Sterling strengthened broadly today, support by comments from Jonathan Haskel, a known hawk on BoE’s MPC. Haskel indicated his preference to maintain interest rates until there is clear evidence that inflationary pressures have subsided sustainably. This stance has introduced some uncertainty regarding the widely anticipated BoE rate cut in August. While many economists still expect a rate reduction, upcoming economic data—such as this week’s UK GDP report and next week’s CPI figures—could still shift these expectations.

Meanwhile, Canadian dollar ranks as the second strongest currency, closely followed by Euro. The common currency has recovered from earlier losses caused by the French parliamentary elections, which resulted in a hung parliament. The left-wing coalition secured the most seats, while the far-right group garnered the least among major coalitions. In contrast, Kiwi is the weakest performer, followed by Swiss franc, which is feeling the pressure from Euro’s rebound. Dollar, Aussie, and Yen are mixed, with markets keenly awaiting key events such as Fed Chair Jerome Powell’s testimony and the release of US CPI data later this week.

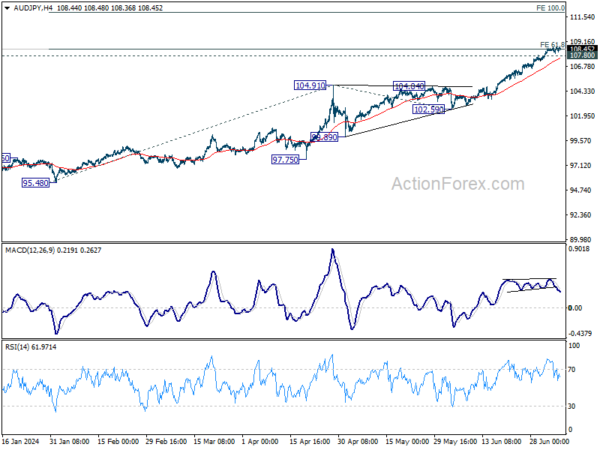

In the upcoming Asian session, AUD/JPY will be one to watch, with Australia’s Westpac Consumer Sentiment and NAB Business Confidence reports due to be released. Technically, recent uptrend stalled after hitting 61.8% projection of 95.48 to 104.91 from 102.59 at 108.41. But there is no sign of a deep pullback yet. As long as 107.80 minor support holds. Further rally is in favor. Sustained break of 108.41 will pave the way to 100% projection at 112.02 next.

In Europe, at the time of writing, FTSE is up 0.28%. DAX is up 0.40%. CAC is up 0.10%. UK 10-year yield is down -0.013 at 4.115. Germany 10-year yield is up 0.009 at 2.545. Earlier in Asia, Nikkei fell -0.32%. Hong Kong HSI fell -1.55%. China Shanghai SSE fell -0.93%. Singapore Strait Times fell -0.19%. Japan 10-year JGB yield rose 0.0209 to 1.091.

BoE’s Haskel advocates holding rates amid tight labor market

BoE MPC member Jonathan Haskel highlighted in a speech that assuming no further shocks, inflation will depend on the “interaction of a tight labour market and second-round effects as previous inflation works its way through the wage-price system.”

Haskel emphasized that the MPC is closely monitoring labor market conditions and underlying inflationary indicators, particularly services inflation.

He expressed concerns about the current state of the labor market, stating, “The labour market continues to be tight, and I worry it is still impaired. I would rather hold rates until there is more certainty that underlying inflationary pressures have subsided sustainably.”

ECB’s Knot rules out July rate cut

ECB Governing Council member Klaas Knot has indicated there is no case for another rate cut in July. In an interview with Handelsblatt, Knot stated, “I don’t see a case for another rate cut in July.” He emphasized that the next ECB meeting that will consider rate adjustments will be in September.

Knot expressed satisfaction with ECB’s progress in reducing inflation, projecting that 2% target will be achieved by late 2025. However, he warned against tolerating further delays, noting that inflation will have exceeded ECB’s target for four and a half years by that time.

Market expectations suggest between one and two rate cuts this year and just over four cuts over the next 18 months. This implies that the deposit rate would remain above 3% into the second half of next year. K

not commented on this outlook, saying, “As long as we are above 3%, we are still restrictive. And that will be the case for the foreseeable future, beyond which I cannot make meaningful statements.”

Eurozone Sentix drops sharply to -7.3 on rising political and economic uncertainties

Eurozone Sentix Investor Confidence dropped sharply in July, falling from 0.3 to -7.3, significantly worse than the expected 0.0. This decline ends a series of eight consecutive rises and marks a severe setback. Current Situation Index also declined from -9.0 to -15.8, while Expectations Index fell from 10.0 to 1.5.

Sentix highlighted that investors are increasingly concerned not just about the French elections but also about upcoming state elections in Germany. Moreover, growing worries about the health of the incumbent US president and the uncertainty surrounding who will run against Donald Trump in the next presidential election are adding to the overall anxiety. This uncertainty is creating a vacuum, compounded by the slowdown in the US economy, which is beginning to affect the rest of the world.

Given this “first mover” trend in the Eurozone, ECB is likely to consider further interest rate cuts. Investors anticipate that ECB will shift its focus more towards addressing economic weaknesses, particularly as the Sentix thematic barometer on “Inflation” signals an easing of inflationary pressures.

BoJ highlights spread of big firm wage hikes to smaller companies

In the Regional Economic Report, BoJ maintained its economic assessment for five out of Japan’s nine regions, while upgrading two and downgrading two. Eight regions, with the exception of Hokuriku, indicated that their economies had been recovering moderately, picking up, or picking up moderately, although some weakness was noted in certain areas.

“Many regions reported that big firms’ big pay hikes in this year’s wage negotiations were spreading to small and medium-sized companies,” BoJ noted. This suggests a positive spillover effect from large corporations to smaller businesses.

BOJ also noted that consumption was “firm as a whole,” driven by robust spending from inbound tourists. This strong tourist spending is helping to offset softer consumption among households affected by rising living costs.

Japan’s nominal wages rises 1.9% yoy, highest in 11months

Japan’s nominal labor cash earnings increased by 1.9% yoy in May, up from April’s 1.6% growth. Despite this being the 29th consecutive month of growth and the most substantial increase in 11 months, it fell short of the expected 2.1% yoy.

Regular pay saw a notable rise of 2.5% yoy, marking the best pace since January 1993, while overtime pay rebounded by 2.3% yoy, its first increase in six months.

However, these gains in nominal wages are overshadowed by the continued decline in real wages, which fell by -1.4% yoy, marking the 26th consecutive month of decline. This is also a deterioration from the -1.2% yoy drop recorded in April.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2773; (P) 1.2796; (R1) 1.2837; More…

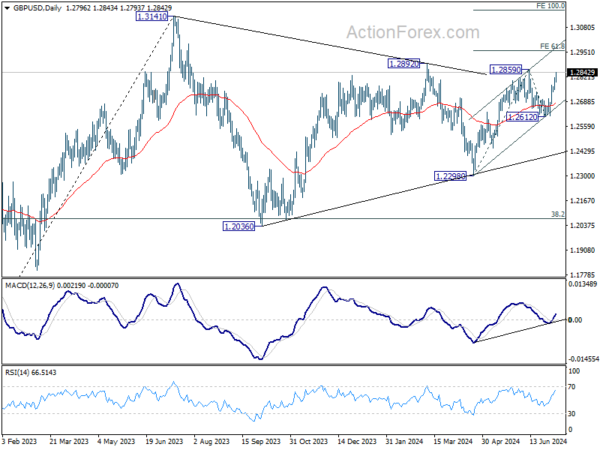

Intraday bias in GBP/USD remains on the upside as rally from 1.2612 is in progress for retesting 1.2859 resistance. Firm break there will resume the rally from 1.2298 and target 61.8% projection of 1.2298 to 1.2859 from 1.2612 at 1.2959. Decisive break there would prompt upside acceleration through 1.3141 to 100% projection at 1.3173. On the downside, below 1.2793 minor support will turn intraday bias neutral first.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern which might still extend. Break of 1.2612 support will bring another fall to 1.2298 support and possibly below. Nevertheless, break of 1.2892 resistance will argue that larger up trend from 1.0351 might be ready to resume through 1.3141.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y May | 1.90% | 2.10% | 1.60% | |

| 23:50 | JPY | Bank Lending Y/Y Jun | 3.20% | 3.10% | 3.00% | |

| 23:50 | JPY | Current Account (JPY) May | 2.41T | 2.13T | 2.52T | |

| 05:00 | JPY | Eco Watchers Survey: Current Jun | 47 | 46.3 | 45.7 | |

| 06:00 | EUR | Germany Trade Balance (EUR) May | 24.9B | 19.9B | 22.1B | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jul | -7.3 | 0 | 0.3 |