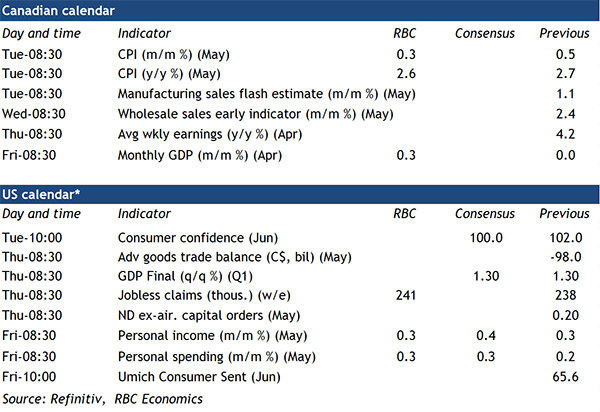

We expect Canadian inflation numbers on Tuesday will show further signs of gradual easing in price pressures. Consumer price index growth should edge down to 2.6% year-over-year from 2.7% in April. That would mark the fifth consecutive month that annual price growth is within the Bank of Canada’s 1% to 3% inflation target range.

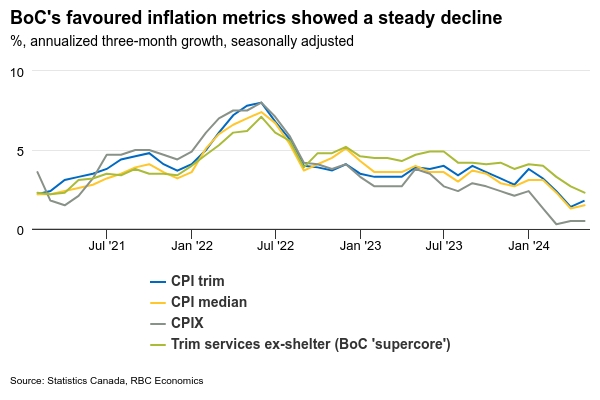

Gasoline prices eased in May alongside lower global oil prices, and food price growth likely continued to move lower. But, the BoC will be focused on their preferred core measures for evidence that a broadly based slowdown in price growth in 2024 is continuing. The closely watched three-month rolling averages for the CPI-trim and CPI-median measures will likely tick higher but remain relatively low after unusually soft readings left both under the 2% inflation target over the last two months. The breadth of inflation pressures has continued to ease with the share of consumer products seeing inflation above a 3% annual rate back close to its historical rate in April.

A softening economic growth backdrop has made it more likely that Canadian inflation pressures will not reaccelerate the way they did in the United States earlier this year. We expect a 0.3% increase in next Friday’s April gross domestic product numbers—consistent with the preliminary Statistics Canada estimate. But two-thirds of that gain is expected to come from a rise in oil production and drilling activity ahead of the TMX pipeline expansion starting service this spring. Manufacturing output was likely little changed with a small increase in sale volumes (0.4%) pulled from inventories rather than new production. April retail sale volumes edged up 0.5% but preliminary estimates from Statistics Canada pointed to lower sales in May, consistent with signs of softening in our own tracking of card transactions. We expect May GDP growth to look softer. That would leave GDP for Q2 as a whole tracking close to our 1.4% annualized forecast, marking another decline in per-capita output.

Week ahead data watch

SEPH employment data for April will also be closely watched for further signs of softening in the labour market. Job openings (not counted in the timelier Labour Force Survey data) are expected to continue to drift lower as labour demand slows.

We expect U.S. personal consumption to edge higher from 0.2% to 0.3% in May, given retail sales were up 0.1% in May. Personal income likely drifted higher by 0.3% due to a slight rebound in wage growth (0.4%).