- NZDUSD is lower today after the RBNZ’s decision to keep rates unchanged

- It trades a tad above a very busy support area

- Momentum indicators are possibly preparing to send bearish signals

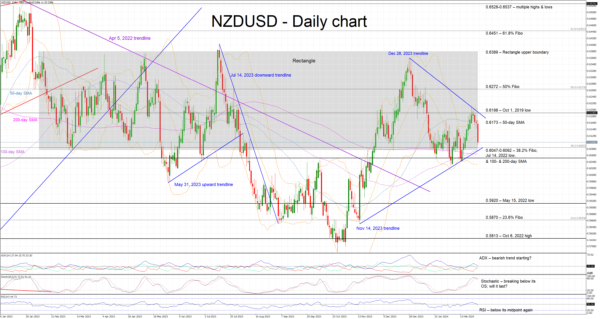

NZDUSD is recording its third consecutive red candle, crashing lower after the RBNZ’s decision disappointed certain market analysts expecting a rate hike earlier today. NZDUSD is currently trading a tad above the busy 0.6047-0.6092 area and the lower boundary of the 1-year-old rectangle, but still far from the 2024 low of 0.6037.

In the meantime, the momentum indicators are gradually turning bearish. More specifically, the RSI has dropped below its 50-midpoint and it is thus pointing to increasing bearish pressure. Similarly, the Average Directional Movement Index (ADX) is hovering above its 25-threshold with its DI- subcomponent edging aggressively higher. More importantly, the stochastic oscillator has broken below both its overbought territory and simple moving average. Should this move pick up pace, it would be regarded as a strong bearish signal.

If the bulls decide to retake the market reins, they could try to lead NZDUSD higher towards the 50-day simple moving average (SMA) at 0.6173. The October 1, 2019 low at 0.6198 is a tad higher with the next target possibly expected at the 50% Fibonacci retracement of the April 5, 2022 – October 13, 2022 downtrend at 0.6272.

On the flip side, the bears appear willing to take advantage of the current momentum and finally break below the 0.6047-0.6092 area, which is populated by the 38.2% Fibonacci retracement, the July 14, 2022 low, the 100- and 200-day SMAs and the November 14, 2023 ascending trendline. If successful, the path then appears to be clear until the May 15, 2022 low at 0.5920.

To sum up, the bears are enjoying the RBNZ-induced correction in NZDUSD, but their focus is now mostly on the momentum indicators signaling a more protracted downleg.