- NZDUSD records a sizeable green candle today

- Strong reaction following the recent acute correction

- Momentum indicators are mixed, bearish pressure weakening

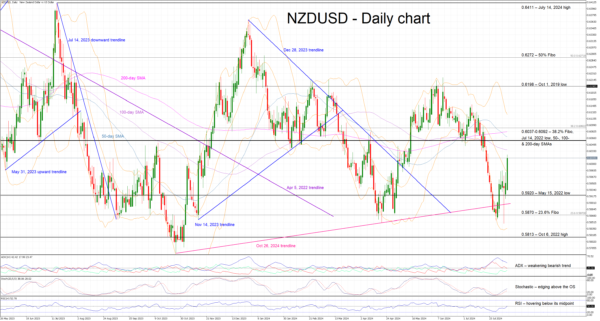

NZDUSD is edging aggressively higher today, cancelling out a good part of the recent correction that led to a new 9-month low. The overall positive market sentiment and the stronger labour market data from New Zealand during the Asian session have helped NZDUSD climb higher as the RBNZ is preparing for next week’s rate-setting meeting.

In the meantime, the momentum indicators are mixed. More specifically, the Average Directional Movement Index (ADX) is dropping towards its 25-threshold and thus signalling a weakening bearish trend in the NZDUSD. Similarly, the RSI is trying to climb above its 50-midpoint, potentially indicating that the recent bearish pressure has probably faded away. More importantly, the stochastic oscillator is edging higher, well above its oversold territory (OS), and heading towards its midpoint.

If the bulls remain confident, they could try to lead NZDUSD towards the 0.6037-0.6092 range, which is defined by the 38.2% Fibonacci retracement, the July 14, 2022 low, and the 50-, 100- and 200-day simple moving average (SMAs). If they manage to overcome this key resistance area, the path is clear until the October 1, 2019 low at 0.6198.

On the flip side, the bears are trying to retake the market reins and push NZDUSD towards the May 15, 2022 low at 0.5920. If successful, they could then retest the support set by the 50% Fibonacci retracement of the April 5, 2022 – October 13, 2022 downtrend at 0.5870 and be given the chance to record a 2024 low.

To sum up, NZDUSD bulls are staging a comeback, but market sentiment remains fragile and thus the recent bearish move might still have legs.