- The Dow Jones Industrial Average (DJIA) has given up all its ex-post US CPI intraday gains triggered by losses inflicted on the 10-year US Treasury Note futures.

- The ongoing weakness seen on the DJIA may act as a drag on the Nasdaq 100.

- Watch the 19,800 pivotal resistance on the Nasdaq 100 for a potential short-term mean reversion decline scenario to unfold.

Since our last publication, the Nasdaq 100 has rocketed and surpassed the 19,160 short-term resistance as highlighted. Yesterday, 12 June, it printed another fresh all-time high of 19,557 on the backdrop of a softer-than-expected US inflationary trend for May.

The core US CPI print (excluding food and energy) continued decelerating to a three-year low of 3.4% y/y in May from 3.6% y/y in April and below the consensus estimates of 3.5% y/y.

However, there are several key intermarket and fundamental factors to highlight where the ongoing eight weeks of red-hot bullish price actions seen in the Nasdaq 100 may have hit a roadblock and the next occurrence is a potential “healthy” corrective decline within its medium-term and major uptrend phases.

Mildly hawkish Fed dot plot

The latest US Federal Reserve’s economic projections (dot plot) summary was released yesterday in conjunction with the FOMC meeting.

The Fed’s monetary policy decision outcome did not surprise market participants as it maintained its Fed funds rate at 5.25%-5.50% for the seventh consecutive meeting.

In contrast, the latest projections of the dot plot threw in a “mildly hawkish” surprise. The median projected Fed funds rate at the end of 2024 now stands at 5.1% which suggests an implied forecasted sole rate cut before 2024 ends, compared to previous forecasts of three cuts, and below market expectations of two rate cuts (potentially in September and December) priced in for 2024 as inferred from the CME FedWatch Tool as of 13 June 2024.

In addition, the median projection for the core PCE inflation for 2024 and 2025 has been revised upwards to 2.8% and 2.3% from 2.6% and 2.2% respectively as forecasted earlier in March.

Hence, the current implied forward guidance of the Fed still erred towards a cautious stance in executing its interest rate cut cycle and maintained its current data-dependent approach in the decision-making process.

This data-dependent mantra was echoed during Fed Chair Powell’s press conference where he stated that the Fed needs more data to be able to cut rates despite an acknowledgment that the inflationary trend in the US has shown further modest progress toward the Fed’s 2% target.

The only “celebratory takeaway” for the dovish camp was an additional projected rate cut to the Feds fund rate in 2025, an implied forecast of four cuts versus three cuts projected earlier in March’s dot plot.

Dow Jones Industrial Average sold off together with the 10-year US Treasury Note futures

Fig 1: 10-year US Treasury Note futures with S&P 500, Nasdaq 100 & DJIA as of 13 Jun 2024 (Source: Trading View, click to enlarge chart)

Fig 2: 10-year US Treasury notes futures (continuous contract) medium-term trend as of 13 Jun 2024 (Source: Trading View, click to enlarge chart)

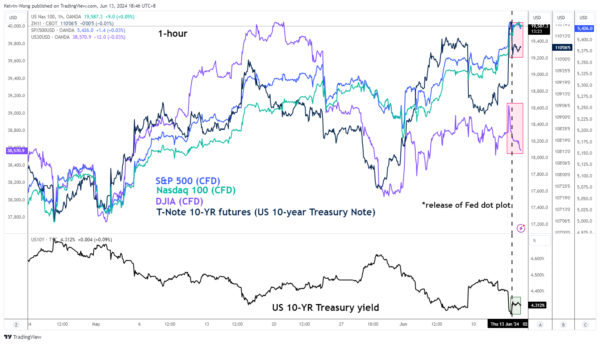

Interestingly, upon the release of the “mildly hawkish” Fed dot plot, the Dow Jones Industrial Average (DJIA) staged a minor bearish reversal in line with similar movement seen in the 10-year US Treasury Note futures, and the DJIA gave up all its intraday gains fuelled by the ex-post US CPI data release (see the red boxes depicted in Fig 1).

On the contrary, the S&P 500 and Nasdaq 100 have been immune to the intraday sell-off of the Dow Jones Industrial Average triggered by a minor intraday recovery in the 10-year US Treasury yield to recapture its 4.30% support after it hit an intraday low of 4.25% on Wednesday, 12 June that in turn, led to a drop in the 10-year US Treasury Note futures (bond prices move in opposite direction with bond yields).

As seen on the technical analysis chart of the 10-year US Treasury Note futures (continuous contract), its rebound from Monday, 11 June low has now almost reached a key medium-term resistance zone of 110-12/111-08 (also the 200-day moving average) which suggests a potential mean reversion drop back towards its range support at 108-00/107-23 (see Fig 2) cannot be ruled out.

Hence, a further potential drop in the 10-year US Treasury Note futures may add further downside pressure seen currently in the price actions of the Dow Jones Industrial Average where it may act as a drag on the heavily concentrated mega-cap technology and AI-centric Nasdaq 100 and S&P 500 due to their direct intermarket correlation.

Nasdaq 100 melt-up has hit a medium-term resistance zone

Fig 3: US Nas 100 major and medium-term trends as of 13 Jun 2024 (Source: Trading View, click to enlarge chart)

Fig 4: US Nas 100 short-term trend as of 13 Jun 2024 (Source: Trading View, click to enlarge chart)

The recent medium-term uptrend phase of the US Nas 100 CFD Index (a proxy of the Nasdaq 100 futures) from its 19 April 2024 low of 16,985 has hit a 19,570/730 medium-term resistance zone which is defined by a cluster of Fibonacci extension levels and the upper boundary of the major ascending channel from 6 January 2023 low (see Fig 3).

In addition, the daily RSI is now fast approaching an extremely overbought level of 78.31 printed on 15 June 2023. These key technical elements suggest the current melt-up move may have reached an overstretched condition where the next move is probably a potential corrective mean reversion decline at least in the short term.

Watch the 19,800 pivotal resistance for a potential short-term mean reversion decline scenario to unfold that may expose the next intermediate supports at 19,240/19,100 and 18,910 (also the 20-day moving average) (see Fig 4).

However, a clearance above 19,800 invalidates the bearish scenario to see the continuation of the impulsive upmove sequence for the next intermediate resistances to come in at 19,900 and 20,120/155.