Shares of Nio Inc. and BYD Co. rose Friday, while those of fellow China-based electric vehicle maker Li Auto Inc. fell, after the companies reported February deliveries that fell from last year and last month.

Nio

NIO,

said it delivered 8,132 EVs in February, down 19.1% from the 10,055 vehicles delivered in January, and 33.1% less than the 12,157 vehicles delivered in February 2023.

The deliveries in February consisted of 4,765 sport-utility vehicles and 3,367 sedans.

Nio’s stock rose 0.9% in premarket trading. The stock has been hovering just above the four-year closing low of $5.38 hit on Feb. 5. It has tumbled 36.6% year to date, while the Global X Autonomous & Electric Vehicles ETF

DRIV

has slipped 2.1%, the iShares MSCI China ETF

MCHI

has lost 4.3% and the S&P 500 index

SPX

has gained 6.8%.

Meanwhile, Li Auto

LI,

said overnight that it delivered 20,251 EVs in February, up 21.8% from a year ago but down 35% from January.

The stock fell 2.9% ahead of Friday’s open. But that was after it rocketed 65.8% in February, which was the second-best monthly performance since the stock went public in July 2020, behind just the record 78.4% rally in November 2020.

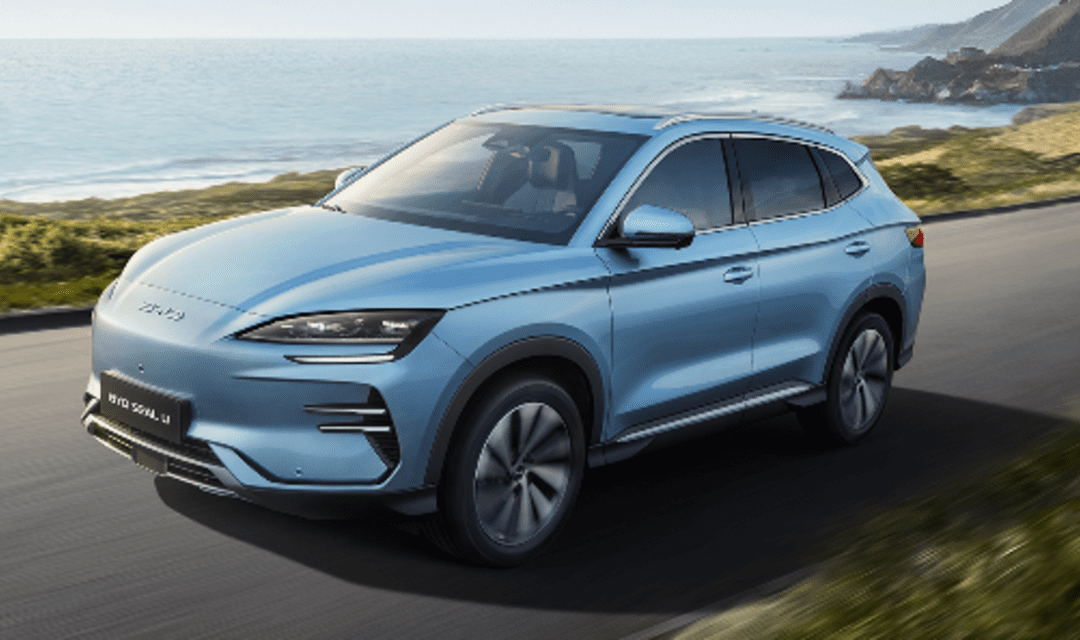

Elsewhere, BYD Co.

BYDDY,

002594,

said it sold 122,311 “new energy” vehicles in February, down 36.8% from the 193,655 vehicles sold a year ago and down 60.7% from the 311,493 vehicles sold in January.

For battery-electric vehicles, February sales fell 39.4% from last year and dropped 47.9% from January. Plug-in hybrid EV sales were down 33.8% from a year ago and down 30.2% from January.

BYD’s U.S.-listed stock climbed 3.3% toward a six-week high ahead of Friday’s open.

Among other China-based EV makers, XPeng Inc.’s stock

XPEV,

rose 1.2% in Friday’s premarket. The company said it delivered 4,545 EVs in February, down 24.4% from the 6,010 EVs delivered last year and 44.9% less than the 8,250 EVs delivered in January.