Bloomberg: The coming 12 months are shaping up as the year of the interest-rate cut, with the Federal Reserve poised to lead the charge for richer countries.

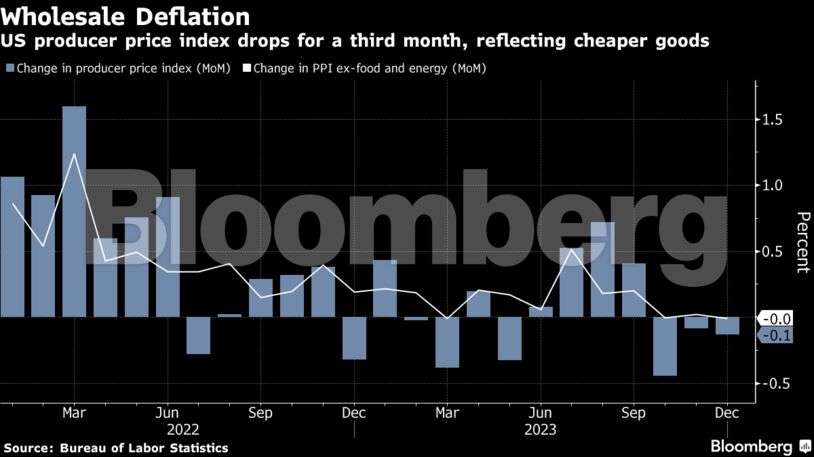

Traders boosted bets on how aggressively the Fed will lower borrowing costs this year after a report showed prices paid to producers continued to fall in December. Even so, the path to taming inflation will be bumpy, as a measure of consumer prices rose by the most in three months.

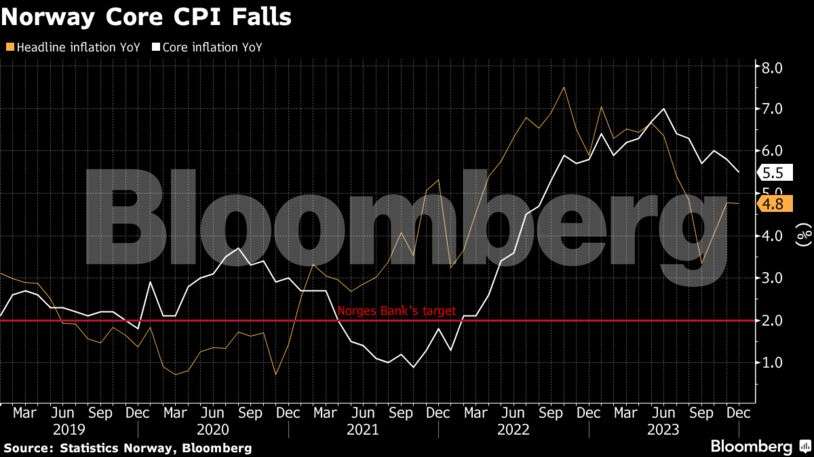

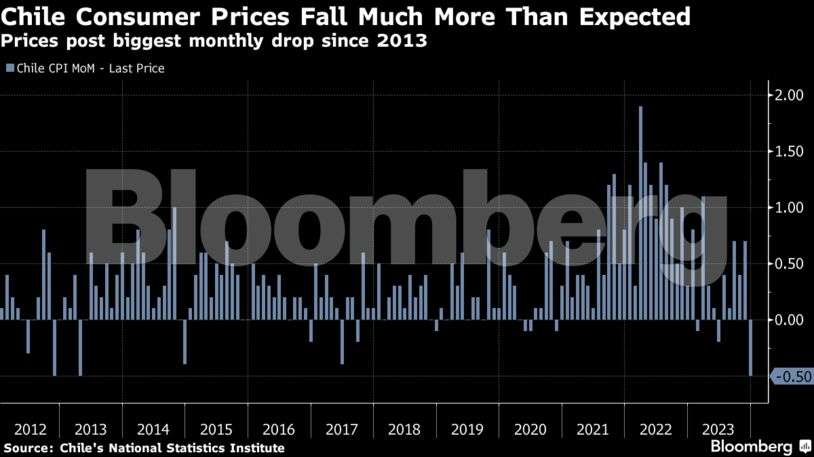

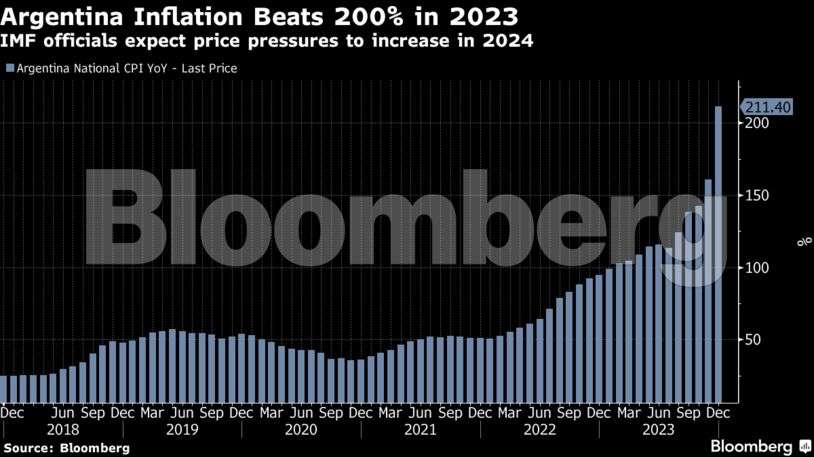

Similar metrics in Norway and Chile eased in December, while Argentina ended the year with inflation above 200%. While inflation is mostly retreating around the world, soaring shipping costs and a jump in oil prices are stoking worries about a revival of cost pressures.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

World

After racing ahead with the most aggressive tightening campaign in decades during 2022 and 2023, central banks around the world are poised to begin easing monetary policy as inflation continues to retreat. The shift is captured by Bloomberg Economics, whose aggregate gauge of rates across the world shows a decline of 128 basis points over the year, mostly led by emerging economies. Poland, Serbia and Korea held rates steady this past week, while Peru cut.

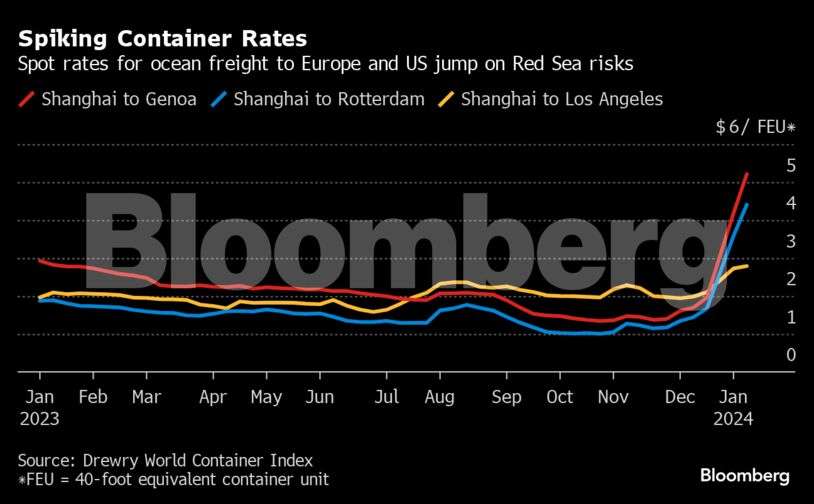

Only days into 2024 that was meant to be the year inflation dissipated, manufacturers and retailers are again juggling delays and facing higher expenses as persistent attacks by Houthi rebels in the Red Sea rattle a major shipping route through the Suez Canal. Ocean freight rates for goods from Asia to Europe have more than doubled over the past four weeks.

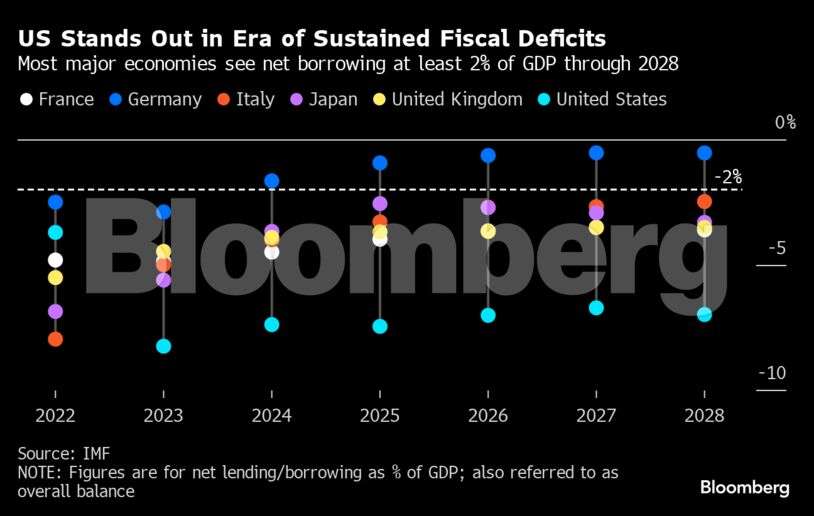

Over the next several weeks, governments from the US, UK and the eurozone will start flooding the market with bonds at a clip rarely seen before. Saddled with the kind of bloated deficits that were once unthinkable, these countries — along with Japan — will sell a net $2.1 trillion of new bonds to finance their 2024 spending plans, a 7% increase from last year, according to estimates from Bloomberg Intelligence.

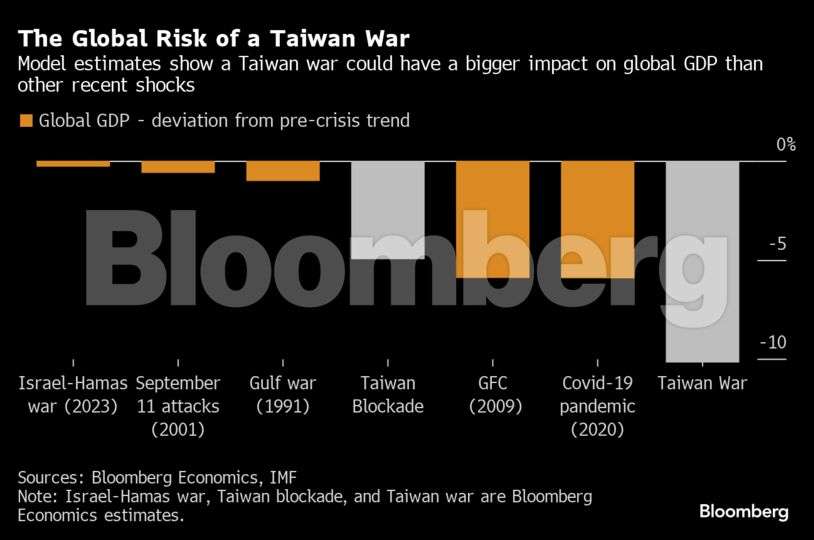

War over Taiwan would have a cost in blood and treasure so vast that even those unhappiest with the status quo have reason not to risk it. Bloomberg Economics estimate the price tag at around $10 trillion, equal to about 10% of global GDP — dwarfing the blow from the war in Ukraine, Covid pandemic and Global Financial Crisis.

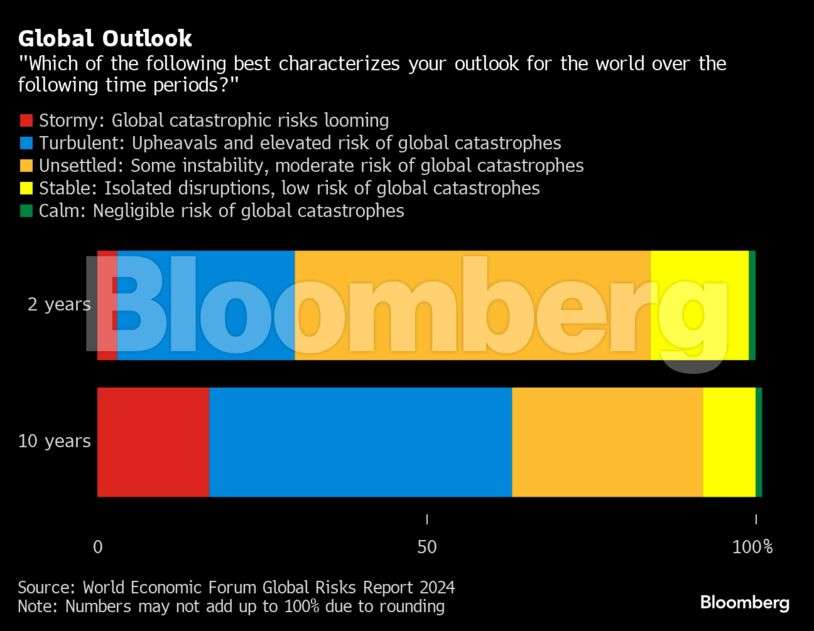

An annual poll conducted by the World Economic Forum — ahead of its global summit in Davos this week — put “misinformation and disinformation” at the top of threats facing the global economy in the short term. The report confronts how economies squeezed by high borrowing costs after a once-in-a generation inflation shock just as major elections take place could present a toxic backdrop for the world in coming months.

US

US inflation accelerated at the end of 2023, fueled by stubborn services costs while a protracted decline in goods prices petered out. Much of the surprise in so-called core goods, which excludes energy and food, came from pickups in prices for used cars and apparel, despite year-end promotional activity.

Prices paid to US producers extended their retreat in December, prompting traders to increase bets on how aggressively the Fed will cut interest rates this year. Categories within the PPI that feed directly into the calculation for the Fed’s preferred inflation metric were mostly soft.

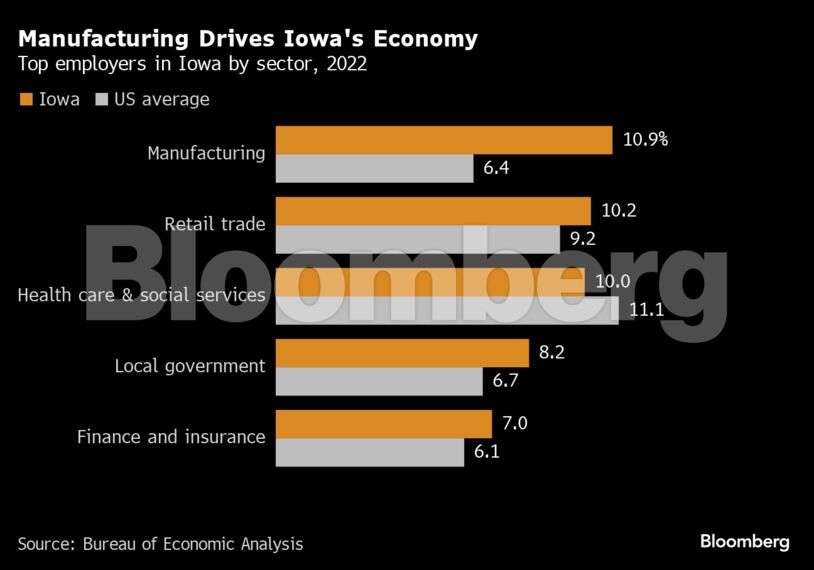

With its large White and rural population, evangelical voters and mix of factories and farms, Iowa — which on Monday will host the first contest in the race for the Republican presidential nomination — is hardly representative of the national electorate. But it is a good bellwether of Republican sentiment — and the party’s ideological fault lines.

Europe

Norway’s underlying inflation rate fell more than expected at the end of last year, reducing chances of more monetary tightening and suggesting there’s a chance interest-rate cuts start earlier than policymakers have signaled.

Asia

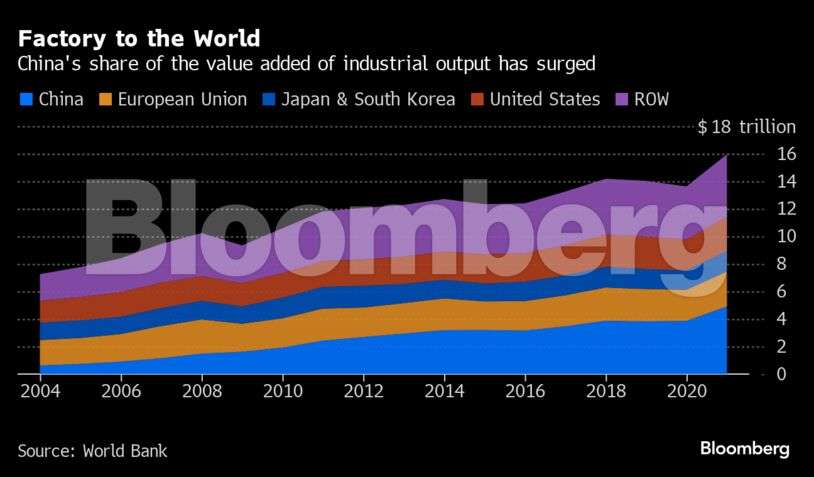

As China’s property sector declines, President Xi Jinping needs to reshape the nation’s economic model to drive growth over the next decade. His government’s solution risks igniting a new wave of trade tensions across the globe. China’s leaders are pouring money into manufacturing as property-related activity, which once spurred about a fifth of the economy’s expansion, turned into a drag on growth in 2022.

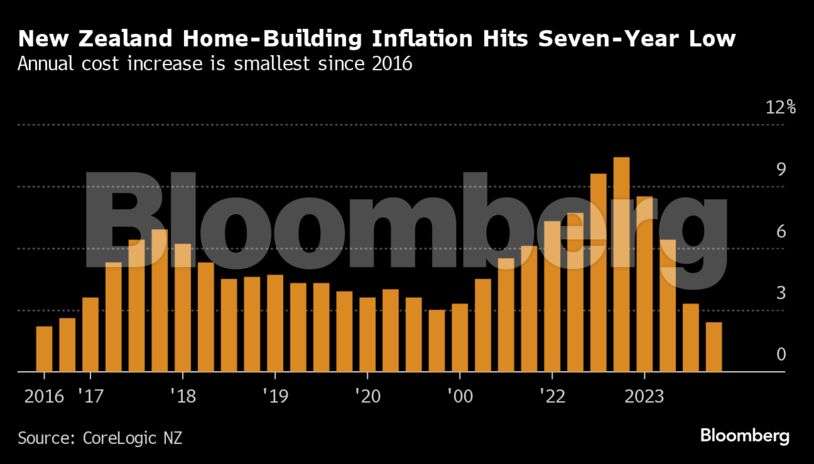

New Zealand house-building costs rose at the slowest pace in more than seven years as high interest rates and economic uncertainty curb demand for new homes.

Emerging Markets

Chilean consumer prices posted their biggest monthly drop in more than a decade in December, surprising investors and supporting the central bank’s guidance for more sharp interest rate cuts ahead.

Argentina ended 2023 with the fastest inflation in more than three decades as President Javier Milei started to unwind a thicket of currency controls and price freezes imposed by the previous administration. The International Monetary Fund gave Milei’s plan a vote of confidence, approving Wednesday a review of its $44 billion program that paves the way for a larger-than-expected loan disbursement of $4.7 billion.