India’s service sector ended the 2024–25 fiscal year on a solid note, with HSBC India’s Services PMI recording 58.5 in March.

Though marginally lower than February’s 59.0, the index remained well above the neutral 50.0 mark and the long-run average of 54.2, signaling continued robust expansion driven by strong demand and new business gains.

Growth was seen across all service subsectors, with Finance & Insurance leading, followed by Consumer Services. However, international sales showed signs of slowing, with foreign new orders rising at the weakest rate in 15 months.

Input cost inflation eased to a five-month low, driven by reduced pressures across most categories except Consumer Services. Competitive market conditions kept charge inflation subdued—output prices rose at the weakest pace since September 2021, with only 1% of firms reporting higher fees compared to February.

Pranjul Bhandari, Chief Economist at HSBC commented on the performance, stating, “India recorded a 58.5 services PMI in March 2025, softening slightly from the month prior. Domestic and international demand remained fairly buoyant, despite being sequentially a tick lower than the month before. Meanwhile, job creation and charge inflation both cooled during March. Looking ahead, business sentiment remains generally positive, but intensifying competition presents a significant challenge to many survey participants.”

Hiring Slows Amid Adequate Capacity

While employment still increased, the pace was the weakest in nearly a year. Many businesses reported having sufficient resources to meet current demand. The volume of outstanding business rose only slightly, at the slowest rate since September 2024.

Moderating Input Inflation

Business expenses continued to rise, particularly in food, freight, maintenance, medical equipment, and vehicle parts. Still, overall inflation eased, with Consumer Services being the only segment to report a rise in cost pressures.

Business Confidence weakens Slightly

Overall sentiment slipped to a seven-month low, falling below its long-term average. Consumer Services firms remained the most optimistic, followed by Finance & Insurance, Real Estate & Business Services, and Transport, Information & Communication.

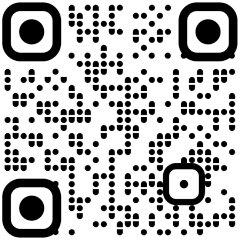

Movement of Services PMI so far