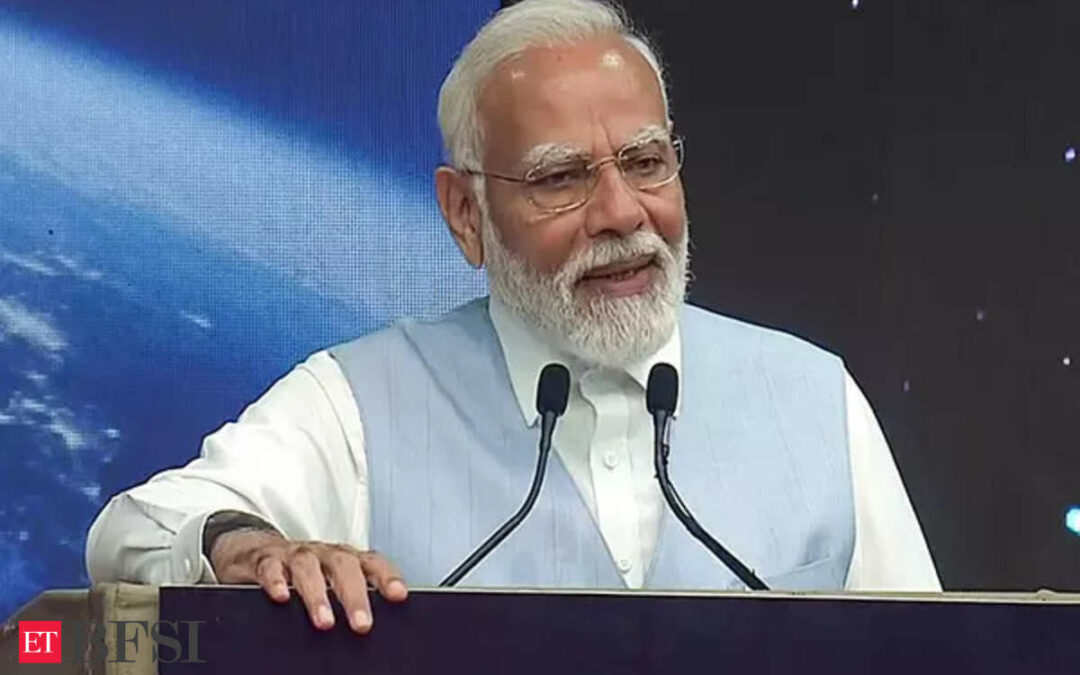

Mumbai: Prime Minister Narendra Modi on Monday said there is a need to study “newer banking structure” with the evolving changes in the financial industry’s landscape.

Speaking at the inauguration event for the commemoration of 90 years of the Reserve bank of India (RBI) here, Modi said there may be a requirement for newer ways of “financing, operating and business models” in the changing landscape.

The PM said the banking industry needs to move forward to ensure that it can fund the credit needs of the projects necessary for the country’s future growth.

There are some challenges confronting the industry along with this, including artificial intelligence and blockchain, which are changing the face of banking, cyber security amid the increasing reliance on digital banking and innovations like fintechs, he said.

“In such a situation, we need to think about the changes that will be required in the country’s banking sector and its structure,” Modi said in his address to the audience, which included richest Indian Mukesh Ambani, Tata Sons Chairman N Chandrasekaran, Mahindra Group Chairman Anand Mahindra, and some top bankers.

Modi also said an assessment of the credit needs should be done by the RBI, keeping in mind the growth prospects and potential of the country.

The PM did not specifically mention ownership of banks, but it can be noted that corporate ownership of banks has been a very controversial issue in the past.

Those in support of allowing corporates to own banks said business houses can pump in the required capital into a lender that can ensure that funding needs of the economy can be fulfilled.

Those against the idea, which include former RBI Governor Raghuram Rajan and Deputy Governor Viral Acharya, have flagged the risk of conflict of interest in such a structure where corporates or large industrial houses own lenders.

In 2020, an RBI working group had suggested that the rules can be changed to allow large corporate houses to promote banks, but media reports a year later said the RBI had sidestepped the rules.

A slew of business houses had applied unsuccessfully to get a universal banking licence in 2013. At present, large corporate houses have promoted non-banking finance companies (NBFCs) as part of their financial sector play.

Meanwhile, amid concerns around the high private sector debt-to-GDP ratio in many countries around the world, Modi suggested that the RBI undertake a study in the Indian context on the same.

He said India is contributing to 15 per cent of the incremental global growth and pitched for efforts to take the economy towards economic self-sufficiency wherein it will be able to resiliently withstand any challenge.