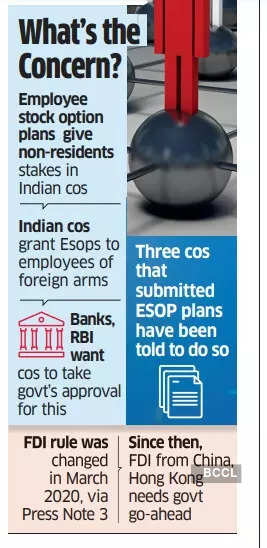

Mumbai: A grant of stock options to persons located in China, Hong Kong and a few other countries is attracting the kind of scrutiny done for acquisition of shares by investors from such nations.

In a move that reflects greater regulatory orthodoxy, the Reserve Bank of India (RBI) is learnt to have asked companies to take the government’s approval for offering employees’ stock option plans (Esops) to staff based in countries sharing a land border with India.

At least three companies that submitted Esop proposals for employees of overseas arms have received such instructions from banks, two persons aware of the development told ET.

With this, the provisions of Press Note 3 (PN3) — which tightened the foreign direct investment (FDI) regulations in 2020 to curb any “opportunistic takeover/acquisition of Indian companies” amid plunging share prices during the pandemic — extends to grant of Esops to those located in bordering countries. PN3 states that “an entity of a country, which shares land border with India, or where the beneficial owner of an investment into India is situated in, or is a citizen of, any such country, can invest only under the government route.”

Regulatory authorities probably fear that Esops can be used to sidestep PN3. For the purpose of PN3, India recognises Pakistan, Afghanistan, Nepal, Bhutan, China (including Hong Kong), Bangladesh and Myanmar as countries sharing land border with India.

Some of the affected companies have drawn RBI’s attention to the matter after their banks rejected the Esop forms — particularly because a grant of Esops does not immediately translate into ownership, and even upon exercise of the options, the resulting equity holdings are insignificant. An RBI spokesman did not comment on the matter.

“PN3 cannot apply at the stage of ‘grant’ of Esops, except when Esops are granted to citizens of Pakistan and Bangladesh,” said Harshal Bhuta, partner of chartered accountancy firm PR Bhuta & Co. “At the time of exercise of Esops, it is the ‘beneficial ownership’ criteria that needs to be tested to determine whether the government approval would be required in terms of PN3.”

Bhuta said, “While this term has not been defined under PN3 or Rule 6(a) of RBI’s non-debt instrument regulations, money laundering and corporate laws such as PMLA and Companies Act, 2013, provide for a 10% equity ownership or control.

threshold to identify ‘beneficial owners.’ Shares issued upon exercise of Esops would typically be below 10% and would not result in control. Thus, PN3 may not become applicable at this stage either.” However, given the present regulatory position, a finance ministry clearance would be needed, irrespective of whether employees receiving Esops are NRIs seconded to overseas subsidiaries of Indian business groups, or foreign nationals working in such outfits.

SEEKING RBI’S VIEW

A large public sector bank, which has not processed the Esop suggestion of a corporate client, has sought RBI’s views on the subject, said a person aware of the development.

“As per RBI, if a prior government approval is required for foreign investment in a company, then the same requirement applies to Esops too, even if they are not yet exercised,” said Rutvik Sanghvi, partner with chartered accountancy firm Rashmin Sanghvi & Associates.

“While options may not be covered under the definition of ‘equity instruments,’ as per non-debt instrument rules, amendments made due to PN3 would equally apply to such options as if they were exercised. Any legal provision introduced, which requires security clearance from the government, should be looked at in substance, and not in form,” he said.