FNG has learned via regulatory filings that London based, FCA regulated multi-asset liquidity solutions provider MAS Markets has continued to grow its business in its third full year of operation in FY2024 (year ended May 31, 2024), with its Revenues more than tripling from 2023 – and that after Revenues tripled last year as well.

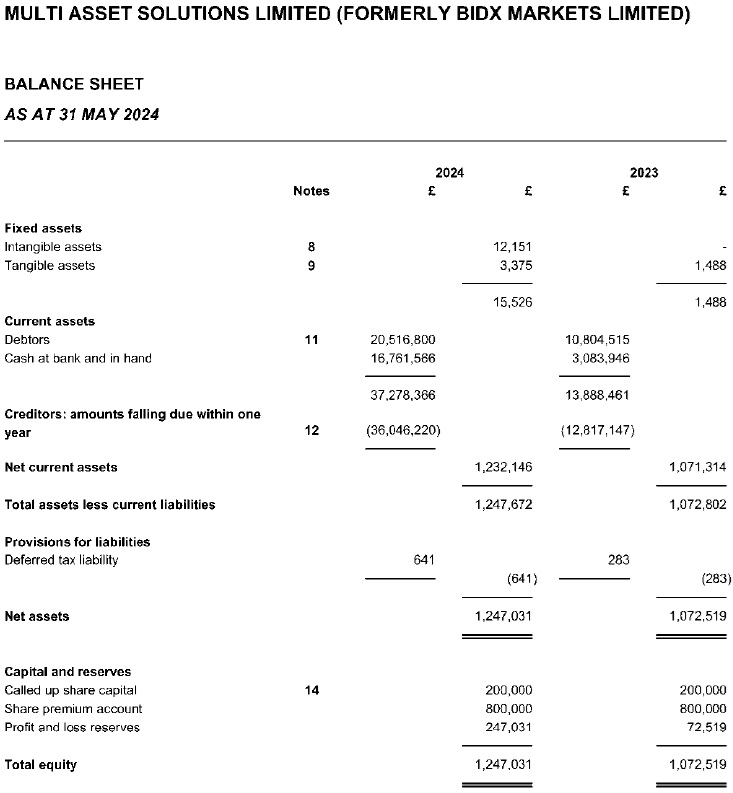

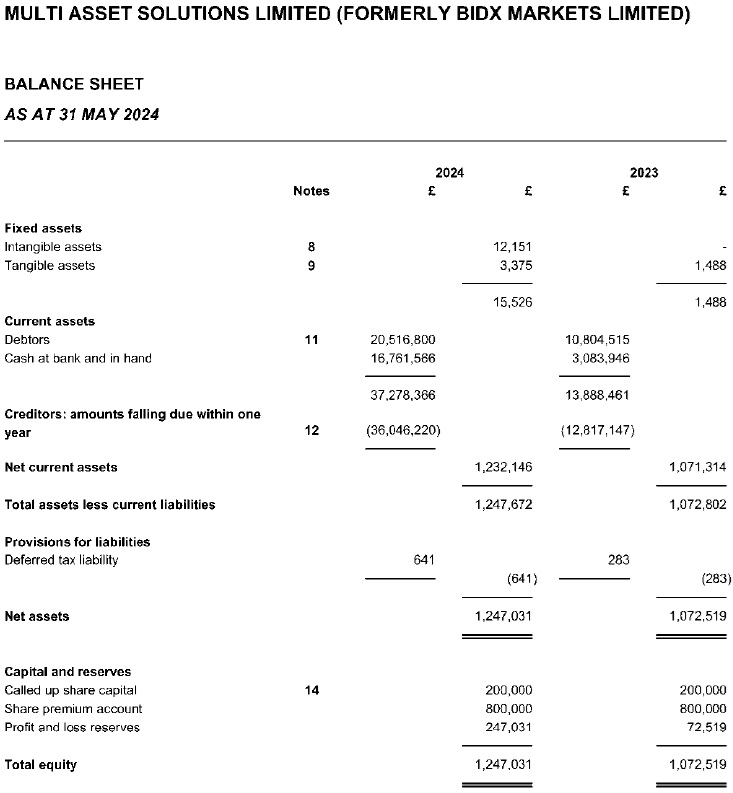

Revenues at MAS Markets came in at £3.19 million in 2024, more than 3x the company’s Revenues of £1.05 million in 2023. MAS Markets managed to grow itself profitably, as Net Profit totaled £247K in 2024, up from £73K the previous year.

MAS Markets was rebranded from BidX Markets earlier this year, as was exclusively reported at the time here at FNG. The formal company name was also changed, from BidX Markets Limited to Multi Asset Solutions Limited. BidX Markets was founded in 2021 by CEO Simon Blackledge (pictured above), who had previously run MT4/MT5 white label solutions provider itexsys.

The principal activity of the company is that of provision of investment (brokerage) services and acting as principal to its clients in foreign exchange and derivatives including index Contracts For Difference (CFDs). The London headquartered brokerage provides tailored access for brokers, asset managers and funds to industry leading Tier 1 liquidity, connectivity, and distribution services. MAS also provides turnkey White Label Trading Platform solutions to Retail Brokers, Agency Desks and regulated Fund Managers.

MAS Markets’ FY2024 income statement and balance sheet follow below.