Reserve Bank of India (RBI) has allowed investors of its Retail Direct Platform to use the National Automated Clearing House (NACH) facility to make investments.

“Once an investor chooses NACH as the payment option while placing a bid, the investor need not log in again for making payments. The investor’s account will be debited automatically for the placed bids on the specified date. Investors can continue to earn interest for the money lying in the account till the debit date. NACH also provides for higher payment limits up to Rs 1 crore,” RBI said in an email sent to RBI Retail Direct customers.

Also read: How can NRIs open an RBI Retail Direct Account

Do note that there is a time lag of two days from the creation of a NACH mandate and when the investor’s bid will go through

UPI vs NACH payment facility

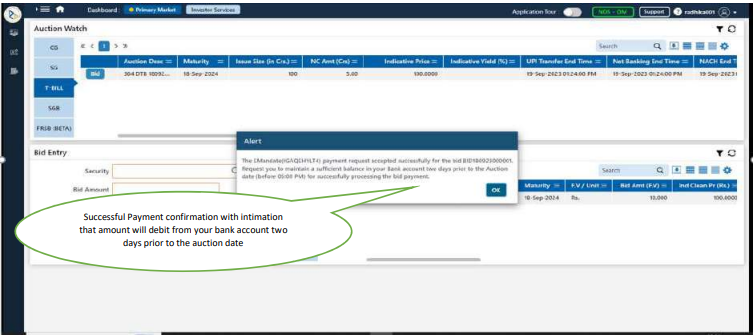

Time taken to invest: Before NACH came into existence as an additional payment option on RBI Retail Direct, an investor had to place the bids and his/her preferred price and pay using UPI/Net-banking immediately. If the bid price was accepted in the auction cut-off investors would get successful allotment after the auction date was over. Otherwise, if the allotment was not successful the money so paid would be refunded. In NACH mandate-type payments money would only be deducted two days prior to auction date. Until the time two days prior to auction date comes, the money would stay in the bank account of the individual.RBI in its email said, “Successful Payment confirmation with intimation of that amount will debit from your bank account two days prior to the auction date.”

Time taken to log in: The RBI has clarified that once the bid is placed and the NACH mandate is set-up and is used for paying for the bid an individual does not need to login again to invest. Whereas in UPI an investor needs to login in order to put in his/her bid and also make the payment, as the payment happens immediately when the bid is placed.

Limit: Unified Payment Interface (UPI) can be used to invest up to Rs 5 lakh in government bonds through RBI retail direct platform. However in NACH mode there exists an higher limit of up to Rs 1 crore.

How the NACH payment process in RBI Retail Direct works

According to the RBI’s email about NACH payments on RBI Retail Direct portal, heer is a four things to keep in mind before setting up a mandate:

1. Investors have to register themselves for NACH by creating an E-Mandate

2. While making Payment for a bid, Investors have to select the NACH Option and the registered E mandate UMRN.

3. Bid Indicative amount will auto debited from Investors bank Account on specified Date.

4. Post Auction allocation, excess mark-up amount will be credited back to the Investors account.

“In the Retail Direct System, currently only the E-mandate registration facility is available,” said the RBI in a guide note about NACH payments on RBI retail direct. Also in order to create an NACH E-mandate an individual requires either his/her bank’s debit card or net-banking facility.

Here’s a step-by-step guide on how to create a NACH mandate on RBI Retail Direct Portal

Step 1: Go here- https://rbiretaildirect.in/#/login/ and login to your RBI Retail Direct Account. If you do not have an RBI Retail Direct account then create one by clicking on the ‘REGISTER HERE’ button.

Source: RBI Retail Direct Website

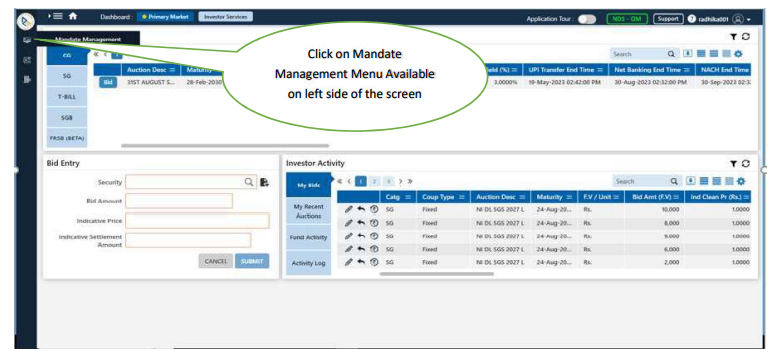

Step 2: Once logged in click on the ‘Mandate Management Menu’ button on the left side of the dashboard page.

Source: RBI guide note on NACH payments on RBI Retail Direct

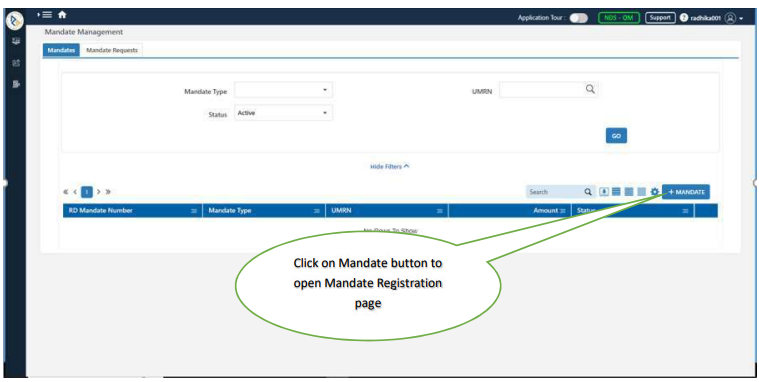

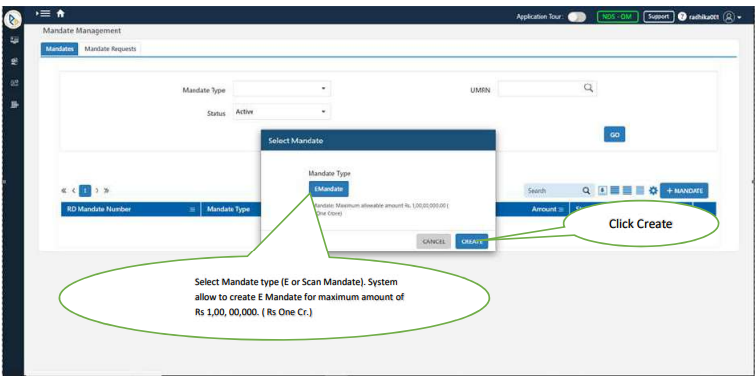

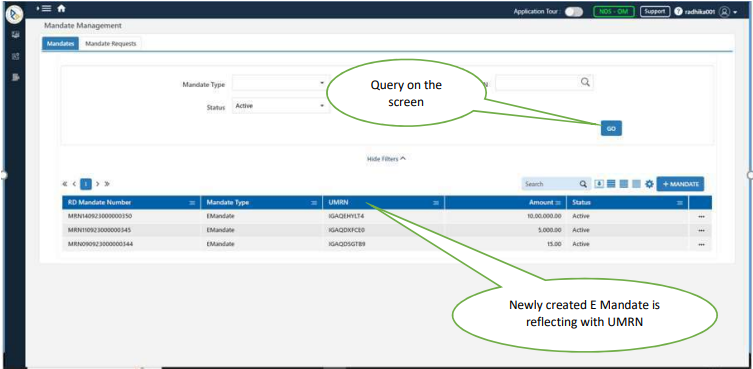

Step 3: A new webpage will open. This webpage will have a button called ‘MANDATE’, click on that. A new small dialog box would open tilted ‘Mandate Registration Page’. Click on ‘EMANDATE’ and click on ‘Create’. Presently this is the only option available.

Source: RBI guide note on NACH payments on RBI Retail Direct

Source: RBI guide note on NACH payments on RBI Retail Direct

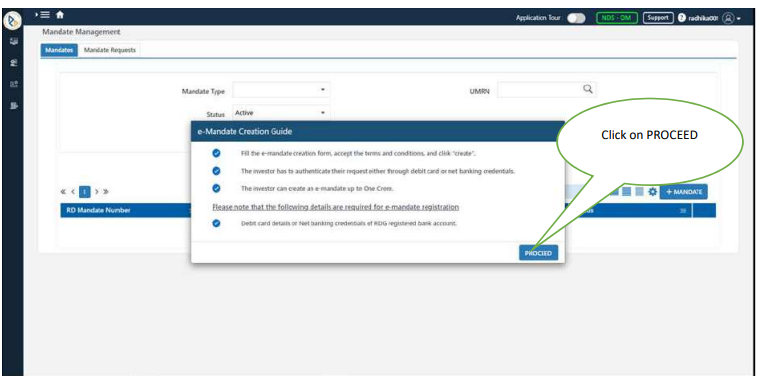

Step 4: Another dialog box titled ‘e-Mandate Creation Guide’ would open. Click on ‘Proceed’.

Source: RBI guide note on NACH payments on RBI Retail Direct

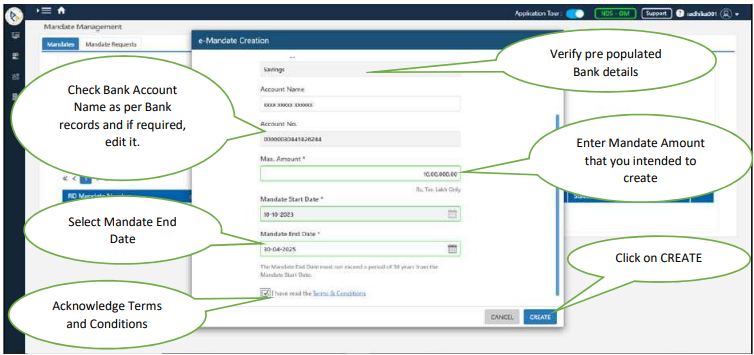

Step 5: A new web page titled ‘Mandate Creation’ would open. Here an individual must verify the pre-filled data which would have been captured while opening the RBI Retail Direct Account. Then select the end date for the E-Mandate and type in the maximum amount to be deducted through E-Mandate. Once verified, acknowledge the terms and conditions and then click on ‘CREATE’.

Source: RBI guide note on NACH payments on RBI Retail Direct

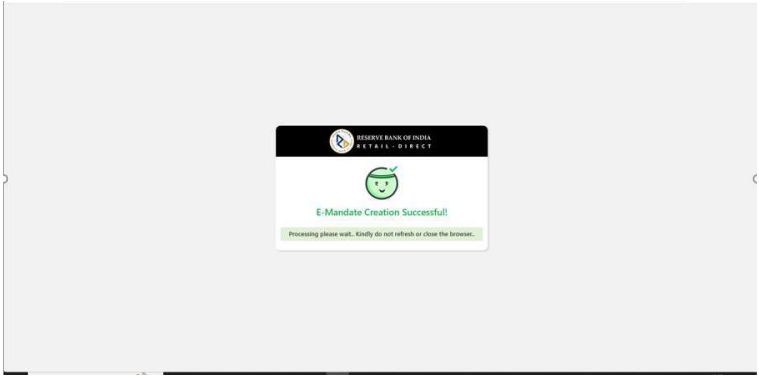

Step 6: A new bank specific web page would open and on this page an individual would have to select an authentication method- debit card or net-banking. Once the authentication is successful an individual would be directed back from their bank specific page to the RBI Retail Direct page with a message saying either the mandate creation has been successful or failed.

Source: RBI guide note on NACH payments on RBI Retail Direct

In order to get to know the UMRN of the mandate which was just created go back to the ‘Mandate Management Menu’. And click on the ‘GO’ button.

Source: RBI guide note on NACH payments on RBI Retail Direct

How to make investments using NACH on RBI Retail Direct

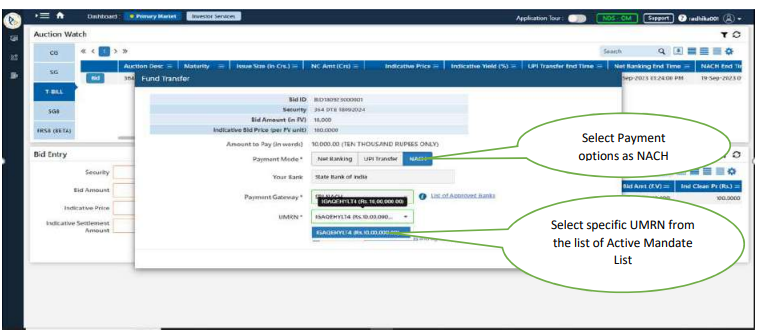

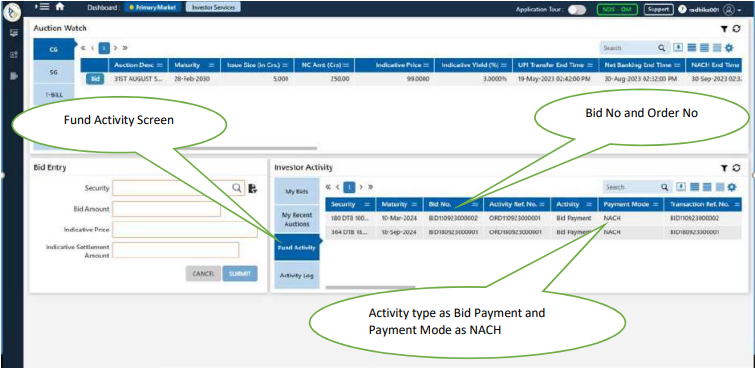

Step 1: Select the specific security (bonds or state development loans) and click on the bid button. Type in your preferred price at which you would like to buy and then proceed to fund transfer. On the fund transfer page select the payment option as NACH and then select the UMRN from the list of active NACH mandates. Once selected acknowledge the terms and conditions and click on ‘PAY’.

Source: RBI guide note on NACH payments on RBI Retail Direct

Step 2: A small dialog box would open intimating the individual that his auction bid was submitted and that the investment money would be deducted from his bank account two days prior to the auction date.

Source: RBI guide note on NACH payments on RBI Retail Direct

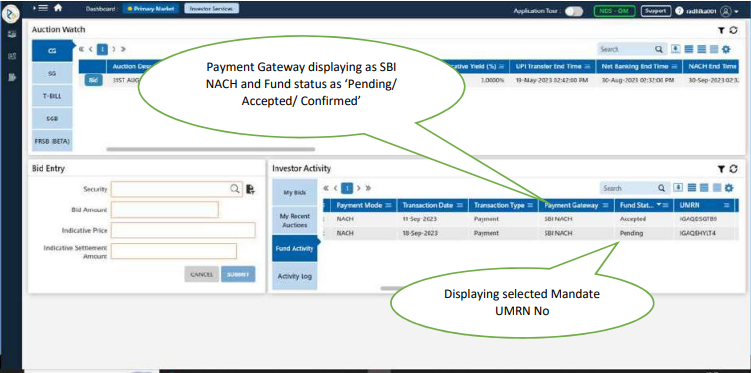

In order to check whether the bid got placed successfully or not go to the dashboard and then navigate to the ‘Investor Activity’ column. In this column every bond or state development loan which you have bid for will be shown and on the ‘Payment Type’ column NACH or whatever mode you used for paying would be shown. If NACH was used then on the ‘Payment Gateway’ column the status would either be shown as ‘Pending/Accepted/Confirmed’. The UMRN would also be shown.

Source: RBI guide note on NACH payments on RBI Retail Direct

Other columns like ‘Bid No.’, ‘Order No.’, ‘Transaction Reference Number’ and others would also be populated.

How to cancel e-Mandate on RBI Retail Direct Portal

Step 1: Go to the ‘Mandate Management Page’ and select the specific ‘E-Mandate’ and then click on the menu button which is represented by three dots (…). There would be an ‘Cancel’ button. Click that.

Source: RBI guide note on NACH payments on RBI Retail Direct

Step 2: A dialog box titled ‘e-Mandate Cancel’ would appear. Click on the ‘Delete’ button. Another small dialog box titled ‘Alert’ would pop up and it would ask for final acknowledgement that clicking on the ‘Delete’ button would cancel the e-Mandate which the individual created. Click Yes.