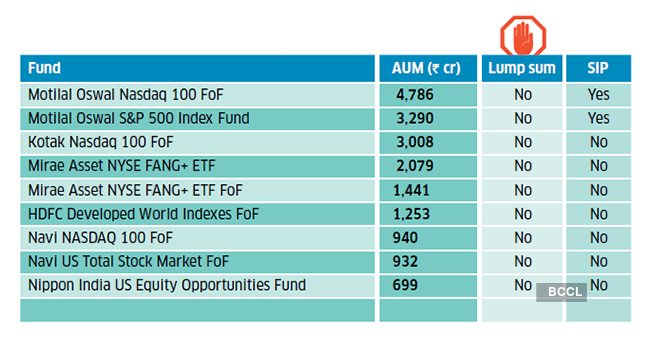

The once popular mutual fund route to foreign markets has largely closed due to the RBI restrictions on overseas investments. Many international funds have shut down or restricted inflows, only allowing investments to the extent of fund redemptions. Some accept SIP contributions, while others permit bullet investments. Additionally, the fund of funds route for investing in overseas ETFs has ceased, with funds halting fresh inflows from 1 April.

Initially, when funds reached the RBI’s investment limit in 2022, it was believed to be temporary, with the cap expected to increase soon. However, the cap continues to remain unchanged, having deprived investors of overseas exposure for over two years now.

Of the 69 international funds, 26 have been closed in some capacity. Some have been toggling flows intermittently due to limited capacity. The Rs.7,500 crore Motilal Oswal Nasdaq 100 ETF initially paused flows for 3-4 months two years ago, but now remains open, providing liquidity daily based on demand. However, it uses outflows to manage limits and may close at any time. Pratik Oswal, Head, ETFs and Index Funds, Motilal Oswal AMC, points out, “We have some headroom to invest abroad, but we are not encouraging large investors and are giving preference to retail SIP contributions.”

Funds still open for both SIP and lump sum

With MF investors mostly shut out, an important lever of portfolio construction is now broken, insist experts. The 2011-2023 period proved rewarding for overseas investing, particularly in the US-dedicated equity funds. Motilal Oswal Nasdaq 100 ETF, the biggest such fund, has led the way with a stunning 22% annualised return since inception in March 2011. Franklin India Feeder Franklin US Opportunities and ICICI Prudential US Bluechip, both launched in 2012, have yielded 15.8% since inception. DSP US Flexible Equity, another 2012 launch, has also clocked 14.9%. While returns have been great, the real utility of global funds lies in their lower correlation with the Indian markets, say experts. Vidya Bala, Head, Research, Primeinvestor.in, asserts, “International markets, specifically the US, not only provides diversification in the nature of businesses, but also has increasingly lower correlation with the Indian market, thus providing market diversification as well. Hence, a reduction does impact the benefit of having this segment in one’s portfolio.” Vivek Banka, Co-Founder, GoalTeller, says, “Along with the unfavourable shift in taxation of international funds, this investment restriction has taken the sheen off this space. It has left investors with a void in achieving diversification and participating in themes like tech and AI, which aren’t available as freely in India.”

Funds temporarily suspended

The list includes only the nine biggest funds. Source: Value Research

Until the cap was reached, domestic funds increasingly looked to global stocks for diversification. It was the central plank of Parag Parikh Flexi Cap’s ‘go anywhere’ style, with foreign exposure at roughly 30% of its corpus in 2021. It proved highly beneficial. Several other domestic funds, including a focused fund, value fund, ESG fund and a hybrid fund, started making provisions for allocation to foreign stocks. However, after the curbs, these funds are no longer making incremental bets in foreign stocks. Parag Parikh Flexi Cap’s overseas positions now comprise 15% of its portfolio. Raunak Onkar, Fund Manager, PPFAS Mutual Fund, says the fund will continue to allocate incremental inflows to domestic stocks only. However, given a chance to invest more in foreign holdings, the co-fund manager of this flagship scheme would like to hike exposure to foreign stocks as it will help diversify geographically.

Newer multi-asset funds provide exposure to foreign equities, but they have reduced their overseas allocation. The diversification once offered by these funds is now diminished. “One can invest in funds like Parag Parikh Flexi Cap and others, which still have some offshore exposure. However, the diversification would be minimal in the overall context of things,” remarks Banka.

With more and more funds clocking out, investors are finding it tough to navigate this space. SIP commitments have either been ended or will get shuttered soon. Apart from Motilal Oswal Nasdaq 100 ETF, other big offerings currently open include Franklin India Feeder Franklin US Opportunities Fund, ICICI Prudential US Bluechip Equity Fund, Edelweiss US Technology Equity FoF, ICICI Prudential Nasdaq 100 Index Fund, Kotak Global Innovation FoF, etc. For now, investors can continue with their SIP commitments or make lump-sum investments.

Investors have limited choices beyond these. While they can still invest in local ETFs tracking global indices, these units are only available for purchase on stock exchanges. AMCs cannot create new units in these ETFs, posing a risk of tracking error. Although some less liquid ETFs have shown divergence between fund NAV and market price since the curbs, investors could still consider a few ETFs offering liquidity. “The direct ETF route is still available and though the deviation between NAV and market price has increased since the RBI regulations, it may be worth taking some exposure through the ETF route,” suggests Bala.

The only other option is to invest directly in global stocks, using individual limits under the Liberalised Remittance Scheme (LRS) of the RBI. However, experts caution against this route due to steep costs and tax compliance hassles. The new 20% TDS cuts a fifth of remitted money, while high charges for remittance and forex conversion reduce investible capital. Paperwork and tax compliance add to the inconvenience. “We don’t advocate more than 10% to global investments due to tax inefficiencies, paperwork and lack of understanding,” adds Banka.