~Samriddhi Singh Mahar

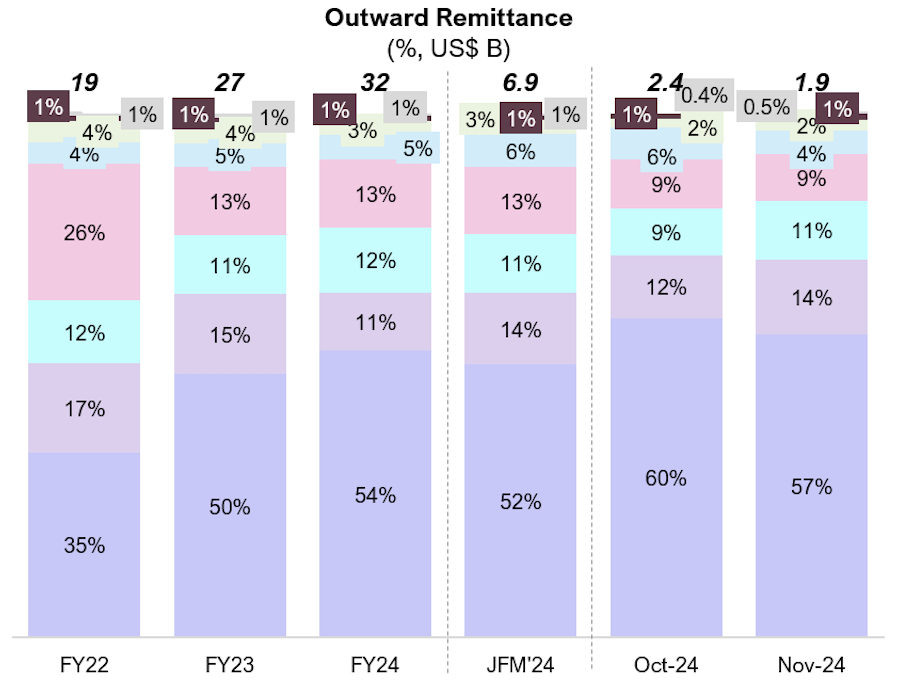

India’s outward remittances has continued its declining trends with a sharp drop to USD 1.9 billion in November 2024 from USD 2.4 billion October 2024, this drop was majorly driven by a drop in investment and equity. This is nearly a drop of 19%.

Outward remittances have been on a steady decline since August:

(Source: 1Lattice)

In November, travel expenses accounted for the largest share of outward remittances at 57%, followed by family maintenance, gifts and education, which contributed 14%, 11%, and 9%, respectively.

In comparison, last month, travel expenses accounted for 60%, followed by family maintenance, education, and gifts, which contributed 12%, 10%, and 8%, respectively.

This data reflects a slight shift in changing financial priorities among remittance senders.

Investments in equity and debt held a 4% share in November, a 2% decline from the 6% share held by equities and investment in October, the data elaborated.

(Source: 1Lattice)

Outward remittance in the form of debt and equities has witnessed a sharp fall to USD 85 million in November, from USD 149 million in October.

The drop in outward remittances for equities reflects reduced investor confidence, or risk aversion, signaling cautious capital allocation amidst market volatility and global uncertainties.

Over the past decade, the nature of India’s outward remittances has changed significantly. In FY14, the largest share was for ‘gifts,’ followed by ‘others,’ with notable portions also directed towards supporting relatives and investing in equity/debt. However, these categories have seen a sharp decline in recent years, as per a research note by Aditi Gupta, economist, Bank of Baroda.

There has also been a commensurate increase in India’s outward remittance in the last 10 years. From just USD 1.1bn in FY14, remittance outflows increased to USD 31.7bn in FY24. This translates into a CAGR of over 40%, which is much higher than the CAGR of remittance inflows in the same period. Barring FY21, which was marked by the Covid-19 pandemic, remittance outflows from India have shown a clear upward trend.Bank of Baroda – research note