Ever since the AP crisis in 2010 and the creation of a new category of NBFC-MFIs in December 2011, the regulations have carefully nurtured the growth of microfinance in India. According to a latest report by Microfinance Industry Network (MFIN), the microfinance active loan accounts increased by 15.4 per cent during the past 12 months from 13 crores as on March 31, 2023.

As of end of March, 2024, the microfinance industry served about 7.8 crore unique borrowers, through 14.9 crore loan accounts. The overall microfinance industry currently has a total Gross Loan Portfolio (GLP) of Rs 4,33,697 crores. Gross loan portfolio as on March 31, 2024, showed an increase of 24.5 per cent YoY over Rs 3.48 lakh crores.

Microfinance loan portfolio was recorded at Rs 4.3 lakh crores as on March 31, 2024 while microfinance loan disbursals during FY23-24 progressed to Rs 3.35 lakh crores as compared to Rs 2.9 crores in the last financial year. About 7.26 crore loans were disbursed during FY23-24 as against 7.17 crores in FY 22-23, said the report.

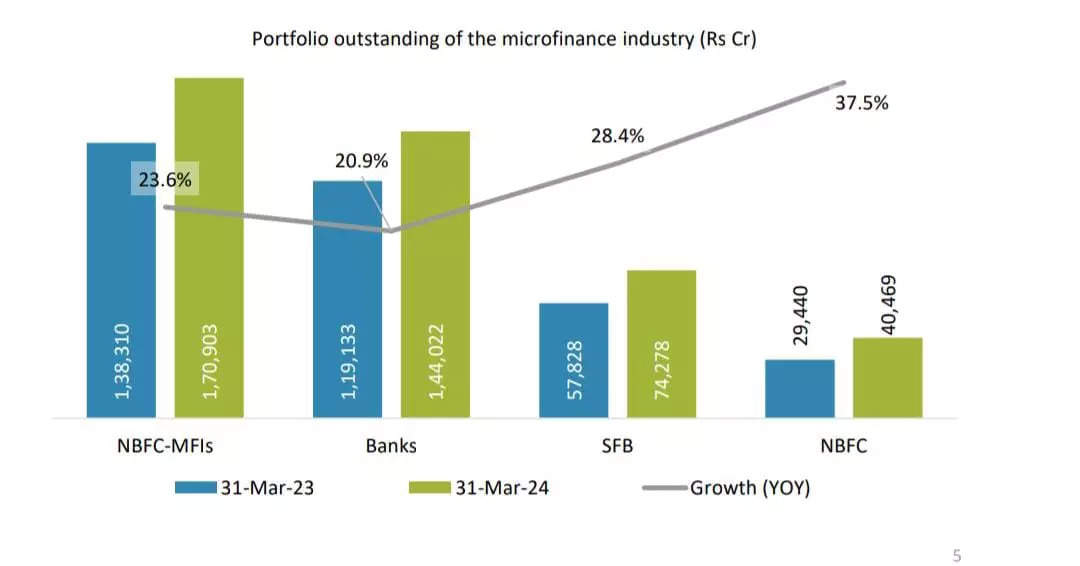

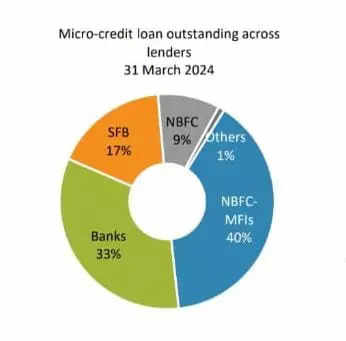

About 87 NBFC-MFIs are the largest provider of micro-credit with a loan amount outstanding of Rs 1.7 lakh crores, accounting for 39.4 per cent of total industry portfolio.

Further, approximately 14 banks hold the second largest share of portfolio in micro-credit with total loan outstanding of Rs 1.44 lakh crores, which is 33.2 per cent of total micro-credit universe. SFBs have a total loan amount outstanding of Rs 0.74 lakh crores with total share of 17.1 per cent. NBFCs account for another 9.3 per cent and other MFIs account for 0.9 per cent of the universe, the report added.

In terms of regional distribution of gross loan portfolio, East and Northeast and South account for 62 per cent of the total portfolio. Bihar remains the largest state in terms of portfolio outstanding followed by Tamil Nadu and Uttar Pradesh.

NBFC-MFIS see AUM increase

The Assets under Management (AUM) of NBFC-MFIs stood at Rs 1.56 lakh crores as on March 31, 2024, a 29.5 per cent YoY rise as compared to Rs 1.21 lakh crores in the previous year, highlighted the MFIN report.

The AUM includes owned portfolio Rs 1.26 lakh crores and managed portfolio (off BS) of Rs 0.3 lakh crores.

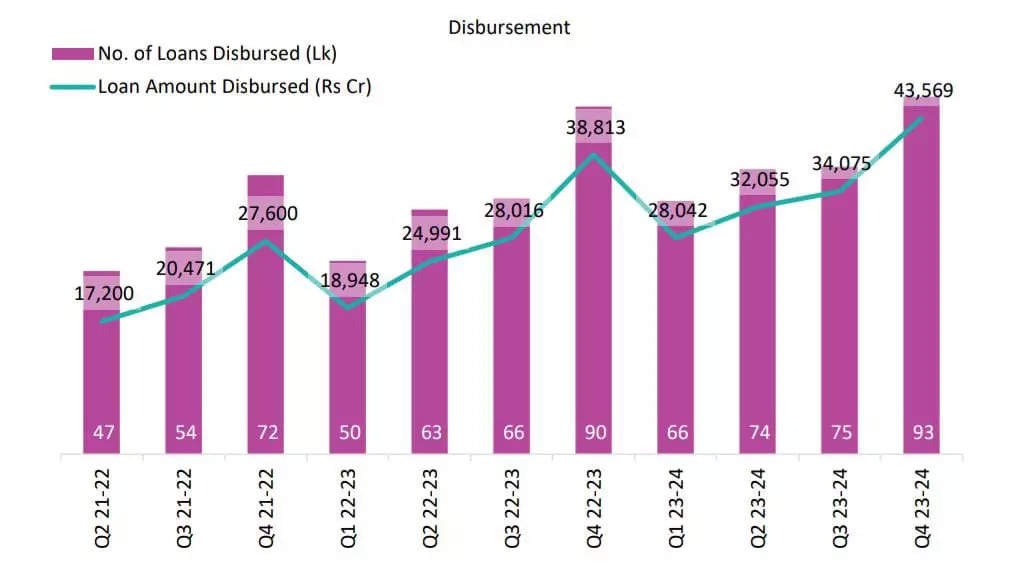

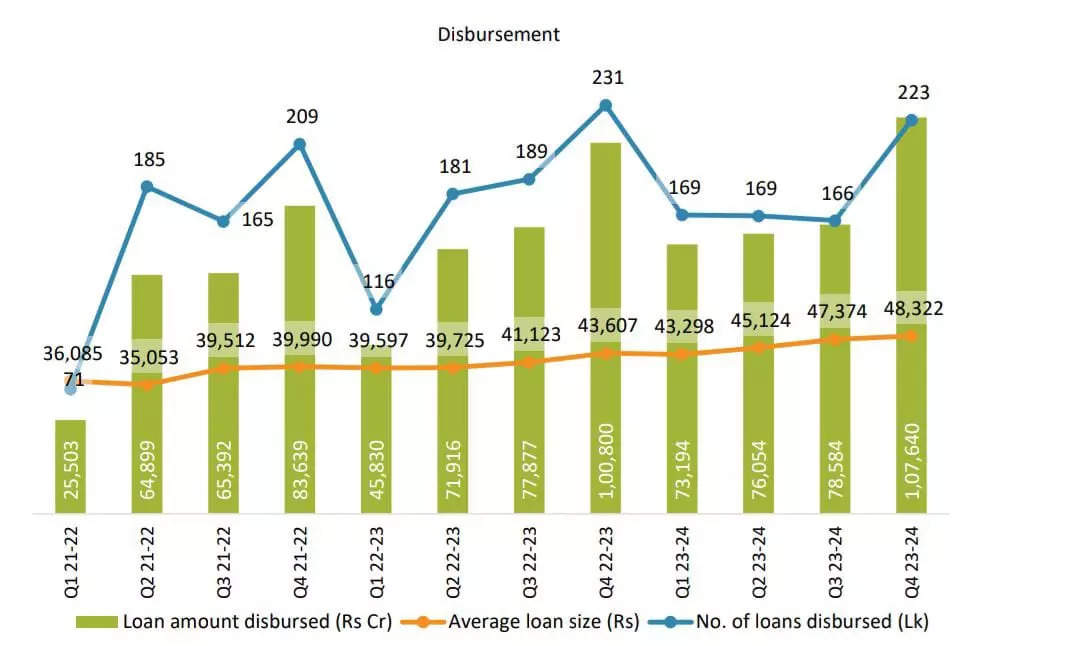

Loan amount of Rs 1.38 lakh crores was disbursed in FY23-24 through 3.1 crore accounts, as compared to Rs 1.1 lakh crores disbursed in FY22-23 through 2.7 crore accounts, the report said.

The average loan amount disbursed per account during FY23-24 was Rs 45,024 which is 9.9 per cent higher in comparison to the last financial year.

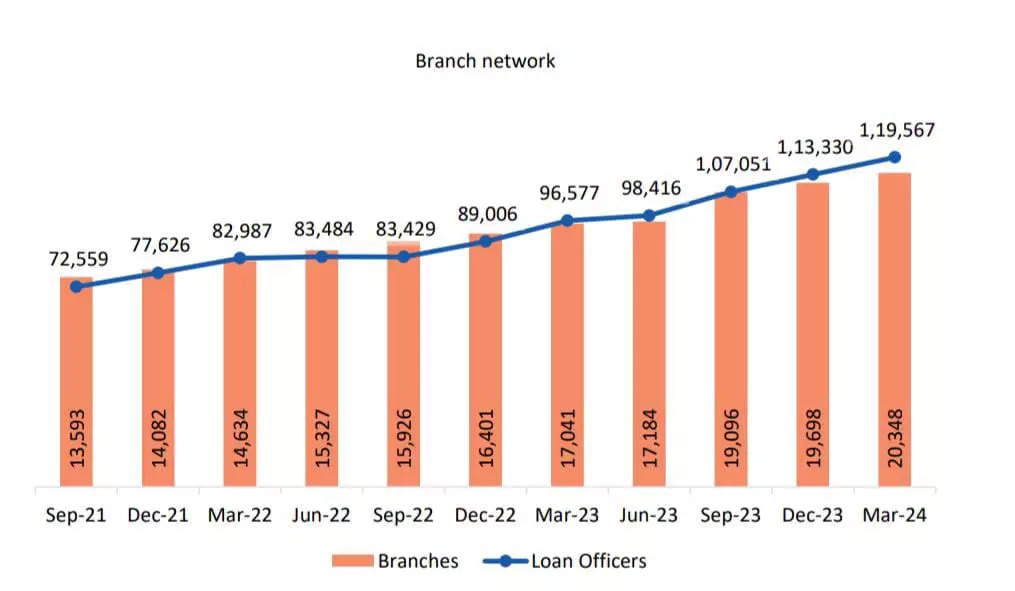

As of FY24, NBFC-MFIs on an aggregated basis, have a network of 20,348 branches with 1,83,842 employees, the report said.

During FY23-24, NBFC-MFIs received a total of Rs 0.89 lakh crores in debt funding, which is 29.1 per cent higher than FY22-23. Total equity of the NBFC-MFIs grew by 39 per cent YoY to Rs 0.34 lakh crores as of March 2024, the report added.