Canadian Dollar remains the weakest performer for the week at this point. Yet, losses is so far contained, with the recovery after the brief selloff following BoC’s rate cut overnight. While further cuts are anticipated within the year, the likelihood of another immediate adjustment in July is currently seen as unlikely , with market odds at about 40% only. Instead, analysts now predict possibly only two more rate reductions, one each in Q3 and Q4.

Attention is now shifting to ECB’s anticipated rate cut today. The main question is whether ECB will hint at additional easing measures for the remainder of the year, particularly through its upcoming economic projections. Euro has displayed mixed performance so far this week but could potentially strengthen if ECB’s stance is perceived as less dovish than expected.

Overall in the forex markets, Swiss Franc leads as the strongest currency of the week, with Yen and New Zealand Dollar also showing robust performances. The U.S. Dollar trails Canadian Dollar as the second weakest, followed by the Australian Dollar. British Pound and Euro are holding steady in the middle of the performance spectrum.

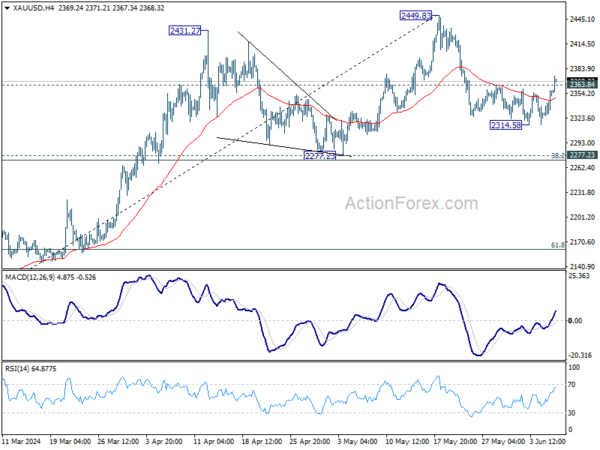

Technically, Gold’s break of 2363.84 resistance argues that pull back from 2449.83 has completed at 2314.58 already. Further rise would be seen back to retest 2449.83, but upside would likely be limited there for the first attempt. Meanwhile, break of 2314.58 will extend the corrective fall to 2277.23 cluster support instead.

In Asia, at the time of writing Nikkei is up 0.72%. Hong Kong HSI is up 0.24%. China Shanghai SSE is down -0.09%. Singapore Strait Times is up 0.25%. Japan 10-year JGB yield is down -0.0357 at 0.969. Overnight, DOW rose 0.25%. S&P 500 rose 1.18%. NASDAQ rose 1.96%. 10-year yield fell -0.047 to 4.289.

BoJ’s Nakamura warns of inflation risks, advocates maintaining current policy

BoJ board member Toyoaki Nakamura, known for his dovish stance, cautioned in a speech today that “inflation may not reach 2 per cent from fiscal 2025 onward” if households reduce spending, which would discourage companies from further price hikes.

Nakamura highlighted that domestic consumption has been sluggish recently. He also pointed to the uncertainty surrounding the sustainability of wage increases, noting that the impact of rising wages on prices has been weak too.

Given the current data, Nakamura stated that it is appropriate to keep monetary policy unchanged for the time being. He was the sole dissenter in the BoJ’s decision to end eight years of negative interest rates and bond yield control in March.

Tech sector propels NASDAQ to new record

The US stock markets continued to display diverged performance. While DOW continued to struggle to bounce, S&P 500 and NASDAQ surged to new record highs. In the background, investor confidence is growing that Fed will begin cutting interest rates in September, with markets currently pricing in nearly 70% odds of this outcome.

A significant driver of this bullish sentiment is the strong performance of the tech sector, which has boosted overall risk appetite. Nvidia’s market valuation reached the USD 3T for the first time, surpassing Apple to become the world’s second-most valuable company.

Technically, near term outlook will now stay bullish in NASDAQ as long as 16336.07 support holds. A goldilocks non-farm payroll report tomorrow could prompt upside acceleration towards 138.2% projection of 10207.47 to 14446.55 from 12543.85 at 18427.31.

ECB to initiate easing cycle, markets seek clues on next moves

ECB is expected to commence its monetary policy loosening cycle today, with market anticipating a 25 basis point reduction in deposit rate to 3.75% and an adjustment of main refinancing rate to 4.25% correspondingly. Key focus areas will be ECB’s communication during the press conference and updates in the economic projections, which could provide crucial insights into the central bank’s policy strategy for the remainder of the year.

Economists are divided on the future pace of easing, with some forecasting two additional rate cuts in September and December. However, they acknowledge that the likelihood leans overwhelmingly towards fewer rate cuts rather than more, particularly if core inflation remains elevated and economic recovery picks up speed at the beginning of Q3. Current market pricing reflects this uncertainty, with only 60% probability assigned to a rate cut in September.

A critical aspect to monitor will be any adjustments in the inflation forecasts, especially any upward revisions. A significant increase in inflation projections could diminish the likelihood of a rate cut in September.

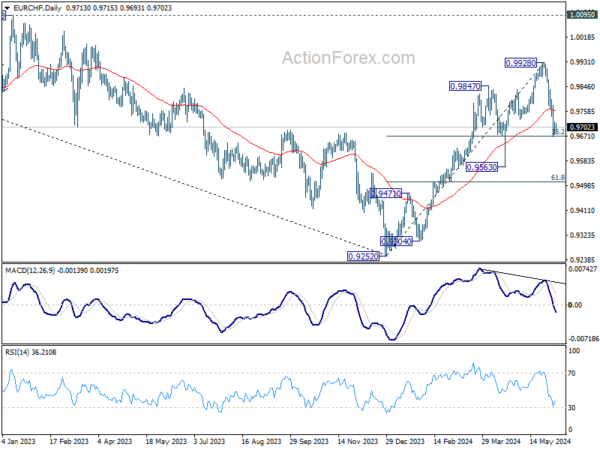

EUR/CHF is now sitting at a juncture, pressing 38.2% retracement of 0.9252 to 0.9928 at 0.9670. Strong bounce from the current level, followed by sustained trading above 55 D EMA, will maintain near term bullishness. That is, while corrective pattern from 0.9928 could still extend further, rise from 0.9252 is in favor to resume at a later stage.

However, sustained break of 0.9670 will raise the chance of bearish reversal, and bring deeper decline to 0.9563 support next.

Looking ahead

Germany factor orders, Eurozone retail sales and UK PMI construction will be released in European session. Later in the day, US will release jobless claims and trade balance. Canada will release trade balance and Ivey PMI.

USD/CAD Daily Outlook

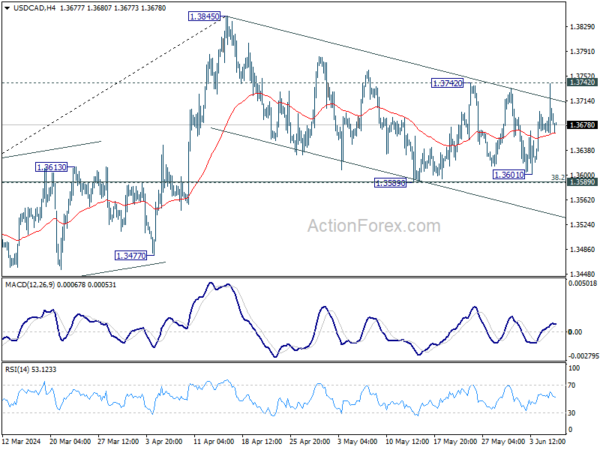

Daily Pivots: (S1) 1.3659; (P) 1.3700; (R1) 1.3736; More….

USD/CAD is still stuck in range after failing to break through 1.3742 resistance. Intraday bias remains neutral for the moment and outlook is unchanged. On the upside, break of 1.3742 resistance will revive the case that correction from 1.3845 has completed at 1.3589. Intraday bias will be back on the upside for retesting 1.3845. On the downside, firm break of 1.3589 support will argue that whole rise from 1.3176 has completed at 1.3845 already. Fall from 1.3845 should then resume to 61.8% retracement of 1.3176 to 1.3845 at 1.3432.

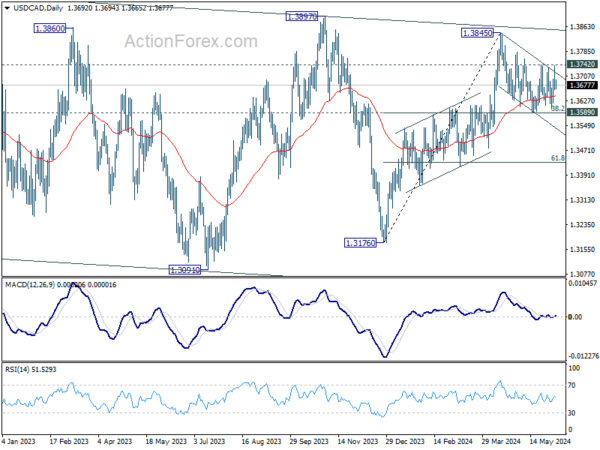

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern. In case of another fall, strong support should emerge above 1.2947 resistance turned support to bring rebound. Firm break of 1.3976 will confirm up resumption of whole up trend from 1.2005 (2021 low). Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3176 at 1.4149.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | Trade Balance (AUD) May | 6.55B | 5.50B | 5.02B | 4.84B |

| 05:45 | CHF | Unemployment Rate May | 2.40% | 2.30% | 2.30% | |

| 06:00 | EUR | Germany Factory Orders M/M Apr | 0.50% | -0.40% | ||

| 08:00 | EUR | Italy Retail Sales M/M Apr | 0.30% | 0.00% | ||

| 08:30 | GBP | Construction PMI May | 52.5 | 53 | ||

| 09:00 | EUR | Eurozone Retail Sales M/M Apr | 0.20% | 0.80% | ||

| 12:15 | EUR | ECB Rate On Deposit Facility | 3.75% | 4.00% | ||

| 12:15 | EUR | ECB Main Refinancing Operations Rate | 4.25% | 4.50% | ||

| 12:30 | USD | Trade Balance (USD) Apr | -69.8B | -69.4B | ||

| 12:30 | USD | Initial Jobless Claims (May 31) | 215K | 219K | ||

| 12:30 | USD | Nonfarm Productivity Q1 | 0.30% | 0.30% | ||

| 12:30 | USD | Unit Labor Costs Q1 | 4.70% | 4.70% | ||

| 12:30 | CAD | Trade Balance (CAD) Apr | -2.2B | -2.3B | ||

| 12:45 | EUR | ECB Press Conference | ||||

| 14:00 | CAD | Ivey PMI May | 65.2 | 63 | ||

| 14:30 | USD | Natural Gas Storage | 89B | 84B |