Ever feel like no matter how hard you work, getting ahead just isn’t as easy as it used to be?

You’re not imagining things.

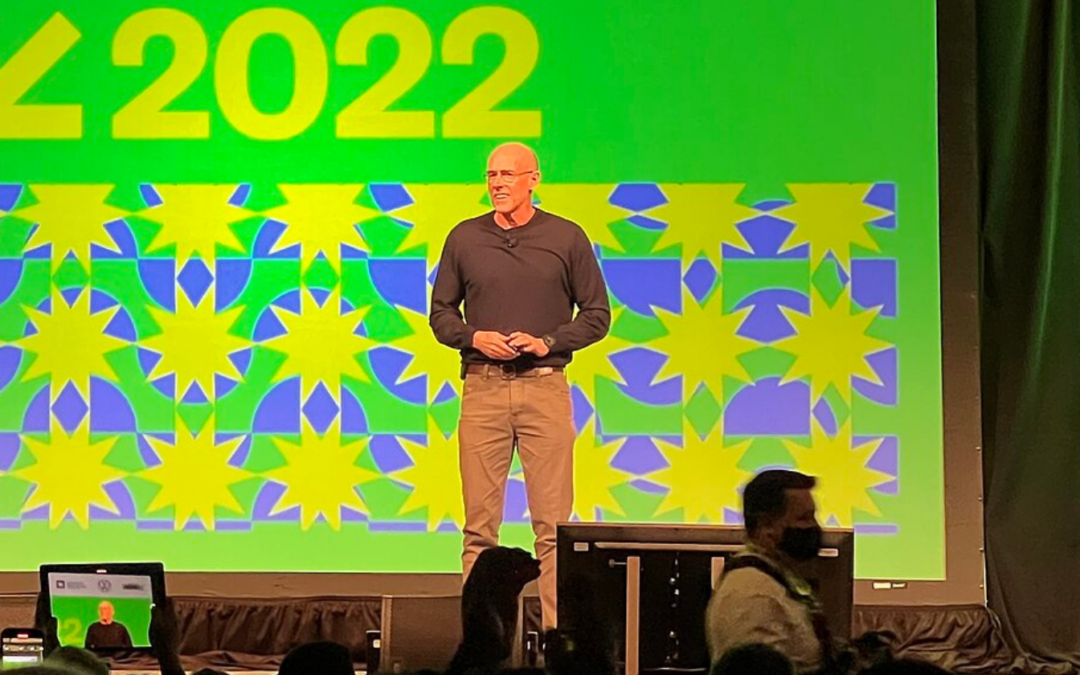

Scott Galloway—entrepreneur, professor, and self-made millionaire—says today’s economy is stacked against young people in ways previous generations didn’t face.

The old playbook for success? It just doesn’t work like it once did.

But here’s the good news.

While the game has changed, there are ways to adapt, outmaneuver obstacles, and carve your own path forward.

Galloway breaks down exactly why it’s tougher than ever to get ahead—and what you can do about it.

1) The cost of education has skyrocketed

A college degree used to be a ticket to a stable, well-paying job. Not anymore.

Scott Galloway points out that the cost of education has risen much faster than wages, leaving many graduates drowning in debt before they even start their careers.

Meanwhile, the return on investment for a degree isn’t as clear-cut as it once was.

This doesn’t mean education isn’t valuable—it just means you have to be strategic.

Instead of blindly following the traditional path, consider alternatives like trade schools, online certifications, or gaining real-world experience through internships and apprenticeships.

The key is to build skills that actually translate into opportunities, rather than just chasing a diploma.

2) Homeownership is becoming out of reach

When my parents bought their first house, they were in their twenties, living on middle-class salaries. It wasn’t easy, but it was possible.

Fast forward to today, and buying a home feels like a distant dream for many. Prices have soared, wages haven’t kept up, and competition is fiercer than ever.

Scott Galloway highlights this as one of the biggest shifts making it harder for young people to build wealth.

I’ve experienced this firsthand. A few years ago, I started saving for a down payment, thinking I was being responsible.

But by the time I had what I thought was enough, housing prices had jumped so much that I was still priced out. It felt like running on a treadmill—no matter how hard I worked, I wasn’t getting anywhere.

So what’s the move?

Galloway suggests rethinking the idea that homeownership is the only path to financial security.

Renting isn’t necessarily “throwing money away” if it allows you to invest in other ways—like starting a business, building skills, or putting money into the stock market.

The key is adapting to today’s reality instead of chasing an outdated version of success.

3) The rich are getting richer—and it’s not by accident

Let’s be real. The system favors those who already have money.

Scott Galloway doesn’t sugarcoat it—wealth isn’t just being “earned” anymore, it’s being “compounded”.

If you come from money, you have access to better education, stronger networks, and financial safety nets that allow you to take risks without fear of total failure.

If you don’t? You’re playing the game on hard mode.

I used to believe that working hard was enough. That if I just pushed myself, made smart choices, and stayed disciplined, I’d eventually break through.

But then I started noticing something—many of the people getting ahead weren’t necessarily the hardest workers; they were the ones who had a head start.

So what do you do when the deck is stacked against you?

Galloway’s advice: focus on leverage.

Build skills that are in demand. Create multiple income streams. Surround yourself with people who challenge and support you.

And most importantly—play the long game. You might not have a built-in advantage, but with the right moves, you can still create your own.

4) Job security is a thing of the past

There was a time when landing a good job meant stability. You worked hard, moved up the ranks, and eventually retired with a pension. That time is gone.

Scott Galloway points out that companies today are more focused on shareholder profits than employee loyalty.

Layoffs happen overnight. Entire industries get disrupted. And even the most “secure” jobs can vanish without warning.

I’ve seen it happen to friends—one day they’re thriving in their careers, the next they’re updating their résumés and scrambling for interviews.

Not because they did anything wrong, but because the company “restructured” or “downsized.”

So how do you protect yourself?

Galloway’s advice: stop relying on a single employer for your financial future. Develop skills that make you adaptable. Build a personal brand.

Create additional income streams—whether it’s freelancing, investing, or starting a side business. In a world where job security is fading, your security comes from what you can build for yourself.

5) The cost of living keeps climbing, but wages don’t

Everything is getting more expensive—rent, groceries, healthcare—but wages? They’ve barely budged.

Scott Galloway highlights a brutal reality: in the past 40 years, the cost of living has skyrocketed, while median wages have only inched up.

In the 1980s, a minimum-wage worker in the U.S. could afford rent on a single paycheck. Today? In most cities, that’s impossible.

I’ve felt it firsthand. A salary that seemed decent a few years ago now barely covers the basics. And every time I think I’m making progress, something—higher rent, inflation, unexpected expenses—sets me back. It’s exhausting.

So what’s the move?

Galloway says the key is to play offense, not just defense. Relying on a single paycheck isn’t enough anymore—you need to increase your earning potential.

That means negotiating salaries, learning high-value skills, and finding ways to create income beyond your 9-to-5. Because waiting for wages to catch up? That’s not a strategy—it’s a trap.

6) Burnout is becoming the norm

Somewhere along the way, we stopped working to live and started living to work.

Scott Galloway points out that hustle culture has convinced us that if we’re not constantly grinding, we’re falling behind.

The result? More people than ever are exhausted, stressed, and questioning if all this effort is even worth it.

I’ve been there. Pushing myself to do more, take on extra work, say yes to every opportunity—because I thought that’s what it took to succeed.

But instead of getting ahead, I just felt drained. And no matter how much I did, it never felt like enough.

Galloway’s advice? Success isn’t just about working harder—it’s about working smarter.

Setting boundaries, prioritizing health, and making time for things that actually matter. Because what’s the point of getting ahead if you’re too burned out to enjoy it?

7) Luck plays a bigger role than we like to admit

We love stories about people who “pulled themselves up by their bootstraps.” But the truth? Success isn’t just about hard work—it’s also about timing, circumstances, and plain old luck.

Scott Galloway doesn’t deny the value of effort, but he also acknowledges that where you’re born, who you know, and even random chance can make or break opportunities.

Some people start ten steps ahead without even realizing it. Others work just as hard—if not harder—and still struggle to break through.

That doesn’t mean you should give up. It means you should give yourself grace. If you’re not where you want to be yet, it’s not necessarily because you’re not trying hard enough.

And if you do find success, remember—it’s not just yours alone.

The bottom line

If getting ahead feels harder than ever, that’s because it is. The rules have changed, and the old paths to success don’t guarantee what they once did.

But here’s what Scott Galloway makes clear—you’re not powerless.

The key is adaptation. Recognizing the barriers, but not letting them define you. Building skills that create leverage. Finding new ways to grow wealth, security, and fulfillment outside of outdated models.

Most importantly, give yourself credit.

If you’re pushing forward in a system that wasn’t built for you, that alone is resilience.

Stay sharp, stay flexible, and play the long game. The world is shifting—but so can you.