Nikkei tumbled sharply in Asian session today, largely in response to Yen’s rebound late yesterday, which followed strong verbal interventions by Japanese officials aimed at curbing the currency’s recent weakness. Additionally, profit-taking activities could be another factor as markets gear up for an extended holiday weekend.

Yen’s rebound,while notable, has not yet demonstrated strong momentum, reflecting the perception that BoJ is not yet embarking on a definitive tightening path. Even when BoJ decide to raise rates again, it’s anticipated to proceed with gradual and cautious steps, a sentiment echoed in the Summary of Opinions from BoJ’s historic meeting last week.

In the wider currency markets, a general trend of range trading prevails, with the notable exception of the Swiss Franc, which has emerged as the weakest currency of the week. Dollar, meanwhile, trails as the second worst for the week, although prospects for an upside breakout remain favorable, albeit slightly postponed by the holiday atmosphere. Zealand Dollar is also underperforming.

Sterling is currently the strongest, followed by Canadian and Australian Dollars. These three currencies, typically sensitive to risk sentiment, have been buoyed by another day of robust rallies in US stock indexes overnight.

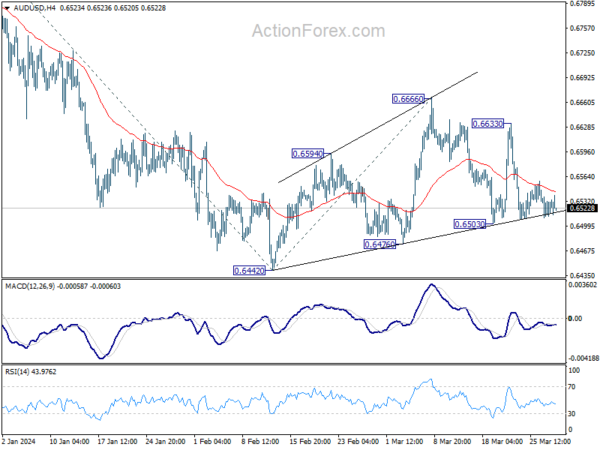

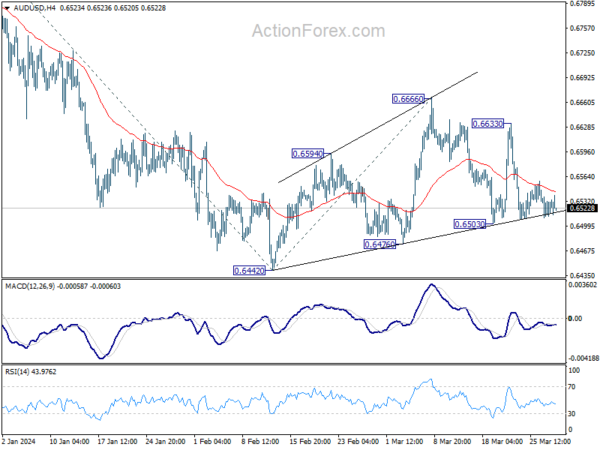

Technically, it’s unsure if the greenback is ready to have upside breakouts before, or after the holiday break. Key levels to watch include 1.0801 support in EUR/USD, 1.2574 support in GBP/USD, 0.6503 support in AUD/USD, and 1.3612 resistance in USD/CAD.

In Asia, Nikkei closed down -1.46%. Hong Kong HSI is up 1.49%. China Shanghai SSE is up 0.96%. Singapore Strait Times is down -0.58%. Japan 10-year JGB yield is down -0.0164 at 0.708. Overnight, DOW rose 1.22%, S&P 500 rose 0.86%. NASDAQ rose 0.51%. 10-year yield fell -0.038 to 4.196.

BoJ opinions: Board emphasizes caution in historic shift away from negative rate

At last week’s policy meeting, which marked the conclusion of Japan’s extensive easing program and its first interest rate hike since 2007, BoJ board members underscored the importance of a cautious approach. The Summary of Opinions from this pivotal gathering highlighted board members’ perspectives on the delicate balance required in this new phase of monetary policy.

One member stressed the necessity of maintaining a “cautious stance”, especially in light of ending the negative interest rate policy, pointing out that “Japan’s economy is not in a state where rapid policy interest rate hikes are necessary.”

Furthermore, clarity and communication were emphasized as crucial elements in this transitional period. “It is important to clearly communicate through the use of various methods that the changes in the monetary policy framework proposed at this monetary policy meeting will not be a regime shift toward monetary tightening,” another member articulated.

The summary also conveyed concerns about the potential impact of premature expectations on Japan’s economic stability. A member warned of the risks associated with policy changes sparking speculative expectations misaligned with economic fundamentals, which could inadvertently destabilize financial conditions. Such volatility could “dampen the momentum of the virtuous cycle operating in Japan’s economy and delay the achievement of the inflation target.”

NZ ANZ business confidence fall to 22.9, inflation expectations down to 3.8%

New Zealand ANZ Business Confidence fell from 34.7 to 22.9 in March. Own Activity Outlook fell from 29.5 to 22.5. Inflation expectations fell from 4.03% to 3.80%. Cost expectations rose from 73.5 to 74.6. Pricing intentions fell from 48.2 to 45.1. Profit expectations fell from 5.3 to -3.8. Wage expectations rose from 78.9 to 80.5. Employment intentions fell sharply from 6.2 to 3.5.

ANZ’s acknowledged the solid progress being made, such as narrowing current account deficit and downward trend in inflation. However, concerns are raised about “stickiness” of some inflation measures and persistent uncertainty around inflation outlook. The bank’s message emphasizes caution, stating, “It’s certainly too soon to declare victory. But eyes on the prize; we’re getting there.”

Fed’s Waller: Latest data confirm no rush for interest rate cuts

In a speech overnight, Fed Governor Christopher Waller articulated that Fed is in “no rush” to initiate interest rate cuts. This position comes in light of recent economic developments, suggesting that interest rates may need to be maintained at their current restrictive levels “longer than previously thought.”

Waller acknowledged the significant strides made in curbing inflation last year and the substantial improvement in labor market balance. Yet, he expressed reservations about the pace of continued progress, stating, “the data we have received so far this year has made me uncertain about the speed of continued progress.”

This uncertainty has been fueled by economic indicators over the past month, with Waller highlighting February’s robust job growth of 275k and a three-month average job growth of 265k, alongside persistently high inflation metrics.

Particularly concerning to Waller is a notable jump in Core PCE inflation to 0.4% on a monthly basis in January, a significant increase from an average of around 0.1% in the fourth quarter. These observations have solidified Waller’s belief that there is “no rush to cut the policy rate,” advocating for a continuation of the Fed’s current restrictive stance, “for longer than previously thought.”

Waller remains optimistic about making further progress towards disinflation, which could eventually justify a reduction in the federal funds rate target range within the year. But he asserts “until that progress materializes, I am not ready to take that step.”

SNB Schlegel: No target for Franc exchange rate, intervenes as necessary

SNB Vice President, Martin Schlegel, clarified overnight that the central bank does not adhere to a specific target for Swiss Franc’s exchange rate. Instead, Schlegel reiterated the usual stance that the bank “monitors the exchange rate closely and intervenes in the foreign-exchange market as necessary.”

Separately, in its Quarterly Bulletin, SNB noted that “Many economic indicators suggest that economic activity was slightly more dynamic in the first quarter of 2024 than in the preceding quarters.”

The report attributed this “moderate” growth primarily to the service sector’s resilience, while highlighting continued stagnation in the manufacturing sector. SNB acknowledged that “persistently weak global demand” remains a significant hurdle for manufacturing, with Swiss Franc’s exchange rate increasingly being cited by companies as a contributing challenge.

Looking ahead

UK GDP final, German retail sales and unemployment, Eurozone M3and Swiss KOF economic barometer will be released in European session. Later in the day, Canada GDP, US GDP final, jobless claims, Chicago PMI and pending home sales will be released.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 163.32; (P) 163.87; (R1) 164.30; More…

Intraday bias in EUR/JPY remains neutral for the moment. Strong support is still expected from 55 4H EMA (now at 163.58) to bring rebound. On the upside, break of 165.33 will resume larger up trend to 61.8% projection of 153.15 to 163.70 from 160.20 at 166.71. However, sustained break of 55 4H EMA will turn bias to the downside for deeper fall to 160.20 support instead.

In the bigger picture, current rally is part of the up trend from 114.42 (2020 low), which is still in progress. Next target is 169.96 (2008 high). Break of 160.20 support is needed to be the first sign of medium term topping. Otherwise, outlook will stay bullish in case of retreat.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 00:00 | NZD | ANZ Business Confidence Mar | 22.9 | 34.7 | ||

| 00:00 | AUD | Consumer Inflation Expectations Mar | 4.30% | 4.50% | ||

| 00:30 | AUD | Retail Sales M/M Feb | 0.30% | 0.40% | 1.10% | |

| 00:30 | AUD | Private Sector Credit M/M Feb | 0.50% | 0.40% | 0.40% | |

| 07:00 | EUR | Germany Retail Sales M/M Feb | 0.30% | -0.40% | ||

| 07:00 | GBP | GDP Q/Q Q4 F | -0.30% | -0.30% | ||

| 07:00 | GBP | Current Account (GBP) Q4 | -21.5B | -17.2B | ||

| 08:00 | CHF | KOF Economic Barometer Mar | 102.3 | 101.6 | ||

| 08:55 | EUR | Germany Unemployment Rate Mar | 5.90% | 5.90% | ||

| 08:55 | EUR | Germany Unemployment Change Mar | 10K | 11K | ||

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Feb | 0.30% | 0.10% | ||

| 12:30 | CAD | GDP M/M Jan | 0.40% | 0.00% | ||

| 12:30 | USD | Initial Jobless Claims (Mar 22) | 211K | 210K | ||

| 12:30 | USD | GDP Annualized Q4 F | 3.20% | 3.20% | ||

| 12:30 | USD | GDP Price Index Q4 F | 1.70% | 1.70% | ||

| 13:45 | USD | ChicagoPMI Mar | 46.4 | 44 | ||

| 14:00 | USD | Pending Home Sales M/M Feb | -2.00% | -4.90% | ||

| 14:00 | USD | Michigan Consumer Sentiment Mar F | 76.5 | 76.5 | ||

| 14:30 | USD | Natural Gas Storage | -26B | 7B |