- Gold seems to be peaking for now

- 96% bullishness is a warning sign

- Other commodities ready to move higher

- CRB Index moving higher again

- White precious metals heading higher: silver, platinum, palladium

Watch nickel very closely. Copper is set to move higher

Best plays for PGMs: CHN, ZIM

For Silver: LGM

For Nickel: CHN, WMG

GOLD

This still might be resolved to the upside but it is making heavy weather of it this week.

Bullishness for Nth American gold stocks is 96% and neither Newmont nor Barrick look strong.

Short term uptrend broken

Close to testing longer term parabola

GOLD STOCKS

No follow through after new high spike.

Everyone is bullish!

No one left to buy.

No follow through after new high spike

Needs a correction after a big 6 month move higher

SILVER

Hot money from gold has headed here to silver.

That 100:1 gold:silver ratio was too high. Silver at just 1% of the gold price.

PLATINUM

EVs batteries and ICE catalysts are still fighting it out but Platinum is running a multiyear deficit and prices will have to rise further.

Platinum was grossly oversold vs gold.

A big catch up to come.

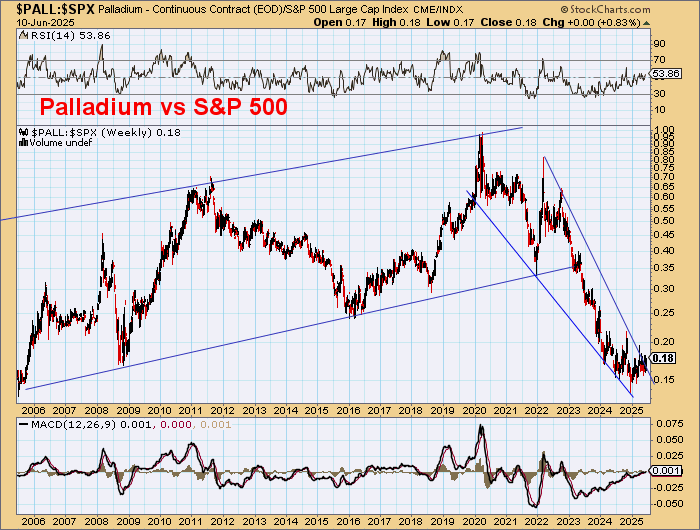

PALLADIUM

Palladium is also running a multiyear deficit so current prices are quite unsustainable.

Palladium had that `irregular ‘ B wave new high before declining in 5 waves down to complet Wave 2.

Wave 3 to new highs should follow.

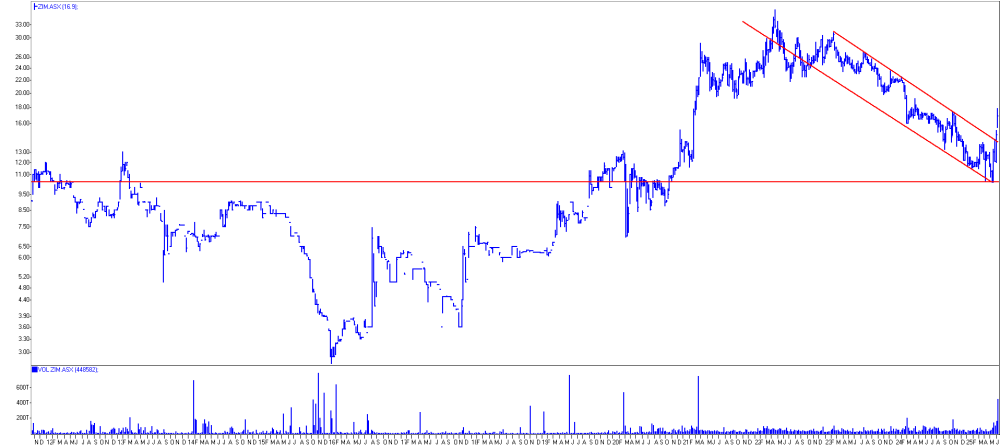

Zimplats (ZIM.ASX) is a strong turnaround as PGM prices turn up.

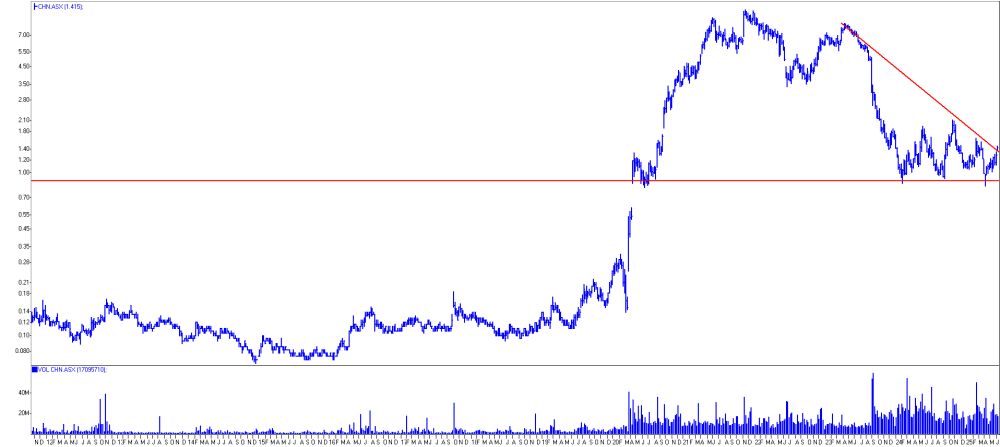

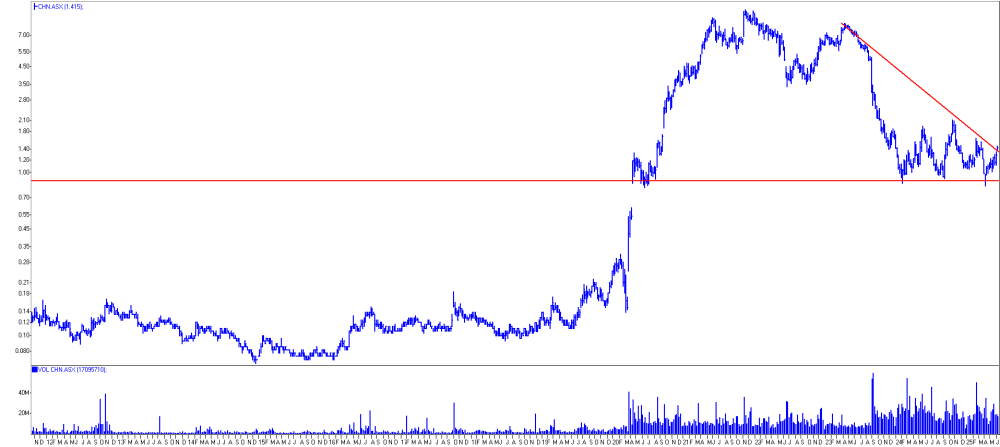

Chalice (CHN.ASX) will be the principal beneficiary of rising palladium prices.

Watch also for nickel prices.

NICKEL

Indonesian nickel production from saprolite/laterite sources has also is share of unprofitable operations at current nickel prices so closures are likely.

It seems Indonesia has the ESG bug at present so environmental regulations on tailings and on new mining areas are likely to interrupt growth plans.

So much of Western nickel sulphide mine production has closed so if demand keeps rising for stainless steel (~67% of nickel usage) the that surplus in 2025 should turn to deficit in 2026.

A break of this downtrend seems imminent.

Something has to happen here.

Nickel vs gold.

WMG

A higher nickel price will help CHN but also WMG.

CHN’s new metallurgical flowsheet is showing 50 -56% recovery for its 0.24-0.27% Ni ores in Years 1-4 and 30-45% for 0.15-0.17% Ni in later years.

Mulga Tank will be a far cleaner nickel-only ore feed at 0.27% ( and probably much higher in early years starter pits) so perhaps met work might be able to achieve >50% nickel recovery which would have a major benefit to project profitability.

WMG also has an active drilling program ahead in the September quarter.

WMG 2021-2025 weekly