Nikkei surges through 40k mark for the first time ever, standing out in an otherwise subdued Asian session. This index was propelled by Japan’s unexpectedly robust capital spending report for Q4, which significantly bolstered investor confidence. While the surge in capital expenditure may not directly sway BoJ’s immediate monetary policy decisions as wages growth remains the key focus, it undoubtedly presents positive developments that the central bank welcomes. Meanwhile, Japanese investors continues to be largely unfazed by BoJ’s gradual move towards exiting negative interest rates.

In currency markets, Japanese Yen, alongside Australian and New Zealand Dollars, registered as the weaker currencies, contrasted by the strength seen in Sterling, Euro, and Dollar. The Swiss Franc and Canadian Dollar are mixed in the middle. Despite these movements, most major currency pairs and crosses remained within Friday’s range. The day’s trading activity is expected to be muted, given the light economic calendar, with the exception of Swiss Franc, which could see some movement in anticipation of Swiss CPI release.

Looking ahead, the coming week promises to ramp up activity levels with rate decisions from ECB and BoC on the horizon. Additionally, Fed Chair Jerome Powell’s semiannual testimony before Congress is highly anticipated, alongside a slew of critical economic data, including the US non-farm payrolls report.

Technically, GBP/CHF is worth a watch today. The rally from 1.0634 resumed last week and edged higher to 1.1215 before turning sideway. For now, further rise is expected as 1.1114 support holds. Next target is 61.8% projection of 1.0893 to 1.1182 from 1.1114 at 1.1293. Decisive break there could trigger upside acceleration to 100% projection at 1.1403. The next move might hinge on today’s Swiss CPI data.

In Asia, at the time of writing, Nikkei is up 0.38%. Hong Kong HSI is down -0.19%. China Shanghai SSE is up 0.10%. Singapore Strait Times is down -0.40%. Japan 10-year JGB yield is down -0.0030 at 0.717.

Japan’s capital expenditure surges 16.4% in Q4, signaling strong business investment momentum

Japan’s capital expenditure surged remarkably by of 16.4% yoy in Q4, significantly outperforming expectations of 2.9% yoy increase. This marked the eleventh consecutive quarter of business investment growth, highlighting the robust confidence among Japanese corporations in the country’s economic prospects.

The impressive figures come as a beacon of optimism, especially considering they will contribute to the revision of Q4’s GDP data, which initially indicated unexpected contraction of -0.4% qoq. With this revision, it’s anticipated that Japan may have narrowly avoided slipping into a technical recession.

The investment growth was particularly pronounced among manufacturers, who increased their spending by 20.6% yoy. This 11th consecutive quarter of expansion was predominantly driven by the information and communication machinery and transport equipment sectors.

Non-manufacturers also contributed with 14.2% yoy increase in investment, marking the sixth consecutive quarter of growth. The telecommunication, transportation, and postal service sectors were notably instrumental in this rise.

A Finance Ministry official commented on the data, stating, “The results reflect our view that the economy is recovering moderately. But we will need to monitor the impact of slowing overseas economies and inflation on corporate activity.”

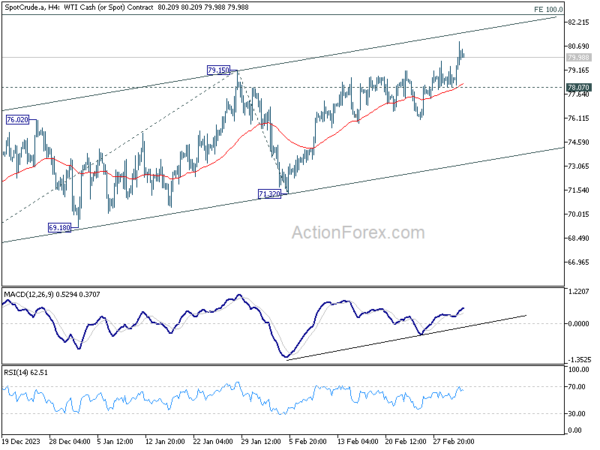

OPEC+ extends production cuts, more upside in WTI in near term

OPEC+ members announced on Sunday their agreement to extend voluntary oil output cuts of 2.2m barrels per day into Q2, aiming to stabilize the market and support oil prices. Saudi Arabia, the de facto leader of the oil cartel, committed to prolonging its substantial voluntary cut of 1m bpd through the end of June, effectively maintaining its production levels around 9m bpd. Additionally, Russia announced it would reduce its oil production and exports by an extra 471k bpd Q2.

Technically speaking, WTI’s rise from 67.79 is still seen as a corrective bounce for now. Further rally is expected as long as 78.07 support holds, to 100% projection of 67.79 to 79.15 from 71.32 at 82.68. However, strong resistance could emerge below 61.8% retracement of 95.50 to 67.79 at 84.91 to limit upside and bring reversal.

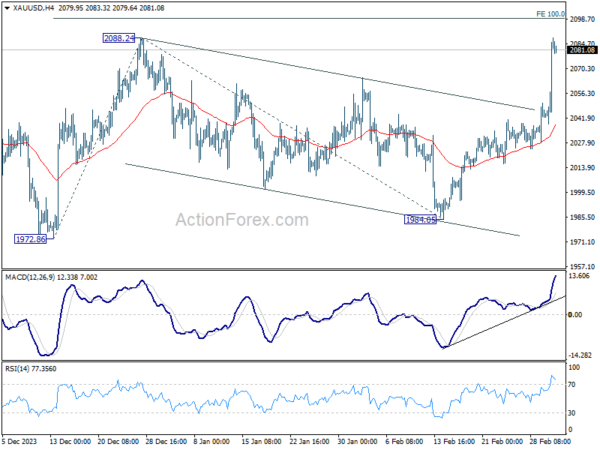

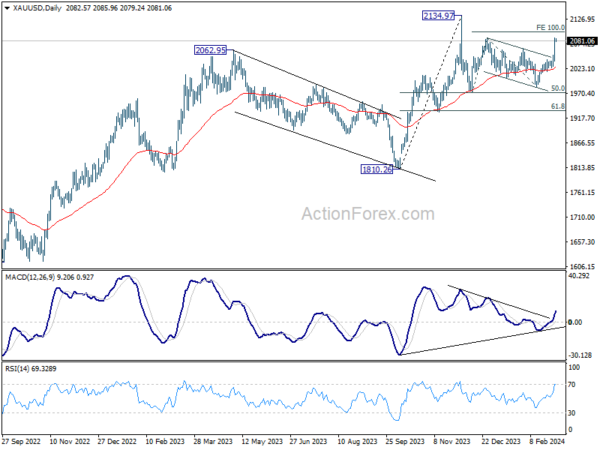

Gold may lose momentum above 2100 despite strong rally

Gold accelerated sharply higher last week, propelled in part by the significant decline in US treasury yields on Friday. Technically, the key question now is whether the bounce from 1972.86 signifies the commencement of long-term uptrend resumption, or merely constitutes the second leg of the medium term corrective pattern from 2134.97.

For now, favor is mildly on the latter case. Hence, while further rally is likely through 100% projection of 1972.86 to 2088.24 from 1984.05 at 2099.43, Gold should start to lose upside momentum above there, and top below 2134.97.

Nevertheless, further upside acceleration above 2099.43, or around 2100 in short, would argue that Gold is already ready to resume the long term up trend.

ECB and BoC Decisions; Fed Powell Testimony; NFP and More Data

The coming week is packed with central bank decisions and market-moving economic data releases. The focus is squarely on ECB and BoC, with both institutions scheduled to announce monetary policy decisions. Additionally, Fed Chair Jerome Powell’s testimony before Congress and a slew of important economic indicators from around the globe will further shape market dynamics.

ECB is widely anticipated to keep main refinancing rate steady at 4.50% and deposit rate at 4.00% in its upcoming meeting. A recent Reuters poll revealed a shift in economist expectations with 46 out of 73 predicting the first rate cut in June, reflecting an increase from about 45% in January. 17 expect red an April cut while 10 expect ECB to wait until the second half.

This adjustment reflects growing consensus that additional time may allow for further easing of inflationary pressures. Moreover, the forthcoming first-quarter wage data, expected in May, will offer the ECB valuable insights into wage trends, affirming that wage-driven inflationary pressures are not intensifying.

Should ECB officials lean towards an April rate cut, it is incumbent upon President Christine Lagarde to subtly adjust her rhetoric to prime the markets for such a move, leveraging the upcoming economic projections as justifications. Failing to signal any imminent changes could implicitly align ECB with the growing anticipation of a June rate cut.

Similarly, BoC is expected to hold overnight rate at 5.00%. Recent meetings have seen BoC transition from a hawkish to a more dovish posture, notably dropping its tightening bias in January. Yet, it might still be premature for the central bank to signal an inclination towards rate reductions. A Reuters poll indicated that 19 out of 31 economists expect BoC to commence rate cuts in June. Seven said the first cut would come in the second half of the year, with five expecting it in April.

Fed Chair Jerome Powell’s upcoming two-day Congressional testimony is another event of high interest, though it is anticipated that Powell will reiterate Fed’s position on waiting for more definitive signs of inflation approaching 2% target before considering rate cuts. Recent remarks from other Fed officials have echoed a reluctance to hasten rate cuts, with many economists delaying their forecasts for the initial reduction to June or later. Hence, Powell’s testimony might not introduce new policy insights. Meanwhile, Fed’s release of the Beige Book economic report will also be closely scrutinized for further clues on regional economic trends.

On the data front, US ISM services and non-farm payroll reports are set to be major market movers, alongside Canada’s employment data, Japan’s Tokyo CPI, Switzerland’s CPI, Australia’s GDP, and China’s Caixin PMI services.

Here are some highlights for the week:

- Monday: New Zealand terms of trade; Japan monetary base, capital spending; Australia building approvals; Swiss CPI; Eurozone Sentix investor confidence.

- Tuesday: Japan Tokyo CPI; Australia current account; China Caixin PMI services; France industrial production; Eurozone PMI services final, PPI; UK PMI services final; US ISM services, factory orders.

- Wednesday: Australia GDP; German trade balance; UK PMI construction; Eurozone retail sales; US ADP employment, Fed’s Beige Book; BoC rate decision.

- Thursday: New Zealand manufacturing sales; Japan average cash earnings; Australia goods trade balance; China trade balance; Swiss unemployment rate, foreign currency reserves; Germany factory orders; ECB rate decision; Canada building permits, trade balance; US jobless claims, trade balance.

- Friday: Japan household spending, current account, leading indicators; Germany industrial production, PPI; Eurozone GDP revision; Canada employment; US non-farm payrolls.

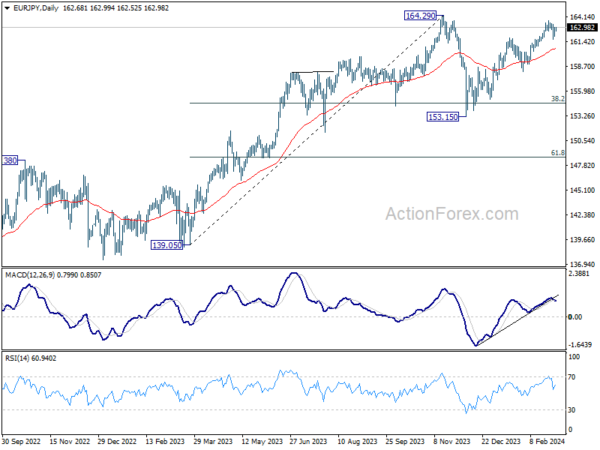

EUR/JPY Daily Outlook

Daily Pivots: (S1) 162.06; (P) 162.54; (R1) 163.18; More…

Intraday bias in EUR/JPY remains neutral for the moment. Corrective pattern from 163.70 could extend further. Break of 161.67 minor support should push the cross through channel support (now at 161.18) to 38.2% retracement of 153.15 to 163.70 at 159.66. Nevertheless, firm break of 163.70 will resume whole rally from 153.15 to retest 164.29 high.

In the bigger picture, price actions from 164.29 medium term top are seen as a correction to rise from 139.05 only. As long as 148.38 resistance turned support holds (2022 high), larger up trend from 114.42 (2020 low) is expected to resume through 164.29 at a later stage. Next target would be 169.96 (2008 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Terms of Trade Index Q4 | -7.80% | -0.20% | -0.60% | |

| 23:50 | JPY | Capital Spending Q4 | 16.40% | 2.90% | 3.40% | |

| 23:50 | JPY | Monetary Base Y/Y Feb | 2.40% | 4.70% | 4.80% | |

| 00:00 | AUD | TD Securities Inflation M/M Feb | -0.10% | 0.30% | ||

| 00:30 | AUD | Building Permits M/M Jan | -1.00% | 4.00% | -9.50% | -10.10% |

| 07:30 | CHF | CPI M/M Feb | 0.50% | 0.20% | ||

| 07:30 | CHF | CPI Y/Y Feb | 1.10% | 1.30% | ||

| 09:30 | EUR | Eurozone Sentix Investor Confidence Mar | -10.8 | -12.9 |