MUMBAI: The National Company Law Tribunal (NCLT) has affirmed the legality of the charge held by Piramal Capital & Housing Finance on realty developer Radius Estate Projects’ development spread over a prime 5.4-acre land parcel in Santacruz, Mumbai’s western suburb.

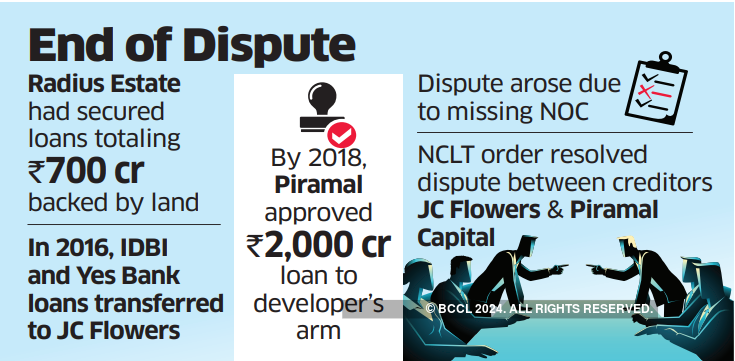

This order pronounced on Wednesday resolves a contentious dispute between the creditors including J.C. Flowers Asset Reconstruction and Piramal Capital and Housing Finance, providing much-needed clarity on the financial obligations associated with the project Avenue 54.

The project has been embroiled in a legal battle involving multiple stakeholders. Radius Estate Projects, formerly Vishwaroop Realtors, had initially secured loans from financial institutions. These loans totaling Rs 700 crore were backed by mortgages on the project’s land and assets through a series of deeds and agreements.

In 2016, one of the entities of the developer executed a deed of mortgage in favour of IDBI Trusteeship to secure a term loan from Yes Bank, which was later transferred to J.C. Flowers Asset Reconstruction. Additional loans were sanctioned taking the total amount to Rs 700 crore, and further charges were created on the property.

By 2018, Diwan Housing Finance Limited (DHFL), which was subsequently acquired by Piramal Capital & Housing Finance, sanctioned a project loan of Rs 1,100 crore and an additional Rs 900 crore, totaling Rs 2,000 crore to the developer’s arm Sumer Radius Reality.

The dispute arose when Sumer Radius Realty and other joint developing entities defaulted on its loan repayments. Despite this, a mortgage over the Avenue 54 project was created in favour of DHFL without obtaining the required No Objection Certificate (NOC) from the initial mortgage holder, Yes Bank.

J.C. Flowers Asset Reconstruction Pvt. Ltd., representing the original creditors, argued that the subsequent charges in favour of DHFL, now Piramal, were illegal and should be invalidated. It also sought to exclude Piramal from being recognized as a financial creditor of Radius Estate Projects.

The NCLT, after a thorough review of the case, ruled in favor of Piramal Capital & Housing Finance. The tribunal recognized that while the initial NOC issued by Yes Bank was conditional and eventually revoked due to non-compliance by Sumer Radius Realty and its joint developing entities, the subsequent mortgages and financial arrangements made by DHFL/Piramal were legitimate.The tribunal ruled that the claims made by J.C. Flowers Asset Reconstruction to invalidate these charges were unfounded.

The NCLT declared that the Avenue 54 Project is subject to the charges held by Piramal that are legally binding. This decision solidifies Piramal’s position as a significant financial creditor with legitimate claims over the project’s assets.

In this case, J.C. Flowers Asset Reconstruction was represented by advocate Rohit Gupta. The company’s resolution professional Vithal M. Dahake was represented by Amir Arsiwala and Piramal Capital & Housing was represented by Ryan Dsouza.

In June 2023, Piramal Capital & Housing sold Rs 3,656 crore bad loans portfolio to Omkara ARC, which included the loans to Radius Estate Project as well.

The ruling has significant implications for the stakeholders involved in the Avenue 54 Project. For Piramal Capital & Housing Finance, it secures their financial interests and reinforces their creditor rights. For Radius Estate Projects, the decision provides a clear directive on the legal standing of their financial obligations and the prioritization of creditor claims.

The ruling also underscores the importance of adhering to proper procedures in financial agreements and obtaining necessary approvals when creating charges on mortgaged properties.