The global financial markets are responding with caution to the rising tensions in the Middle East. However, this sentiment is tempered and contained, with significant shifts and trends yet to be firmly established. European stock markets are reflecting a subdued sentiment, with DAX and CAC registering modest declines, and FTSE remaining mostly flat.

The anticipated lower opening in US futures, while bond markets are on holiday, might offer more substantial market movements. However, if geopolitical tensions don’t escalate further, focus will likely shift back to the economic calendar. Key events slated for this week include release of US inflation data, FOMC minutes, and UK’s GDP figures.

In the currency markets, risk aversion is driving demand for safe-haven currencies. Notably, Yen and Swiss Franc have emerged as the day’s top performers. However, their gains that can be characterized as limited for the time being.

Euro and Sterling are currently underperforming, partly driven by soft investor sentiment data for the former. Nonetheless, their downturn is not significantly steeper than that of Australian and New Zealand Dollars.

On the flip side, Canadian Dollar is showcasing strength, buoyed by the resilience in WTI oil prices, which have managed to sustain today’s rebound. Amidst these movements, Dollar finds itself in a neutral territory, prolonging its consolidation phase from last week’s peak.

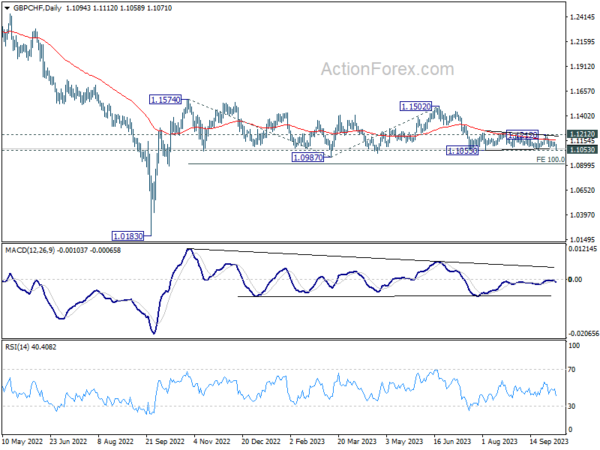

From a technical perspective, GBP/CHF is back eyeing 1.1053 support with today’s decline. Decisive break there will confirm resumption of the fall from 1.1502. That would likely resume the whole decline from 1.1574 . Next target should be 100% projection of 1.1574 to 1.0987 from 1.1502 at 1.0915, even if the fall from 1.1574 is a corrective pattern. With UK GDP release on the horizon for Thursday, it remains to be seen if downside breakout will materialize before the crucial data point.

In Europe, at the time of writing, FTSE is up 0.21%. DAX is down -0.77%. CAC is down -0.50%. Germany 10-year yield is down -0.0341 at 2.854. Earlier in Asia, Japan was on holiday, Hong Kong HSI rose 0.18% on half-day trading. China Shanghai SSE closed won -0.44%, back from week-long holiday. Singapore Strait Times lost -0.25%.

Eurozone Sentix fell to -21.9, current situation hits rock bottom in a year

Investor confidence in Eurozone appears to be staying on shaky ground, as evidenced by the dip in Sentix Investor Confidence from -21.5 to -21.9 for October. While this decline was milder than the anticipated drop to -24.0, it still casts a shadow on the economic climate of the region.

The more granular aspects of the report offer a mixed picture. Current Situation Index slipped from -22.0 to a low of -28.0, a trough not seen since November 2022. Conversely, Expectations Index, which forecasts sentiments for the coming six months, exhibited a rally, climbing from -21.0 to -16.8, marking its zenith since April.

Sentix noted, “The economic situation in the Eurozone remains difficult.” While the uptick in Expectations Index could provide a glimmer of hope, Sentix tempers this optimism by clarifying that it “does not yet indicate a turnaround.” Instead, it might simply imply a slowing down in the waning momentum.

Additionally, Sentix noted investors perceive ECB as somewhat hamstrung in its ability to intervene. The bank’s typical proactive stance in assisting a faltering economy is “not yet discernible.”

Shifting focus to Germany, the data presents a narrative akin to Eurozone. The Overall Investor Confidence experienced a minor lift, moving from -33.1 to -31.1. Yet, this was counterbalanced by Current Situation Index, which not only fell from -38.3 to -39.5 but also reached its nadir since July 2020. On a positive note, Expectations Index saw a boost, rising from -27.8 to -22.3.

ECB’s de Guindos urges caution on oil prices amid enormous geopolitical uncertainties

ECB Vice-President Luis de Guindos highlighting the “enormous uncertainty” that geopolitical tensions are injecting into the financial markets and the broader economy, in light of the heightened conflicts between Israeli and Hamas forces in Gaza.

“The macroeconomic environment is subject to enormous uncertainty.” He further stressed the heightened unpredictability by noting, “Nobody knows what is going to happen in the future,” particularly in light of the recent events over the weekend.

De Guindos still anticipates a downturn in both headline and core inflation. However, he urged stakeholders to remain vigilant. His concerns stemmed mainly from “the evolution of oil prices, the depreciation of the euro and the evolution of unit labor costs”.

USD/CHF Mid-Day Outlook

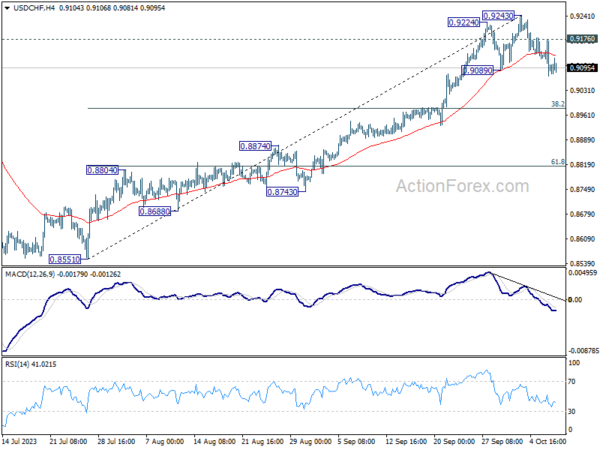

Daily Pivots: (S1) 0.9056; (P) 0.9116; (R1) 0.9159; More….

No change in USD/CHF’s outlook as intraday bias stays mildly on the downside. Correction from 0.9243 would target 38.2% retracement of 0.8551 to 0.9243 at 0.8979. On the upside, though, above 0.9176 minor resistance will turn bias back to the upside for retesting 0.9243.

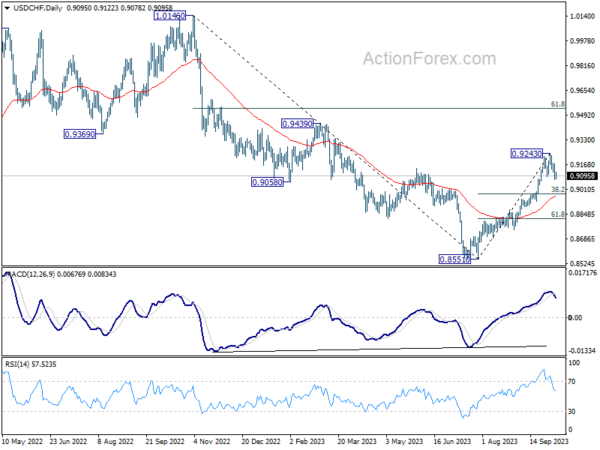

In the bigger picture, current development indicates that rise from 0.8551 is reversing whole down trend from 1.0146. Further rally would then be seen to 61.8% retracement at 0.9537 and above. For now, this will be the favored case as long as 55 D EMA (now at 0.8967) holds, even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | Germany Industrial Production M/M Aug | -0.20% | -0.10% | -0.80% | -0.60% |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Oct | -21.9 | -24 | -21.5 |