The financial markets continued to see extreme volatility. DOW dropped by over -1000 points overnight, but the global rout seems to have paused for now. Nikkei staged a dramatic 10% rebound in early trading after yesterday’s history plunge of -12.4%. However, this recovery was not mirrored by other Asian markets. Investor sentiment remains fragile, with worries over US recession dominating the headlines.

In the currency markets, Australian Dollar is holding steady following RBA’s decision to keep interest rates unchanged, as anticipated. The new economic projections present a complicated outlook. Inflation is expected to dip to the target rate by mid-2025, rise again in subsequent quarters, and then return to the target range by mid-2026. It’s still uncertain whether RBA would need to raise interest rates again. However, given the risk of inflation resurgence highlighted in the projections, RBA is likely to remain cautious and avoid premature policy easing.

For the week so far, Yen remains the strongest performer. Canadian Dollar has overtaken Swiss Franc for the second spot, with Euro following as the third strongest. New Zealand Dollar is currently the weakest performer, followed by Sterling and then Australian Dollar. Dollar and Swiss Franc are positioned in the middle.

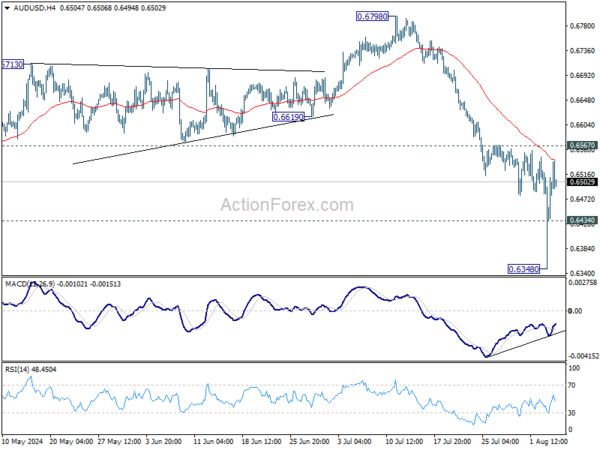

Technically, while AUD/USD staged a strong rebound after diving to 0.6348, there is no follow through momentum so far. Further decline will remain in favor as long as 0.6567 resistance holds. Below 0.6434 minor support will bring retest of 0.6348 first. Firm break there will resume the decline form 0.6798 towards 0.6269 (2023 low). Nevertheless, strong break of 0.6567 will suggest near term reversal and bring stronger rally.

In Asia, at the time of writing, Nikkei is up 7.85%. Hong Kong HSI is down -0.01%. China Shanghai SSE is down -0.09%. Singapore Strait Times is down -0.60%. Japan 10-year JGB yield is up 0.01542 at 0.908. Overnight, DOW fell -2.60%. S&P 500 fell -3.00%. NASDAQ fell -3.43%. 10-year yield fell -0.007 to 3.785.

RBA maintains cash rate, anticipates inflation resurgence post-mid-2025

RBA kept its cash rate target unchanged at 4.35%, as widely expected. Maintaining its stance of “not ruling anything in or out,” the highlighted that underlying inflation “remains too high” and stated it will be “some time yet” before inflation sustainably returns to the target range. The central bank emphasized that monetary policy will need to be “sufficiently restrictive” until the Board is confident that inflation is moving sustainably towards the target range.

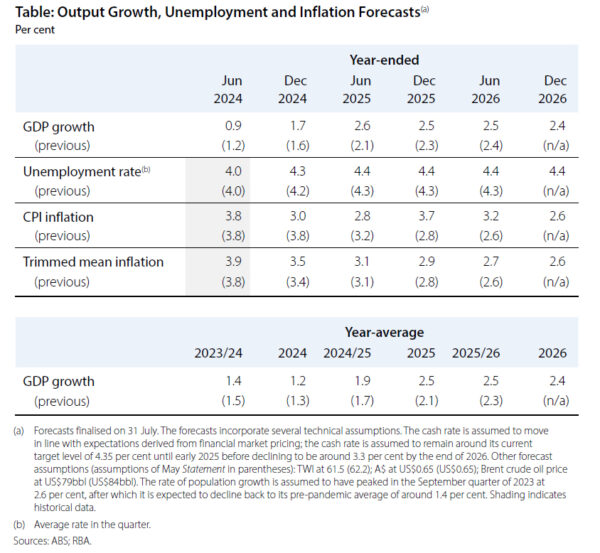

In its new economic projections, RBA forecasts headline inflation to briefly dip to 2.8% in June 2025, back in the target range, but expects it to surge above the target in subsequent quarters before falling back to 2.6% by the end of 2026. Meanwhile, growth projections have been generally upgraded.

Details of the new economic projections include:

CPI at:

- 3.0% by the end of 2024, downgraded from the prior 3.8%.

- 3.7% by the end of 2025, upgraded from the previous 2.8%.

- 2.6% by the end of 2026 (new projection).

Trimmed mean CPI at:

- 3.5% by the end of 2024, up from 3.4%.

- 2.9% by the end of 2025, up from 2.8%.

- 2.6% by the end of 2026 (new projection).

Year-average GDP growth in:

- 2024 downgraded from 1.3% to 1.2%.

- 2025 upgraded from 2.1% to 2.5%.

- 2026 projected to be 2.4% (new).

Unemployment rate at:

- 4.3% by the end of 2024, up from the prior 4.2%.

- 4.4% by the end of 2025, up from 4.3%.

- be 4.4% by the end of 2026 (new projection).

Japan’s nominal wages surge 4.5% yoy in Jun, outpacing inflation for first time in 27 months

Japan’s nominal wages, or average monthly cash earnings, rose by 4.5% yoy in June, significantly exceeding expectations of a 2.3% yoy increase. This marks the 30th consecutive month of wage growth. More importantly, with CPI rising 3.3% yoy in the same month, real wages increased by 1.1% yoy, marking the first gain in 27 months as wage growth finally outpaced inflation.

A Ministry of Health, Labor and Welfare official commented, “We will monitor incoming data closely to see if the trend has really changed as there is a possibility that those firms that paid bonuses in July might have just moved up the timing this year.”

Excluding bonuses and non-scheduled payments, average wages climbed 2.3% yoy, while overtime and other allowances rose by 1.3% yoy.

Also released, household spending in June fell by -1.4% yoy, worse than the expected -0.9% yoy decline, marking the second consecutive month of decline following a -1.8% drop yoy in May.

Fed’s Daly raises alarm over “real weakness” in slowing labor market

San Francisco Fed President Mary Daly commented in a forum overnight, stating that “we’ve now confirmed that the labor market is slowing”. She emphasized the importance of ensuring that this slowdown does not turn into a downturn.

However, she expressed her concern that “it’s too early to tell” whether the labor market is “slowing to a sustainable pace which allows the economy to continue to grow” or if it is approaching a point of “real weakness.”

Daly also mentioned that she expects interest rates to eventually come down “to preserve the balance” of full employment and price stability. However, she cautioned that she is not prepared to specify when or by how much, as she plans to review more data before the next Fed policy meeting in September.

Looking ahead

Swiss unemployment rate and retail sales will be released in European session. Germany will release factory orders. Eurozone will release retail sales. UK will release PMI construction. Later in the day, both US and Canada will release trade balance.

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9235; (P) 0.9310; (R1) 0.9408; More….

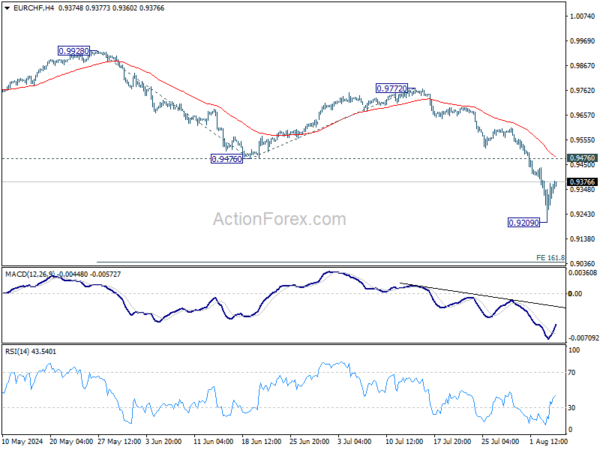

EUR/CHF recovered after hitting 0.9029 and intraday bias is turned neutral for consolidations first. But near term outlook will stay bearish as long as 0.9476 support turned resistance holds. Below 0.9209 will target 161.8% projection of 0.9928 to 0.94767 from 0.9772 at 0.9041 next.

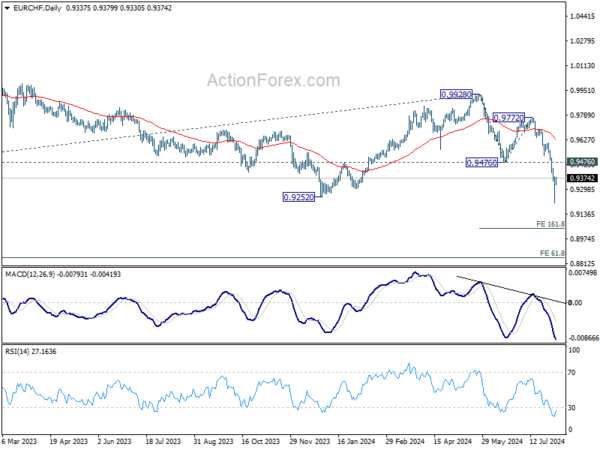

In the bigger picture, current downside acceleration argues that medium term corrective pattern from 0.9407 (2022 low) might have completed with three waves to 0.9928. Decisive break of 0.9252 (2023 low) will confirm long term down trend resumption. Next target will be 61.8% projection of 1.1149 to 0.9407 from 0.9928 at 0.8851. For now, outlook will stay bearish as long as 0.9928 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Jun | 4.50% | 2.30% | 1.90% | 2.00% |

| 23:30 | JPY | Household Spending Y/Y Jun | -1.40% | -0.90% | -1.80% | |

| 04:30 | AUD | RBA Rate Decision | 4.35% | 4.35% | 4.35% | |

| 05:45 | CHF | Unemployment Rate M/M Jul | 2.50% | 2.40% | ||

| 06:00 | EUR | Germany Factory Orders M/M Jun | 0.80% | -1.60% | ||

| 06:30 | CHF | Real Retail Sales Y/Y Jun | 0.50% | 0.40% | ||

| 08:30 | GBP | Construction PMI Jul | 51 | 52.2 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Jun | -0.20% | 0.10% | ||

| 12:30 | CAD | Trade Balance (CAD) Jun | -2.0B | -1.9B | ||

| 12:30 | USD | Trade Balance (USD) Jun | -72.5B | -75.1B |