The Indian banking sector is structurally in stronger shape to ride the retail credit growth story over the next decade, amid rising consumerism. However, funding such growth via retail deposits at a reasonable cost among rising structural disruptions could emerge as the biggest challenge.

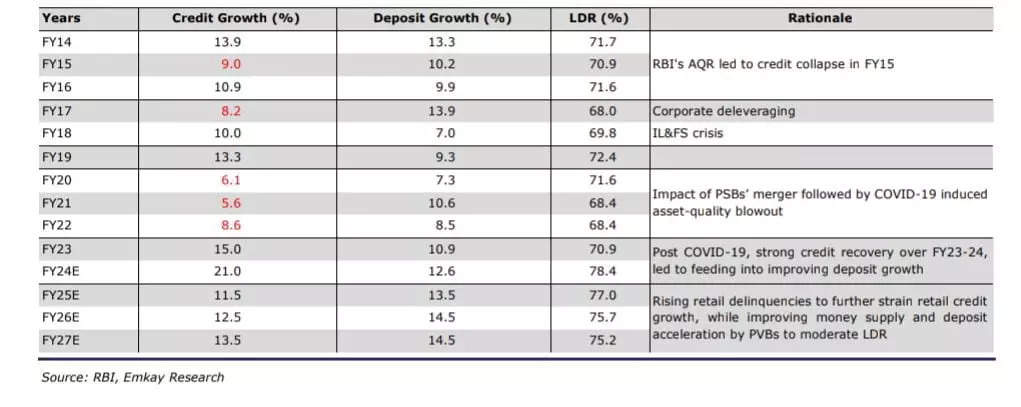

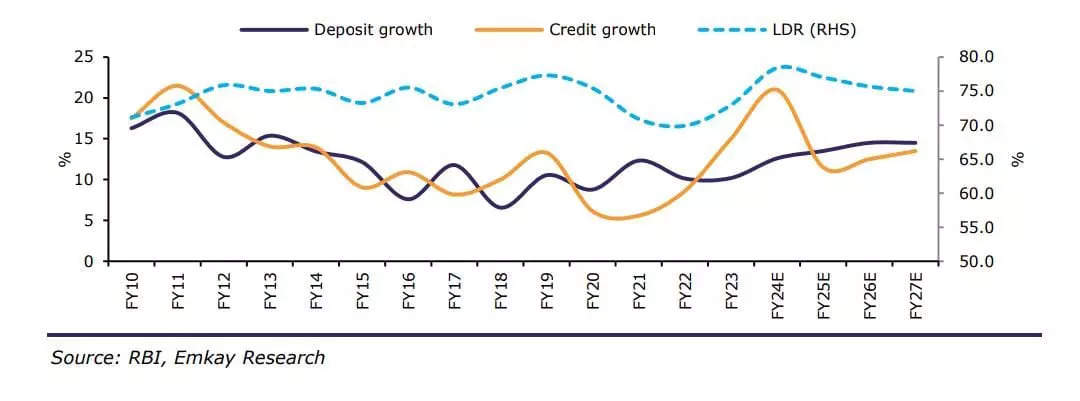

A recent report by Emkay Global Financial Services revealed that the credit growth trajectory is expected to slow down to 12-14 per cent YoY over FY25-27 from the current 16.5 per cent YoY (21 per cent incl-HDFC) and so also LDR to 75 per cent from a current high of 80 per cent.

The overall deposit growth and more so slowing retail deposit growth (including SA) could emerge as a structural risk to India’s long term retail credit growth story, unless it is addressed.

Some of the banks have reduced the excess cash on the balance sheet to fund credit growth in the recent period, thereby delaying deposit growth and protecting margins. However, most of these levers are now largely exhausted and, thus, banks will have to mobilize deposits to incrementally fund credit growth.

This credit-deposit gap has also raised concerns among investors that slower deposit growth, as seen for the past few years, is more structural in nature and, thus, could derail the credit growth story (mainly led by retail) in the long run.

It is believed that banks’ preference for low-cost deposits is likely to remain high and, thus, accelerating deposit growth is imperative for banks to support credit growth in the long run, said the report.

Challenges on profitable lending to soften credit growth

In the past 50 years, in most instances credit collapse or moderation has been led by adverse macroeconomic or asset-quality issues and not mainly because of any slowdown in deposit growth/transient liquidity tightness.

It is believed that the credit growth is more a function of underlying demand, growth, and return aspirations of the lenders (as funding can be arranged at higher rates) and expected asset-quality behavior.

If there is enough demand and, thus, opportunities to lend at a rate that borrowers can absorb without hurting credit quality and return ratios, then banks would not mind raising funds (via bulk deposits/market borrowings) even at a higher cost, as is evident from the recent deposit acceleration (~13% YoY) after a prolonged slowdown since FY14, highlighted the report.

However, it’s believed that the extended elevated rate cycle and, thus, higher funding cost coupled with rising asset-quality risk in unsecured retail loans contributing 12 per cent of YTD credit growth has raised concerns about profitable lending, the report added.

Additionally, recent RBI’s actions to contain the bank’s undeterred growth in unsecured/NBFC loans as well as regulatory clampdown on NBFCs/Fintechs have also instilled fear in the minds of lenders.

Thus, the interplay of these factors is expected to slow down the credit growth trajectory to 12-14 per cent YoY over FY25-27 from the current 16.5 per cent YoY (21 per cent incl-HDFC) and so also LDR to 75 per cent from a current high of 80 per cent.

Deposit acceleration imperative

Deposit growth has been lower (<15 per cent) in the past decade due to cyclical macro and micro disruptions, but so has credit growth. However, concerns have emerged as to whether the cyclical deposit growth (including retail deposits) weakness could aggravate and turn more structural in nature, thereby derailing India’s strong consumption-led credit growth story in the long run, said the report.

Systemic deposit growth depends upon multiple macro factors: GDP/National Disposable Income growth, propensity to save, money supply, credit-deposit multiplier, real interest rate, exchange rate, and substitution effect (Alternate Investment Opportunities); and micro-factors at the bank level – phygital footprint, interest rate, and product/service offerings, among others.

GDP/Disposable income growth (National/PCI), the propensity to save (due to higher consumption/lower real interest rate), and credit growth (due to asset quality/merger pangs) have been relatively sub-par and volatile over the past few years, feeding into slower deposit growth (<15 per cent) since FY14 (except during demonetization).

Nominal GDP/disposable income growth is expected to improve a bit, but rising consumption should continue to impact savings growth and, so, deposits. As far as the much-discussed substitution effect on deposit mobilization is concerned, the RBI’s empirical study suggests that the impact, if any, on money supply/deposits is only at the margin level; however, it is believed that it certainly leads to some retail deposit leakage for banks, the report asserted.

On the micro level, the digital footprint has become inevitable, but branches have also been an important source for retail deposit growth in the past and will remain so in the ensuing decade.

This is evident from the strong correlation between branches and deposit market share gains/loss at the state as well as bank level and, thus, has forced banks to resume branch expansion. Banks with a relatively weak liability franchise have to resort to higher rate offerings, which is an economically unsustainable strategy in the long run, the report added.