- Global markets experienced a volatile week, influenced by a tech selloff, China growth concerns, and anticipation of central bank decisions and US earnings reports

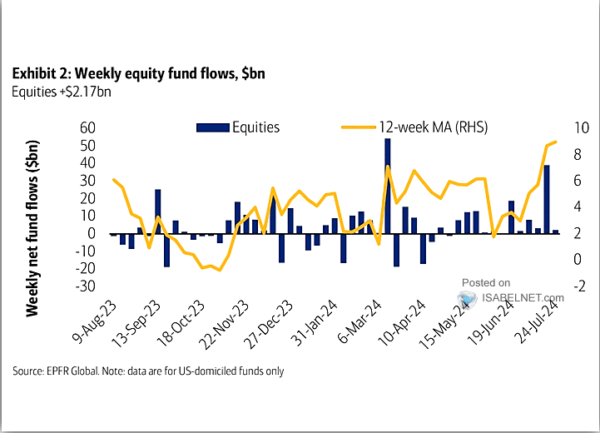

- Despite the volatility and tech led selloff, US equity funds saw inflows.

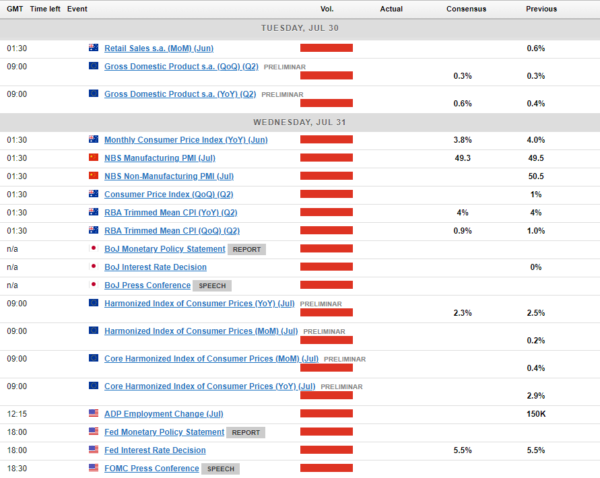

- Central bank meetings, particularly the FOMC and BoJ, and US NFP data will be key drivers of market sentiment in the coming week.

Week in Review: Sentiment Overshadows US Earnings and Data

A tumultuous week for global markets fraught with risk, volatility and a whole lot of opportunity is drawing to a close. The tech selloff in US Megacap tech stocks accelerated in the early part of the week, compounded by concerns around growth in China. A rally on Friday by the SPX and Nasdaq 100 was led by a rebound in tech stocks with Meta, Microsoft and Amazon leading the way.

Despite the concerns around Big tech stocks US equity funds still experienced inflows of around $2.17 billion for the week, according to Bank of America research

Source: EPFR Global, US Domiciled Funds Only

Elsewhere Gold prices recovered late in the week as well after dipping as low as 2353.10 on Thursday to trade at 2388.25 at the time of writing. Oil prices also appear to have found support with Brent posting a weekly low just above the psychological $80 a barrel mark.

Market moves this week have baffled many and that is understandable. US data for the first time this year appears to be overshadowed by other factors which have been driving markets.

The lackluster reaction to the US GDP and PCE prints further highlight this recent phenomenon. It would appear that the effects of the tech sell-off, early positioning for the US election, and the unwinding of carry trades have created significant market movements that overshadow US economic data.

Whether these factors will overshadow a host of economic data events due next week, remains to be seen.

The Week Ahead: Central Bank Meetings and NFP to Dominate

US

Looking ahead to next week, there is a lot happening globally which could have an impact on financial markets. Market participants will pay attention to the FOMC meeting but it remains too soon in the eyes of many to expect a rate cut..

The NFP and jobs report on Friday may have a bigger impact on the US dollar next week. Depending on the rhetoric from Federal Reserve Chair Jerome Powell the data could be an important cog in whether the Fed cut rates in September as expected.

Europe + UK

The Euro Area will report its preliminary inflation numbers on Wednesday as market participants eye further cuts from the European Central Bank. A soft inflation print will go some to solidifying the belief that more cuts are on the way and could see the Euro fall further.

The UK and the Bank of England (BoE) will definitely be in the spotlight next week. As one analyst put it, next week’s BoE decision is just too close to call. Looking overall at the UK which has somewhat outperformed expectation in 2024, there is a growing possibility of a cut next week.

The UK inflation story is looking better despite some recent upside surprises in services. An excellent way of looking at it, two members of the nine-person committee have already begun voting for rate cuts. Two or possibly three others hold the opposite view and are clearly resistant to cuts. This leaves four or five members in the middle, who seem undecided.

June’s meeting indicated that some, perhaps most, of these officials believed the decision was finely balanced. However, since the general election was called in late May, we’ve heard very little from these policymakers.

This lack of commentary makes it difficult to predict Thursday’s meeting with confidence. Nonetheless, we continue to maintain our long-held base case that a rate cut will occur in August.

Asia Pacific Markets

The most anticipated event next week is the Bank of Japan (BoJ) policy meeting. The reason…rumors that the central bank will unveil a plan to halve its bond buying and may even debate a 15bps rate hike.

This news brought a lot of volatility and strength to the Japanese Yen this week. The economy has returned to a recovery trajectory following an unexpected contraction in the first quarter of 2024, and solid wage growth in May should bolster the central bank’s confidence.

The key for me is wage growth, a key gauge punted by Governor Ueda since he assumed office. The positive increases in wages coupled with an announcement this week of a new minimum wage cap are signs that the economy may be about ready for a rate hike.

Inflationary pressure continues to plague the RBA and Australian consumers, something which RBA Governor Bullock acknowledged recently. The Governor seems to support the idea that domestic demand is too strong to permit inflation to decrease at an acceptable rate. Another uptick in inflation is likely to see rate hike bets ramp up for the RBA’s August meeting.

The US Earnings season continues next week with some heavy hitters on the agenda. Microsoft will release results after market close on Tuesday, followed by Meta on Wednesday and Apple and Amazon on Thursday. Significant volatility could materialize particularly in the S&P 500 and Nasdaq 100.

Chart of the Week

The chart of the week that I will be focusing on is the Nasdaq 100. Last week’s selloff continued, pushing the Nasdaq 100 below the ascending trendline before bouncing off the 100-day moving average (MA) on Friday.

Currently, the daily candle appears likely to close as a bullish engulfing candle, suggesting potential further recovery next week. However, a retest and rejection of the trendline could lead to new lows next week, depending on earnings reports and overall market sentiment.

For the Nasdaq to reach support at 18,400 and potentially lower levels, a break and daily candle close below the 100-day MA are necessary, with the 200-day MA resting at 17,656.

On the upside, resistance lies at the trendline, and a break above this level could bring 19,480 into focus, followed by the psychological barrier at 20,000.

Nasdaq 100 Daily Chart – June 28, 2024

Source:TradingView.Com (click to enlarge)

Key Levels to Consider:

Support:

Resistance: