Stocks

People who do these jobs are 40% less likely to end up with cognitive impairment after 70

A new study on the risks of cognitive decline looked at 7,000 people in 305 occupations.

This ‘hidden gem’ of a city wants the tech world to take notice

Although it’s home to 11 Fortune 1,000 companies, Richmond, Va., has a “modesty problem.”

Technology stocks show signs of ‘breaking down’ ahead of Big Tech earnings

Technology stocks are broadly showing signs of “breaking down,” as the sector struggles in a slump this month that has deepened significantly, according to Bespoke Investment Group.

Living to 95 may impact the world as much as AI and climate change

You need an “evergreen” approach to life, work and health, economics professor Andrew Scott says.

If recent stock-market weakness has you on edge, this might be your problem

4 ways to play defense from a market-beating fund manager

Activist investor Ancora ramps up pressure in Norfolk Southern board battle

The Norfolk Southern proxy fight is intensifying ahead of the company’s annual meeting on May 9.

Oil prices fall as analysts say Middle East tensions not likely to escalate

Oil prices retreated Monday as concern eased that the geopolitical tensions in the Middle East would disrupt supply.

CoStar pays big premium to buy tech company that creates virtual showings

Matterport’s stock skyrocketed Monday, after the provider of 3D “digital twins” of real estate properties agreed to be acquired by online real estate marketplace CoStar Group Inc. in a deal valued at $1.6 billion.

Chipotle kicks off Middle East expansion with first Kuwait restaurant

The Kuwait City restaurant marks Chipotle’s first entry into a new country in 10 years.

Albertsons’ profit tops estimates and offsets revenue miss

Chief Executive Vivek Sankaran said the numbers came against a “difficult industry backdrop.”

Opening arguments kick off Donald Trump’s historic first criminal trial. Here’s what to expect.

Trump faces felony charges for allegedly trying to cover up hush-money payments to adult-film star Stormy Daniels.

My daughter has special needs. Does the IRS have the authority to take money from a trust that I set up in her name?

“I am not in any trouble and nor do I currently owe any money to the IRS. However, I’ve had several expensive run-ins with the IRS.”

My wife and I bought a vacation home with a 6.6% mortgage rate. Should we sell our rental property to pay it off?

“The way I look at it, paying the mortgage off now would give us a guaranteed 6.6% return, which is higher than our return on the condo.”

Cardinal Health’s stock falls after company says contract with OptumRx will not be renewed after June

Drug distributor backs fiscal 2024 profit guidance despite end of contract that generated 16% of its revenue last year.

Verizon loses fewer subscribers than expected on key metric, and its stock rises

Verizon lost fewer net postpaid phone subscribers than expected in the latest quarter, as consumer gross additions ticked up and churn improved.

Quanex to buy British rival Tyman in $1.1 takeover that would pull U.K. firm off the London Stock Exchange

The $1.1 billion takeover would see the FTSE 250 company taken off the London Stock Exchange following a series of exits in recent months

Gold set for biggest one-day fall since December as geopolitical concerns ease

Gold prices are under pressure as the new trading week kicks off, with geopolitical pressures seen easing in the Middle East.

The 2025 BMW Z4: This quick and agile luxury sports car drives with flair

The 2025 BMW Z4 is a luxury sports car with speed, agility, and class. It’s good at what it does, and it’s not just a weekend toy.

Cars are piling up at dealerships, and that means discounts—but not for every brand

March saw an increase in the oversupply of new vehicles, but the situation changes from brand to brand.

Tesla cuts prices for many of its models worldwide, slashes cost of Full Self-Driving in U.S.

Tesla Inc. cut prices for many of its vehicles in the U.S., China and Europe over the weekend amid slumping sales.

Salesforce, Informatica reportedly can’t agree to deal terms

Salesforce Inc.’s bid to buy Informatica Inc. has sputtered after neither company could agree to terms, the Wall Street Journal reported Sunday night.

S&P 500 heads for worst month since 2022 as bond yields jump on inflation fears

The U.S. stock market’s bull run has hit a rough patch, as bond yields spiked this month on fears that a robust economy is helping to keep inflationary pressures alive.

The Magnificent Seven have gotten less magnificent ahead of earnings. This one could have the most explaining to do.

Four of the Magnificent Seven stocks will make their case to investors this week.

I bought an air fryer from Costco. Should I now buy gold?

The warehouse chain has done a brisk business selling the precious metal.

House passes bill that could lead to U.S. TikTok ban, and Senate’s OK looks likely

The U.S. House of Representatives has voted in favor of a revised bill that could lead to a nationwide ban of TikTok, setting the measure up for a Senate vote before President Joe Biden can sign it into law.

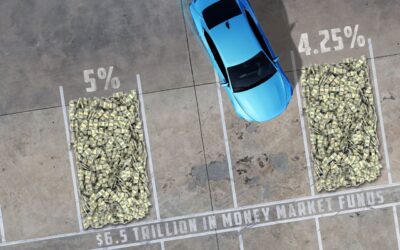

Here is a one-year CD that now pays 5.36% — thanks to the Federal Reserve

There are safe places to park your money and get a decent return.

I love small towns and rail-trails. My house budget is $200,000 — so where can I retire?

Looking for ideas on the best place for you to retire? Email HelpMeRetire@marketwatch.com.

Here’s what the S&P 500’s 50-day moving average is telling us now about stocks

The once-reliable market-timing indicator has lost its predictive power.

Juice up your S&P 500 fund for higher returns

What you add to the S&P 500 can spice up your results, for higher returns and possibly lower risks

Big pharma is looking to fatten profits with buyouts of weight-loss drug companies. Here are 4 candidates.

Even if they’re not acquired, these small companies are developing promising obesity and diabetes treatments.

IRA beneficiaries don’t have to take an RMD this year. But here’s why maybe they should.

Beneficiaries of individual retirement accounts don’t have to take required minimum distributions this year — a responsibility that can normally result in owing more in taxes.

Biden has lost control of the financial cycle ahead of the election

Mortgage rates are back above 7% and the Federal Reserve is no position to conduct multiple rate cuts before November.

How much stock exposure is enough for retirees? These 10 target-date funds offer clues

Funds pegged to retirement in 2020 still kept a meaningful allocation to the stock market.

This timeline charts oil prices reacting to Israel-Iran attacks so far. What comes next?

A volley of attacks between Israel and Iran isn’t rattling oil markets. Is crude priced for peace?

This chart shows why the stock-market rally should broaden out later this year

The earnings-growth differential between the largest S&P 500 companies and the rest is expected to shrink later in 2024.

I’m 55 with no kids. I was unhappy at work so I took early retirement. I’ve more than $2.7 million in stocks and $1.6 million in real estate. Is that enough?

”I expect to inherit close to $500,000, but I am not counting on that in my planning.”

Test yourself: See if you’re one of the few who can answer these 2 basic retirement questions

Financial literacy can make a big difference in how well prepared we are for retirement.

How to find off-market property listings, according to real-estate pros

Looking for off-market properties involves thick skin and some detective work, three real-estate pros say.

Why Elon Musk’s latest Tesla robotaxi promise is unlikely to deliver

If anything, autonomous vehicles seem to be further away from the ultimate goal of being fully self-driving.

Tesla earnings day is around the corner. So far, robotaxis are ‘just a buzzword.’

Tesla is heading toward its earnings day next week, and there’s plenty for investors to worry about.

Nike discloses ‘second phase’ of job cuts at its headquarters amid cost-savings efforts

More than 700 staff at Nike’s global headquarters in Oregon will have been laid off by June 28, the company said.

Tesla’s stock suffers sixth straight slide as Cybertruck recall is announced

Tesla must recall nearly 4,000 Cybertruck vehicles due to potential problems with their accelerator pedals.

Bitcoin’s price stable after fourth ‘halving’. Here’s what investors need to know.

Bitcoin’s latest “halving” — the fourth in the cryptocurrency’s history — is now complete. And while the token’s prices are off their highs from earlier in the day, there doesn’t seem to be much of a reaction — at least, not yet.

‘My boss didn’t even know’: Tesla employees talk about being shocked at how they were laid off

“I got the email on my off day, and they sent it in the middle of the night — no warning,” one former Tesla employee said about the layoffs.

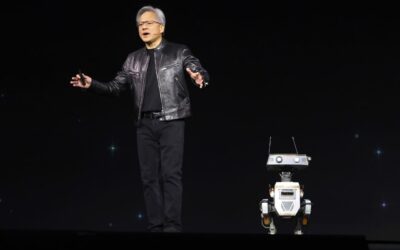

Nvidia’s stock plunge leads Magnificent Seven to record weekly market-cap loss

The decline in Magnificent Seven stocks has erased a collective $934 billion from their market capitalizations so far this week.

Tesla’s stock keeps getting cheaper — and Cathie Wood’s ETFs keep buying it

ARK Invest ETFs bought roughly $26 million of Tesla stock in the past three days, and more than $100 million in April.

U.S. dollar — and its No. 1 status — could become a casualty of economic war

A less-respected U.S. dollar will have major implications for world trade and American consumers.

As Paramount’s stock soars, bonds see net selling despite juicy yields and discounted prices

Paramount’s bonds that mature in 2032 and 2036 are currently yielding more than 7%.

Rate-cut expectations give way to questions about a Fed hike — and how much higher interest rates should go

Portfolio managers, economists, and Federal Reserve policy makers are all asking the same question: Are U.S. interest rates, now at a 23-year-high of 5.25% to 5.5%, high enough?

Cinemark poised to reap the benefits of a better box office, says Wedbush, raising price target and estimates

Cinemark Holdings Inc. is well positioned for an improved box office as the movie theater industry recovers from the effects of last year’s Hollywood writers’ and actors’ strikes, according to analyst firm Wedbush.

AMC’s stock resumes rally, on pace for highest close since March

Shares of movie-theater chain and original meme stock AMC are up three of the past four days.

Why Super Micro’s stock is tumbling toward its worst day in two months

Some were hopeful Super Micro would give a positive update ahead of its official results, but that didn’t materialize when the company set its earnings date.

Tesla reports earnings next week — can you as an investor expect anything good?

Also: Netflix’s good numbers and a reporting change, buying a home off-market, and retirement investing strategies.

Norfolk Southern fires back at activist Ancora as proxy fight intensifies

Norfolk Southern has slammed the “flawed assumptions” of Ancora’s “highly unrealistic near-term financial targets” for the company.

Amex says cardholders are buying lots of ‘front-of-cabin’ plane tickets, as total spending grows 7%

American Express saw an acceleration in new card acquisitions during the first quarter, and it recorded a profit beat for the period.

Trump Media’s ‘DJT’ stock rises again after call to stop ‘naked’ short selling

Trump Media & Technology’s stock rallied Friday and was headed for a third straight gain after the parent company of Donald Trump’s social-media platform Truth Social asked regulators to look into potential illegal selling activity.

‘I’d rather wear a potato sack’: I’m a bridesmaid at three weddings. The brides chose ugly dresses — and I’m obliged to pay. Should I say no?

“I’m getting increasingly anxious about these mounting expenses, and I don’t know how I can possibly afford them.”

Netflix is undergoing a tech ‘rite of passage,’ and Wall Street doesn’t like it

Other technology companies have pulled back on financial disclosures as they’ve grown, and now Netflix will do the same.

Schlumberger posts profit gain for first quarter as revenue tops estimates

International revenue rose 18% to offset softness in North America, says CEO.

Mark Zuckerberg is now richer than Elon Musk as Meta launches new AI

Zuckerberg’s total net worth of $178 billion surpassed Musk’s $170 billion as of Friday, according to Bloomberg’s Billionaire Index.

P&G’s stock falls after sales miss, as baby and health-care volumes declined

Shares of Procter & Gamble Co. slipped Friday, after the consumer packaged-goods company reported fiscal third-quarter sales that came up short of forecasts, amid weakness in the segment encompassing baby, feminine and family-care products.

Apple removes WhatsApp and Threads from China store after order from government: WSJ

The removal from the app store means Chinese mobile users are unable to download and use it via VPNs, which allow users to get around the country’s firewalls.

Five reasons why the stock-market’s ‘painful’ pullback may be nearing its end

It’s been a painful experience for investors over recent days. But it may soon come to an end says Tom Lee

This unusual combination signals either booms, bubbles or inflections, says Bank of America

There’s an unusual combination in markets this year that has happened just five times in the last 60 years.

Seven places to retire for people who love cruises

If you plan to cruise a lot in retirement, being within driving distance of a major port can open up the world to you.

Nordstrom confirms it’s looking to go private, with founding family interested in deal

Nordstrom Inc. has formed a special committee of independent directors to explore going private, the company said on Thursday — a move that arrives as clothing retailers struggle with subdued demand and pressure from investors for stronger profits.

Oil prices jump, U.S. stock futures sink on reports of explosions heard in Iran

Crude oil prices jumped and U.S. stock futures sank Thursday night following reports of explosions in a city in western Iran, amid fears of a wider conflict between Israel and Iran.

Try a weekend beach escape to Pensacola: White sand, Blue Angels and blackened redfish

Opera in your flip-flops, mingling with artists, fresh seafood, white sand beaches, sailing and paddling are the makings of a fabulous Florida vacation.

Oil advances but off session highs after Israel retaliation avoids Iran’s nuclear facilities

Oil prices were modestly higher on Friday, following price spikes earlier after Iran fired defenses in military bases in response to drones in the air, suspected to be Israel’s.

Israel downgraded by S&P Global just ahead of retaliatory attack on Iran

S&P dropped Israel’s sovereign credit rating by one notch to A+ from AA-, with the outlook negative, hours before signs of fresh tensions between that country and Iran.

Stocks are bad at holding early gains lately. Can they avoid this six-year milestone?

The S&P 500 needs to end higher on Thursday to avoid a four-day streak of opening in the green, but closing in the red.

These tips for investing in mutual funds and ETFs can elevate your portfolio

This week: Retirement planning with target-date funds; fighting inflation with TIPS funds, and tapping into growth trends and buyouts.

3M may be poised to cut its dividend — and break with a 64-year tradition, says analyst

The company is grappling with legal settlements and a slowdown in growth and margins that are making its dividend difficult to sustain.

June Fed rate-hike risk looms as U.S. labor market stays strong

The once-unthinkable scenario of no interest-rate cuts by the Federal Reserve in 2024 is now giving way to another possibility: a slight chance of a quarter-point rate hike by June.

This century-old stock-market indicator suggests selloff is far from over

A stock-market indicator with more than a century of history is flashing a warning for investors, suggesting the selloff that began earlier this month may deepen.

White House ‘carefully monitoring’ gasoline prices to make sure they’re affordable, Biden aide says

The Biden administration is “carefully monitoring” gasoline prices to ensure their affordability for Americans, a top White House economist said Thursday, as prices have climbed compared to a month ago.

Elevance Health’s quarterly profit tops estimates to offset a revenue shortfall

The stock was on track for its highest close since Dec. 12, 2022, and its biggest percentage increase since July 14, 2023.

‘It’s the scene of an unsolved murder’: We put in an offer on a secluded cabin with 40 acres, but someone was killed there. Should we bail?

“It doesn’t really bother me that someone was killed there. However, what does bother me is the fact that this murder is still unsolved.”

Infosys’ stock falls for a 7th straight day, the longest loss streak in 2 years

Infosys’s stock continued its selloff Thursday toward a 10-month low, after the India-based information-technology consultant reported fiscal fourth-quarter revenue that missed expectations.

Eight stock picks in AI, obesity drugs, e-commerce and other growth areas beyond the S&P 500

Nicole Kornitzer of Buffalo Funds explains how she invests in “secular growth trends that can last a number of years.”

Bill that could lead to TikTok ban gets potential new path to becoming law soon

The prospects may have improved this week for a bipartisan House bill that could lead to a nationwide ban for TikTok.

Can you negotiate severance if you’re laid off? It’s possible — and it’s the ‘No. 1 thing’ most workers leave on the table.

Elon Musk apologized for “incorrectly low” severance packages in the latest Tesla layoffs. Here’s one way to protect yourself from future job cuts.

Leading index for U.S. economy retreats again in March

The leading indicators for the economy fell in March, just a month after posting its first increase in two years, but there’s little sign that growth is slackening.

Fed’s Williams says he doesn’t feel ‘urgency’ to cut rates

The Federal Reserve’s benchmark interest rate is in a “good place,” moving inflation down, and there is no need to rush to push it lower, said New York Fed President John Williams, on Thursday.

Jobless claims flat at 212,000 and still show no sign of rising layoffs

The number of Americans who applied for unemployment benefits last week was unchanged at 212,000, reflecting a surprisingly resilient labor market in which layoffs and unemployment are very low.

Philly Fed factory gauge jumps to highest level in two years in April

The Philadelphia Fed said Thursday its gauge of regional business activity jumped to 15.5 in April, from 3.2 in the prior month.

Oil prices on track to fall for fourth straight day as demand disappoints

Crude-oil prices continued to soften for a fourth straight day Thursday, with futures falling to their lowest level in three weeks.

The stars may be aligning for a repeat of last August’s stock selloff, warns JPMorgan

Investors dismissed a march higher in bond yields last year. That didn’t turn out so well, says JPMorgan.

Alaska Air’s stock up 1.6% after carrier’s loss is narrower than expected and revenue tops estimates

Alaska Air Group has received $162 million in initial cash comp from Boeing over window blowout

Good news for retirees as these ‘low-risk’ investments go on sale

This stampede away from certain assets has created a buyer’s market.

‘He left me for another woman’: During my divorce storm, I began withdrawing benefits from our joint and survivor annuity. Can I reverse this?

“I made a hasty decision to take early retirement as I was financially broke.”

Tesla shareholders shouldn’t be fooled again on Elon Musk’s pay package

Tesla Inc. shareholders have the opportunity to send a message to Chief Executive Elon Musk and his compromised board of directors by voting against Musk’s self-designed pay package.

Nokia says it expects rebound in second half of 2024 following 19% drop in first quarter sales

The Finnish telecoms company said a slump in infrastructure spending in the U.S. and India hit its first quarter revenue

Buy eBay and short Etsy, says Morgan Stanley in call on e-commerce

Morgan Stanley says investors should buy eBay and short Etsy in a call on the $1.1 trillion U.S. ecommerce market.

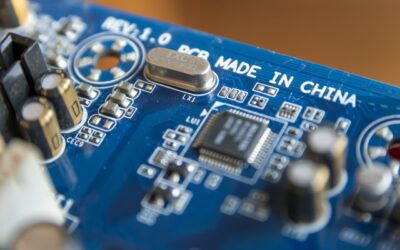

TSMC posts surge in profits as AI boom boosts high-tech chip sales

The Taiwanese chipmaker beat analysts’ forecasts following a surge in demand for its most advanced 3nm chips

CEO Anne Wojcicki looking to take 23andMe private

23andMe Chief Executive Anne Wojcicki is looking to take the beleaguered DNA-testing company private, less than three years after it went public.

The company that lost 99% of its value now has an explanation — a margin call

China Tianrui Group Cement last week saw its stock drop 99%, and then didn’t tell investors why for more than a week.

Silver has outperformed gold in 2024 and is on track for a 4th straight yearly supply deficit

Silver has been outpacing gold’s gain so far this year, and an annual report from the Silver Institute predicts that the global market for the metal is poised to mark a fourth straight yearly supply deficit.

Biden calls for tripling tariffs on Chinese steel and probing Beijing’s potentially unfair trade actions in shipbuilding

President Joe Biden’s administration rolled out new measures that aim to protect U.S. industries and target China on Wednesday, the same day Biden spoke in Pittsburgh to members of the United Steelworkers union.

Red Lobster may file for bankruptcy protection: report

Seafood restaurant chain Red Lobster may be headed for bankruptcy, according to a published report.

Fed’s Beige Book finds steady economic growth but little progress in reducing inflation

The U.S. economy grew slightly faster in the early spring and businesses added more workers, a Federal Reserve survey found, but there was little progress in further reducing inflation.

Trump’s DJT stock rises for a change, for its best day since the ticker changed

Investors in Trump Media and Technology were enjoying a rare win on Wednesday, as Donald J. Trump’s social-media platform’s stock rallied on a day that the broader stock market fell.

AMC’s stock continues rally, on pace for best two-day stretch since October

Shares of AMC Entertainment Holdings Inc. continued their rally Wednesday, climbing 7.2% after ending Tuesday’s session up 10.1% to register their biggest gain since February.

Will the Baltimore Bridge collapse weigh on CSX’s earnings?

Railroad operator CSX reports first-quarter results after market close Wednesday.

How much money should you keep in your checking account? This TikTok user says she would ‘panic’ if her balance fell below $4,000.

There are downsides to keeping too much in checking, experts say.

Three reasons Generation X thinks reality bites when it comes to retirement

Gen X will start turning 60 next year, and they’re less optimistic than baby boomers about their retirement prospects. Here’s why.

Morgan Stanley reportedly planning four-part bond deal a day after blowout earnings

Morgan Stanley is planning to tap the investment-grade bond market later Wednesday with a four-part deal divided between four-year, six-year and 11-year notes, Bloomberg reported.

Can dementia be funny? How about elder scams? ‘The Conners’ mines difficult aging topics for laughs

You’d be surprised by the laughs you can get from a bungled attempt at credit-card fraud.

FTC is gearing up to block the proposed merger of Coach parent Tapestry and Michael Kors parent Capri: NYT

FTC’s five commissioners are due to meet next week to discuss the $8.5 billion deal.

Tech layoffs still in spotlight after Apple and Take-Two cuts. But how does 2024 compare to 2023?

The tech sector layoffs that characterized 2023 have continued into 2024 with a number of big-name companies announcing cuts.

Travelers’ stock suffers biggest selloff in 4 years after profit miss

Shares of Travelers Companies Inc. took a hit Wednesday, after the property casualty insurer missed expectations for first-quarter profit, combined ratio, and net premiums written, while total revenue beat views.

American pandemic savings have depleted faster than other countries. Is that good or bad?

Mohammed El-Erian took to social media on Wednesday to post a chart, drawing on International Monetary Fund research, showing that the U.S. has depleted pandemic savings faster than other economies.

IMF worried about global spillovers from loose U.S. fiscal policy

The International Monetary Fund on Wednesday turned its spotlight on the growing U.S. fiscal deficit, warning that it is now a risk to both the domestic economy and global economy.

Abbott Labs’ first-quarter results top estimates amid strong medical-device sales

Abbott Laboratories on Wednesday reported first-quarter sales and profit that topped expectations amid strength in its medical-device business.

Elon Musk again got no pay last year and Tesla formally asks for help changing that

Tesla’s proxy showed that Elon Musk continued to receive no compensation for his role — but it also formalized the company’s latest attempt to change that.

Why the bond market still holds the cards as Fed walks back its pivot talk

Fed Chairman Jerome Powell is indicating inflation appears to be stuck, a threat to expected rate cuts

Eli Lilly reports positive data in Phase 3 trial of weight-loss drug as treatment for sleep apnea

Zepbound reduced apnea effect by up to 63% and achieved about 20% weight loss after a year.

‘We’re pricing in an acceleration.’ Portfolio manager offers two stocks to protect from this big investor blind spot.

Markets are pricing in an acceleration, and not even a mild recession, warns Matt Stucky, chief portfolio manager, equities, at Northwestern Mutual Wealth Management. He’s got two stocks for that.

You’re paying a lot more for food these days. Here’s how to save money on groceries.

These expert-approved tips can help keep grocery bills within your budget.

Just Eat shares drop as falling takeaway orders in North America hit Grubhub owner’s sales

The Dutch takeaway seller reported a 6% drop in sales driven by plunging orders in North America

My mother-in-law, 75, has difficulty paying off her $52,000 mortgage and $20,000 HELOC. Should she sell her home — or take out a reverse mortgage?

“She can barely make her mortgage payment as all her income goes towards the house payment and living expenses.”

The revised, renewed and renamed 2024 Audi Q8 e-tron has longer range and better driving dynamics

The electric midsize SUV we knew as the Audi e-tron is now the Q8 e-tron, with longer range and cutting-edge Audi style.

LVMH weathers luxury market slowdown as fashion business bolsters sales

The luxury conglomerate posted a 3% increase in its organic revenue in the face of a post-COVID slump that has hit rivals including Kering and Burberry

ASML orders miss estimates as CFO says it’s still on track to meet 2025 goal

ASML Holding, the Dutch microchip equipment maker whose machines are so high tech that the U.S. limits what it can sell to China, on Wednesday reported worse-than-expected orders and a sharp drop in profit as the company works through what it calls a transition year.

Oil posts back-to-back losses, suffering from ‘uneasy calm’ on Middle East tensions

Oil futures notched back-to-back-session losses on Tuesday.

Rents have finally stopped skyrocketing. They’re now stuck at a price most Americans can’t afford.

Rent growth is slowing, but many cost-burdened households see no respite from rising prices.

ETFs that buy bank stocks are under pressure, lagging U.S. equities market

Exchange-traded funds that hold bank stocks were under pressure Tuesday afternoon, lagging the broader U.S. equities market.

‘Extremely active’ hurricane season may lead to late-summer surge in gas prices

U.S. gasoline prices at the pump probably aren’t too far from their likely peak this year, but a particularly active Atlantic hurricane season could lead to a late-summer surge in fuels costs, analysts warned Tuesday.

Fed’s Powell says likely to take longer to meet conditions to cut interest rates

Recent inflation data has not given greater confidence about declining inflation, Fed chair says.

Netflix is getting ready to body-slam the competition with live sports-entertainment content

For now, the password-sharing crackdown and advertising are likely to carry the day for Netflix, whose global membership stands at 260 million.

‘He has quit talking to me’: My father, 83, suffers from hoarding disorder and dementia. Do I have a right to intervene?

“I want to do what’s right and ethical as his child.”

Cutting interest rates is misguided — the easy money would only fuel inflation

The Federal Reserve should keep credit conditions tight for now.

Teslas have never been this cheap. Here’s why leasing or buying a used one may be the best deal.

The EV maker, which is laying off workers, has been slashing prices. ‘There’s a great opportunity for used-car buyers.’

How to save money on your internet and mobile data plan with the FCC’s new broadband ‘nutrition labels’

‘In the past, all of this stuff was hidden in small print,’ says one expert about the FCC’s new labels to help consumer compare broadband deals.

Do cash-gushing stocks outperform the S&P 500? Here’s what history has to say.

Here’s how selecting stocks five years ago by FCF yield would have worked out.

Fund managers are giving up on bonds in a way they haven’t in 20 years

Fund-manager allocations to bonds dropped by the most in more than 20 years as they become more optimistic on growth while becoming less convinced the Fed will succeed in fighting inflations, a survey published Tuesday showed.

Fed shouldn’t cut interest rates to boost U.S. financial stability, IMF says

The Federal Reserve should not cut interest rates with an eye on financial stability concerns, the International Monetary Fund said Tuesday, in its latest update on financial market risks.

Microsoft-allied Rubrik could be valued at more than $5 billion after IPO

Data security company Rubrik has set terms for its initial public offering, which puts it on course to be valued are more than $5 billion

This is the best hedge against unexpected inflation. It’s not what you think.

Gold is not the best hedge against unexpected inflation. Neither is bitcoin.

AMD’s stock can surge 40%, this new bull says — even as Nvidia still dominates

HSBC turns bullish on AMD shares, saying there won’t just be one winner in the market for AI GPUs.

European bank stocks are a better bet than U.S. peers, says JPMorgan

Investors should consider buying European bank stocks ahead of their U.S. counterparts, according to analysts at JPMorgan.

People who say they go to religious services weekly are probably lying, study finds

In what looks to be a clear violation of the Ninth Commandment, people are dramatically overestimating how frequently they attend religious services.

UnitedHealth swings to a loss but stock surges after adjusted profit beats views

Health insurer books a near $700 million hit from Change Healthcare hack during the quarter, sees more costs coming

Tesla’s earnings pressure builds as ‘gut-punch’ executive departure is confirmed

Tesla Inc. confirmed large-scale job cuts on Tuesday, as well as the departure of a key executive — moves that add pressure ahead of the company’s earnings report next week.

Stock-market pullbacks are price of admission, says strategist who expects bumpy gains

Keith Lerner, chief market strategist at Truist Advisory Services, said it’s normal for markets to pull back — only three years out of the last 40 was there not a pullback of more than 5%.

UBS increasing capital by $25 bln is right level, say Swiss authorities

Forcing UBS to hold some $25bn more in capital would be the “right” level, according to Swiss lawmakers.

How Salesforce’s potential Informatica deal is an unwelcome flashback to its old ways

Wall Street did not react well to reports that Salesforce Inc. might buy Informatica, as investors were reminded of its mixed track record at acquisitions.

Increase the retirement age, but only for those who can work longer

Let’s see if we agree on what the retirement age is today

Ericsson posts increase in profits as higher margins offset falling sales

Ericsson shares jumped 5% on Tuesday after the company posted an increase in its profits, as higher margins offset its falling sales

Gold to ‘shine bright like a diamond,’ hit $3,000 within months, says Citigroup

Citigroup analysts predict gold will reach $3,000 within six to 18 months, with more buyers piling in amid Fed rate cut hopes and geopolitical tensions.

Bill to boost child tax credit and corporate breaks looks almost dead on Tax Day

Analysts are not sounding optimistic on the tax package’s prospects in this election year.

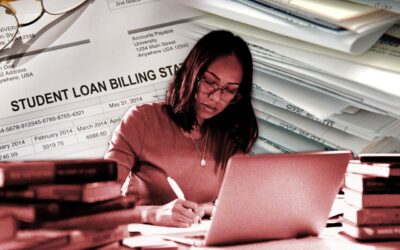

They thought a degree would change their life. Instead, it left them trapped in school and in debt for years.

A $28.5 million deal between Walden University and its former students highlights claims of “reverse redlining.”

Reddit is bucking this big tech trend. Analysts view it as a positive.

‘We don’t really have capex to speak of,’ Reddit CFO Drew Vollero told MarketWatch on the day of the company’s initial public offering last month

Cisco’s stock could surge more than 20% on these three drivers, says BofA

BofA’s Tal Liani upgraded Cisco shares, cheering the company’s opportunity to benefit from networking growth on the heels of market-share gains.

‘Streamflation’ nation: Streaming platforms are overcharging us for subpar content

As costs escalate, the temptation to engage in password sharing, VPN usage, and reliance on third-party apps intensifies.

Here’s how much Caitlin Clark and the other top picks in the historic 2024 WNBA draft will make as pros

Hint: It’s less than $100,000

Oil prices a ‘chief concern’ for markets after Iran attack on Israel

U.S. stocks look to rebound on Monday, after fears over the conflict in the Middle East sparked a flight to safety Friday in U.S. markets.

12 ways to screw up your retirement savings

It’s easy to make mistakes when saving for retirement — even when you have money to invest.

The world is on fire — here are 4 economic ways to put it out

Why helping the poorest countries with debt relief and investment benefits all of us.

Gold falls from record high as market awaits Israel response to Iran attack

Gold futures trade sharply lower Monday, easing back after ending last week at a record high.

Nvidia is the No. 1 S&P 500 growth stock in this screen. See which other companies joined or left the list.

An updated screen of the S&P 500 by expected growth rates for sales, earnings and cash flow shows many changes from last year’s list.

DJT stock tumbles after Trump files for the sale of nearly 115 million shares

Trump Media’s stock tumbled Monday, after the social-media platform filed to issue new shares, and for current stockholders to sell off nearly 150 million shares.

How the WNBA is preparing for Caitlin Clark and the historic 2024 draft class

Monday is the WNBA draft, and Clark is expected to be selected No. 1 by the Indiana Fever. Ticket prices for its road games are already up 151% compared with last season.

I want to tap in to my 401(k) early. What ways are allowed?

There are a few new possibilities, thanks to Secure 2.0

‘Punishing myself would not help’: My credit card was stolen — the thief revealed lots of nasty surprises about my finances

“The best and riskiest part of credit cards is you don’t have to think about the bill for 30 days.”

It’s Tax Day. Here’s what time your return is due — and how to file for an extension.

For many taxpayers, it’s still possible to get free last-minute tax prep in time for the April 15 deadline.

Retail sales rise sharply and could boost U.S. GDP in the first quarter

Sales at retailers rose a robust 0.7% in March and outlays in February were also stronger than initially reported, indicating the economy got a decent boost from consumer spending in the first quarter.

Goldman Sachs’s stock soars 3.7% after first-quarter earnings crush estimates

Goldman Sachs saw a rebound in investment banking as deal flow improved.

Crude-oil prices slide as markets see muted reaction to Iranian attack on Israel

Crude-oil prices retreated on Monday after an Iranian attack on Israel caused little damage, helping to diminish expectations about a broader conflict involving the two bitter rivals.

Corporations have broken capitalism. Here’s how to fix it.

Customers come before shareholders.

‘She burned his papers’: My elderly neighbor named me as his power of attorney. Can his estranged daughter object?

“He and his daughter had not seen each other or spoken to each other in at least three years.”

Adidas wins double upgrade at Morgan Stanley, thanks to ‘Spezial’ and other shoes

Morgan Stanley has upgraded Adidas shares to overweight, saying “channel checks point to building positive sentiment and top-line momentum.”

Temenos shares rally as independent review says short seller’s claims were ‘misleading’

An independent review rejected allegations made Hindenburg Research that knocked $2 billion off Temenos’ market capitalization in February

Medical Properties Trust shares rally on Utah hospital deal

Shares of beleaguered hospital real estate owner Medical Properties Trust soared in preopen trade on Monday after the company agreed to sell Utah hospital properties.

Jeep’s cult-favorite pink Wranglers are back, and it’s not a Barbie thing: The ’70s sitcom that inspired the color

The last time they offered it more than 30,000 customers jumped for it, and the company had to extend its run to meet demand.

Apple loses spot as world’s top smartphone seller as iPhone sales drop 10%

Global smartphone sales increased by 7.8% year-on-year driven by Chinese firms Xioami and Transsion’s double-digit increases

The step-by-step investor guide to navigating armed conflicts

This survival guide is not specific to any particular crisis at hand but based on an analysis of the extensive empirical literature on the impact of wars, civil wars, terror acts, and similar events.

Consumers’ bad feelings about a good economy shouldn’t be ignored, Boston Fed President says

In a conversation with MarketWatch, Susan Collins said she is wary of a negative self-fulfilling prophecy among pessimistic Americans.

Fresh uncertainty around Fed rate cuts exposes the stock market’s winners and losers

Higher U.S. inflation is dashing investors’ hopes for multiple Federal Reserve rate cuts this year, while opening the door to 5% Treasury yields across the board and cleaving the stock market into distinct categories of winners and losers.

Netflix earnings on deck. It could be a lot harder to please investors this time around.

Netflix’s stock has been on a tear over the past year, as the streaming platform gradually adopts the traits of the thing it once upended — a regular TV station.

Bitcoin and other cryptos rebound, but remain lower after Iran attacks Israel

Cryptocurrencies were clawing back some territory on Sunday, the day after a selloff following Iran’s missile and drone attack on Israel.

Cryptocurrencies plunge as Iran begins attack against Israel

Demonstration of how crypto assets can react to global events when more traditional investment instruments are not available for trading.

The stock market is testing the bulls to see if they have what it takes

Maintain a core bullish position but keep your powder dry.

Do you avoid the stock market’s worst six months or hold on?

Why ‘buy and hold’ does better than ‘sell in May and go away’ and most other market-timing bets.

My teenagers filed taxes for the first time, and they weren’t happy about it

They asked some good questions I couldn’t fully answer — even though I’m a “smart money person.”

I need to take RMDs from a 401(k) with $400,000. Should I invest in a Roth IRA or CalSavers?

“Do I just have to ‘bite the bullet’ and pay the taxes?”

Extreme tariffs on Chinese imports could hurt the U.S. more than China

Americans already pay more for China-sourced goods.

Nvidia doesn’t have a monopoly in AI — though it sure seems that way

Pricing power and lack of competition are driving Nvidia’s growth, but rivals are gaining traction.

An investment club helped this woman retire at 60 — even after her employer cut her pension

“One thing I always wanted to have was financial freedom.”

Here’s a simple stock-market timing system you can use that beats all the others

‘Seasonality Timing System’ shifts into and out of stocks using nothing more than the calendar.

Got a bigger tax refund this year? It might seem like a ‘happy surprise’ — but don’t get too excited.

This year, there’s an additional reason to stay sober about refunds — and it stems from how the tax code deals with the rising cost of living.

With inflation running hot, Series I bonds are still a smart move for yield and tax advantages

Even if your high-yield savings rate stops going down, you should think about your long-term cash plan.

This fund has outperformed with stocks that are ripe targets for other companies

Here’s a look at another strategy to continue a series of articles about ways to diversify beyond broad index strategies in the stock market.

Delta’s results are further proof that the carrier is a winner, say analysts

Delta is showing strength in a capacity-constrained environment, according to Melius Research.

Fears of Israel-Iran escalation are driving stocks lower. Here is what investors need to know.

Cracks in the stock market’s big rally in the past five months intensified on Friday as investors worried about a potential escalation of tensions between Iran and Israel.

Small-cap stocks ‘challenged’ as inflation pushes out Fed rate-cut expectations, warns BofA

U.S. small-cap stocks are “challenged” as Wall Street pushes out expectations for when the Federal Reserve may begin lowering interest rates due to concerns over persistent inflation, according to BofA Global Research.

‘She doesn’t like to rock the boat’: My mother will spend millions taking care of my aging stepfather. What can I do?

“It has been stated that he is not leaving my mom anything and that all his money will go to his kids.”

Tesla’s latest self-driving push? A price cut on its FSD software.

Tesla’s FSD software is the “crux” of the bull case for the company’s stock, an analyst wrote earlier this week. Now, the company has made a move that could get more drivers to try it out.

Apple’s stock was the Dow’s biggest winner this week — for the first time since November

Apple Inc.’s weekly stock gain wasn’t too much to write home about in the absolute, but it was good enough to be the largest in the Dow Jones Industrial Average.

Biden’s message to Iran: ‘don’t’ attack Israel — but he warns it could come ‘sooner than later’

President Joe Biden on Friday afternoon urged Iran not to attack Israel, with his remarks coming after reports said a direct attack could come as soon as Friday or Saturday.

UL Solutions’ stock soars 21.5% in trading debut after upsized IPO priced at high end of range

Stock of the testing, inspection and certification company shines in its first day of trading on the New York Stock Exchange.

Rent the Runway is on track for its best week ever after putting up meme-stock-like gains, but the stock is still way down overall

Rent the Runway Inc., an online clothing-rental platform whose stock has plummeted over the past three years as it wrangles debt and weaker clothing demand, is up some 360% this week, putting shares on pace for their best week on record.

U.S. large-cap stocks post biggest weekly outflow in 16 months, say BofA strategists

U.S. large-cap stocks saw their largest weekly outflow since December 2022 in the past week, according to BofA Global.

Iran-Israel fears sink stocks as traders rush to gold, Treasury bonds

Reports that Israel is bracing for an imminent attack by Iran sparked a scramble for safety across markets on Friday, inspiring traders to dump stocks in favor of Treasury bonds, gold and the U.S. dollar.

Zoetis’s stock falls 8% after report that its arthritis shots may have sickened pets

Company says drugs are safe and effective, but can have side effects

JPMorgan, Wells Fargo, Citi stocks drop despite robust first-quarter earnings

JPMorgan’s stock gives back some of its gains for the year as first-quarter results trigger selling.

Cha-ching! Trump on track for $1 billion stock bonus — while outside investors lose up to 50%

Donald Trump is poised to make a huge profit from his latest venture, even as outside investors lose their shirts. Stop me if you’ve heard this one before.

‘We’ve had our ups and downs’: My late in-laws left their estate to me, my husband and our son. Do we need to hire an attorney?

“None of us want to buy the other out.”

A $1.50 sandwich? Despite inflation, food at the Masters golf tournament is still among the cheapest in professional sports.

Food prices in the U.S. are up 2.2% over the past 12 months, but at the Masters, a pimento cheese sandwich is still $1.50 and no food item costs more than $3.

How to get financial advice for free

Also, estate planning, a successful stock-market timing strategy and tips about housing and taxes.

Why it’s so expensive to own a car right now, in 5 charts

The good news for car owners? The price of a new car is finally getting cheaper. The bad news? Just about every other cost of owning a vehicle is getting a lot more expensive.

Consumer sentiment falls in April on worries about sticky inflation

An early reading of consumer sentiment in April retreated from a 32-month high, a sign of some frustration on the part of Americans about lingering inflation.

Inside the secret meeting where Donald Trump’s ‘catch and kill’ trial began

Soon after Trump announced his run for president in 2015, he allegedly hatched a plot with his lawyer and the publisher of the National Enquirer to pay to make damaging stories go away.

Frustrated with filing taxes? I just fixed your 2025 return. No charge!

Americans spend an insane amount of time and money doing their taxes. There’s got to be a better way.

Nvidia just keeps getting stronger, and that could be trouble for this stock

Wall Street may be overestimating Arista’s ability to capitalize on AI, and that’s partly because of Nvidia’s growing strength, says an analyst.

Import inflation rises for third month in a row. Higher oil prices play big role.

Import price index increases 0.3% in March

Oil prices bounce on continued Mideast tensions, but head for weekly decline

Crude futures moved higher Friday morning, shaking off weakness seen after the International Energy Agency lowered its forecast for oil-demand growth, with jitters around Middle East tensions providing support.

Labour party to face ‘uphill struggle’ in fight to boost U.K. economy, JPMorgan says

The U.K.’s Labour party will cruise to victory but is set to face an “uphill struggle” in its fight to revive Britain’s troubled economy, a JPMorgan analyst said Friday.

Stocks look vulnerable now — and not because of inflation, the Fed or the election

Bearish insiders, bullish individuals and bracing for global conflict.

Musk has two weeks to turn the ship around, says Tesla bull who is losing faith

Tesla’s next earnings call needs to emphasize that Model 2 is a priority, says a leading analyst.

‘My half-siblings are trying to slither their way in to get a handout’: How do I make sure my parents only leave their home to me?

“My sister from my mom’s previous marriage lives in an RV in our driveway.”

Apple to launch new range of Macs in line with AI push: report

Apple is planning to install upgraded M4 processors in its Mac computers in line with efforts to embed AI capabilities in its products and boost its dwindling sales

Biden administration approves $7.4 billion in student-debt relief for 277,000 borrowers

More than a quarter of a million student-loan borrowers who have been in repayment for at least a decade will have their debt cancelled, the Biden administration announced Friday.

Since 1926, stock-market returns are pretty lousy when valuations are this high

It’s the sort of stat you would expect a value fund manager to highlight, but it does offer caution about the future.

Gold barrels past $2,400 to a new high. There’s not much standing in its way, say analysts.

Gold was squarely aimed at its 17th record high on Friday, with prices surging past the $2,400 level as investors continued to watch geopolitical tensions and prospects for U.S. interest rate cuts.

These in-the-know investors are more bearish than they’ve been since 2014

Corporate insiders are selling far more of their shares than buying.

Silver has outpaced the strength of gold’s gain so far this year

Silver prices have gained ground on the heels of a rally in gold, with prices for the white metal on Thursday settling at a nearly three-year high and outpacing the strength of gold’s gain in the year to date.

Aerospace SPAC Mission Space Acquisition looks to the stars in filing for $100 million IPO

The Cape Canaveral-based blank-check company is eyeing opportunities in the aerospace and defense industries.

These tips for investing in mutual funds and ETFs keep your portfolio financially fit

Getting real about weight-loss ETFs, stock returns and bearish corporate insiders.

Boeing needs to focus on solutions, not shareholders

Aerospace giant’s self-inflicted woes hold broader lessons on how not to run a company.

The bar is finally low enough for Nike, analyst says. These big events could help the stock this year

Demand for shoes and clothes has suffered as prices for more crucial things, like groceries, stay high.

StepStone’s stock rises after J.P. Morgan upgrades asset manger to overweight

Shares of private-markets investment manager and data provider StepStone Group Inc. rose 5.4% on Thursday after the stock drew an upgrade to overweight from neutral at JPMorgan Chase on Thursday on growth expectations for the sector.

Fed’s Collins: Recent data ‘reduces the urgency to ease’

Recent labor market and inflation data highlight the need for the U.S. central bank to be patient about monetary policy, and has reduced the “urgency” to cut interest rates, Boston Federal Reserve President Susan Collins said Thursday.

What is a good credit score — and how can you improve yours?

For the first time in a decade, the national average credit score in the U.S. dropped in late 2023, according to data from Fair Isaac Corporation. But what exactly is a credit score and how do you know if you have a good one?

Bad news for home buyers: Mortgage rates jump on the back of strong economic data

The 30-year mortgage rate is averaging at 6.88% Freddie Mac said in its latest weekly survey on Thursday.

CarMax’s stock drops 13% after it misses analyst estimates for net income and revenue

CarMax cited economic uncertainty as it extends its long-term sales target of 2 million units a year.

Nikola’s proposal for reverse split sends its stock even further below $1

The EV company is asking shareholders to vote for a plan that would help it maintain listing requirements and potentially broaden its investor base.

Why Apple’s doubters might be getting the stock wrong again, according to BofA

Investors have found plenty of reason to sour on Apple shares lately, but BofA explores whether they’re underestimating margin potential.

Oil prices consolidate after push higher on fears of potential Iran attacks

Oil futures consolidate after rising more than 1% the previous session on fears of a more direct confrontation between Israel and Iran.

Fed’s Williams sees inflation falling ‘closer to’ 2% target by next year, despite recent ‘bumps’

“I expect inflation to continue its gradual return to 2%, although there will likely be bumps along the way, as we’ve seen in some recent inflation readings,” Williams said Thursday.

Beer sales helped Constellation Brands, but wine and spirits revenues stayed weak

The parent company of Corona and Modelo beers cites nearly 11% net sales growth from its beer business as positive highlight

Powell’s printer went brrrr. Kashkari goes grrrr. And WallStreetBets has a new bogeyman.

Neel Kashkari is now the object of scorn on Reddit’s message board.

Zimbabwe’s new currency, the ZiG, is on a roll

Zimbabwe’s fledgling new currency has steadily gained since its launch on Monday.

Vertex Pharma’s $4.9 billion takeover of Alpine Immune expected to boost its rare-disease portfolio

Vertex Pharmaceuticals Inc.’s acquisition of Alpine Immune Sciences Inc. makes strategic sense and will bolster the company’s rare-disease franchise, analysts said Thursday.

Why Amazon CEO Andy Jassy says the company is especially suited to win in AI

It’s no surprise that AI got prominent mention in Amazon CEO Andy Jassy’s lengthy annual shareholder letter.

Micron says Taiwan earthquake will have mid-single digit percentage impact on quarterly DRAM supply

The earthquake that hit Taiwan earlier this month has not caused any permanent damage to Micron’s facilities, infrastructure or tools.

‘Playing defense.’ Three stocks this adviser is counting on to ride out uncertain economic times.

Tim Chubb, chief investment officer at wealth management and advisory firm Girard, a Univest Wealth Division, flags tech and other “durable growth stories” in an uncertain economy.

U.K. regulator issues warning to fund manager Woodford five years after fund collapse

Five years after a fund’s collapse, the U.K. financial watchdog issued a warning notice to Neil Woodford and his fund management company, Woodford Investment Management.

Morgan Stanley ups China growth forecast after strong exports boost country’s GDP

Morgan Stanley said strong exports and a Beijing led investment push will see China’s economy grow faster than previously expected in 2024

‘The ship has turned.’ JPMorgan upgrades iconic U.K. retailer Marks & Spencer

Marks & Spencer, the storied U.K. retailer, saw an upgrade to overweight at JPMorgan, as the bank said it’s the retailer demonstrating the biggest positive inflection out of the pandemic.

Ad giant Publicis Groupe sees ‘clear rebound’ in sales to tech sector following 2023 slump

The French advertising giant said it saw a clear rebound in sales to tech companies following a slump that hit ad firms’ sales in 2023

Markets are wrong to think U.K. rate cuts will track the U.S., says Bank of England policymaker

Linking the trajectory of interest rate cuts in the U.K. too tightly to the U.S. is mistaken because British inflation will be stickier, according to a Bank of England monetary policymaker.

If you won a $1.3 billion Powerball jackpot, what would you do with it? Here’s what financial advisers suggest.

Someone has come forward to claim last weekend’s big prize, but what’s the best way to spend and invest it?

USDA cuts July cattle report due to budget woes, frustrating market participants

Cattle producers fret about market transparency after USDA cancels its July cattle report due to budget constraints.

‘Serious possibility’ that Fed’s next rate move is a hike, warns Larry Summers

“You have to take seriously the possibility that the next rate move will be upwards rather than downwards.”

Trump’s DJT stock dives toward lowest close since Ron DeSantis dropped out

Trump Media’s stock has lost about 33% since it took the former president’s initials as its ticker.

Three directors to leave Paramount board as company holds merger talks: report

The media conglomerate is in exclusive merger talks with Skydance Media, the independent production company run by David Ellison.

Gold buyers are holding on to the precious metal as prices break records — and are ready to buy more

There are signs that retail gold investors are starting to shy away from profit-taking, even as prices for the metal rise to fresh all-time highs.

NFTs see some resurgence in interest and activity after crypto rally. Here’s why.

A weekly look at the most important news and moves in crypto, and what’s on the horizon in digital assets.

I couldn’t pay my $370,000 mortgage so I applied for a loan modification. Now I have a 52-year loan. Is this normal?

“I found out last year, after talking to a few people who did the modification, that it should have been only for 10 years.”

Allen Weisselberg’s perjury sentence shows how proximity to Trump can be perilous

The Trump Organization’s former finance chief joins a long list of Trump advisors and employees who have found themselves in serious legal trouble.

Rising consumer prices show inflation heading in the wrong direction. What next?

A runup in inflation in the first three months of 2024 shows signs of persisting, potentially keeping interest rates high through the summer.

Medical Properties Trust downgraded on execution risk and rent-collection challenges

Collier Securities cut rating on real-estate investment trust to neutral from buy as stock falls.

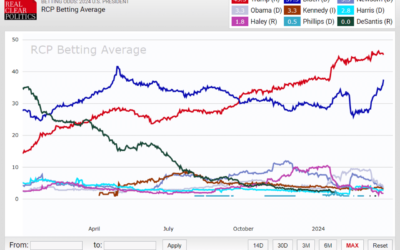

Arizona abortion ruling could hurt Trump, but latest inflation report weighs on Biden

A hotter-than-expected reading on inflation and a swing state’s moves on abortion appeared to be having an impact on the 2024 White House race on Wednesday — but they were pulling in different directions.

Macy’s to add two Arkhouse nominees to board in deal that will end proxy contest

Arkhouse Management and Brigade Capital are seeking to acquire Macy’s in a $6.6 billion deal.

Swiss government backs tougher rules for banks, causing UBS shares to drop

Switzerland’s government’s put forward plans to curb banker’s bonuses, strengthen the country’s financial regulator, and increase capital requirements for banks

KPMG failed to stop cheating on training exams, hit with $25 million in fines

The $25 million penalty is the largest the Public Company Accounting Oversight Board has ever levied — more than 3 times larger than the $8 million settlement reached with Deloitte Brazil in 2016.

This weight-loss ETF has performed well in its first five months. How does it compare with cheaper alternatives?

GLP-1 medications will likely expand beyond their current uses for diabetes or weight loss, according to money managers at Tema

Norfolk Southern’s revenue will take a Baltimore bridge hit. This is what it means for CSX.

The shockwaves from the collapse of the Francis Scott Key Bridge in Baltimore continue to reverberate through the rail industry.

Delta’s stock jumps, as accelerating business-travel demand fuels record revenue

Delta Air Lines’ stock flew toward a three-year high Wednesday, after the air carrier reported a first-quarter profit beat — and record revenue — fueled by accelerating business-travel demand.

Senators Chuck Schumer, Ron Wyden and Cory Booker pushing cannabis legalization bill

Pols send out letter to colleagues to gauge support for the Cannabis Administration and Opportunity Act

This stock lost 99% of its value, and the company still hasn’t said why

One Hong Kong-listed company lost 99% of its value and still hasn’t said why.

This JPMorgan pro says the Fed has it backward — rates need to be cut to lower inflation

The Fed and investors won’t see inflation easing until the central bank starts cutting rate says this JPMorgan strategist.

Oil prices edge higher ahead of official U.S. inventory data

Oil futures edge higher as traders await official data on U.S. crude and fuel inventories.

Where home-insurance costs are rising the fastest in the U.S. — it’s not California or Florida

Homeowners across the nation are grappling with the rising cost of home insurance. But the sharpest hikes aren’t being felt in the most disaster-prone markets, according to a new report.

European Central Bank to stand pat this week but faster-than-the-Fed rate cuts may hit euro

The European Central Bank is expected on Thursday to leave interest rates at record highs but to imply that a cut in borrowing costs is likely by the summer

I invested half of my son’s inheritance with a 13.5% return. A major broker underperformed the S&P with the rest. Do I push to manage all of his assets?

“Am I letting my ego get in the way?”

FCC’s new ‘nutrition labels’ for broadband internet aim to show you exactly what you’re paying for

Americans often aren’t clear on what they’re getting from their internet service providers, and that has spurred a new requirement from the Federal Communications Commission that takes effect Wednesday.

Fitch Ratings downgrades China outlook to negative as economic concerns rise

Fitch Ratings downgrades China outlook to negative as economic concerns rise

Philips shares climb after finalizing pact with U.S. over device sales

Philips reiterated its financial outlook on Wednesday after finalizing a consent degree with the U.S. Department of Justice and Food and Drug Administration that will prevent it from selling new respiratory care devices in the U.S. but will allow for exports.

Cinemark well-positioned for box-office rebound and market-share gains, says Benchmark

Movie-theater chain Cinemark Holdings Inc.’s growth prospects are strong, according to Benchmark analyst Mike Hickey.

4 things Wall Street will watch for when the Fed releases minutes of March meeting

Here’s what investors will be watching for when the Federal Reserve releases minutes of its March policy meeting.

Memo to Jamie Dimon and other bankers: What benefits large banks doesn’t necessarily benefit Americans

Preferential treatment of banks has fostered widespread disregard for rules.

My father is leaving me and my brother $20,000 ‘hidden’ checks to find after he dies. Is this a good idea? Will we owe taxes?

An unconventional way of leaving money to loved ones could result in some unexpected complications.

Tesla’s stock removed from Baird’s bearish list with analysts bullish on robotaxis and energy

Analysts still expect a ‘messy’ first quarter and say second-quarter expectations are too high

You’re likely being wildly unrealistic about how much money stocks can make

Here’s a key lesson for Financial Literacy month: Be real and study market history.

One in three women skip mammograms when faced with job loss and other hurdles, CDC says

Many women dealing with job loss, lack of transportation and similar issues are skipping potentially lifesaving breast-cancer screenings, according to a new report from the U.S. Centers for Disease Control and Prevention.

Rising oil prices are pushing up 10-year inflation expectations and Treasury yields

Oil appears to be playing a major factor in this week’s rise of the benchmark 10-year Treasury yield to its highest levels since November, and boosting market-based inflation expectations over the long run.

Nvidia’s stock enters a correction. Here’s where the other Magnificent Seven stocks stand.

Apple is already in a correction and Tesla is in a bear market, but the other four Magnificent Seven tech stocks are near highs.

Bank of America says the copper supply crisis is here

Copper was thought to be headed toward a supply crisis as the world adopts electric vehicles and other greenification measures.

Congressional push to take TikTok off your phone may ‘be lost in the fog of presidential politics,’ Pence says

Senate Minority Leader Mitch McConnell and former Vice President Mike Pence are throwing their support behind a House-passed bill that could lead to a nationwide ban for TikTok, but the measure still looks likely to face a slow process in the Senate.

Some Apple Vision Pro users suffer black eyes, headaches and neck pain

Apple’s Vision Pro is creating oohs and aahs — and black eyes — among some early adopters of the heralded VR headset.

Brent oil prices edge higher as Gaza cease-fire hopes fade

Brent oil futures move higher as prospects for a Gaza cease-fire appear to fade.

Loyal fans are turning sports teams into a multibillion-dollar asset class, Deutsche Bank says

Sports teams loyal fan bases mean they retain their value in the face of wider macro economic uncertainty

The future looks ‘cautiously optimistic’ for AMC, Benchmark says

Movie-theater chain and original meme stock AMC is well positioned for the upcoming slate of blockbuster movies, analyst says

Norfolk Southern reaches agreement to settle East Palestine derailment class action

Norfolk Southern Corp. has reached an agreement in principle to settle a class action lawsuit brought after last year’s derailment of one of the company’s trains in East Palestine, Ohio.

There’s still time to fund your IRA: Investors rush to fund retirement accounts ahead of April 15

As the April 15 tax deadline approaches, more investors are making investments in their future by making last-minute contributions to individual retirement accounts.

JPMorgan is still working on ‘orderly transition’ once CEO Jamie Dimon departs

Bank’s proxy statement highlights recent promotions for potential Dimon successor

Tilray Brands stock drops as it reports wider-than-expected loss and misses on revenue

Tilray Brands Inc.’s stock fell 16% in premarket trading on Tuesday after the cannabis company reported a wider-than-expected loss in its fiscal third quarter, while revenue fell short of analyst estimates.

Here’s the unusual way to trade gold’s breakout rally, from this hedge-fund manager.

As gold punches out its umpteeth high for the year, this hedge fund manager tells investors how to get creative when it comes to profiting off the metal’s gains.

BP says high production and strong trading will offset oil and gas price slump

The British oil major said lower oil and gas prices and a drop in the value of Egypt’s currency could cost it up to $1.2 billion

HSBC to sell Argentina business in latest market exit

HSBC Holdings is selling its Argentina business for over half a billion U.S. dollars, the bank’s latest exit from markets that are no longer core to its business strategy.

Financial scammers have a new weapon to steal your money: AI

Banks are fighting back against deepfakes and voice cloning that snare unsuspecting victims.

We’re spending more on ‘bucket list’ experiences — but are they worth the money?

Problems arise when couples clash over how much to spend.

White House again weaponizes PPP loans in defense of student-debt relief

The White House on Monday turned to a familiar tactic when defending criticism of its student-loan relief plan.

Musk stands his ground on EV adoption, but admits threat of Chinese competition

The Tesla chief executive said China is a threat across the auto sector, and not just in electric vehicles.

Target Circle 360 is live. Here’s how it stacks up against Amazon Prime and Walmart+

Target is the latest big retailer that wants you to consider same-day delivery — for an added cost.

JPMorgan, Wells Fargo, Citi first-quarter profit expected to be flat as interest rates rise and loan activity lags

First quarter saw a revival in initial public offerings and M&A, but expectations for interest-rate cuts have faded

Mortgage rates stay close to 7%. When will they fall? Three economists weigh in.

Three housing economists weigh in on what needs to happen for mortgage rates to fall.

‘It’s totally silly’: From blackout doughnuts to deli sandwiches — have solar-eclipse marketing promotions gone too far?

Perhaps you don’t need to celebrate the rare cosmic event by saving a few bucks on a deli sandwich.

This quality approach to a cheap part of the stock market garners a five-star rating

Small-cap stocks are trading at the bottom of their valuation range over the past two decades.

Treasury yields aren’t acting like the Fed is done hiking interest rates

The benchmark 10-year Treasury yield is doing something it hasn’t normally done in the past, by continuing to climb long after the Federal Reserve was presumably done with lifting U.S. interest rates.

Wells Fargo raises S&P 500 year-end target to Wall Street-high of 5,535 — but expects more volatility in first half of 2024

Wells Fargo on Monday lifted its year-end target for the S&P 500 stock index to 5,535 points, from 4,625 — implying additional upside of more than 6% above Monday’s trading level.

GE Vernova’s stock gets its first upgrade after 14% pullback in trading debut

GE Vernova Inc.’s stock soared 6% Monday, after the renewable energy and power company that was spun off from General Electric Co. got an upgrade to the equivalent of buy from JPMorgan.

Numbers don’t lie: Women’s college basketball is about to overtake the men’s game in ratings and star power

Over 14 million people just watched Iowa play UConn, a record number for a women’s basketball game, and more viewers than all but one NBA Finals game last season

Fed-funds futures point to doubts over June rate cut as inflation data looms

Traders in the federal-funds-futures market are showing signs of doubt that the Federal Reserve may begin lowering interest rates in June, wavering ahead of an upcoming inflation report.

Are employers willing to hire older workers?

A series of studies suggests tempered optimism at best

Bank of America cuts European EV car sales view as government subsidies fade

BEV sales for the 28 European Union countries are expected to rise 11% this year, half of a previous forecast for 22% growth, says Bank of America.

Interest rates could hit 8% or more and wars are creating outsize geopolitical risks, Jamie Dimon warns

Persistent inflationary pressures driven by fiscal deficits and military conflict among other factors may lead to U.S. interest rates of 8% or even more, JPMorgan Chase & Co. Chief Executive Jamie Dimon warned on Monday.

Some eclipse watchers are spending big bucks to outrun their No. 1 enemy: clouds

Mother Nature doesn’t care about the eclipse travel plans of millions of people or the loads of money they are spending to witness the moon briefly mask the sun on April 8.

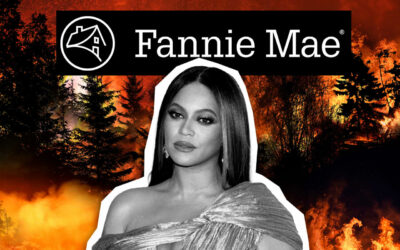

Consumers expect mortgage rates to go up in the next year, but Fannie Mae expects a ‘thaw’ in the housing market

Housing sentiment dipped for the first time since November 2023, but consumers are adjusting, survey says.

Nvidia and these other chip stocks named top plays into earnings season

Ahead of last earnings season, Cantor Fitzgerald analyst C.J. Muse advised investors not to overthink things. He says the same advice applies this time around.

Oil prices pull back on easing worries over Middle East

Oil prices pull back as traders await cease-fire talks.

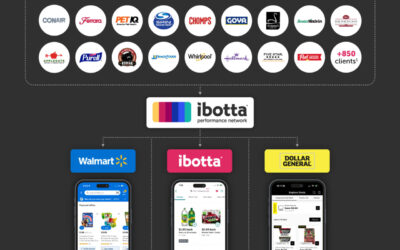

Digital marketing platform Ibotta launches IPO at a valuation of up to $2.7 billion

Ibotta, a digital marketing platform that allows consumer packaged goods companies to offer promotions to customers through a network of publishers, launched its initial public offering on Monday with plans to offer 5.6 million shares priced at $76 to $84 each.

‘I want a stress-free retirement’: I earn $120,000 a year and have $165,000 in savings. How do I invest in this high-interest-rate environment?

“My husband and I would like to provide our new baby with the best life we can.”

The energy sector’s on a tear. But $100 oil is not likely, says Goldman Sachs.

Goldman Sachs does not expect a supply shock to push prices higher

Paddy Cosgrove returns as Web Summit CEO after quitting over Israel-Hamas comments

Paddy Cosgrove on Monday said he was returning to become chief executive of tech conference company Web Summit, after quitting in the wake of controversial comments made after Israel’s initial reaction to Hamas’s attack in October.

Biden wants to cancel student debt for 25 million borrowers — here’s his new plan

President Joe Biden will announce a proposal Monday that, if implemented, will cancel at least some student debt for an estimated 25 million borrowers.

For stocks, the reaction in the 10-year will be more important than CPI itself, says Mike Wilson

Inflation data is out on Wednesday — and stock-market investors should focus on the reaction in the bond market rather than parse the consumer price index itself.

As Congress returns this week, TikTok steps up its fight against a possible ban

While the U.S. Senate is preparing to get back to work Monday on Capitol Hill, it’s not expected to move fast on a House-passed bill that could lead to a nationwide ban for TikTok – and a new advertising blitz from the app aims to help give senators pause.

‘It’s easy to hide things from ourselves’: How a budget can keep you honest and focused on your goals

Personal budgeting has a reputation for being tedious and constrictive, but the right budget can help anyone meet their goals — and even have fun along the way.

European companies are finally buying back their stock, opening up opportunities

Historically, dividends have played a much more important role in Europe than in the U.S., but that’s changing.

Stock-market rally faces key test: Will hot inflation data kill rate-cut hopes?

Can the stock market rally continue if rate cuts no longer appear imminent? Investors may soon find out.

First-quarter earnings are here. So is the ‘hard part’ in the fight against higher prices.

With first-quarter earnings reports just around the corner, the biggest battles with inflation might be out of the way for businesses and their customers.

Wegovy’s heart benefits are not just linked with weight loss, new study suggests

People with obesity-related heart failure and diabetes can get substantial heart-health benefits from weight-loss drug Wegovy, even if they don’t shed many pounds on the medication, according to new research.

AI is like the late 1990s internet boom. Here’s how to avoid AI’s Pets.com and find the winners

Focus on the many layers of technology and businesses that support, use or benefit from AI.

Intel can beat AMD and Qualcomm in the race to put AI on your PC — except for this problem

The computer-chip giant needs to show that it isn’t stuck in old ways.

Mark Zuckerberg now richer than Elon Musk for first time since 2020

Mark Zuckerberg became the third richest person in the world on Friday, surpassing Elon Musk for the first time since 2020.

Gold prices are soaring and the mining stocks are just starting to catch up

Either gold shares rise from here or gold prices take a dive.

Our father died, then our stepmother passed away. Will my siblings and I owe taxes when we sell their house?

“My father remarried at the age of 65. He kept his house in the revocable trust where he had control of his assets.”

This intervention can help Tesla and other carmakers compete against China’s EV subsidies

Western governments should subsidize domestic manufacturing — not impose import tariffs.

Bought a house during the pandemic? Here’s how much more that same home would cost today.

The pandemic-era buying frenzy helped fuel the so-called lock-in effect that’s keeping some homeowners from moving. A new report measures just how bad it is.

Beyoncé name-drops housing-finance giant Fannie Mae on ‘Cowboy Carter.’ Here’s what she meant.

She may be rich and famous now, but Beyoncé is keeping close tabs on the bills, bills, bills that millions of homeowners face today with their home insurance.

This railroad operator is most impacted by the Baltimore bridge collapse

Experts are weighing the supply chain impact of the Francis Scott Key Bridge collapse in Baltimore.

Latest threat to stock-market rally? Investors suddenly fear geopolitical risks.

Concerns about a potential Iranian retaliation against Israel added to the week’s rout in stocks

The U.S. stock market has outperformed Europe’s for years. 2024 could be different.

Europe’s economic prospects are brightening.

Some good news on inflation? Fed might get it with the CPI.

A roaring labor market and high inflation readings early this year have cast doubt on the Federal Reserve cutting interest rates soon. But the March report on consumer prices might offer a ray of hope.

Something’s got to give: European regulators crack down on AI as U.S. tech companies plunge into the market