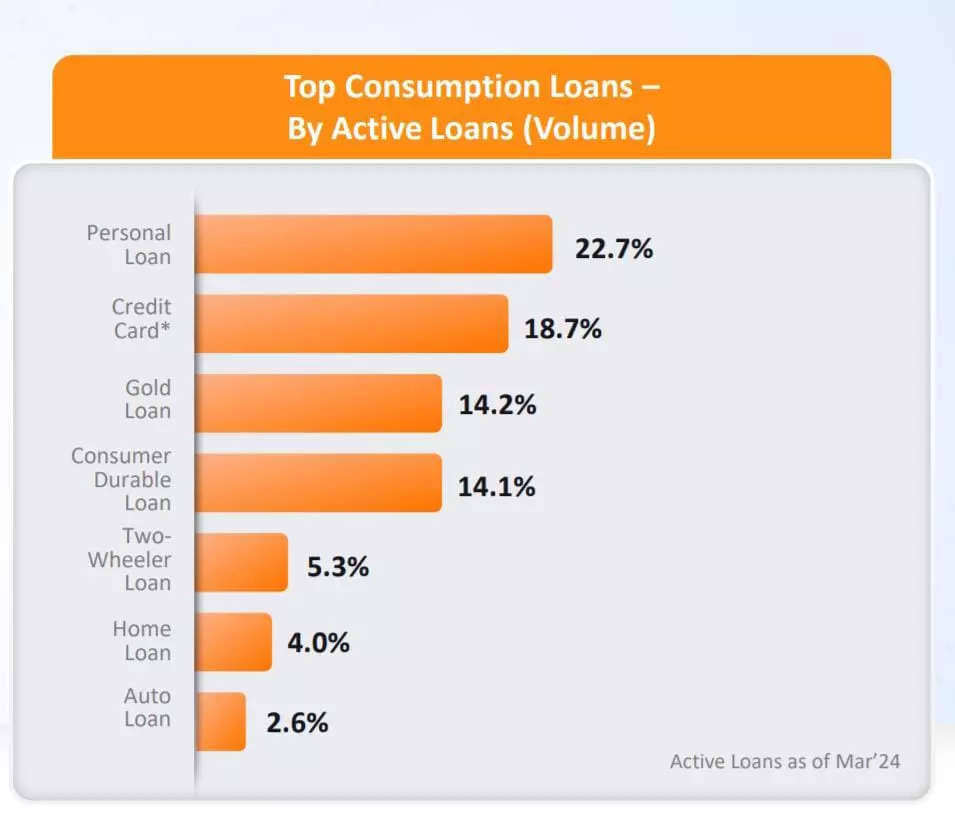

Portfolio outstanding of consumption loans increased by 15.2 per cent YoY to Rs 90.3 Lakh crore as of March 2024. Consumption Lending includes home loans, personal loans, two-wheeler loans, auto loans, consumer durable loans and credit cards. However, portfolio growth has decelerated from 17.4 per cent as of March 2023, primarily driven by the slowdown in the home loans segment, revealed a latest report by CRIF High Mark.

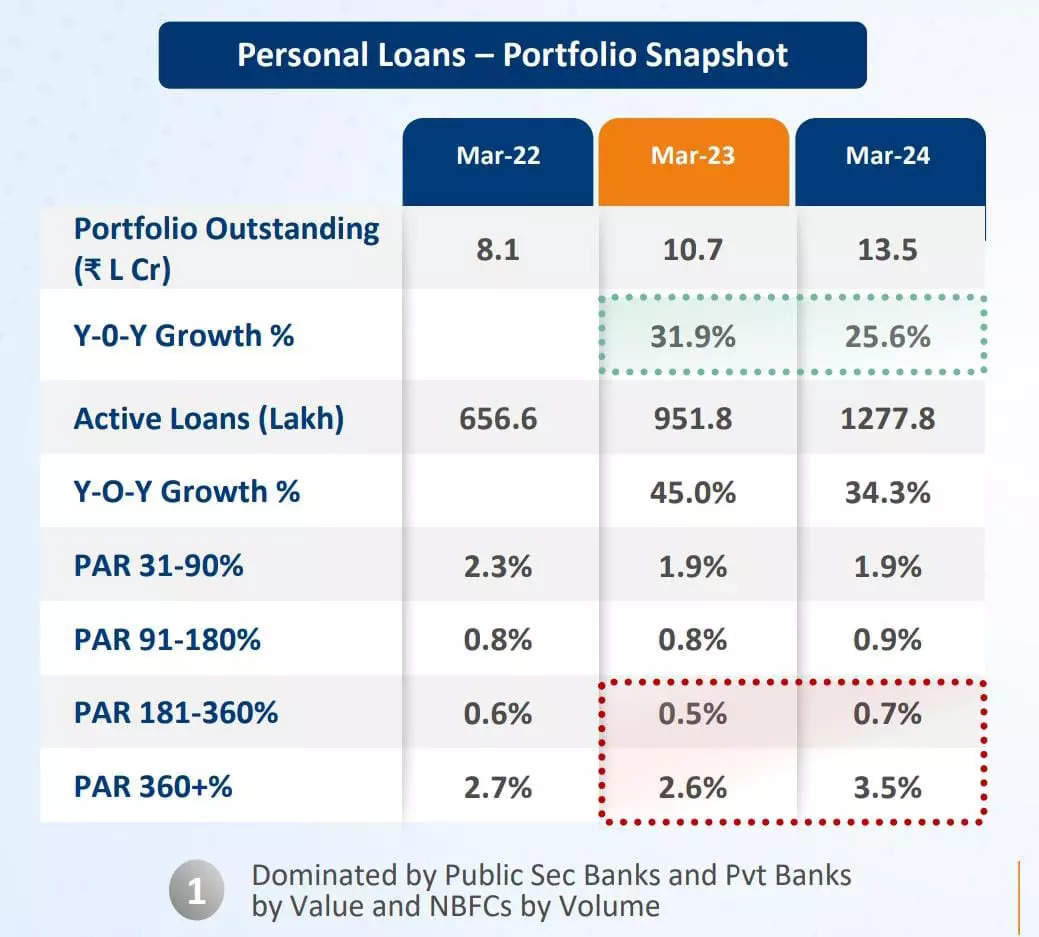

The report highlighted that personal loans has witnessed a robust portfolio growth of 26 per cent YoY as of March 2024, despite recent regulatory reforms.

About Rs 10 lakh+ ticket size loans continue to increase their share in originations by value, while less than Rs 1 lakh ticket size loans continue to dominate by volume. Banks dominate originations (by value) and NBFCs dominate originations (by volume).

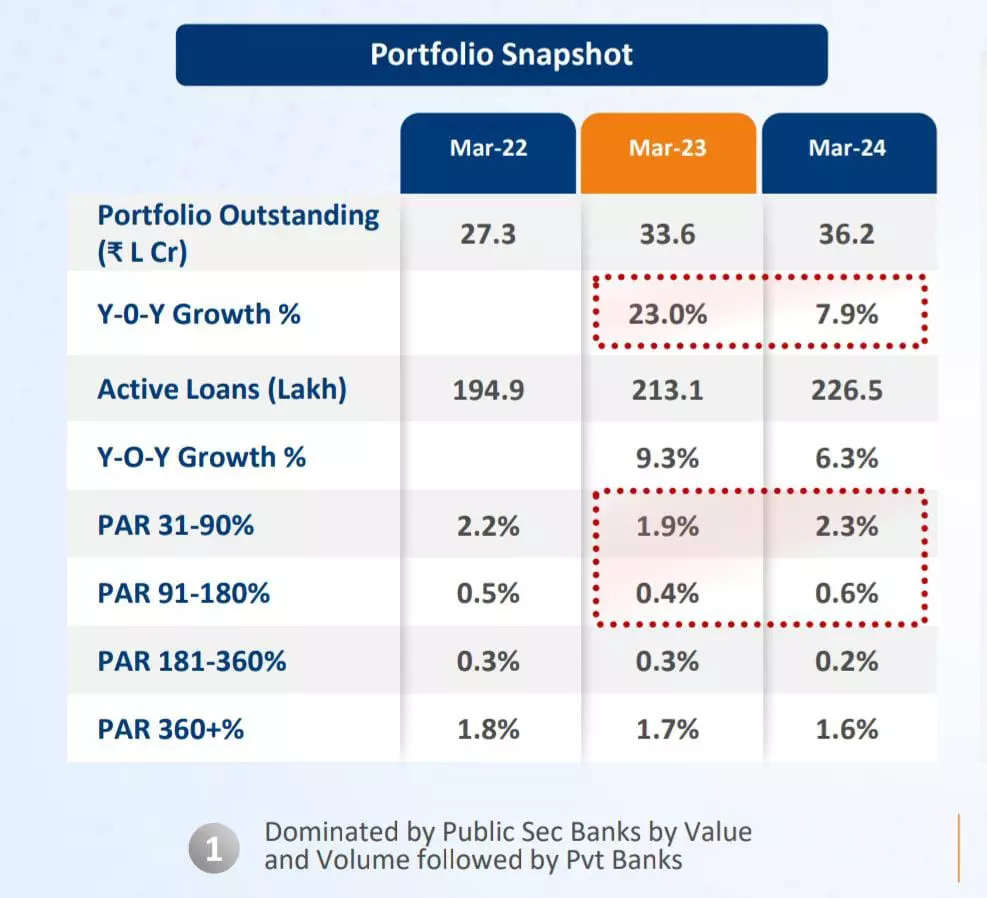

Home & Auto Loans slump

The home loans segment witnessed a slump, portfolio growth slowed down to 7.9 per cent YoY, compared to 23 per cent YoY as of March 2023, due to muted growth in originations — 9.2 per cent in FY24 vs 18.2 per cent in FY23, said the report.

The shift in originations (by value and volume) was from ticket size Rs 5 lakhs to Rs 35 lakhs to Rs 35 lakhs+. Growth of about 32 per cent was witnessed in average ticket size (ATS) from Rs 20.1 lakhs in FY20 to Rs 26.5 lakhs in FY24.

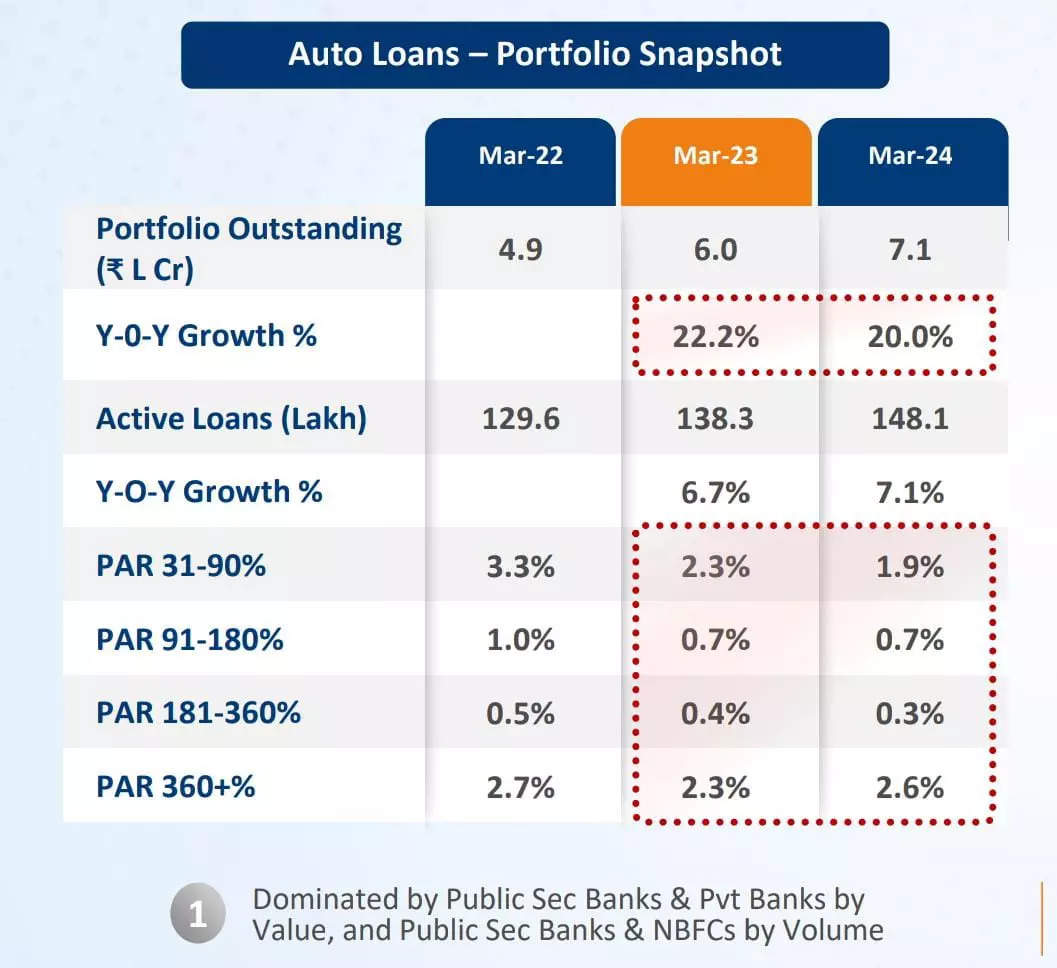

Auto loans also witnessed a marginal slowdown in portfolio growth to about 20 per cent YoY, compared to 22 per cent as of March 2023, buoyed by shift in originations to over Rs 10 lakhs ticket size loans but dampened by lower growth in overall origination volumes, the report highlighted.

There has been a 5 per cent growth in originations volume, compared to 21 per cent in FY23 and 12.5 per cent growth in originations value, compared to 37.3 per cent in FY23.

For two-wheeler loans on the other hand, portfolio growth accelerated to 34 per cent YoY, from 30 per cent as of March 2023, primarily driven by the shift in originations to higher ticket size loans, despite lower origination volume growth YoY (13 per cent in FY24 compared to 32 per cent in FY23.

Shift in originations by value and volume with a 4.6 times growth can be seen for Rs 75K+ from FY20 to FY24, the report added.

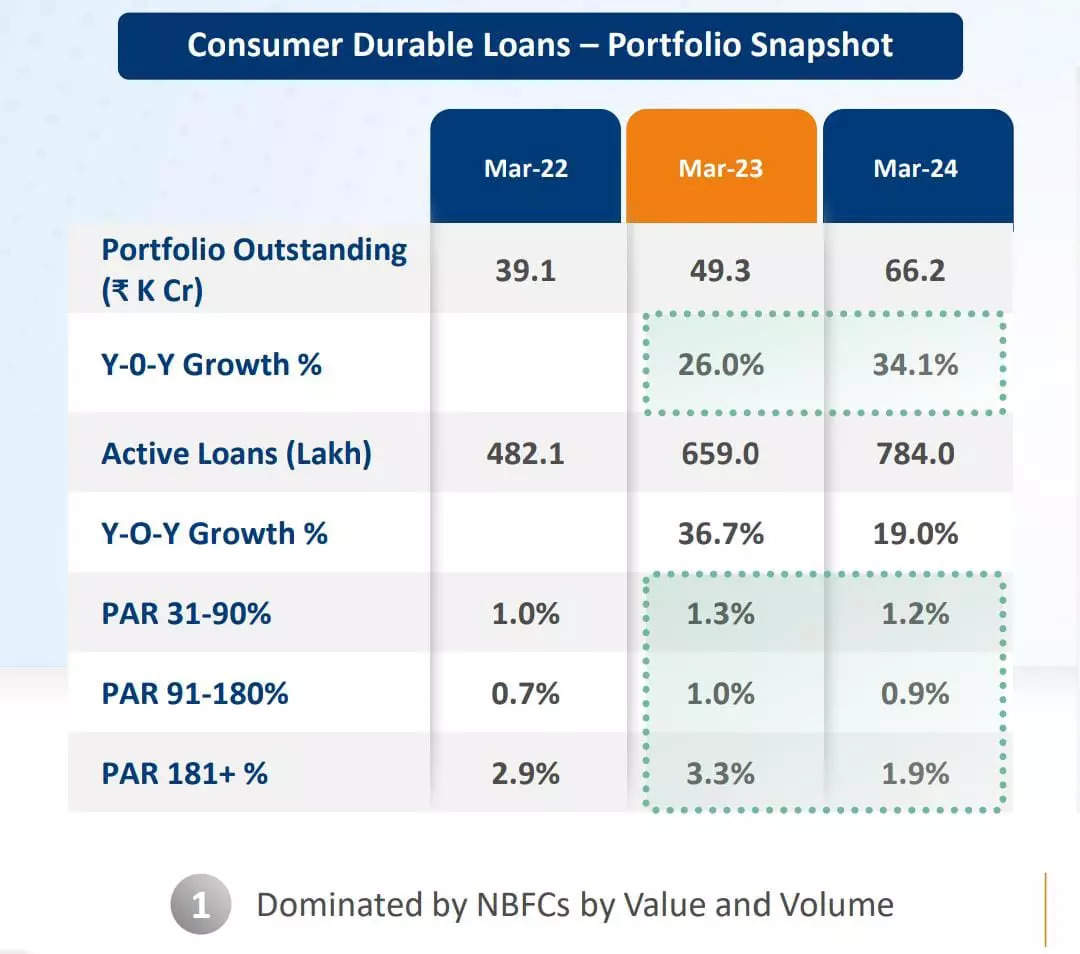

Consumer Durable Loans & Credit Cards

Consumer durable loans has witnessed a robust portfolio growth of 34 per cent YoY, compared to 26 per cent YoY as of March 2023, driven by the shift in originations to Rs 25K+ ticket size loans, which offset the muted growth in originations volumes — 8.5 per cent in FY24 compared to 38.2 per cent in FY23, revealed the report.

There has been about 21 per cent growth in originations by value, and 8.5 per cent growth by volume in FY24. Private banks gained origination share from FY20 to FY23, however NBFCs regained some of their lost share in FY24.

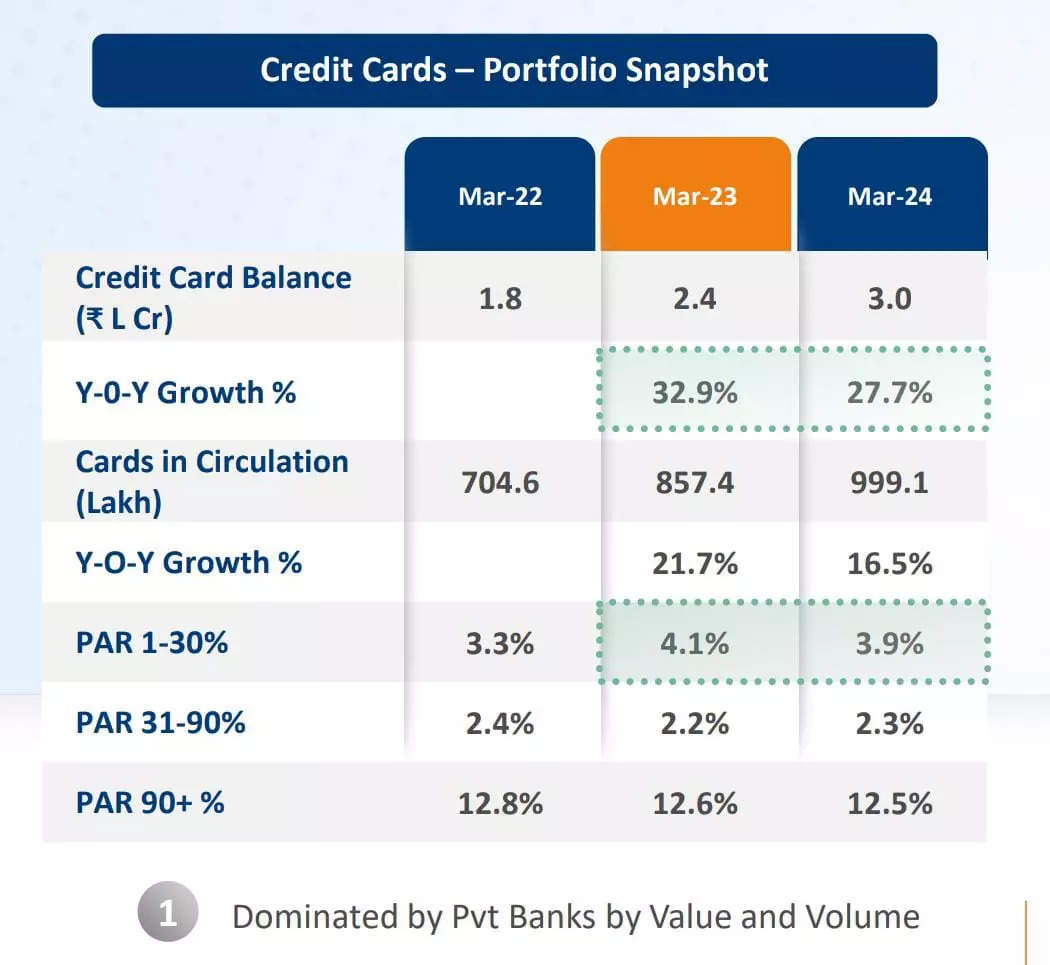

The credit cards segment witnessed a 16.5 per cent growth in active cards from March 2023 to March 2024.

Credit card balances reached Rs 3 lakh crore, with 999.1 lakh cards in circulation as of March 2024, it added.

MSME Lending & Microfinance

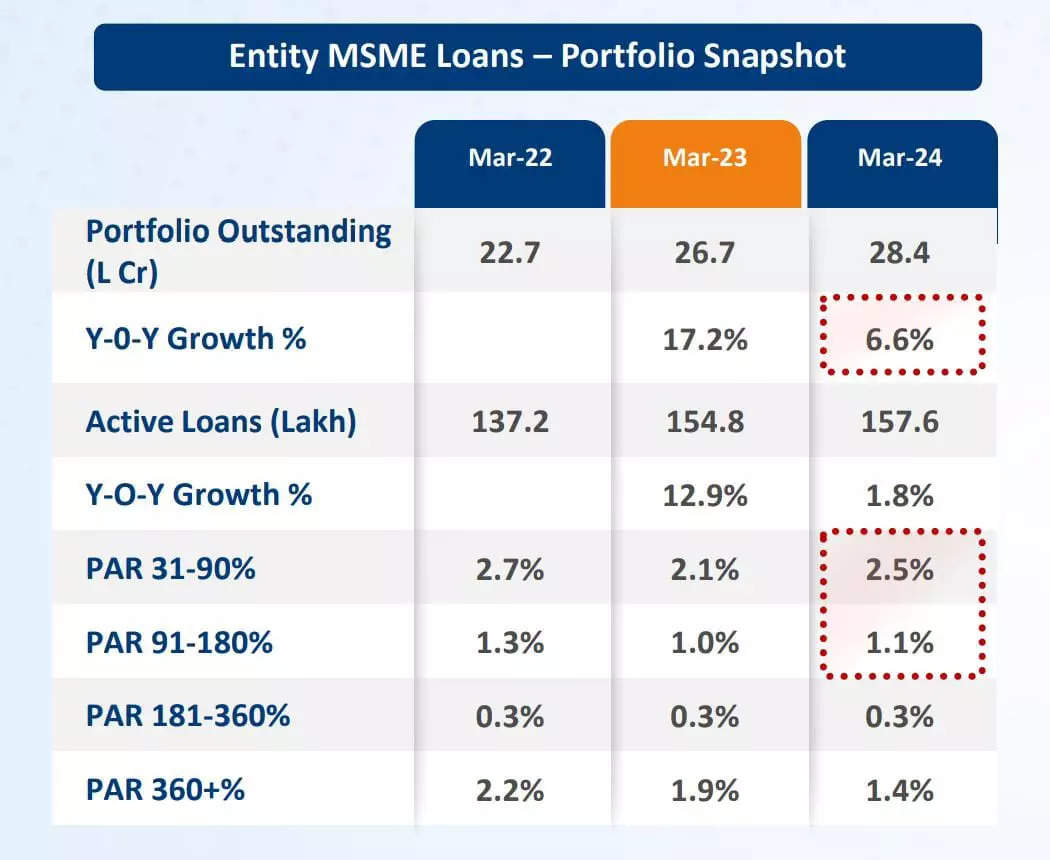

In the MSME lending segment, individual MSME segment growth outpaces that of entity MSMEs, both in terms of portfolio growth (28.9 per cent YoY compared to 6.6 per cent YoY) and originations growth (12.6 per cent YoY compared to 3.1 per cent), the report highlighted.

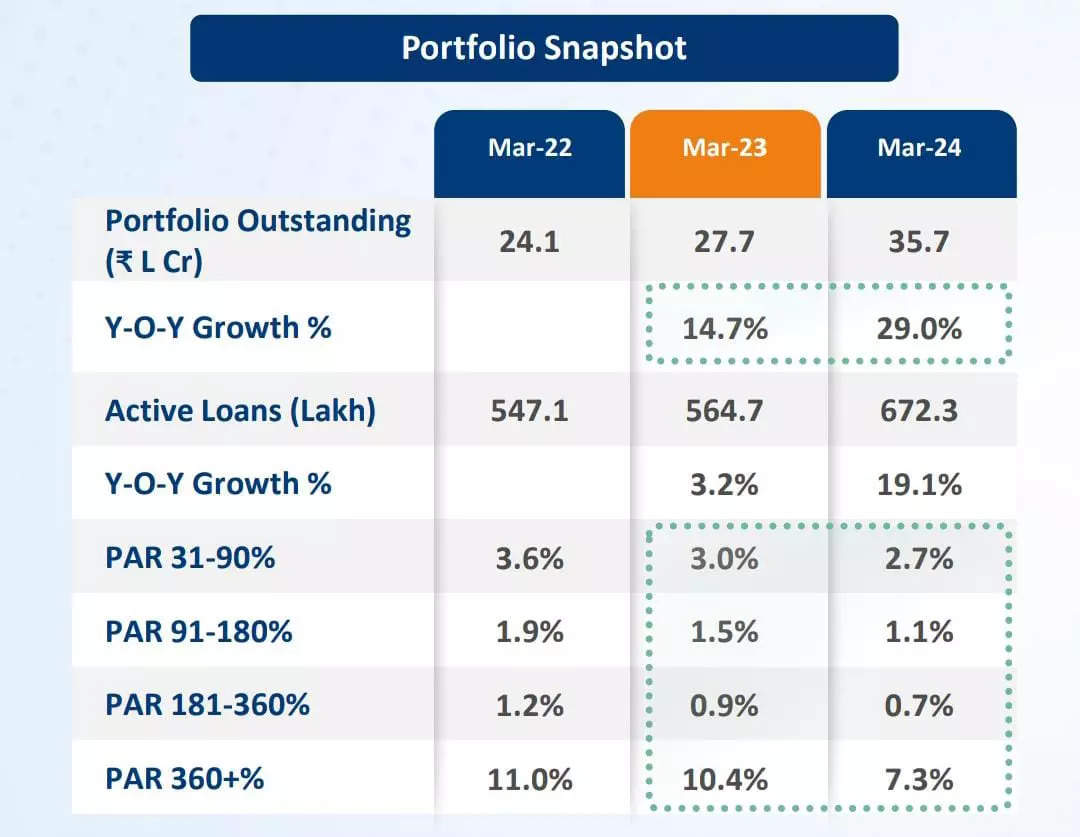

The portfolio outstanding of individual MSME loans stands at Rs 35.7 lakh crore as of March 2024 with growth accelerating to 29 per cent YoY, compared to 15 per cent YoY as of March 2023.

It further witnessed YoY growth in originations by value at 12.6 per cent and by volume at 19.4 per cent in FY24. Individual MSMEs witnessed improvement in delinquency across all ticket sizes and lender types, it added.

The portfolio outstanding of entity MSME loans stands at Rs 28.4 lakh crore as of March 2024 with growth decelerating to 6.6 per cent YoY (compared to 17.2 per cent as of March 2023.

The sector witnessed YoY growth in originations by volume at 18.9 per cent, while 3.1 per cent by value, with the micro segment being the largest contributor.

Portfolio growth for microfinance lending accelerated to 27 per cent YoY compared to 21 per cent YoY as of March 2023, with the microfinance loans portfolio outstanding of Rs 442.7 K crore as of March 2024, the report said.

The average ticket size for MFIs increased by 11 per cent from Rs 40.9K to Rs 45.4K between FY23 and FY24, it added.