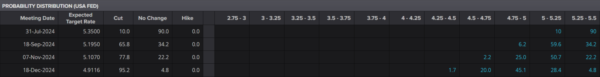

- Despite a decline in core PCE numbers, hawkish comments from Fed policymakers cast doubt on a September rate cut.

- The first half of 2024 saw a widening gap between growth and value stocks, with the former outperforming the S&P 500.

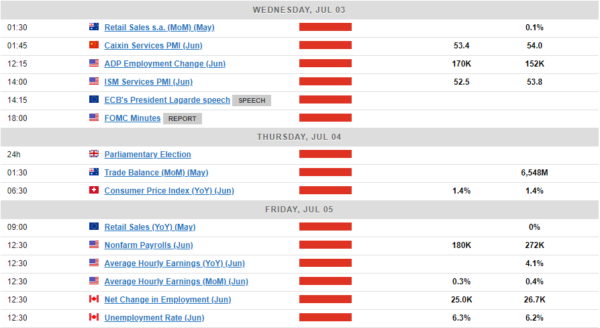

- Concerns over central bank policy divergence and a weakening Yen add to market uncertainty. The week ahead brings key data releases, including US non-farm payroll and unemployment figures.

- Chart of the week: S&P 500 RSI divergence hints at further downside.

Week in Review: PCE fails to deliver clarity, door still open for September rate cut

A big week for markets ended with somewhat of a whimper. Market participants were bracing for US PCE in the hopes of finding clarity on the Federal Reserve’s monetary policy stance. The decline in core PCE numbers bodes well for the Fed and leaves the door open to a September rate cut.

However, if rhetoric from Fed policymakers is followed, a September rate cut is likely out of the question. The back end of the week brought comments from both Rafael Bostic and Mary Daly which struck a rather hawkish tone. Atlanta Fed President Bostic said he saw one rate cut in Q4 of 2024 before a slew of cuts in 2025 as he would like to ensure that inflation is indeed on course for a sub 2% print. Mary Daly who is the San Francisco Fed President went further saying that she sees inflation continue to print above 2% through 2025.

Interest Rate Probability – US Federal Reserve, June 28, 2024

Source: LSEG

The US Presidential debate also added a new dimension for global markets. Following the debate there has been growing rumors that Joe Biden might not even secure the Democratic nomination to stand in the November election. Calls have been made in the past citing President Biden’s age as a major concern. According to data put out by the Kobeissi Letter, the chance of President Biden dropping out of the election more than doubled following the debate last night, upto 43% from around 21% prior. It will be interesting to gauge how this develops next week as despite his legal troubles, Trump still enjoys significant support on Wall Street and is seen as pro-business.

As Q2 comes to a close it is key to note the performance of global stocks in the first half of 2024. The S&P 500 hit a fresh high on Friday before a selloff saw the index trade around -0.35% at the time of writing. The Nasdaq 100 for its part failed to print a fresh high but piqued just above the 20000 mark once more. The most notable takeaway from the first half of the year is the widening gap between growth and value stocks. Growth stocks led by the FANG+ group put in gains of around 30% YTD in comparison to the broader S&P 500 which put in gains of around 15%. The question however as Q3 beckons, is this sustainable…?

The Week Ahead: Q3 starts with French, UK election

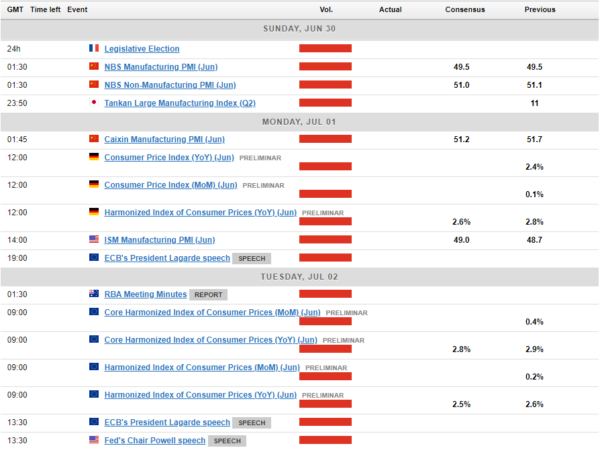

Looking ahead to next week, there is a lot happening globally which could have an impact on financial markets. This kicks off on Sunday which is the first round of Parliamentary elections in France.

Polling in France has delivered a wide range of estimates, but the one thing they all have in common is a victory for the “far-right” National Rally led by Marine Le Pen. Polling puts support for Le Pen at 34% while others believe the National Rally is on course for a majority victory.

Given the uncertainty of a new Government as well as concerns about the policies that may come into force, it’s no surprise that financial markets are spooked. A sign of the concern was reflected in the risk premium of French Government Bonds hit highs last seen during the 2012 euro area crisis.

An outright win for the National Rally could weigh on French Government Bonds and may also have a slight impact on the Euro as uncertainty around the dynamics of how the Government would work. It would be the first time a French President would have to share power with a party outside the political mainstream.

UK elections on July 4, 2024 is revealing a similar story in that it seems a foregone conclusion that a new Government will be elected. The Labor Party led by Keir Starmer are overwhelming favorites based on polling, with Prime Minister Rishi Sunak facing a tough week ahead.

Unlike the French election however, volatility around the UK election is likely to disappoint. Markets have been eerily calm despite polling and there are a host of reasons that could explain this. For starters, very little is expected to change from a fiscal standpoint regardless of who is elected. Secondly, two topics which dominated the agenda heading into the 2019 election was Brexit and a Scottish referendum. Brexit has well and truly been handled while a Scottish referendum seems a way off at present as the implosion of the Scottish National Party (SNP) continues to drag on. Lastly, despite all the hype around elections this year, monetary policy remains the key for 2024, and no matter who wins the UK election that will not change.

Elsewhere in Europe we have the ECB Forum on Central Banking in Sintra, Portugal. The Forum brings together central bank governors, policymakers, academics, and financial market representatives from around the world to discuss critical issues affecting the global economy and monetary policy. The forum serves as a platform for sharing insights, debating economic policies, and exploring challenges and opportunities facing central banks. It plays a key role in shaping future monetary policy directions and fostering international cooperation among central banks.

Given growing concern around Central Bank policy divergence in the months ahead, this may provide insights into where Central Banks stand in relation to one another and what we may expect in Q3 and Q4.

Asian Markets Outlook

Asian markets will see a barrage of PMI and inflation data in the week ahead. China is always the most important one while developments in Japan and particularly the Japanese Yen will be key in the week ahead.

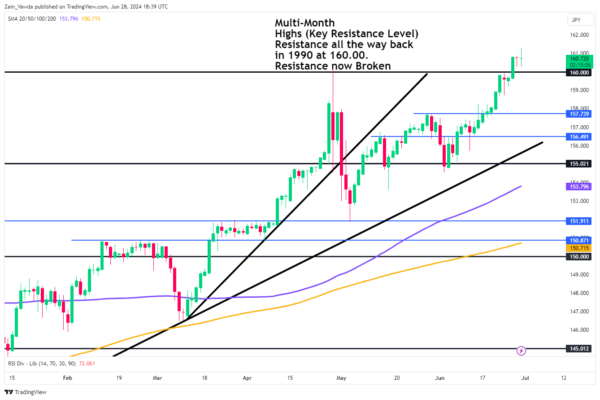

Japanese officials are facing renewed pressure as the Yen weakened beyond the critical 160.00 mark against the US Dollar. Analysts and market participants viewed this level as a threshold likely to trigger FX intervention by the Bank of Japan. Various Japanese officials have issued warnings about the excessive exchange rate and indicated potential intervention.

USD/JPY Daily Chart, June 28, 2024

Source: TradingView.Com (click to enlarge)

Looking at the yen chart above, price has found acceptance above the 160.00 handle with two successive daily candle closes. The 160.00 is key support moving forward and the longer price remains above this level the more nerves we may see from market participants that intervention may materialize. Keep this in mind in the week ahead.

Back to the US and the week will end with the non-farm payroll and unemployment data from the US. Just another data point for the Fed to consider and could either add more uncertainty or validate market participants who are currently pricing in a 64% chance of a rate cut in September.

Chart of the Week

The chart of the week that I will be focusing on is the S&P 500. The reason is Friday’s rejection of the 5500 psychological level once more which coincides with RSi divergence. The RSI has printed a lower high while price action has printed a higher high, which could be a sign that a selloff may be imminent and worth keeping an eye on in the week ahead.

S&P 500 Daily Chart – June 28, 2024

Source:TradingView.Com (click to enlarge)

Key Levels to Consider:

Support:

- 5421

- 5330

- 5267

- 5200 (100-day MA)

Resistance: