Retail Forex and CFD broker Plus500 Ltd (LON:PLUS) today announced its preliminary unaudited results for the year ended 31 December 2023.

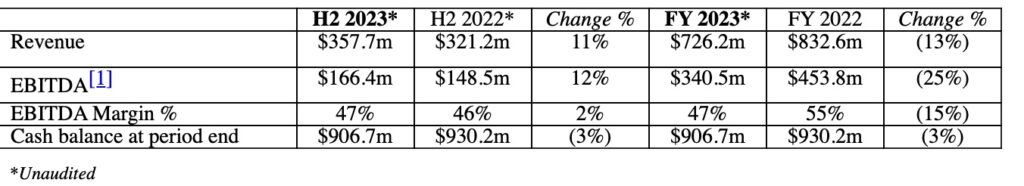

Revenue in FY 2023 was $726.2m (FY 2022: $832.6m), comprising trading income of $674.3m and interest income of $51.9m. EBITDA for FY 2023 was $340.5m (FY 2022: $453.8m) with an EBITDA margin of 47% (FY 2022: 55%). The result reflected lower levels of trading activity seen across the global financial markets during the year.

Customer Income was $600.1m during FY 2023 (FY 2022: $639.6m) and Customer Trading Performance was $74.2m (FY 2022: $193.0m). The Group expects that the contribution from Customer Trading Performance will be broadly neutral over time.

Net profit in FY 2023 was $271.4m (FY 2022: $370.4m) and basic earnings per share was $3.17 (FY 2022: $3.81).

Net financial expenses (income) were $0.2m in FY 2023 (FY 2022: ($23.9m)), driven by FX gains and losses as the Group manages its exposure to a range of operating currencies versus the US dollar. A substantial portion of the Group’s cash is held in US dollars in order to reduce the impact of currency movements on financial expenses over time.

As of 31 December 2023, total assets on the Group’s balance sheet were $1,004.7m (FY 2022: $1,010.0m), with equity of $699.8m, representing approximately 70% of the balance sheet.

The Group has remained debt-free since inception, and had a cash and cash equivalents balance at the end of FY 2023 of $906.7m (FY 2022: $930.2m).

In 2023, Plus500 obtained two new regulatory licences, in the UAE and the Bahamas, which together take the Group’s global portfolio of regulatory licences to 13. This global portfolio provides a significant source of competitive advantage and inherent value for Plus500, both in a monetary and operational sense.

The UAE represents a significant and growing market for the Group and its business in this region is fully operational and developing quickly. The Group’s customer base in the UAE is growing and Plus500’s localised offering is benefitting from a greater understanding of this particular market. The Group will continue to develop its localised offering tailored for the UAE market.

Building on its success of securing new regulatory licences, the Group will continue to target new regulatory licences globally, in 2024 and beyond, to support its strategic objective of entering new markets and offering new products. The Group’s experience in obtaining new regulatory licences leaves it extremely well positioned to execute successfully against this objective.

Since the acquisitions of Cunningham Commodities, a regulated Futures Commission Merchant (FCM) and Cunningham Trading Systems, a technology trading platform provider, Plus500 has secured full clearing memberships with the CME Group exchanges, as well as with the Minneapolis Grain Exchange (MGEX).

In addition, the Group has recently secured a clearing membership of Eurex Clearing AG. This significant milestone followed the recent receipt of a primary membership of the Futures Industry Association (FIA).