By RoboForex Analytical Department

The New Zealand dollar is steadily rising against the US dollar, with the NZD/USD pair reaching 0.6014 as of Monday. The financial markets are gearing up for Wednesday’s Reserve Bank of New Zealand (RBNZ) meeting. Analysts widely anticipate that the RBNZ will maintain the official cash rate at 5.5% for the ninth consecutive time, reflecting ongoing concerns about the robustness of New Zealand’s economy.

Recent data releases have painted a mixed economic picture. The unemployment rate in New Zealand showed a less-than-expected increase in Q2, while inflation expectations dipped to a three-year low for Q3. These factors collectively strengthen the case for potential rate cuts, though it appears unlikely that the RBNZ will adjust rates downward in August, preferring to wait for cues from major global central banks.

Investor attention is also turning towards upcoming US inflation data, which could further influence global monetary policy expectations, particularly Federal Reserve expectations.

Despite challenges in July and August, the NZD has shown commendable resilience, suggesting potential for continued stability and barring significant external shocks.

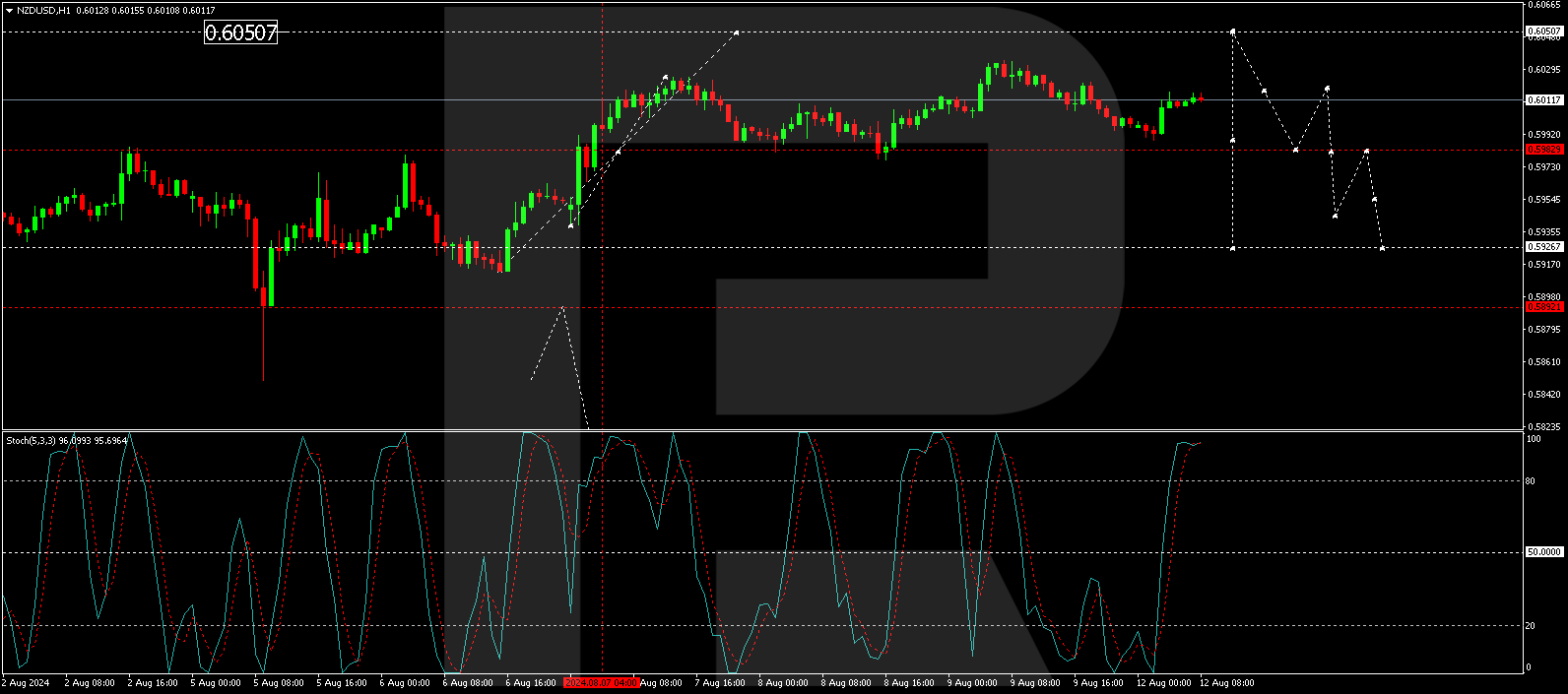

Technical analysis of NZD/USD

The NZD/USD pair is developing a consolidation range just above the 0.5983 level. We expect to see an extension of this range to 0.6050, considered a corrective move. According to our NZD/USD forex forecast, the market will likely initiate a downward trend towards 0.5920 following this correction. A breach of this level could open the path to a further decline towards 0.5800. This bearish outlook is supported by the MACD indicator, which, although above zero, points downwards, indicating potential selling pressure.

On the hourly chart, the NZD/USD is crafting the fifth segment of a growth wave aiming for 0.6050, considered a corrective rally. Upon reaching this level, we anticipate a reversal leading to a decrease towards 0.5983, potentially extending the downtrend to 0.5920. This bearish scenario is substantiated by the Stochastic oscillator, whose signal line is currently positioned above 80 but shows signs of a forthcoming downturn.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- NZD/USD gains momentum ahead of RBNZ meeting Aug 12, 2024

- COT Metals Charts: Speculator Bets led lower by Gold & Copper Aug 10, 2024

- COT Bonds Charts: Speculator Bets led by SOFR 3-Months & Fed Funds Aug 10, 2024

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybeans Aug 10, 2024

- COT Stock Market Charts: Speculator Bets led by Russell & S&P 500 Aug 10, 2024

- The Bank of Mexico unexpectedly cut its interest rate. China’s consumer inflation is on the rise Aug 9, 2024

- EUR/USD Stabilises Amid Fed Speculation and Absence of Major Economic Data Aug 9, 2024

- RBI kept rates at 6.5%. The Canadian dollar is strengthening due to foreign currency inflows and rising oil prices Aug 8, 2024

- Gold (XAU/USD) Recovers Amid Rate Cut Expectations Aug 8, 2024

- This Trend Will Likely Soon Rock the U.S. Financial System Aug 7, 2024