While some might think that taxes are an inconvenience, they actually serve many good uses, including funding health programs, food stamps, disability benefits, and defense programs.

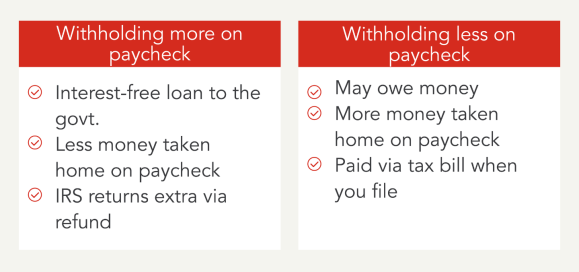

When you pay too much in taxes, however, it creates an interest-free loan to the government that is more than your fair share. This causes you to take home less money per paycheck and essentially has the government holding onto your hard-earned money until tax season.

Whether you want more money in your paycheck and less taxes withheld or a bigger tax refund at tax time and more money withheld from your paychecks is a preference. For many, the tax refund is the biggest check they receive all year, and they prefer to receive a tax refund at tax time, because if they have the additional money in their paycheck they may spend it.

TurboTax has tools to help you estimate your withholding, whether you prefer a tax refund or want more money in your paycheck. Here is more of what you need to know about withholding and overpaid taxes.

How do I know if I overpaid my taxes?

If you’ve overpaid your taxes, you’ll end up getting an IRS refund once you’ve filed your taxes. This is the clearest sign that you’ve overpaid, as the reason you’re getting a refund back in the first place is that you’ve paid too much in taxes throughout the year.

How can I avoid overpayment on my taxes?

In the case of a major life event, such as marriage or divorce, the birth of a child, change in employment, or obtaining a second job, you might not have had time to fully adjust your withholding status via a Form W-4.

In this case, it’s reasonable to expect a tax refund for that year. Adjusting your withholdings promptly can ensure that you’re not paying more than necessary to the IRS, putting more money in your pocket throughout the year. You can adjust your withholding based on your preference, whether you want more money in your paycheck or a bigger refund at tax time.

If you are eligible for refundable credits like Earned Income Tax Credit up to $7,430 for three or more kids in 2023 , you may also see a boost in your refund since refundable credits give you the additional amount of credit beyond taxes you owe, unlike non-refundable credits.

According to the latest IRS statistics, as of December 2023, the average refund was over $3,100, and the total amount of refunds was $334.861 billion. For many, that’s the biggest paycheck of the year.

You can speak to a tax expert to figure out how to properly adjust your withholdings so that you’re receiving the most out of your paycheck and you are estimating your withholdings correctly whether you want a refund at tax time or more in your paycheck.

What happens if I overpaid my taxes?

If you’ve overpaid your taxes, the IRS will issue you a refund when you file your taxes for the year. This is the easiest way to know that you’ve paid more into taxes than necessary.

What should I do in the case of a tax overpayment?

Don’t worry if you made a mistake on your tax return; tax overpayment isn’t generally a problem. If you overpaid your taxes, you have the option of receiving a refund or having the refund amount applied to next year’s taxes.

In the sections below, we’ll talk about what happens if you overpay taxes and how you can respond.

Have your refund applied to next year’s taxes

If you prefer instead to get ahead on the next year’s taxes, you can opt to have the refund applied to your taxes for next year.

This could be a great option if you’re expecting a life change, like starting your own business, where you might be unsure about the tax implications.

Adjust tax withholdings

If you’re frequently receiving a tax refund, you may want to adjust your tax withholdings so you end up receiving more per paycheck from your employer and less of a refund during tax time if you prefer— keeping in mind that the goal of tax time is to have a net of zero, where you don’t owe.

To adjust your withholdings, you’ll need to complete a Form W-4. This form can be found on the IRS website or from your employer’s HR department.

Complete this form per the instructions and return back to your employer; their payroll department will be able to make the necessary changes to your withholdings so that you are paying the appropriate amount for taxes.

Recalculate estimated taxes

Self-employed taxpayers have the option to pay estimated quarterly taxes, making it easier to allocate money for annual taxes. If you’re calculating your estimated quarterly taxes incorrectly, you may be overpaying each quarter.

If you receive a tax overpayment refund or a notice from the IRS about overpaying your estimated quarterly taxes, you should recalculate to make sure you’re not paying more than you should.

Use our self-employed tax calculators, or you can fill out Form 1040-ES to figure out how much you owe in quarterly taxes.

Meeting quarterly tax deadlines is important, so make sure you recalculate your taxes before the next deadline arrives There may be other situations, like selling stock at a gain, where you might consider paying estimated taxes.

Is it better to underpay or overpay taxes?

Generally speaking, it’s better to overpay your taxes rather than underpay. A tax overpayment will result in a refund at the end of the year, which means your taxes are paid in full, and you receive the difference as a refund.

The problem with underpaying your taxes is that you’ll still owe taxes at the end of the year. You may only owe a small portion of your tax liability, but it’s easier to make sure your taxes are paid in advance, so you don’t have to worry about coming up with extra money when taxes are due.

How do I contact the IRS about tax overpayment?

If you overpaid your taxes, you can typically expect to receive a refund several weeks after filing your taxes. In most cases, the IRS will make sure you receive a tax overpayment refund if you overpay on your taxes.

There are several options if you need to contact the IRS about your tax overpayment. You can call the toll-free telephone service at 1-800-829-1040 for answers to federal tax questions. You can also mail tax returns and questions to the IRS, although correspondence by mail is typically slower than other methods.

What if I make a mistake on my taxes?

It’s possible that you notice a missed deduction or credit after filing your taxes that would have resulted in a tax refund. Don’t worry about missing deductions and credits when filing with TurboTax.

No matter what moves you made last year, TurboTax will make them count on your taxes. Whether you want to do your taxes yourself or have a TurboTax expert file for you, we’ll make sure you get every dollar you deserve and your biggest possible refund – guaranteed.

-

Previous Post

Can You Claim a Tax Credit For a Pet? Pet…