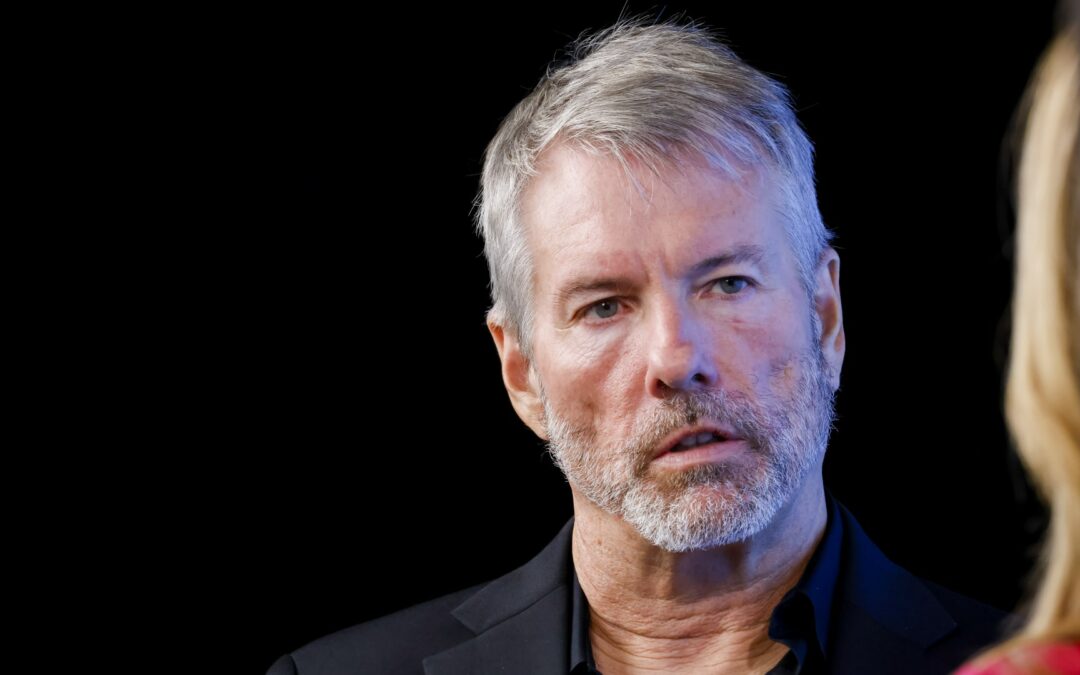

Michael Saylor, chairman and chief executive officer at MicroStrategy, during an interview at the Bitcoin 2023 conference in Miami Beach, Florida, US, on Thursday, May 18, 2023.

Eva Marie Uzcategui | Bloomberg | Getty Images

On the eve of MicroStrategy‘s stock market debut in June 1998, founder Michael Saylor stayed in a penthouse suite at the Lotte New York Palace in Midtown Manhattan. Saylor, who was 33 at the time, says it was the most exquisite hotel room he’d ever seen, paid for by lead underwriter Merrill Lynch.

The next morning, Saylor went to the floor of the Nasdaq to watch his company’s stock open. He recalled seeing a note scrolling across the ticker, warning traders: “Please do not confuse MSTR with MSFT.” The latter belonged to Microsoft, the software giant that had gone public 13 years earlier.

MicroStrategy shares popped 76% in their debut, joining the parade of tech companies benefiting from the dot-com boom.

“It was a good day,” Saylor told CNBC.

More than 26 years later, MicroStrategy and Microsoft were again linked together, but for an entirely different reason. In December 2024, Saylor stood before Microsoft’s shareholders to try and convince them that the company, now valued at over $3 trillion, should put some of its $78.4 billion in cash, equivalents and short-term investment into bitcoin.

“Microsoft can’t afford to miss the next technology wave, and bitcoin is that wave,” Saylor said in a video presentation that he released on X last week. The post has more than 3.6 million views.

Saylor has gone all in on that strategy. MicroStrategy has purchased 439,000 bitcoin since mid-2020, a stockpile that’s now worth about $42 billion and is the basis for the company’s market cap explosion to $82 billion from roughly $1.1 billion when the plan was put in place.

MicroStrategy’s software unit, which specializes in business intelligence, generates just over $100 million in revenue a quarter. After zooming up in 1998 and 1999, the stock crumbled in the dot-com bust, losing almost all its value. In the decades that followed, it slowly bounced back before rocketing up due to bitcoin.

Four years into its bitcoin buying spree, MicroStrategy is the world’s fourth-largest holder, behind only creator Satoshi Nakamoto, BlackRock’s iShares Bitcoin Trust and crypto exchange Binance.

At Microsoft, the shareholder vote supported by Saylor failed by a wide margin — less than 1% of its investors voted for it.

But the spectacle provided Saylor, now 59, with yet another opportunity to preach the gospel of bitcoin and tout the benefits of converting as much cash as possible into that single digital asset. It’s a story that Wall Street has been gobbling up.

MicroStrategy shares are up 477% this year as of Friday’s close, second to only AppLovin among all U.S. tech companies valued at $5 billion or more, according to FactSet data. That follows a 346% gain in 2023.

While the rally was in full force well before November of this year, Donald Trump’s election victory, funded heavily by the crypto industry, propelled the stock even more. The shares have climbed 60% since the Nov. 5 election, and finally exceeded their dot-com era high from 2000 on Nov. 11.

Saylor has long talked about bitcoin in an evangelical fashion and co-authored a book about it in 2022 titled “What is Money?” But his critics have gotten louder than ever of late, describing Saylor as a cult-like leader and his strategy as a “ponzi loop” that involves issuing debt and equity to buy bitcoin, watching MicroStrategy’s stock price go up, and then doing more of the same.

“Wash, rinse, repeat — what could possibly go wrong?” wrote Peter Schiff, chief economist and global strategist at Euro Pacific Asset Management, in a Nov. 12 post on X to his 1 million followers.

Saylor, who has 3.8 million followers, addressed the growing chorus of skeptics last week in an interview with CNBC’s “Money Movers.”

“Just like developers in Manhattan, every time Manhattan real estate goes up in value, they issue more debt to develop more real estate, that’s why your buildings are so tall in New York City,” Saylor said, in a clip that’s been posted to X by his legion of fans. “It’s been going for 350 years. I would call it an economy.”

Saylor is a frequent guest on CNBC, making appearances on various programs throughout the year. He also agreed to two interviews with CNBC.com, one in September and another soon after the election.

The first of those chats came back at the Lotte, just a few elevator stops from the penthouse where he stayed the night before his stock hit the Nasdaq. Saylor was delivering a conference keynote at the hotel and taking meetings on the side.

He wore a designer suit and an orange Hermes tie, matching bitcoin’s designated color. The election was less than two months away, and crypto companies were pumping money into the Trump campaign after the Republican nominee and ex-president, who previously called bitcoin a “scam against the dollar,” started guaranteeing a much more crypto-friendly administration.

‘Inspired the crypto community’

Two months earlier, in July, Trump delivered a keynote at the biggest bitcoin conference of the year in Nashville, Tennessee, where he promised to fire SEC Chair Gary Gensler, an industry critic, and said the U.S. would become the “crypto capital of the planet” if he won.

“I think the election year has inspired the crypto community to find its voice, and I think it has catalyzed a lot of enthusiasm that was latent,” Saylor said in the September interview. “When Trump came out tentatively positive, that was a big boost to the industry. When he came out fully positive, that was another boost.”

Until this year, MicroStrategy was one of the few ways many institutions could buy bitcoin. Because MicroStrategy was an equity, investment firms didn’t need any special provisions to own it. The environment changed in January, when the SEC approved spot bitcoin exchange-traded funds, allowing investors to buy ETFs that track the value of bitcoin.

Since Trump’s victory, it’s all been up and to the right. Bitcoin is up about 41% and BlackRock’s ETF has climbed 39%. Gensler is preparing to leave the SEC, and Trump has picked deregulation advocate and former SEC Commissioner Paul Atkins to replace him.

Venture capitalist David Sacks, an outspoken conservative who hosted a fundraiser for Trump in San Francisco, will be the “White House A.I. & Crypto Czar,” Trump announced earlier this month in a post on his Truth Social platform.

“With the red sweep, bitcoin is surging up with tailwinds, and the rest of the digital assets will also begin to surge,” Saylor told CNBC in a phone interview, soon after the election. He said bitcoin remains the “safe trade” in the crypto space, but as a “digital assets framework” is put into place for the broader crypto market, “there’ll be a surge in the entire digital assets industry,” he said.

“Taxes are coming down. All the rhetoric about unrealized capital gains taxes and wealth taxes is off the table,” Saylor said. “All of the hostility from the regulators to banks touching bitcoin” also goes away, he added.

Republican presidential nominee and former U.S. President Donald Trump gestures at the Bitcoin 2024 event in Nashville, Tennessee, U.S., July 27, 2024.

Kevin Wurm | Reuters

MicroStrategy has gotten even more aggressive with its bitcoin purchases. Saylor said in a post on Dec. 16, that over a six-day stretch starting Dec. 9, his company had acquired 15,350 bitcoin for $1.5 billion.

So far this year, MicroStrategy has acquired 249,850 bitcoin, with almost two-thirds of those purchases occurring since Nov. 11.

“We were going to do it regardless,” Saylor said, referring to the election results. “But what was a headwind has become a tailwind.”

A week before the election, MicroStrategy announced in its quarterly earnings release a plan to raise $42 billion over three years. That included a stock sale of up to $21 billion through financial firms including TD Securities and Barclays, opening up that much more liquidity for bitcoin purchases.

Saylor told CNBC it was “probably the single most important earnings call in the history of the company.”

No amount of ownership is too much for Saylor, who predicted in September that bitcoin could hit $13 million by 2045, which would equal 29% growth annually.

“We’ll just keep buying the top forever,” he said in the same TV interview where he compared bitcoin to New York real estate. “Every day is a good day to buy bitcoin. We look at it as cyber-Manhattan.”

Saylor talks glowingly about bitcoin as the foundation of a new digital economy that will only get bigger. But even since his bitcoin strategy got underway in 2020, there have been pockets of severe pain for investors — the stock lost 74% of its value in 2022 before soaring the past two years.

Still, he’s advising companies to mimic his strategy. Microsoft didn’t listen, but Saylor said there are plenty of “zombie companies,” with core businesses that aren’t going anywhere that could make better use of their cash.

“The traditional advice would be, you do a transformational acquisition, you find that you need a merger partner. You’re dead in the water. Go find somebody to merge with,” Saylor said at the Lotte in September. “Bitcoin is the universal merger partner, right? The real appeal of digital capital is you can fix any company.”

WATCH: CNBC’s full interview with MicroStrategy CEO Michael Saylor