Mumbai: Indian banks’ biggest collective strength – exclusive access to low-cost current and savings account (CASA) deposits – can no longer be taken for granted with the average urban saver increasingly tilting in favour of higher-yielding Dalal Street instruments, such as mutual fund plans and direct stock ownership.

And the already visible struggle for deposits could intensify further for the industry with the biggest index weighting – and overseas ownership – as democratisation of technology and familiarity help lift the veil on the hitherto opaque and esoteric world of D-Street for the average rural saver, fundamentally altering the dynamics in the handling of financial savings to the detriment of high-street banks.

At the system level, CASA ratio of all commercial banks put together is 40.5% as of September 2023, compared with 43.1% in March 2023 – and down from 45.2% at the end of March 2022. That translates into a decline of nearly 5 percentage points in 18 months.

To be sure, CASA ratios may also have fallen because of the rise in bank fixed deposit rates. State Bank of India’s (SBI’s) CASA ratio slipped 330 basis points year-on-year to 41.18% as on 31 December 2023. One basis point is 0.01 percentage point.

“There has been a shift in the savings pattern, especially in the metros, where banks used to get most of their large deposits from,” said P R Rajagopal, executive director, Bank of India.” Thanks to digitisation, these savers have access to other savings products, such as mutual funds, denting banks’ ability to garner deposits.”

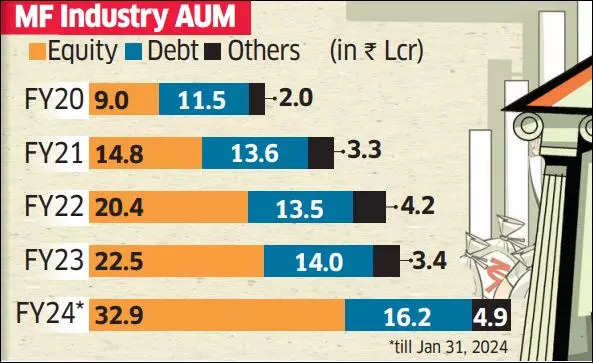

Latest Association of Mutual Funds in India (AMFI) data showed inflows into equity mutual funds hit a 22-month high in January to ₹21,781 crore, and this was the 35th consecutive month of net inflows. Assets under management (AUM) in the pooled funds industry surged to ₹52.74 lakh crore, up from ₹50.77 lakh crore in December.

SIP by SIP

Moreover, total SIP accounts, which allow savers to systematically deploy their surpluses in mutual funds, increased to 79.20 million in January 2024, following the addition of 5.18 million new SIP accounts in January.

The slide in CASA is more apparent in the case of private sector banks of late.

Lured by Attractive Returns

That is because most private bank customers are much younger and comfortable with technology.

They are looking at deploying their idle savings for earning attractive returns and are moving these surpluses to market-linked instruments, such as mutual funds.

The share of CASA deposits of private sector banks declined to 39.9% at the end of December 31, 2023, compared with 44.5% a year ago.

SBI Chairman Dinesh Khara said banks’ CASA ratio is now normalising to pre-Covid levels as people are renewing their spending habits. He also said savers tend to move their funds to higher-yielding assets in times of inflation.

Asset Allocation

“Invariably, we have seen that during inflationary conditions, there is a tendency on the part of all the savers to change asset allocation. But banking remains the only channel through which the money will flow into mutual funds or life insurance or pension funds,” Khara said, adding that this gives banks an advantage.

Indian banks’ credit deposit ratio reached a two-decade high of 80% in December 2023. While the credit growth is 1.5 times the nominal pace of GDP growth, deposits are rising only in line with the nominal GDP, central bank data showed.

Savings are moving toward other asset classes, such as mutual funds, equity investments, and real estate. “All of this is leading to a deterioration in the loan-to-deposit ratio (LDR) levels,” according to a recent report by S&P Global Ratings.

Public sector banks are also facing a challenge because they are no longer getting large floating deposits from their corporate and government accounts.

“Current account deposits are also no longer bulky because companies are actively managing their treasuries and keeping less in their accounts. Also, unlike earlier, the government now only gives ministries their budgeted allocations on demand and not upfront. All these factors have made garnering deposits challenging. These changes are structural and are here to stay,” said Rajagopal from Bank of India.

Also, with some private banks offering flexible deposit plans called sweep deposits, which allow easy liquidity terms, a lot of money from the salary accounts gets parked in such deposits.

“The sweep deposit concept is more prevalent in private banks. Customers could also be shifting to mutual funds, although this holds for both public sector and private sector banks,” said Madan Sabnavis, chief economist, Bank of Baroda.