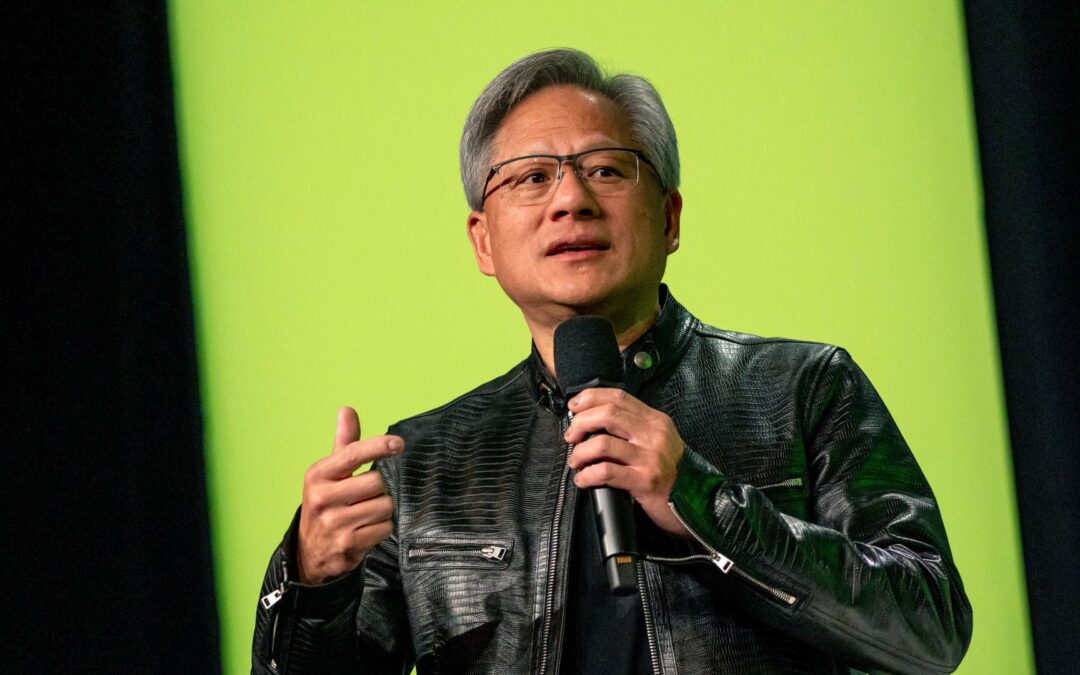

Jensen Huang, co-founder and chief executive officer of Nvidia Corp., during the Nvidia GPU Technology Conference (GTC) in San Jose, California, US, on Tuesday, March 19, 2024.

David Paul Morris | Bloomberg | Getty Images

Nvidia announced a 10-for-1 forward stock split in its fiscal first-quarter earnings report on Wednesday. The shares will begin trading on a split-adjusted basis at market open on June 10, according to a release.

Stock splits do nothing to change the financial fundamentals of a company but they so make each share cheaper, which can have a positive psychological effect on retail investors. Nvidia said the stock split will make ownership “more accessible to employees and investors,” the release said.

Nvidia shares closed on Wednesday at $949.50. With a 10-for-1 split based on that price, each share would cost $94.95, though an investor would have to buy 10 of them to own the same amount of the company as they currently get with one share. Alphabet, Amazon and Tesla all orchestrated stock splits in 2022.

Shares of Nvidia popped nearly 4% in extended trading on Wednesday.

The company said that each holder of Nvidia’s common stock will receive nine additional shares of common stock that will be distributed after market close on Friday, June 7. Trading will commence the following Monday.

Nvidia investors have enjoyed a historic rally over the past five years, with the stock price soaring by 25-fold. The company was long known as the primary maker of advanced graphics processing units (GPUs) for video games, but has emerged of late as the central hardware player in the artificial intelligence boom.

Revenue in Nvidia’s fiscal first quarter soared 262% from the year earlier period, marking the third straight quarter of growth in excess of 200%.

The chipmaker also said that it’s increasing its quarterly cash dividend from 4 cents per share to 10 cents on a pre-split basis. After the split, the dividend will be a penny a share.