Top internet firms didn’t let a ‘funding winter’ dampen their spending in the last fiscal, an ETtech analysis found. Details of this and more in today’s ETtech Dispatch.

Also in this letter:

■ Byju’s cap table reset

■ Bids for modernisation of SCL

■ Nasscom’s suggestions for Budget

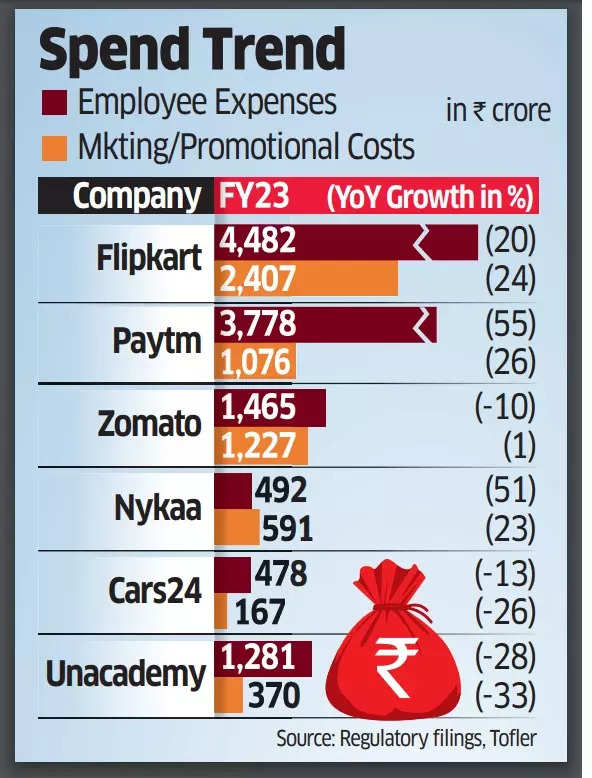

Startups talk up funding winter, but loosen their purse strings

Several of the country’s top internet firms stepped up their spending during fiscal 2023 despite all the talk about controlling expenses given the onset of a ‘funding winter’.

Tell me more: An analysis by ETtech of FY23 financials of eleven of the largest internet companies – both public and private – showed that while some of them managed to trim costs, most others stepped up on spending, either to gain competitive advantage or boost growth numbers.

A closer look:

- Fintech majors Paytm and PB Fintech, the parent entity of Policybazaar, saw employee expenses and marketing costs rise year-on-year by 25-50% in FY23.

- Ecommerce behemoth Flipkart saw its marketing costs go up to Rs 2,400 crore in FY23, up 23% on year.

- Horizontal omnichannel retailers such as Nykaa, Mamaearth-parent Honasa Consumer, and FirstCry saw both employee expenses and marketing costs rise anywhere between 25% and 55% during FY23.

Also read | Advertisements get cash counters ringing at quick commerce and food delivery companies

Outliers: Food-delivery firm Zomato managed to reduce employee costs in FY23 while keeping advertising and promotional expenses flat. Used-cars startup Cars24 and edtech platform Unacademy reined in both marketing and staff costs by 20-30%.

Quote, unquote: “Startups require continuous investments in marketing, technology, and in hiring people with specific skill sets. At the same time, they also course correct on the investments made in other endeavours which have not found the right market fit,” said Rohan Lakhaiyar, partner, Grant Thornton Bharat. “Therefore, the net effect results in no significant cost reduction for the entity.”

Swiggy, PharmEasy record revenue growth, but net losses widen in FY23

Food and grocery-delivery firm Swiggy reported a 45% jump in operating revenue for the fiscal year ended March 2023 to Rs 8,265 crore, even as its net loss expanded 15% to Rs 4,179 crore. Meanwhile, online pharmacy PharmEasy saw a 16% increase in operating revenue to Rs 6,644 crore, with net loss growing 30% to Rs 5,212 crore.Swiggy’s FY23 highlights:

- Total expenses came in at a staggering Rs 12,884 crore, up 34% on year

- Marketing spends rose to Rs 2,362 crore, accounting 28% of operating revenue

- Revenue from sale of services – the bigger component of its topline – increased 39% on year to Rs 4,786 crore

PharmEasy’s FY23 highlights:

- Advertising and promotional expenses reduced to Rs 235 crore, less than half of that in FY22

- Finance costs surged to Rs 665 crore, almost 2.5 times that in FY22

- Almost 90% of the firm’s revenue came from the sale of pharmaceuticals and cosmetic goods.

Swiggy layoffs: Swiggy, which employs between 5,500-6,000 people, is set to cut its workforce by 6% affecting 350-400 roles across teams like technology, call centre, and corporate roles. This comes as Swiggy looks at becoming leaner while aiming to hit profitability ahead of its $1-billion IPO.

PharmEasy rights issue: PharmEasy recently closed its Rs 3,500 crore rights issue, which gave it much-needed room to clear pending debt and continue growing its business. Ranjan Pai, chief of Bengaluru-based Manipal Group, emerged as the largest shareholder in API Holdings, with an at least 15% stake after the rights issue.

PB Fintech’s maiden profit: Policybazaar parent PB Fintech on Tuesday reported its maiden quarterly profit for the quarter ended December 2023. It clocked a consolidated net profit of Rs 37.2 crore, against a loss of Rs 87.6 crore a year ago. It had reported a loss of around Rs 21 crore in the September quarter.

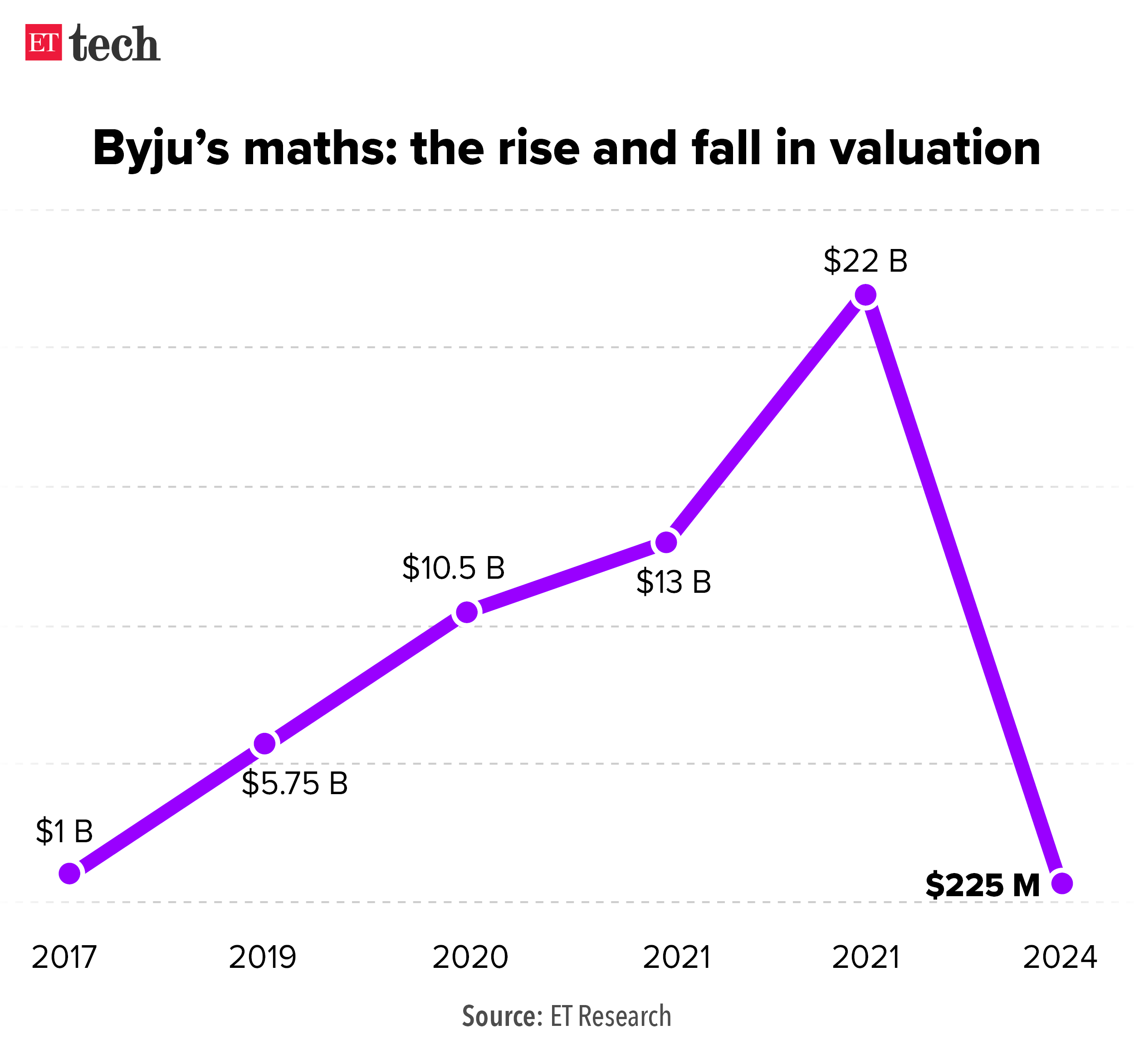

A reset is on cards at Byju’s cap table post rights issue value cut

Troubled edtech firm Byju’s cap table is likely to see a reset. Founder Byju Raveendran may increase his stake in the company if he manages to arrange capital for the proposed rights issue at a 99% cut to its previous peak valuation of $22 billion. But this depends on the final set of investors subscribing to the share sale.

Driving the news: Raveendran has to arrange at least around $40-42 million for his pro-rata investment. Prosus – for example – has to put in $18 million for its 9% stake in Byju’s, and the same would be around $14 million for Peak XV Partners.

Also read | Ranjan Pai may put $50-60 million more to grow Byju’s Aakash

Yes, but: Any investor not investing in this rights issue will practically see their stake fully erode. This happened at PharmEasy, too, where a rights issue was done at a 90% cut in valuation. The staff stock options will be protected as per terms, and the company can issue more Esops to employees to recoup the loss in value.

The rights issue is open for 30 days and investor conversations on further details may begin soon.

Also read | For more capital, Byju’s must pass a tough test

Quote, unquote: “At a $2 billion valuation, a number of investors would have raised questions, and some less at even $1 billion. With literally nominal value at $20-25 million, if you don’t invest now, then there is no point complaining,” a source told ET.

Also read | US lenders drag Byju’s to bankruptcy court in India

Catch-up quick: ET reported on Monday that Byju’s parent Think & Learn has approached its existing shareholders to secure an immediate cash infusion of up to $200 million as part of the rights issue.

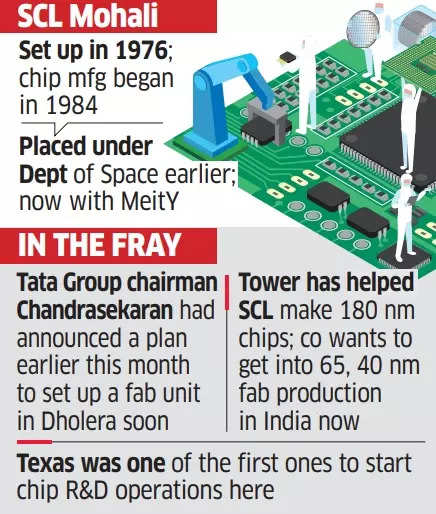

Semiconductor Laboratory revamp: Tata, Texas, Tower among nine bidders

The government has received nine bids from companies such as the Tata group, Israel’s Tower Semiconductor, and Texas Instruments for the overhaul of its Semiconductor Lab (SCL) in Mohali, sources told ET. About $1 billion has been earmarked for the modernisation of the 48-year-old facility.

The contenders: The Tatas have been preparing to enter the chip manufacturing segment in India for the last few years. Earlier this month, group chairman N Chandrasekaran said it will set up a chip-making unit at Dholera in Gujarat soon.

Tower Semiconductor has a close association with SCL as it had helped the Indian government plan the 180 nanometres (nm) chip plant and is keen on entering the commercial chip manufacturing sector here. Texas Instruments has significant chip research and development operations in the country.

Verbatim: “We are evaluating the current bids, including from the Tata group. A couple of companies working in the defence space have also shown interest,” a government official told ET.

Need for upgrade: Currently, SCL produces chips of 180 nm node size, which have very limited use cases. IT ministry officials said the goal is to bring the technology of the facility on par with industry standards of legacy nodes of 65 and 40 nm to start with, before aiming for more cutting-edge nodes.

Nasscom wants govt to let overseas Indian startups list directly

The National Association of Software and Service Companies (Nasscom), in its recommendations for the Union Budget 2024-25, has suggested that India-focused startups incorporated overseas should be able to list on the domestic stock exchanges within the existing externalised structures.

Survey details: Out of 139 startups who participated in a Nasscom survey, approximately 16.5% of Indian-origin startups have externalised legal structures and would consider raising equity capital through a public listing in India if the regulations are amended to allow for a direct listing.

Benefits of the move: Since existing rules permit only domestically incorporated firms from listing in India, such a move could pave the way for reducing considerable tax liabilities for both the company and its investors in the event of ‘reverse flipping’ or moving registration to India.

This is the first time it has been part of the Budget suggestions, said Ashish Aggarwal, head of public policy at Nasscom.

Coming home: ET reported on January 2 that Singapore-based payments firm Pine Labs plans to seek board approval this quarter to move its parent company to India. Similarly, B2B ecommerce firm Udaan is considering a similar move given its IPO plans in 12-18 months. Razorpay and Groww are other startups planning such a move.

Also read | Eruditus joins queue of reverse flips by Indian startups, weighs IPO

Other Top Stories By Our Reporters

Fidelity further marks down fair value of Meesho again: A fund managed by financial services major Fidelity has further marked down the fair value of ecommerce firm Meesho by at least 15%, monthly disclosures made by the fund showed. As per ET’s calculations, the fair value of Meesho, according to Fidelity’s latest disclosures, is around $3.2 billion.

Sebi orders Growpital to stop accepting investments from public: Indian markets regulator Sebi has cracked down on agriculture-focused startup Growpital, prohibiting the firm and its directors from offering any investment products under collective investment schemes (CIS). Additionally, all of Growpital’s assets have been frozen.

Global Picks We Are Reading

■ Prime movers: the German circus exploring Amazon through acrobatics (The Guardian)

■ Robots Are Fighting Robots in Russia’s War in Ukraine (Wired)

■ Silicon Valley investors build $300bn cash pile in start-up funding crunch (FT)