the urgency for immediate monetary easing.

Additionally, the geopolitical landscape has introduced further instability into the markets. Recent escalations between Israel and Iran had investors on edge, as they could have far-reaching impacts on global inflation and supply chain. Although a full-blown conflict was seemingly averted, the dramatic fluctuations observed on Friday highlights the fragile state of global investor confidence, reflecting the risk for sudden market shifts based on geopolitical developments.

Technically, it’s unsure whether S&P 500’s fall from 5263.95 is correcting the rise from 4103.78 only, or the whole five-wave up trend from 3491.58. But in either case, deeper decline should be seen to 38.2% retracement of 4103.78 to 5263.95 at 4817.92. Above 55 D EMA (now at 5067.54) will bring recovery first. But risk will now continue to stay on the downside as long as 5263.96 resistance holds.

Decisive break of 4817.92 will target 4600 cluster support in the medium term, which includes 4607.07 resistance turned support, 61.8% retracement of 4103.78 to 5263.95 at 4586.90, and 38.2% retracement of 3491.58 to 5263.96 at 4586.9.

Similarly, further decline is expected in NASDAQ to 38.2% retracement of 12543.85 to 16538.86 at 15015.21 first. Decisive break there will suggest that it’s already correcting the whole five-wave up trend from 10207.47. Next target will be cluster support slightly above 14000, with 61.8% retracement of 12543.85 to 16538.86 at 14074.74 and 38.2% retracement of 10207.47 to 16538.86 at 14120.26.

Dollar Index edged higher to 106.51 last week but turned sideway since then. Some consolidations would be seen first but further rally is expected as long as 104.97 resistance turned support holds. Rise from 100.61 is seen as the third leg of the pattern from 99.57. Break of 106.51 will target 107.34 resistance, and possibly further to 100% projection of 99.57 to 107.34 from 100.61 at 108.38. The next up move could be fueled by intensified risk aversion.

Sterling Tumbles as Markets Reassess Chance of Summer BoE Rate Cut

Sterling ended as the worst European major last week, largely due to the sharp decline towards the week’s end. Expectations on BoE rate cut changed little earlier in the week, impact from weaker than expected job data offset by stronger than expected inflation reading. However, the real catalyst for Sterling’s downturn was the remarks from BoE Deputy Governor Dave Ramsden.

Ramsden’s commentary suggested a closer alignment of UK’s inflation trends with that of Eurozone, rather than the US. He indicated that the upcoming April CPI figures are likely to reflect this convergence. He highlighted the easing labor market and the effective impact of current restrictive monetary policies in controlling inflation, particularly within the service sector. Inflation is less of a worry for Ramsden now.

This discourse reintroduced the possibility of a rate cut by BoE this summer, following ECB’s anticipated reduction in June and preceding Fed’s expected adjustment in September.

Technically, GBP/CHF’s steep decline last week was contained by 38.2% retracement of 1.0634 to 1.1481 at 1.1157 so far. That keeps price actions from 1.1481 as a corrective pattern to rise from 1.0634 only. Break of 1.1360 minor resistance will solidify near term bullishness for another rally through to 1.1481 at a later stage. However, decisive break of 1.1157 will raise the chance of reversal, as another falling leg in the pattern from 1.1574. In that case, deeper fall would be seen to 61.8% retracement at 1.0958 and below.

Kiwi and Aussie Underperform on Risk Aversion

New Zealand and Australian Dollar were both underperformers last week. The weakness more stemmed from risk-off sentiment, as both RBNZ and RBA are no where near a rate cut for now.

NZD/USD is now trying to draw support from falling channel support line. But risk will stay on the downside as long as 0.5938 support turned resistance holds. Sustained break of the channel could prompt downside acceleration through 0.5771 low. Next target will be 161.8% projection of 0.6368 to 0.6037 from 0.6215 at 0.5679 next. Nevertheless, break of 0.5938 will indicate short term bottoming and bring stronger rebound first.

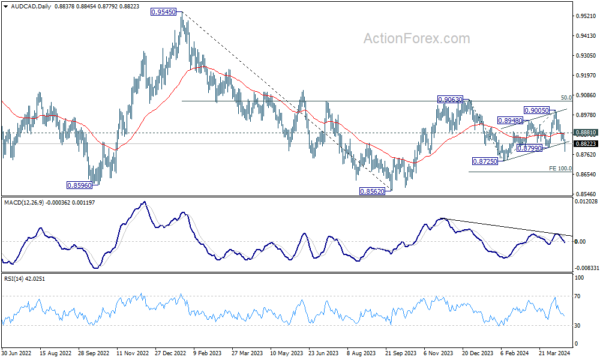

AUD/CAD’s breach of 0.8799 support affirms that case that corrective recovery from 0.8725 has completed with three waves up to 0.9005. Further decline is now expected as long as 0.8881 resistance holds. Firm break of 08725 will confirm resumption of whole fall from 0.9063. Next target will be 100% projection of 0.9063 to 0.8725 from 0.9005 at 0.8667, or even further to retest 0.8562 low.

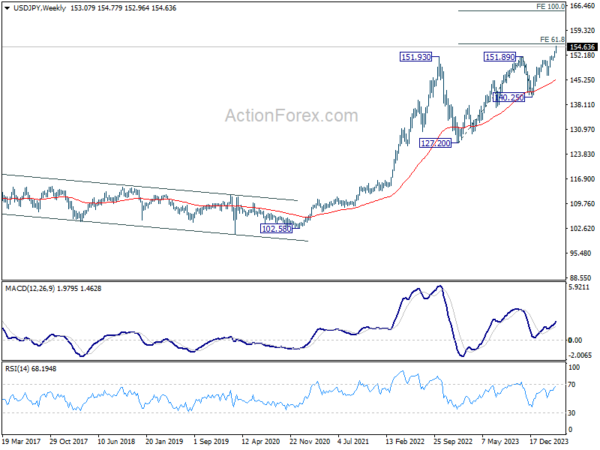

USD/JPY Weekly Outlook

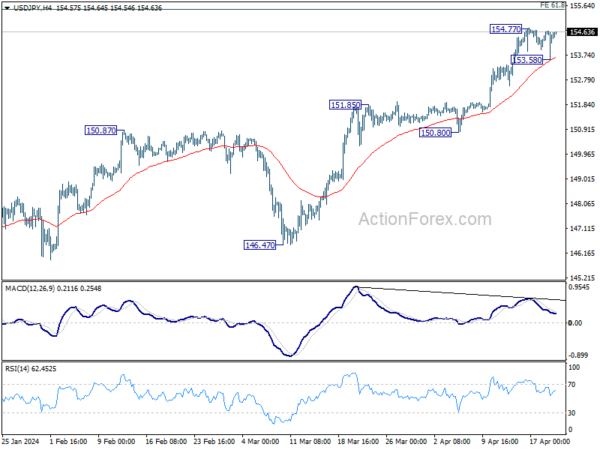

USD/JPY rose further to 154.77 last week but retreated since then. Initial bias stays neutral this week first. Break of 154.77 will resume larger up trend. But considering bearish divergence condition in 4H MACD, strong resistance should be seen from 155.20 fibonacci level to bring correction on first attempt. On the downside, break of 153.58 will turn bias to the downside, for deeper pull back to 55 D EMA (now at 150.83).

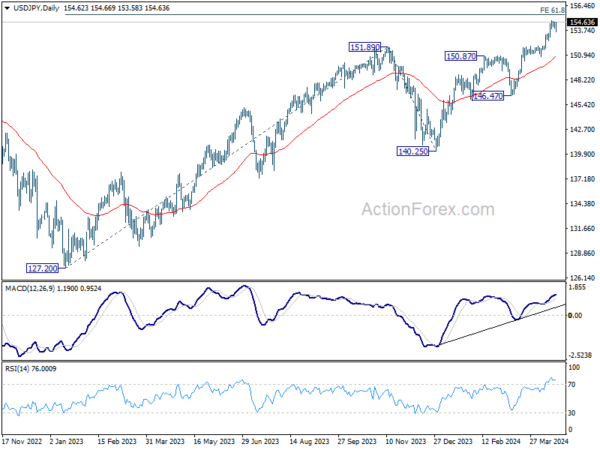

In the bigger picture, current rise from 140.25 is seen as the third leg of the up trend from 127.20 (2023 low). Next target is 61.8% projection of 127.20 to 151.89 from 140.25 at 155.20. Outlook will remain bullish as long as 146.47 support holds, even in case of deep pullback.

In the long term picture, as long as 127.20 support holds (2023 low), up trend from 75.56 (2011 low) is still in progress. Sustained trading above 100% projection of 75.56 (2011 low) to 125.85 (2015 high) from 102.58 at 152.87 will pave the way to 138.2% projection at 172.08. (This is a pure technical view without considering Japan’s intervention.)