“E8 Funding: A Comprehensive Review of Services and Benefits”

“E8 Funding: Empowering Traders with Essential Information and Cutting-Edge Technology for Optimal Risk Management and Long-Term Consistency”

“E8 Funding has diligently crafted a user-centric experience that encompasses critical information essential for traders, coupled with cutting-edge technological solutions that are unrivaled in the industry. The foremost expectation they hold for their traders is that they exemplify disciplined conduct, placing utmost emphasis on risk management and steadfast commitment to long-term consistency.”

As a global entity, E8 Funding extends its funding provisions to traders around the world, driven by a fervent dedication to identifying latent abilities within their community. Their tireless efforts are geared towards establishing distinctive funding avenues, fostering an environment where individuals from all walks of life can transform into accomplished professional traders.

Pros of E8 Funding

Excellent Trustpilot rating of 4.7/5

Unlimited Evaluation free retries

Minimum balance of up to $1,000,000 on ELEV8 accounts

Extension feature

Profit Share 80%

Bi-weekly payouts

Overnight and weekend holding allowed

News trading allowed

Scaling account option

Leverage 1:100

E8 Track accounts have Balances-Based drawdown

No minimum trading day requirements

A Large variety of trading instruments (forex, pairs, commodities, indices, equities, cryptocurrency)

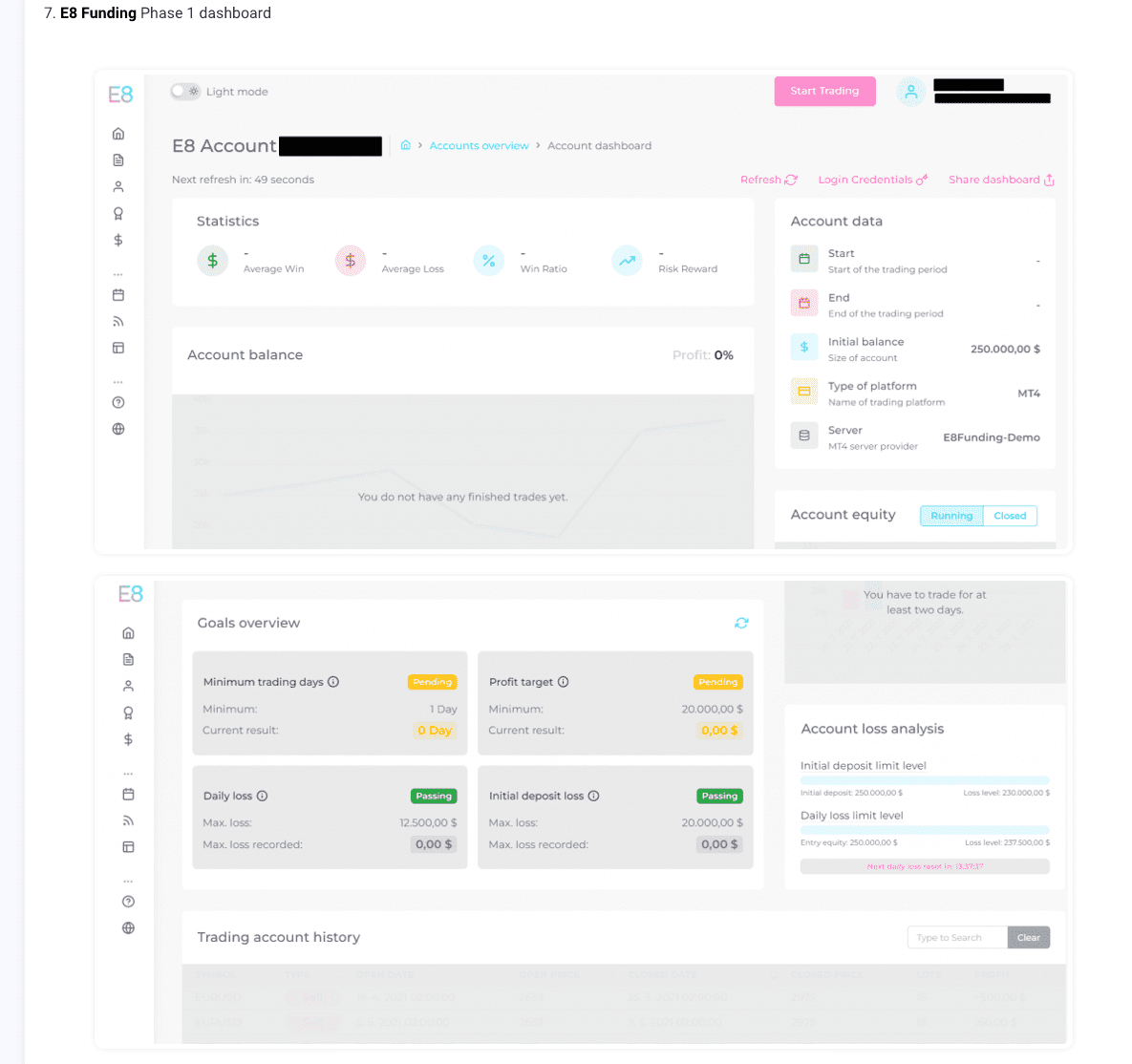

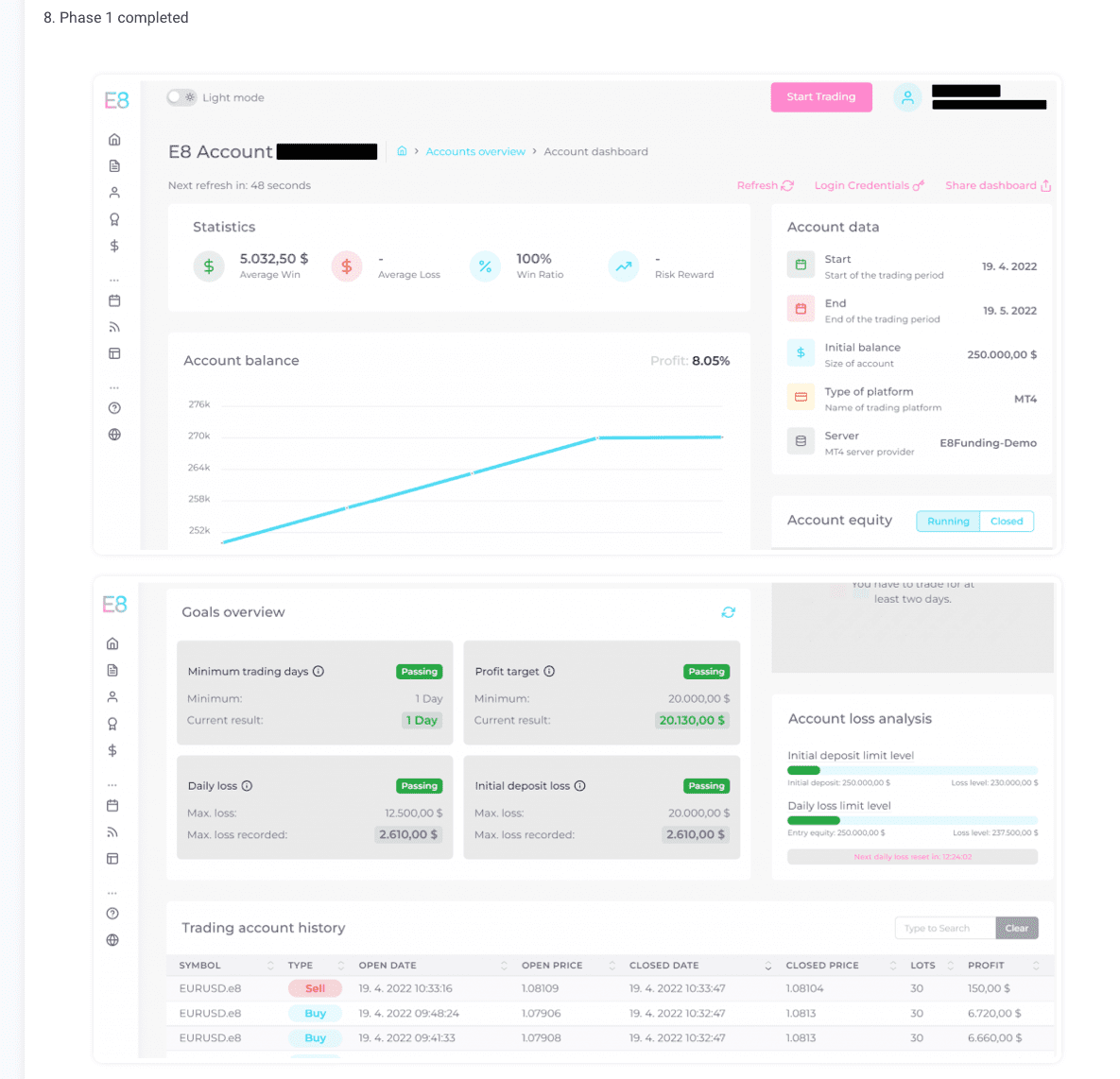

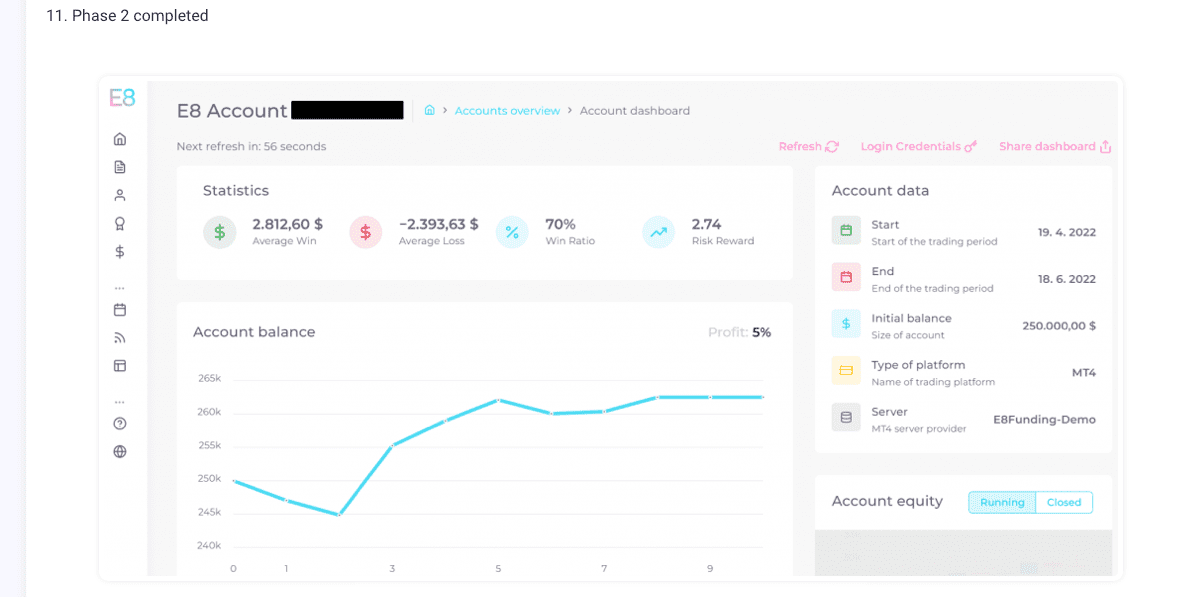

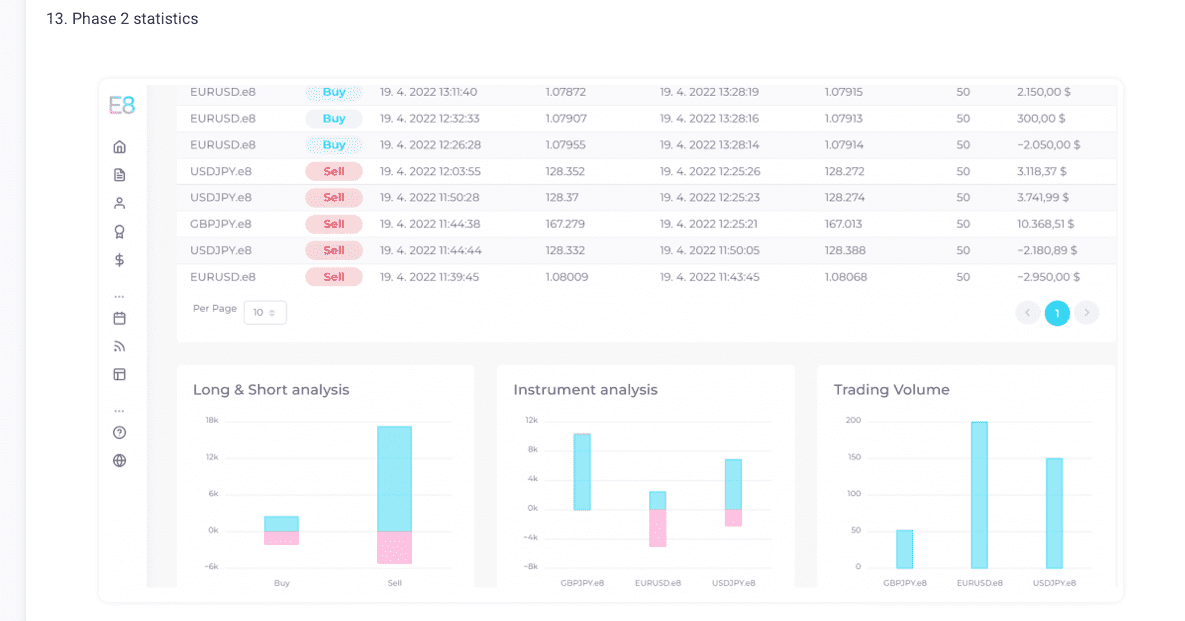

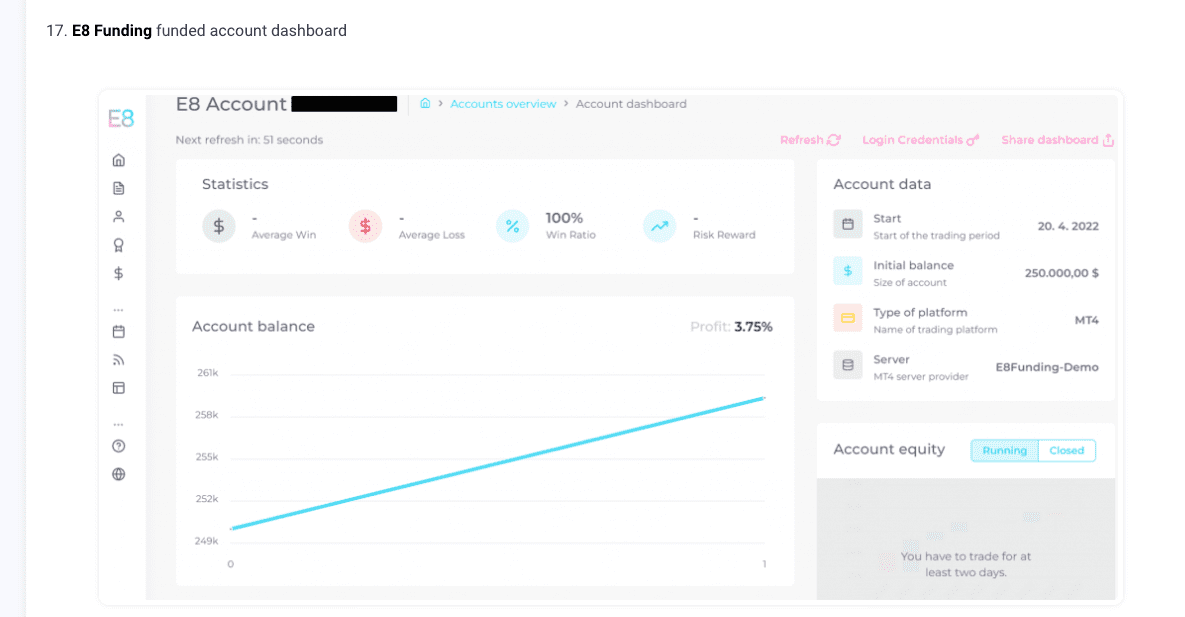

Professional trading dashboard

Cons of E8 Funding

Slippage issue

High commission costs

At E8 Funding, fostering success in the trading careers of individuals is strongly emphasized. The primary requirement they seek from their clients is a demonstration of discipline in risk management and an unwavering commitment to long-term consistency. Traders are allowed to generate substantial profits by effectively managing account sizes of up to $1,000,000, thereby enabling them to secure 80% of the profits earned. To accomplish this, traders can engage in the trading of various financial instruments such as forex pairs, commodities, indices, equities, and cryptocurrencies.

Who are E8 funding?

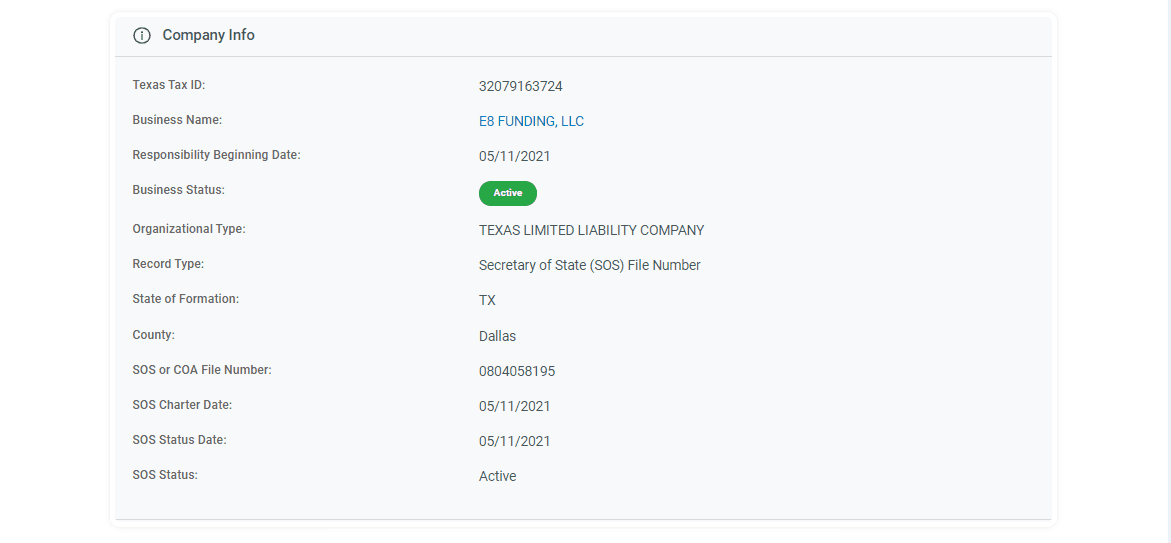

E8 Funding, established on November 5th, 2021, is a pioneering proprietary firm situated in a prime location within the United States. Distinguishing itself as one of the initial prop firms, E8 Funding extends its funding opportunities globally. Their operational bases are strategically positioned in Dallas and Texas, USA, as well as in Prague, Czech Republic. Traders associated with E8 Funding can access substantial capital with balances reaching up to $1,000,000 while benefiting from an 80% profit split arrangement. The firm has formed a valuable partnership with a tier-1 liquidity provider, ensuring direct market access as their trusted brokerage solution.

Their headquarters are located at 100 Crescent Ct, Unit 700, Dallas, TX 75201, United States.

Who’s the CEO of E8 Funding?

Dylan Elchami, the founder of E8 Funding, has set a significant objective of establishing a distinct and accessible pathway for individuals to become professional funded traders, capable of remotely managing capital from any location worldwide. Through dedicated efforts, he has successfully achieved this objective and continues to enhance the offerings and conditions provided by E8 Funding, thereby consistently attracting a growing number of traders to join his esteemed proprietary trading firm.

Within the industry, Mr. Elchami prioritizes facilitating trading for individuals by forging strategic partnerships and delivering cutting-edge software solutions. To ensure an optimal experience for traders, he maintains an in-house team of skilled engineers who continually strive to provide the best possible support and resources.

Those interested in keeping up with Dylan Elchami’s endeavors can easily stay informed by following his LinkedIn profile.

.

The founding program options:

E8 Funding offers its traders three different programs to choose from:

-

- E8 evaluation program accounts

- Normal E8 evaluation program accounts

- Extended E8 evaluation program accounts

- ELEV8 program accounts

- E8 Track program accounts

E8 evaluation program account

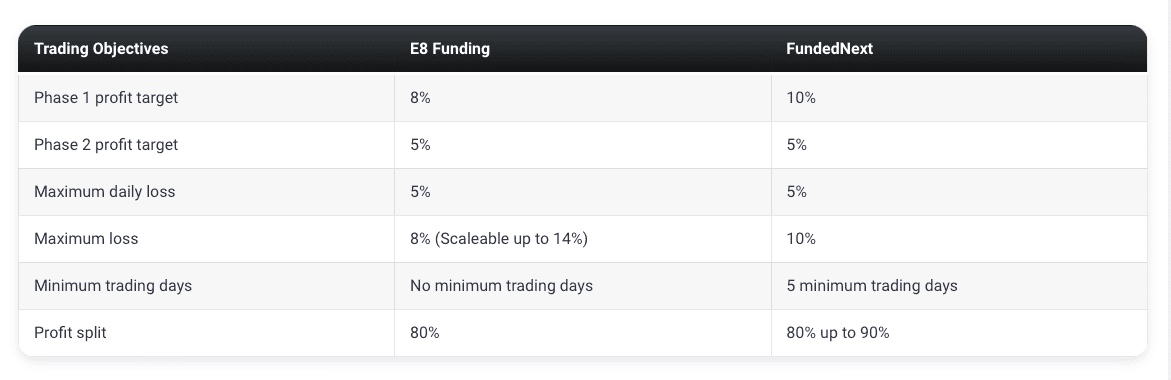

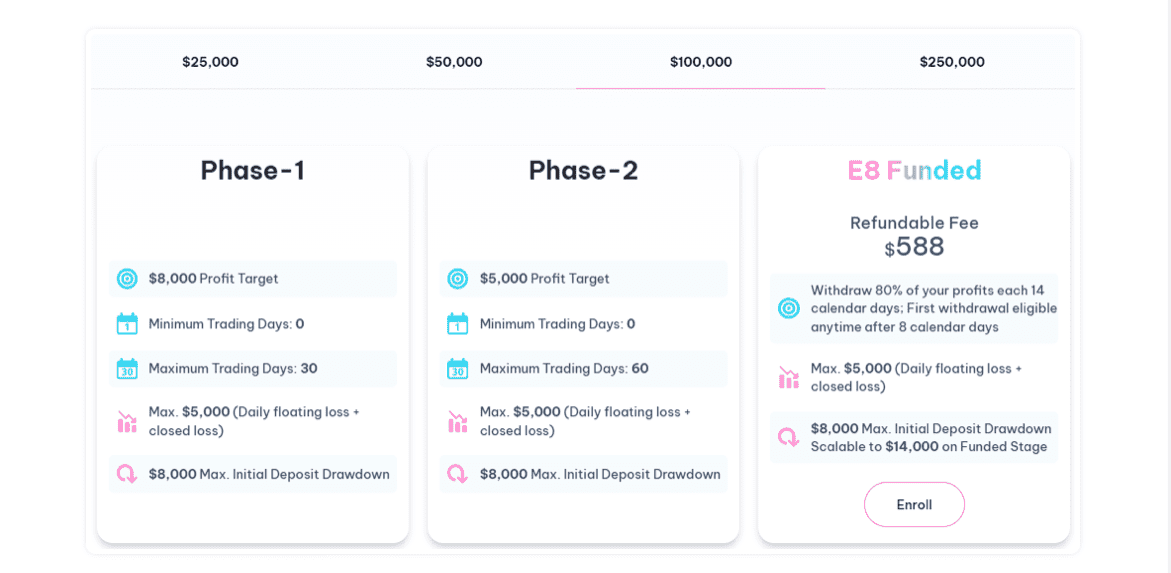

Phase One necessitates traders to achieve an 8% profit target within a 30-calendar-day period while adhering to the rules of not exceeding a maximum daily loss of 5% or a maximum loss of 8%. The profit target must be attained within the specified time frame, starting from the day the trader initiates their first position on the evaluation account. There is no minimum trading days requirement to progress to Phase Two.

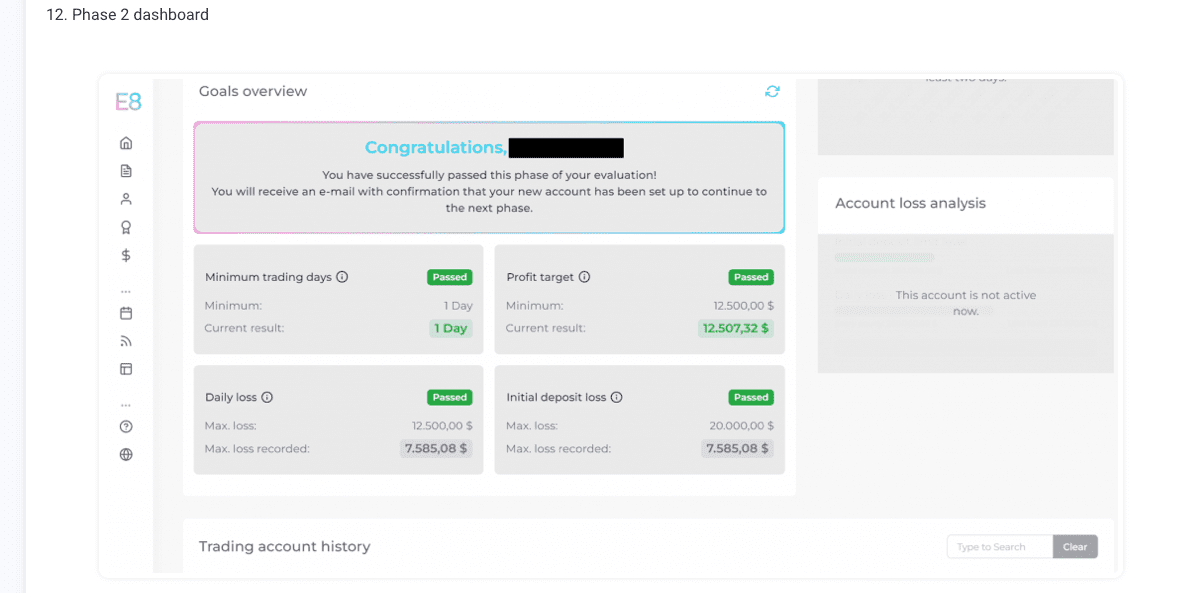

Evaluation Phase Two mandates traders to attain a profit target of 5% within a 60-calendar-day period while complying with the rules of not surpassing a maximum daily loss of 5% or a maximum loss of 8%. Similar to Phase One, the profit target must be achieved within the designated time frame, commencing from the day the trader places their initial position on the evaluation account. No minimum trading days are required to proceed to a funded account.

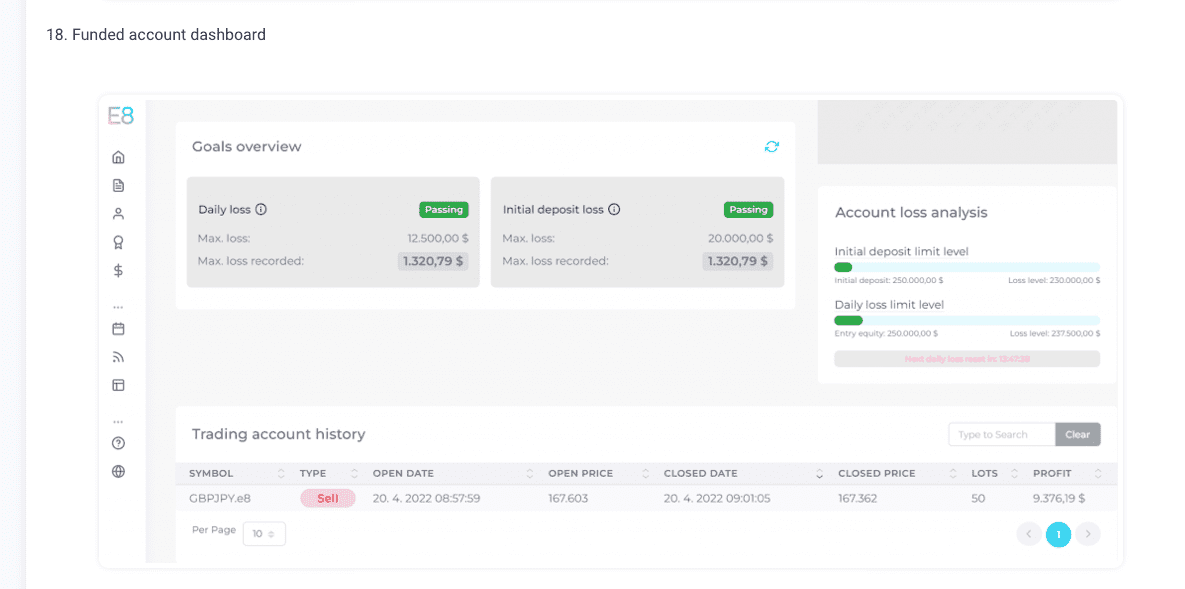

Upon successfully completing both evaluation phases, traders are granted a funded account, where profit targets are not applicable. However, they must adhere to the maximum daily loss limit of 5% and the maximum loss limit of 8%. The initial payout from the funded account occurs 8 calendar days after the first position is taken, while subsequent withdrawals can be submitted bi-weekly. Traders will receive an 80% profit split based on the profits generated from the funded account. It is essential to note that the maximum loss rule increases by an increment of 1% with each successful withdrawal received, reaching a maximum of 14%.

Furthermore, the normal E8 evaluation program accounts feature a scaling plan. Traders can augment their account balance by requesting a profit split at the conclusion of each trading period. They will receive an 80% profit split based on their earned profits, and the withdrawn amount will be added back to the account balance, thereby augmenting the account size.

Example:

After 4 months: If you have a $200,000 account, your account balance will increase to $280,000.

After next 4 months: Balance of $280,000 increases to $360,000.

After next 4 months: Balance of $360,000 increases to $440,000.

And so on…

Trading instruments for the two-step Stellar challenge model accounts are forex pairs, commodities, and indices.

Normal E8 evaluation program account rules

. The profit target represents a predetermined percentage of profit that traders must attain to successfully conclude an evaluation phase, withdraw profits, or expand their trading account. Phase 1 entails an 8% profit target, while Phase 2 requires achieving a profit target of 5%. Notably, funded accounts are exempt from profit targets.

-

- Maximum loss denotes the uppermost acceptable cumulative loss that traders can experience before their account is deemed in violation. For all account sizes, the maximum loss threshold is set at 8% (which can be scaled up to 14%).

- Maximum trading days indicate the maximum duration within which traders must achieve a specific profit target or withdrawal objective. Phase 1 encompasses a maximum trading period of 30 days, whereas Phase 2 allows for a maximum trading period of 60 days.

- Third-party copy trading risk pertains to the utilization of copy trading services. Traders should be aware that by employing a third-party copy trading service, they may encounter other traders utilizing the same trading strategy. Engaging in third-party copy trading carries the potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- Third-party EA risk pertains to the utilization of third-party EAs (Expert Advisors). Traders should bear in mind that by utilizing a third-party EA, they may encounter other traders utilizing the same trading strategy. Engaging in third-party EA usage carries the potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.Maximum daily loss signifies the highest permissible level of loss that traders can incur within a single day before their account is considered in violation. Regardless of account size, all traders are subject to a uniform maximum daily loss limit of 5%.

- Maximum loss denotes the uppermost acceptable cumulative loss that traders can experience before their account is deemed in violation. For all account sizes, the maximum loss threshold is set at 8% (which can be scaled up to 14%).

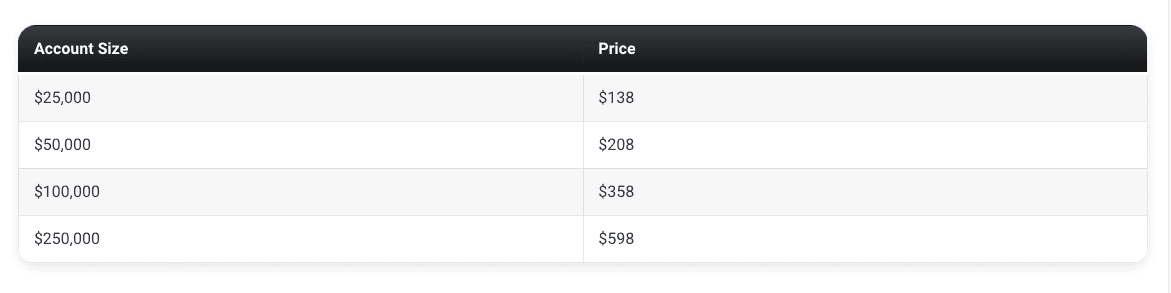

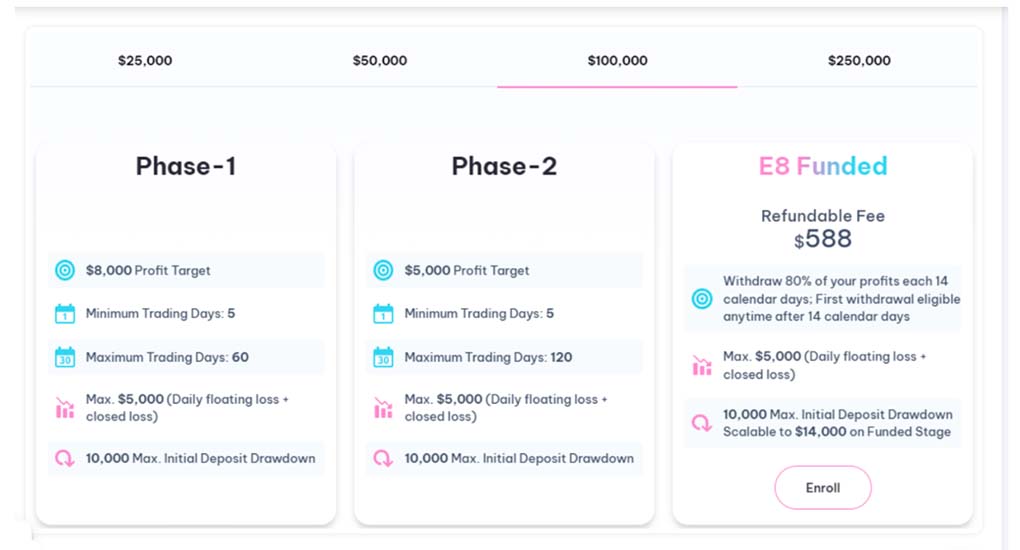

Extended E8 evaluation program accounts

Evaluation Phase One necessitates traders to achieve an 8% profit target within 60 calendar days from the initiation of their first position on the evaluation account. Throughout this phase, it is crucial to abide by the 5% maximum daily loss and 10% maximum loss regulations. Additionally, a minimum of five trading days must be completed to advance to Phase Two.

In Evaluation Phase Two, traders are required to attain a 5% profit target within 120 calendar days from the commencement of their first position on the evaluation account. Similar to Phase One, adherence to the 5% maximum daily loss and 10% maximum loss rules is essential. Again, a minimum of five trading days must be fulfilled to progress to a funded account.

Upon successful completion of both evaluation phases, traders are granted a funded account where profit targets are not applicable. Instead, compliance with the 5% maximum daily loss and 10% maximum loss rules is required. The first payout from the funded account is scheduled for 14 calendar days after the initial position is established, while subsequent withdrawals can be submitted bi-weekly. The profit split for the funded account stands at 80%, based on the trader’s generated profits. It is important to note that the maximum loss rule increases by +1% with each successful withdrawal, reaching a maximum threshold of 14%.

Moreover, the Extended E8 evaluation program accounts incorporate a scaling plan. Traders can augment their account balance by requesting a profit split at the conclusion of each trading period. Upon receiving an 80% profit split and incorporating the withdrawn balance back into the account, the account size is expanded.

Example:

1.- After You are trading a $250k account and you make a 10% profit.

2.- You request a profit split, meaning that you receive a payout of $20k (80% of the $25k profit made)

3.- Your account balance now is $275k.

4.- Since you made a profit of $25k on your $250k account, you continue trading with $275k

Trading instruments for the extended E8 evaluation program accounts are forex pairs, commodities, indices, equities, and cryptocurrencies.

Extended E8 evaluation program account rules

The profit target represents a predetermined percentage of profit that traders are obligated to achieve to successfully conclude an evaluation phase, initiate profit withdrawals, or expand their trading account. Phase 1 entails an 8% profit target, while Phase 2 sets a profit target of 5%. Notably, funded accounts are exempt from profit target requirements.

-

- The maximum daily loss signifies the utmost permissible amount of loss that traders can incur within a single day before their account is deemed to be in violation. Regardless of account size, a uniform maximum daily loss threshold of 5% applies.

- The maximum loss designates the highest admissible cumulative loss that traders can reach before their account is considered in violation. Similar to the maximum daily loss, all account sizes adhere to a maximum loss limit of 10% (which may be adjusted up to 14% in certain cases).

- The minimum trading days denote the minimum duration during which traders are required to actively participate in trading before they become eligible to complete an evaluation phase or request a withdrawal. Both evaluation phases mandate a minimum of 5 trading days, while funded accounts have no minimum trading day requirements.

- The maximum trading days specify the maximum duration within which traders must achieve a specific profit target or withdrawal objective. Phase 1 imposes a maximum period of 60 trading days, while Phase 2 allows a maximum of 120 trading days.

- When utilizing third-party copy trading services, it is important to be aware that other traders may already be employing the same trading strategy through the same service. Consequently, the adoption of third-party copy trading services carries the potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- Similarly, when employing third-party Expert Advisors (EAs), one should consider the possibility that other traders may already be utilizing the same trading strategy via the same EA. Employing third-party EAs carries the potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is surpassed

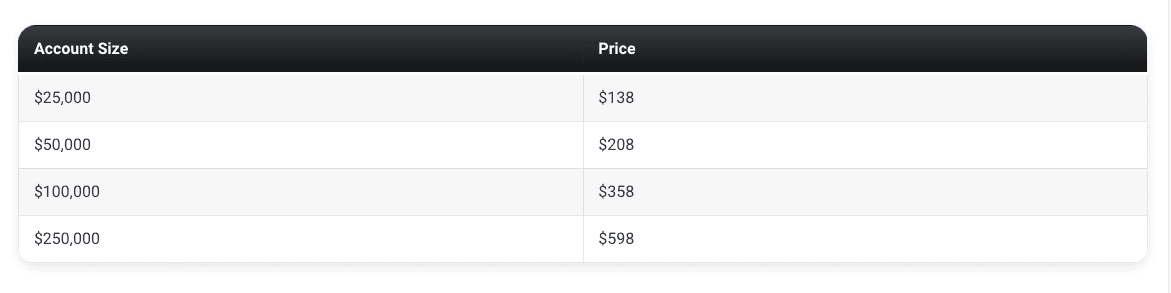

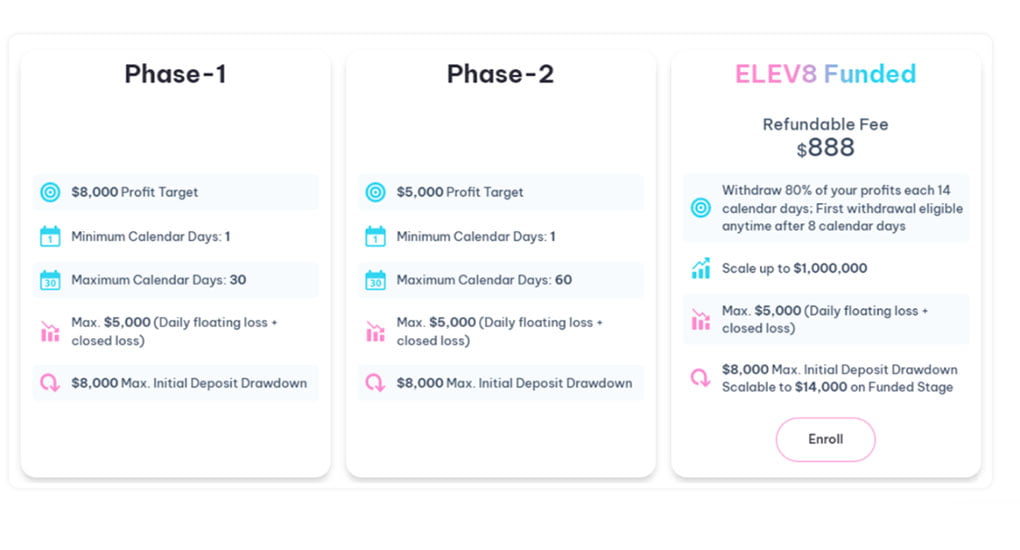

ELEV8 program account

The ELEV8 program account aims to provide traders with a unique opportunity to demonstrate their trading skills by managing up to $1,000,000 in balance while benefiting from access to global markets equipped with cutting-edge technology and top-tier liquidity. Traders participating in the ELEV8 program account are rewarded for their consistency during the two-phase evaluation period.

The ELEV8 program account allows traders to engage in trading with a leverage ratio of 1:100, amplifying their trading potential.

During evaluation phase one, traders are required to achieve a profit target of 8% within a 30-day period, while ensuring they do not exceed the specified maximum daily loss limit of 5% or the maximum loss limit of 8%. There is no minimum trading days requirement to progress to phase two.

In evaluation phase two, traders need to attain a profit target of 5% within a 60-day timeframe, while adhering to the 5% maximum daily loss limit and the 8% maximum loss rule. Similar to phase one, no minimum trading days are mandated to proceed to a funded account.

Upon successful completion of both evaluation phases, traders are granted a funded ELEV8 account, which eliminates profit targets. Instead, traders are solely obligated to abide by the 5% maximum daily loss limit and the 8% maximum loss rule. The initial payout from the funded account is disbursed within 8 calendar days of placing the first position, followed by subsequent withdrawals available on a bi-weekly basis. Traders receive an 80% profit split based on the profits generated from their funded account. It is important to note that the maximum loss rule increases by 1% with each successful withdrawal received, reaching a maximum threshold of 14%.

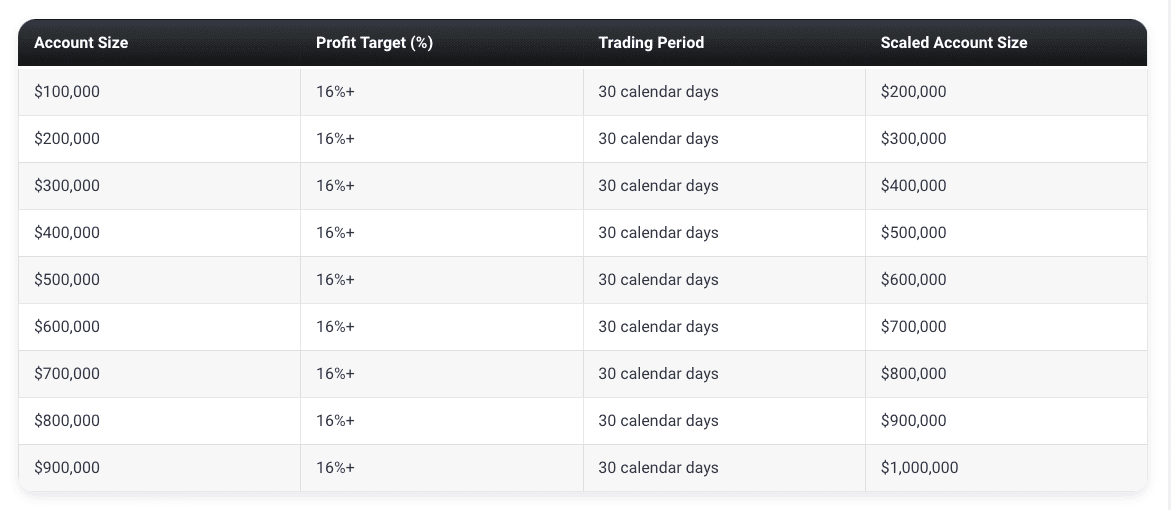

Furthermore, the ELEV8 program accounts incorporate a scaling plan, which can be accessed through the provided spreadsheet.

Trading instruments available for ELEV8 program accounts encompass a diverse range of options, including forex pairs, commodities, indices, equities, and cryptocurrencies.

ELEV8 program account rules

- The profit target represents a predetermined percentage of profit that traders must achieve to successfully complete an evaluation phase, withdraw profits, or expand their trading account. Phase 1 requires a profit target of 8%, while Phase 2 necessitates a profit target of 5%. It is important to note that funded accounts are exempt from profit targets.

- Maximum daily loss refers to the maximum allowable loss that traders can incur within a single day before their account is considered in violation. Regardless of account size, all traders are subject to a uniform maximum daily loss limit of 5%.

- Maximum loss signifies the highest permissible overall loss that traders can experience before their account is deemed in violation. Across all account sizes, a maximum loss limit of 8% (scalable up to 14%) applies.

- Maximum trading days represent the maximum period within which traders must achieve a specific profit target or withdrawal target. Phase 1 allows for a maximum trading period of 30 days, while Phase 2 extends the maximum trading period to 60 days.

- Third-party copy trading risk entails considering the potential consequences of utilizing a copy trading service provided by a third party. When relying on such services, traders should be aware that there may be other traders employing the same trading strategy through the third-party service. Consequently, utilizing a third-party copy trading service carries the risk of being denied a funded account or withdrawal if it exceeds the maximum capital allocation rule.

- Third-party EA risk involves acknowledging the potential risks associated with using a third-party Expert Advisor (EA). By utilizing a third-party EA, traders should be mindful that there may be other traders employing the same trading strategy through the same third-party EA. Thus, employing a third-party EA entails the risk of being denied a funded account or withdrawal if it exceeds the maximum capital allocation rule

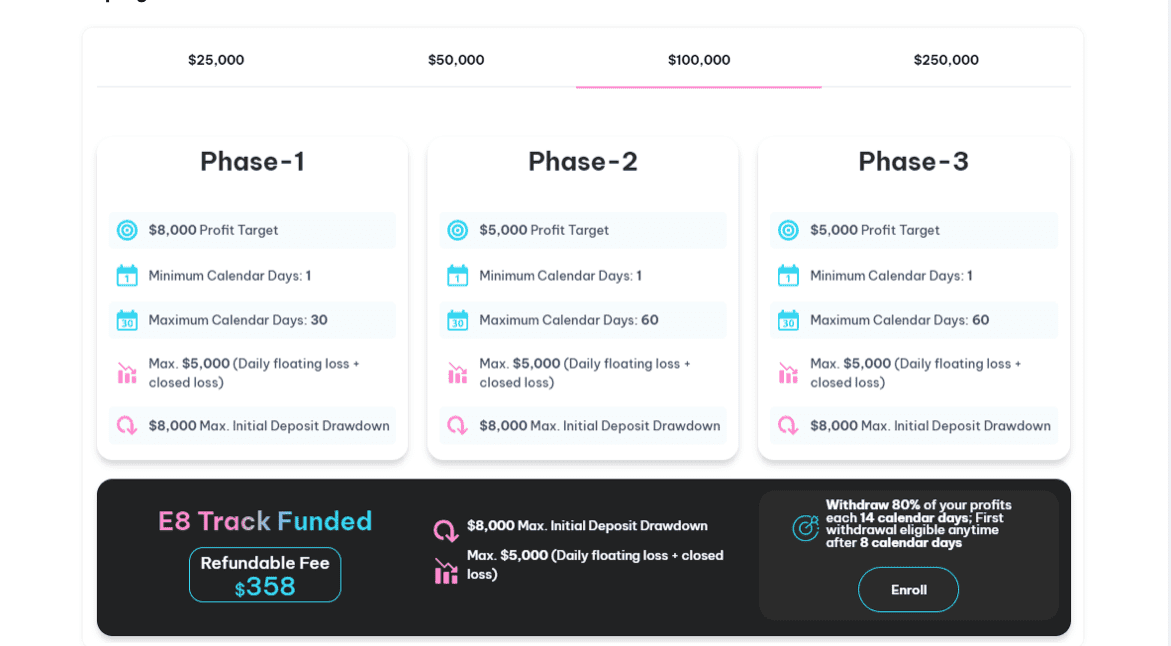

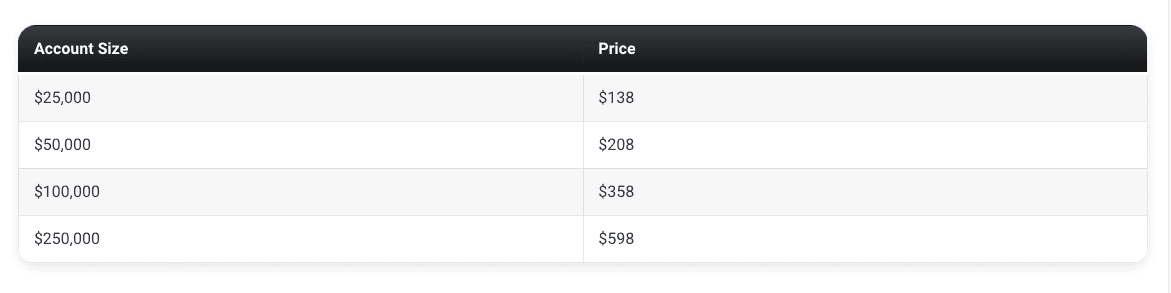

E8 Track program accounts

The E8 Track program account offers traders an avenue to demonstrate their expertise and handle account balances of up to $250,000, at a more cost-effective rate compared to the E8 evaluation program accounts. Throughout the three-phase evaluation period, traders are incentivized for maintaining a consistent trading performance while utilizing the E8 Track program account. Notably, this account facilitates trading with a leverage ratio of 1:100.

In the initial phase of the E8 Track program, traders are required to achieve a profit target of 8% within a timeframe of 30 calendar days from the initiation of their evaluation account. It is crucial to adhere to the 5% maximum daily loss and 8% maximum loss thresholds during this phase. There is no specific minimum trading days requirement to advance to phase two.

In the second phase of the E8 Track program, traders must reach a profit target of 5% within a timeframe of 60 calendar days from the initiation of their evaluation account. Similar to phase one, traders are expected to stay within the limits of 5% maximum daily loss and 8% maximum loss. No minimum trading days are mandated to progress to phase three.

During phase three of the E8 Track program, traders are tasked with achieving a profit target of 5% within a timeframe of 60 calendar days from the initiation of their evaluation account. It is essential to stay within the 5% maximum daily loss and 8% maximum loss boundaries. There is no minimum trading days requirement to proceed to a funded account.

Upon successfully completing all three evaluation phases, traders are granted a funded account, where profit targets do not apply. However, it remains imperative to abide by the 5% maximum daily loss and 8% maximum loss rules. The first payout from the funded account is scheduled for 8 calendar days after the initial placement of trades, followed by subsequent withdrawals on a bi-weekly basis. The profit split for the funded account is 80%, based on the profits generated. It is important to note that the maximum loss rule increases by 1% with each successful withdrawal, up to a maximum of 14%.

The E8 Track program accounts also offer a scaling plan identical to the E8 evaluation program account scaling plan. Traders can augment their account balance by requesting a profit split at the conclusion of each trading period. Upon receiving an 80% profit split based on earnings, the balance before the withdrawal is added back, contributing to an increase in the account size.

Example:

1.- You are trading a $250k account, and you make a 10% profit.

2.- Your account balance now is $275k.

3.- You request a profit split, meaning that you receive a payout of $20k (80% of the $25k profit made)

4.- Since you made a profit of $25k on your $250k account, you continue trading with $275k

Trading instruments for the E8 Track program accounts are forex pairs, commodities, indices, equities, and cryptocurrencies.

E8 Track program account rules

- The profit target represents a specific percentage of profit that traders are obligated to achieve to successfully conclude an evaluation phase, execute profit withdrawals, or expand their trading account. Phase 1 entails an 8% profit target, while both Phase 2 and Phase 3 require a profit target of 5%. It is important to note that funded accounts are exempt from profit target requirements.

- The maximum daily loss denotes the uppermost permissible level of loss that traders can incur on a daily basis before their trading account is deemed in violation. This maximum daily loss threshold is consistent across all account sizes, set at 5%.

- The maximum loss refers to the highest allowable cumulative loss that traders can experience before their trading account is considered in violation. Irrespective of account size, all traders must adhere to a maximum loss limit of 8% (which can be scaled up to 14%).

- The maximum trading days represent the maximum duration within which traders must meet specific profit targets or withdrawal targets. Phase 1 encompasses a maximum trading period of 30 days, while both Phase 2 and Phase 3 have a maximum trading period of 60 days.

- Third-party copy-trading risk arises when utilizing copy-trading services provided by external entities. Traders should be aware that such services may already be utilized by other traders, potentially employing identical trading strategies. Engaging in third-party copy trading services carries the risk of denial of funded accounts or withdrawals if the maximum capital allocation rule is exceeded.

- Third-party EA risk arises when using third-party Expert Advisors (EAs). Traders should consider that other traders may already be employing the same trading strategy through the identical third-party EA. Utilizing third-party EAs carries the risk of denial of funded accounts or withdrawals if the maximum capital allocation rule is surpassed.

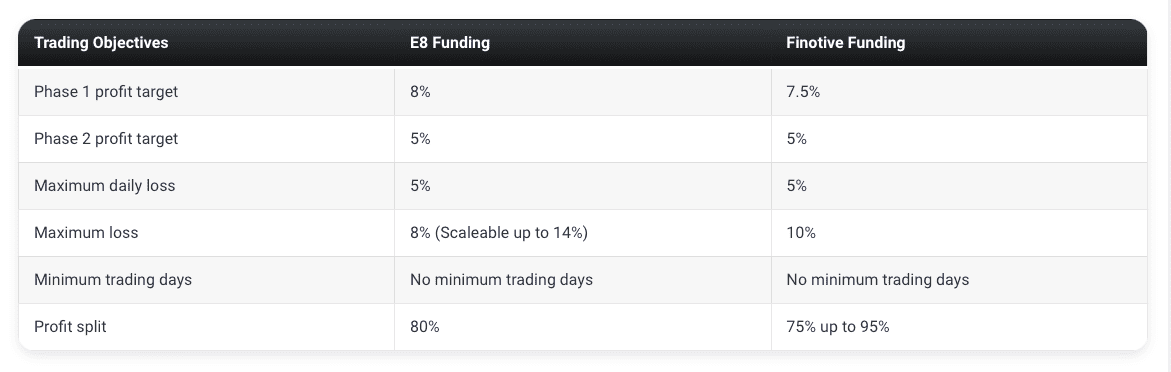

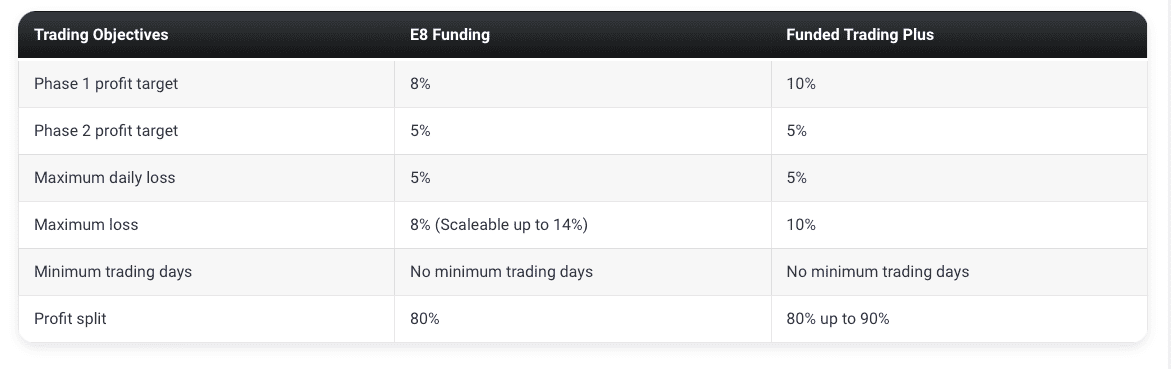

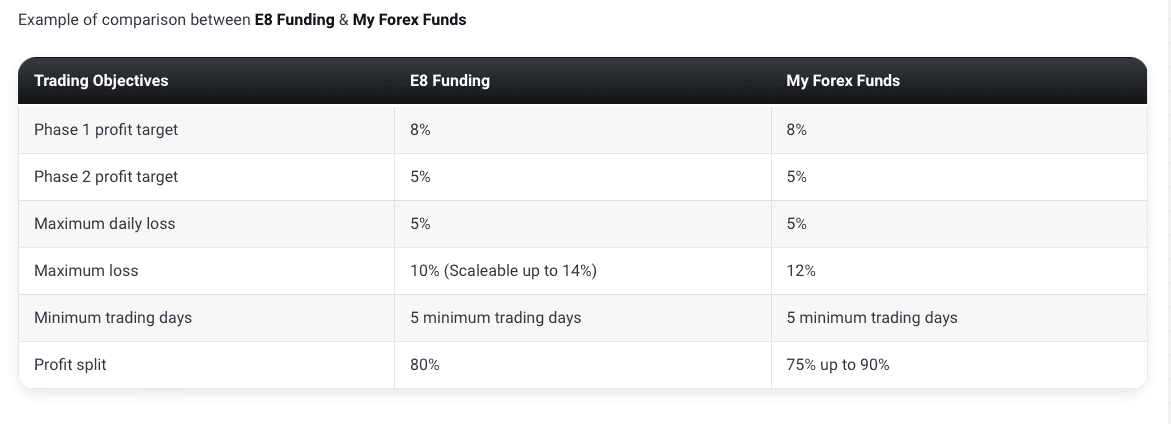

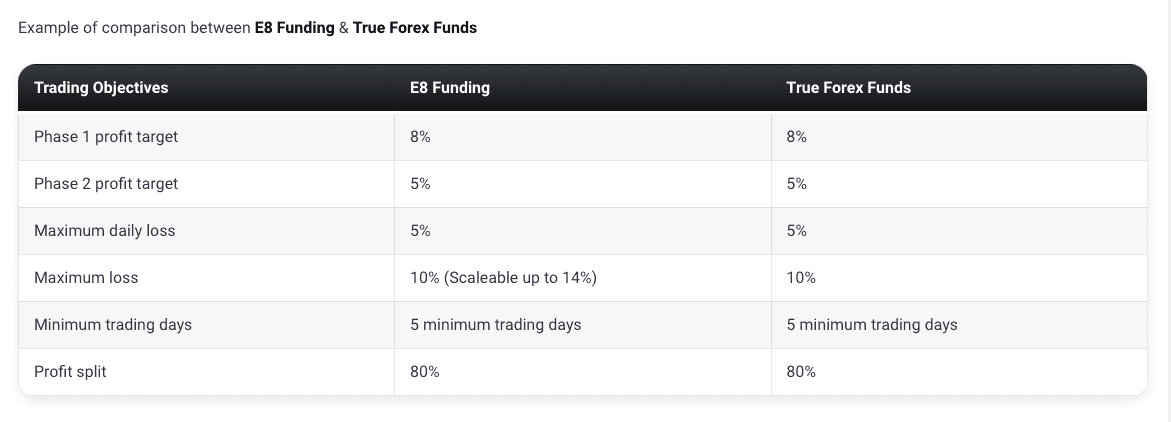

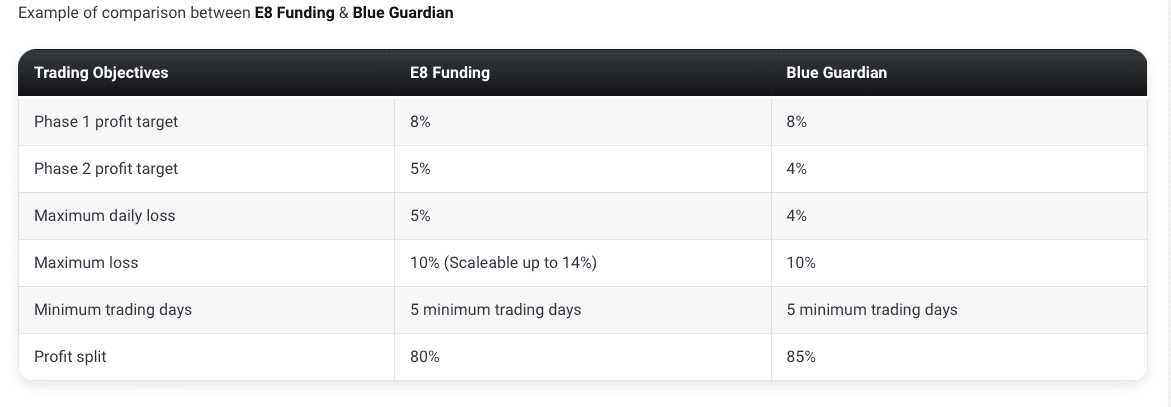

What makes E8 Funding different from other prop firms?

E8 Funding distinguishes itself from other prominent proprietary firms by providing three distinct funding programs: E8 Evaluation, ELEV8, and E8 Track. Remarkably, E8 Funding imposes minimal limitations on traders’ preferred trading styles, allowing for unrestricted trading activities, including trading during news events, holding positions overnight, and even during weekends.

For both the E8 Evaluation and ELEV8 program accounts, E8 Funding employs a comprehensive two-phase evaluation process, mandating traders to successfully navigate through both phases to qualify for payouts. In the initial phase, traders are expected to achieve a profit target of 8%, followed by a reduced target of 5% in the subsequent phase. Notably, stringent risk management measures are in place, with a maximum daily loss threshold of 5% and a maximum overall loss limitation of 8%. Furthermore, there are no minimum trading day requirements in either phase before a trader becomes funded. It is worth highlighting that the E8 Evaluation program accounts also include a scaling plan, setting them apart from their counterparts in the industry. Consequently, E8 Funding offers comparatively modest profit targets and does not impose a minimum trading day obligation, differentiating itself from other renowned proprietary firms.

.

E8 Funding’s extended evaluation program accounts entail a two-phase evaluation process that mandates traders to successfully complete both phases to qualify for payouts. Phase one necessitates achieving a profit target of 8%, while phase two requires a profit target of 5%. Compliance with maximum daily loss and maximum loss regulations, set at 5% and 10% respectively, is also expected. Additionally, a minimum trading duration of 5 days per phase must be fulfilled before attaining funded status.

Notably, E8’s evaluation program accounts offer a scaling plan and distinguish themselves from other leading proprietary firms in the industry by providing comparatively modest profit targets and average drawdown restrictions.

The E8 Funding E8 Track program entails a comprehensive three-phase evaluation process that traders must successfully complete qualifying for payouts. During each phase, specific profit targets are established, with phase one requiring an 8% profit target, and phases two and three mandating a 5% profit target. Furthermore, the program maintains stringent rules regarding daily losses, capping them at 5%, and overall losses, limited to 8%.

Notably, the E8 Track program distinguishes itself from other prominent proprietary firms by offering traders an advantageous scaling plan. Moreover, it stands apart by offering more accessible pricing, relatively lower profit targets, and the absence of minimum trading day requirements. This lenient approach allows traders to pursue funding with greater flexibility and efficiency compared to their counterparts in the industry.

In summary, E8 Funding sets itself apart from other leading proprietary firms by providing three distinct funding programs. In addition, it offers traders an accommodating trading framework with minimal restrictions, exemplified by the absence of minimum trading day requirements, thereby enabling traders to secure funding promptly, even within a single day.

.

Is getting E8 Funding capital realistic?

When evaluating proprietary trading firms that align with your forex trading style, it is crucial to assess the feasibility of their trading requirements. While a company offering a substantial percentage of profit split on a well-funded account may appear appealing, it is imperative to examine whether they impose high monthly percentage gains coupled with minimal maximum drawdown percentages, as this combination significantly diminishes the likelihood of achieving success.

Obtaining capital from the standard E8 evaluation and ELEV8 program accounts is generally feasible due to their comparatively modest profit targets of 8% in phase one and 5% in phase two. Additionally, these accounts adhere to slightly below-average rules concerning maximum daily losses, capped at 5%, and maximum overall losses at 8%.

Obtaining capital from the extended E8 evaluation program accounts remains within realistic bounds, primarily due to the relatively low-profit targets of 8% in phase one and 5% in phase two. These accounts adhere to average rules regarding maximum daily losses, set at 5%, and maximum overall losses, capped at 10%.

Receiving capital from E8 Track program accounts is a realistic option since they feature relatively low-profit targets of 8% in phase one, 5% in phase two, and phase three. Moreover, these accounts maintain average rules for maximum daily losses, set at 5%, and maximum overall losses, limited to 8%.

Considering all of these factors, E8 Funding emerges as an exceptional choice for securing funding, as it provides three distinct funding programs that establish realistic trading objectives and payout conditions to follow

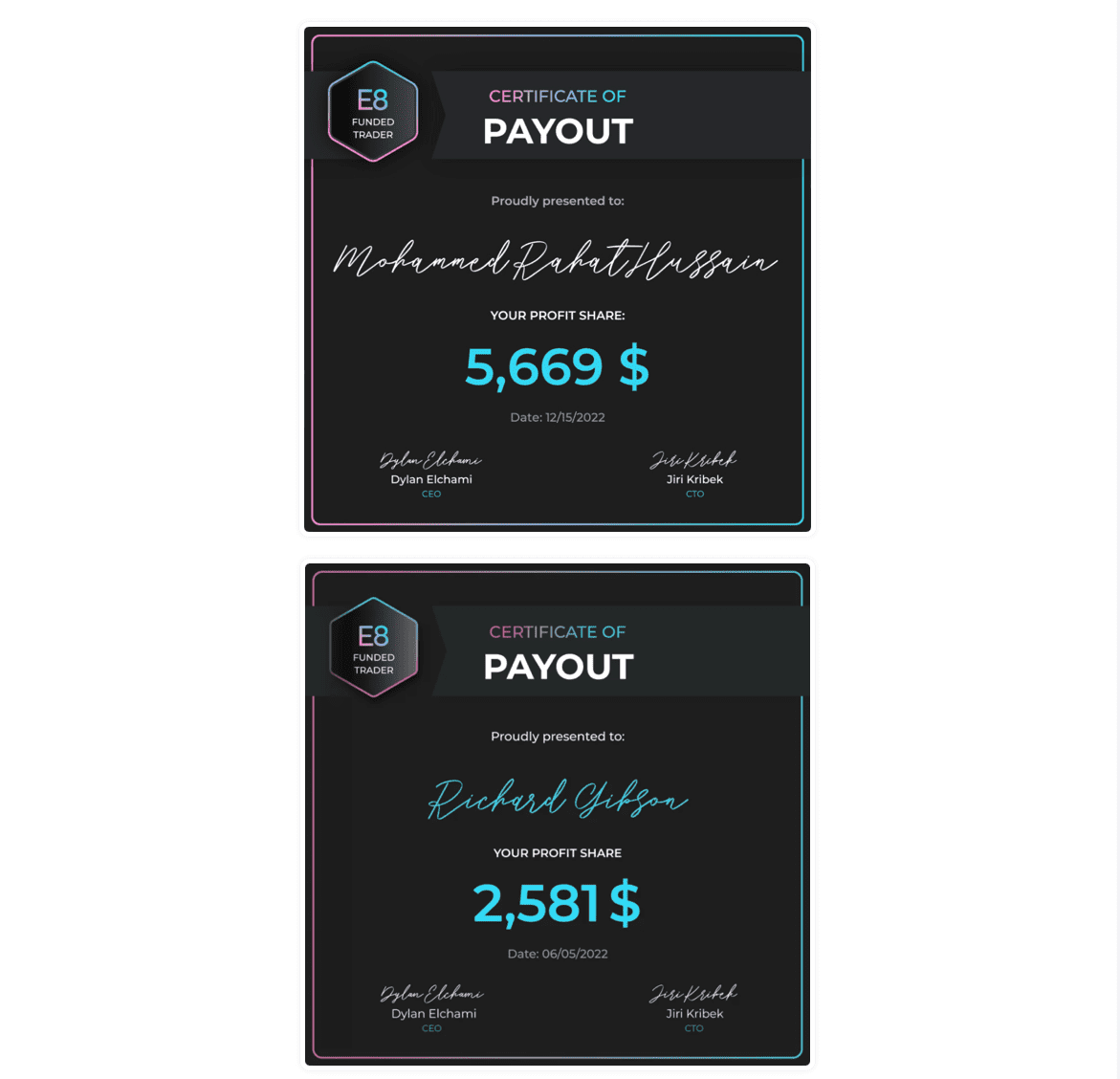

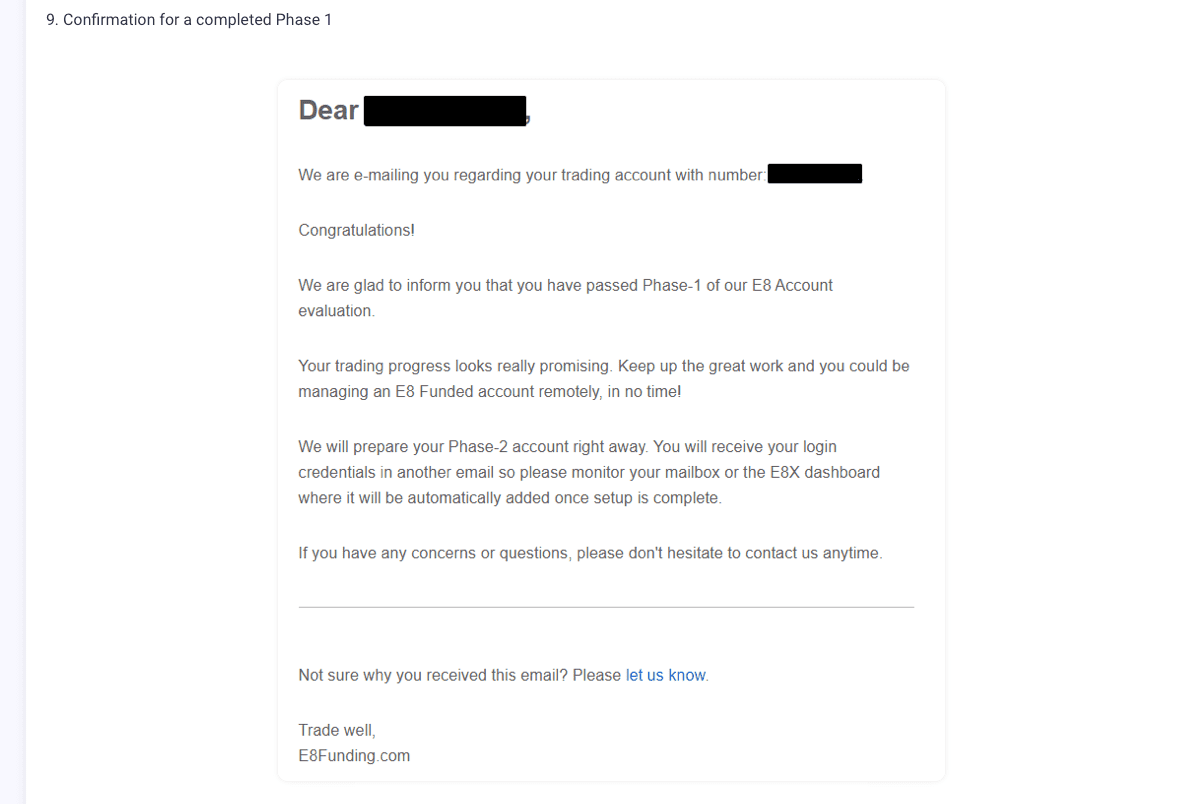

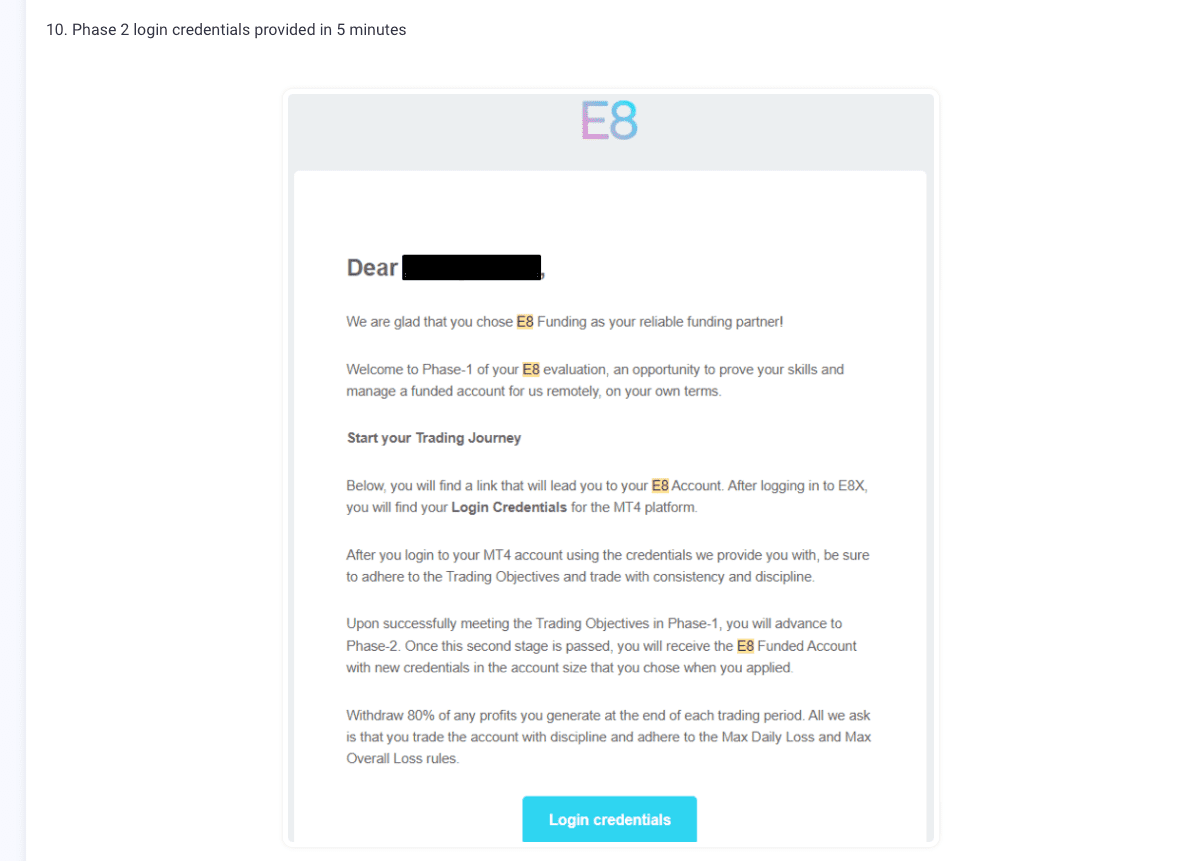

Payment proof

E8 Funding was incorporated on the 5th of November, 2021. After getting funded, traders are eligible for bi-weekly payouts with no minimum profit targets.

You can see examples of payment proof below:

Which brokers doE8 Funding use?

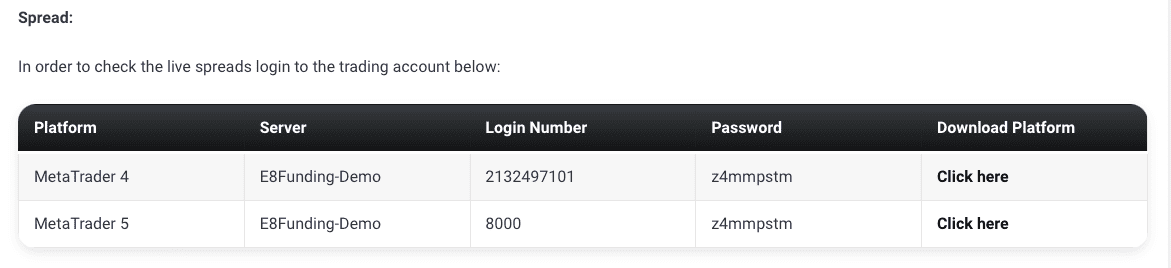

E8 Funding employs a distinct trading approach by bypassing conventional broker brands and instead directly accessing a Tier-1 Liquidity Provider. This enables them to benefit from Direct Market Access, resulting in advantageous conditions such as commission-free trading, tight spreads, and impeccable execution facilitated by their E8 MT4 Server.

In terms of trading platforms, E8 Funding provides the option to trade on both Meta Trader 4 and MetaTrader 5, offering traders a versatile and widely recognized suite of trading tools.

The company strives to provide a tailored trading experience and has established a highly efficient technological framework to facilitate your trading activities. In recognition of their efforts, they were honored with the prestigious title of Best Global Forex MT4 Broker in 2020 at the esteemed Global Forex Awards.

It is important to note that FundedNext operates its own dedicated server, known as the “GrowthNext Server,” within the MT5 platform. Additionally, traders have the flexibility to choose between two popular trading platforms, namely MetaTrader 4 and MetaTrader 5.

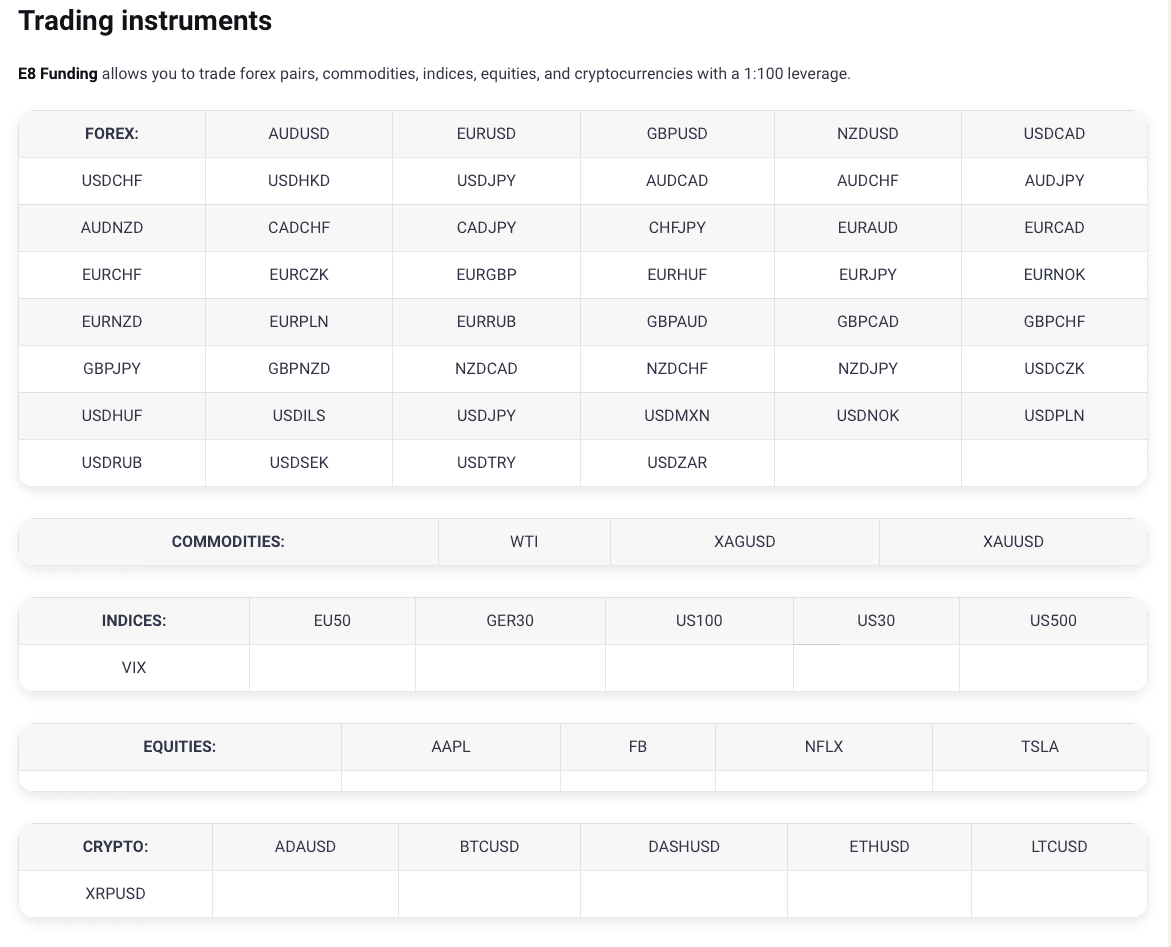

Trading instruments:

E8 Funding allows you to trade forex pairs, commodities, indices, equities, and cryptocurrencies with a 1:100 leverage.

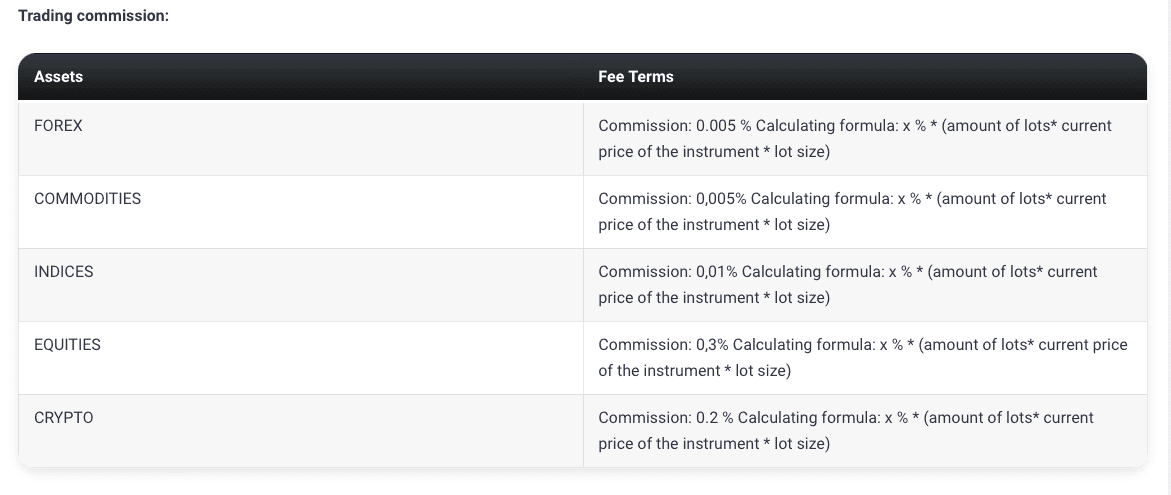

Trading fees

Commission examples:

Forex:

Let’s assume that you open 10 lots for EUR/USD, the current ASK price (for a buy order) is 1.1, the commission is 0.005 % and the size of each lot is 100 000.

The equation is 0,00005 * (10* 1.1 *100 000) = 55 $

If you are using non /USD pairs, you also need to divide it by the exchange rate of the currency.

For example, if you wish to open trade for GBP/JPY and you want to know what is a commission in USD price, the calculation would look like this:

(10 ( positions size) * 100000 (size of each lot) * 163.365 price * 0.00005 (0,005 % commission) ) / 134.975 (USDJPY rate )

Stocks

For AAPL, the commission rate stands at 0.3%. To illustrate, let’s consider the scenario where you intend to purchase one lot, which corresponds to a single AAPL (lot size). In this case, you would multiply the current ASK price of the instrument (approximately $139.68 for AAPL) by the commission rate.

The calculation can be expressed as follows: 0.003 * 139.68 * 1 * 1 = $0.41904.

It should be noted that E8 Funding’s trading instrument commissions are all determined as a percentage based on the prevailing price at the specific moment of the transaction. To obtain comprehensive information on the trading instrument specifications, you can refer to the E8X Public Symbols Dashboard provided by E8 Funding.

Spread

Education and support for traders

E8 Funding does not offer any educational resources or materials on its official website. However, there is a dedicated thread on Forex Factory where users can engage in discussions about the firm and its various features. Additionally, there is another prominent thread on ForexFactory titled “PROP FIRM HUB,” initiated by a user named MasterrMind, which extensively references E8 Funding.

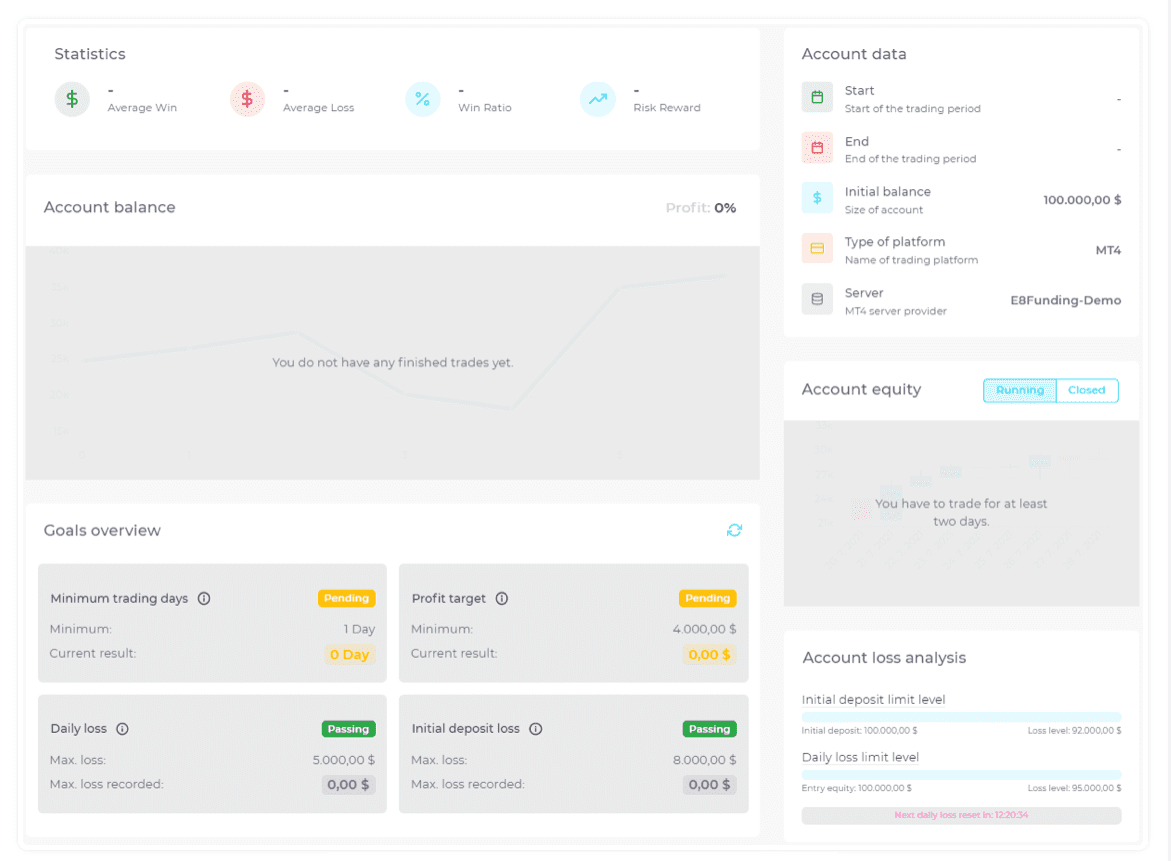

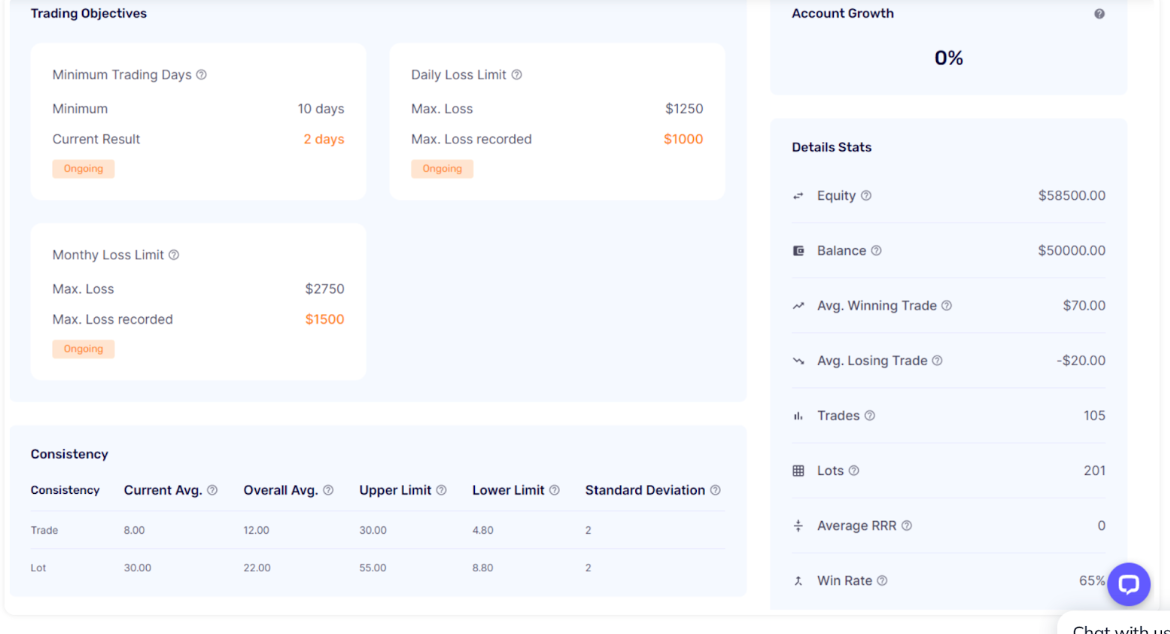

In addition, they offer a distinctive feature among prop firms, which is the availability of a free trial before commencing the Evaluation Process. This valuable opportunity allows individuals to adequately prepare themselves and mitigate the likelihood of errors. Furthermore, they provide their esteemed clients with a meticulously designed dashboard, granting convenient access to effectively manage risk in alignment with their predefined statistical objectives.

For any inquiries regarding missing information, the E8 Funding website features a FAQ page that may provide the answers you seek. In addition, their dedicated support team can be reached through various channels, such as their social media platforms, or via direct email communication at support@e8funding.com.

To ensure prompt assistance, their live chat support team is accessible during the following operating hours: Monday to Friday, from 7 AM to 6 PM CST, and on weekends from 11 AM to 2 PM CST

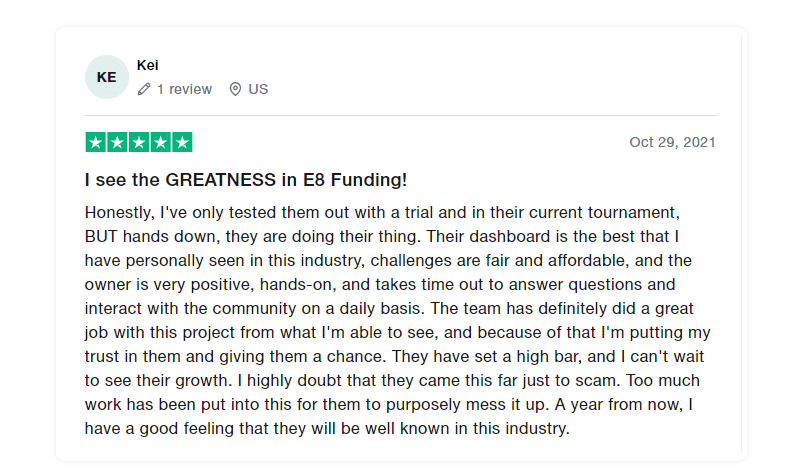

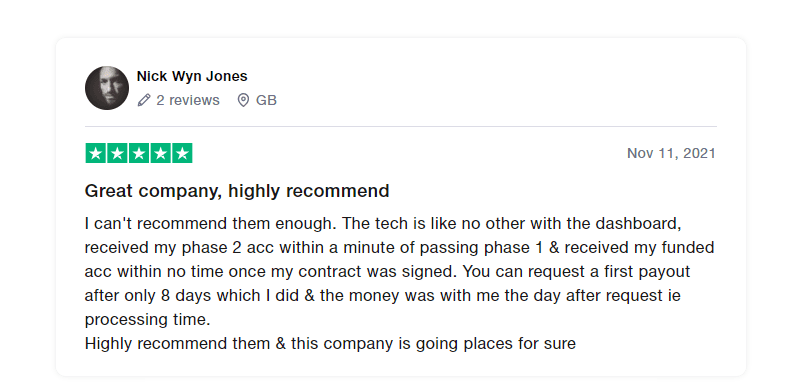

Traders’ Comments about E8 Funding

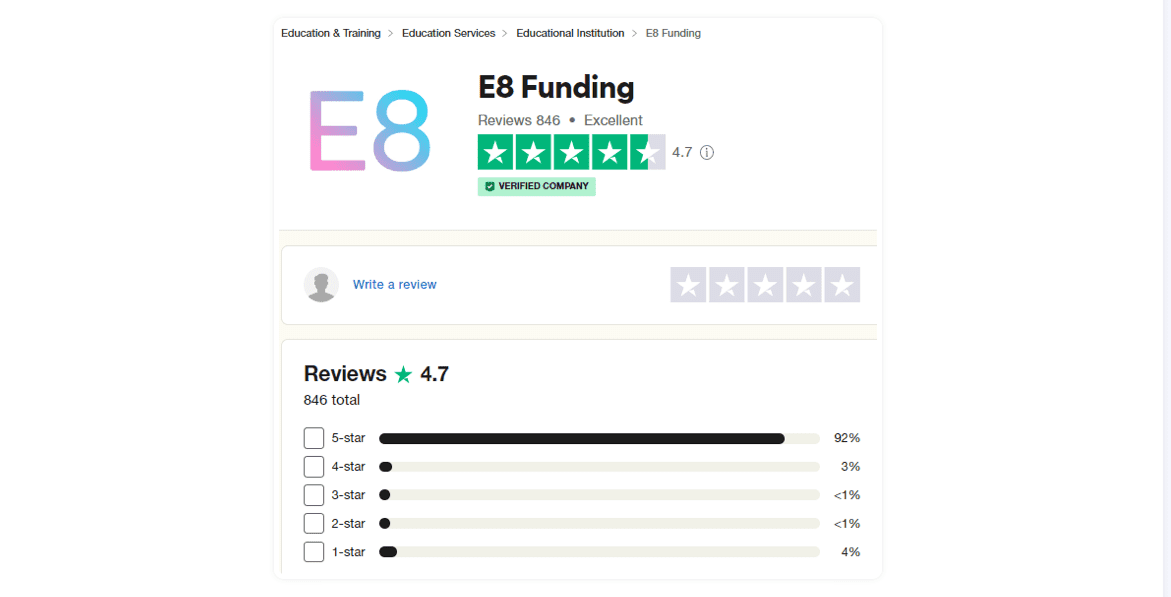

E8 Funding has an excellent review from his community

Trustpilot boasts an extensive array of community members who actively participate by providing positive feedback, resulting in an impressive score of 4.7 out of 5 based on 846 reviews. Additionally, they offer prompt and dependable customer support, ensuring that all necessary information is readily available to users and addressing any uncertainties they may have

Someone also stated that having fair and affordable challenges is another positive feature and a cheerful owner who does his best to interact with his community as much as possible.

A vast majority of the community praises their well-structured dashboard and the fast, responsive customer support team of E8 Funding

Social media statistics

E8 Funding can also be found on social media.

They have a:

Instagram account with 18,5k followers,

Facebook page with 1,3k followers,

Twitter account with 786 followers,

Youtube channel with 422 subscribers and no uploaded videos yet,

Telegram account with 2,962 subscribers

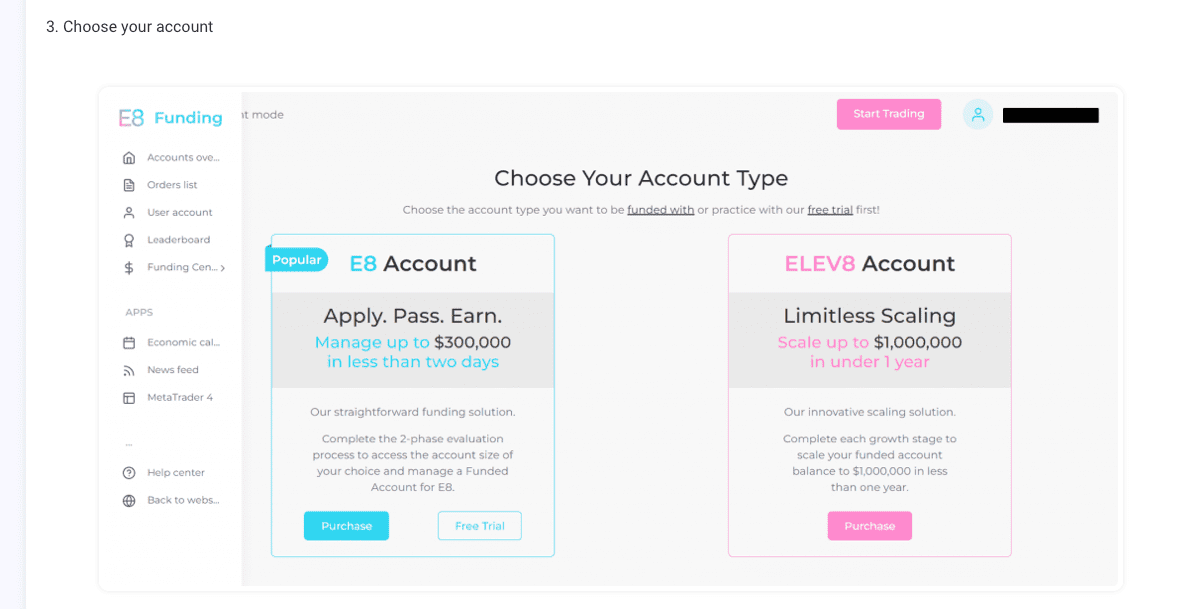

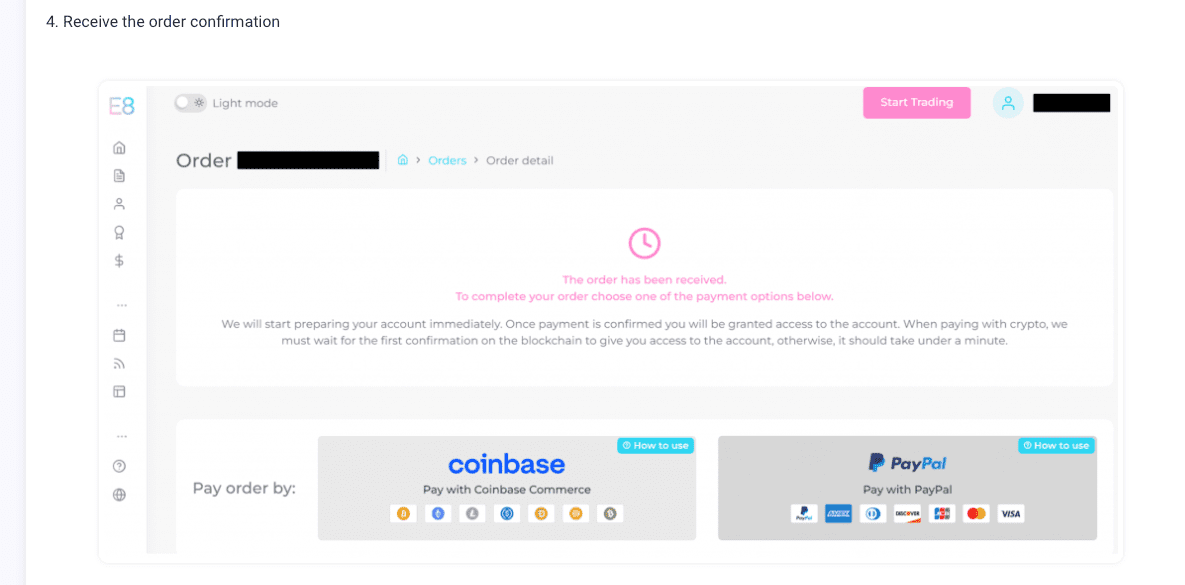

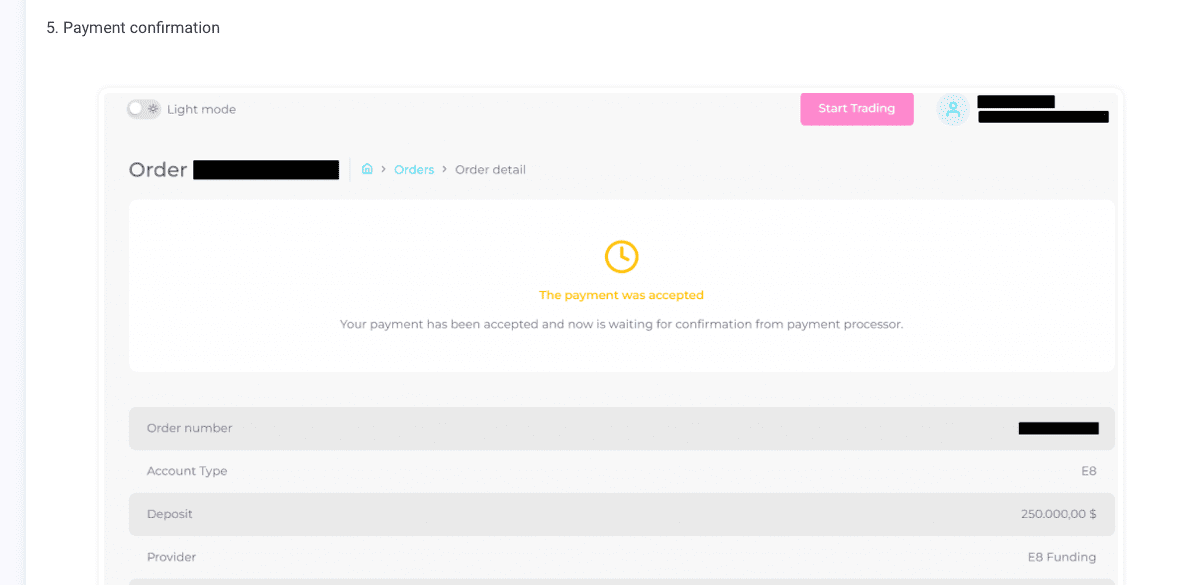

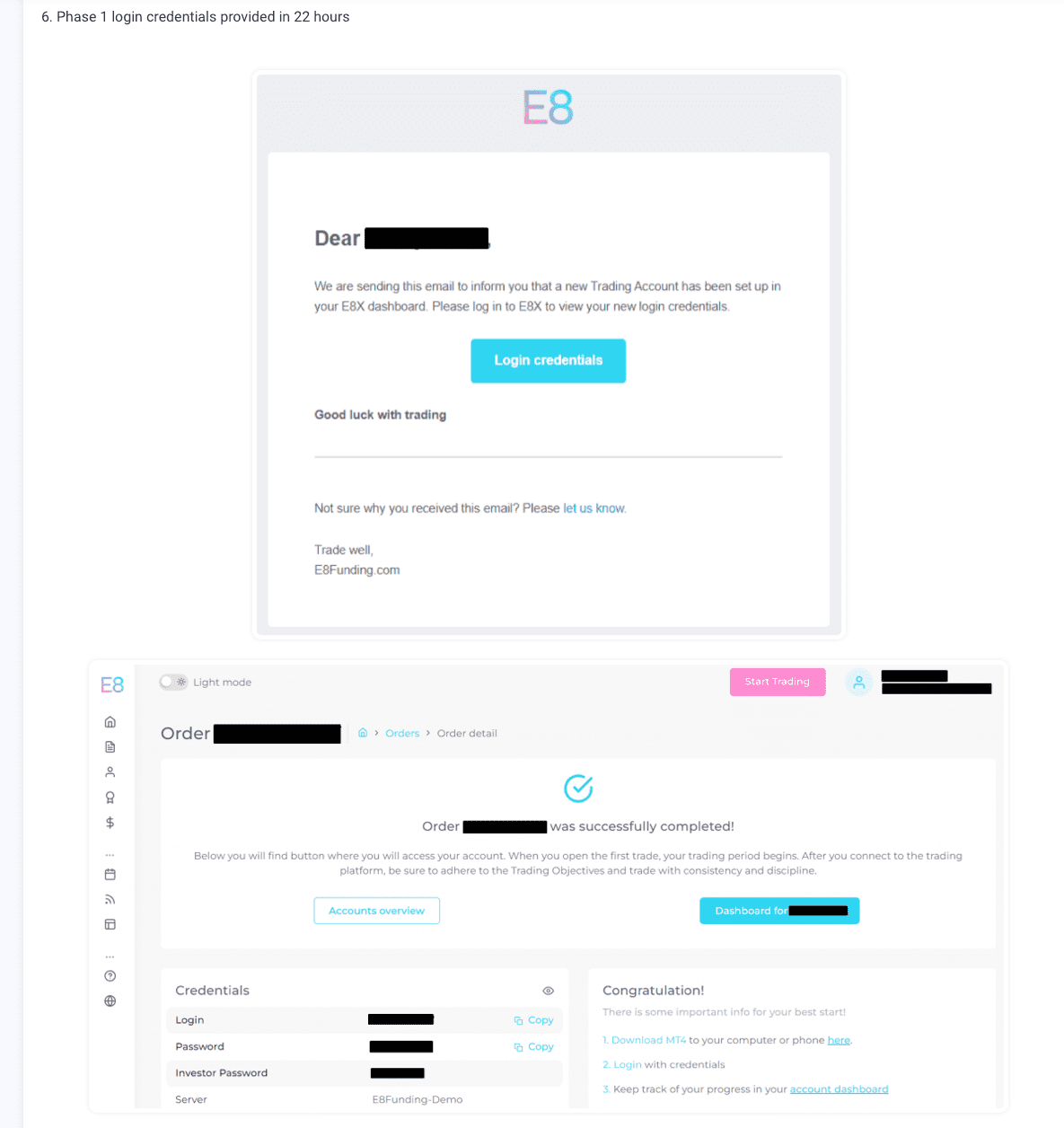

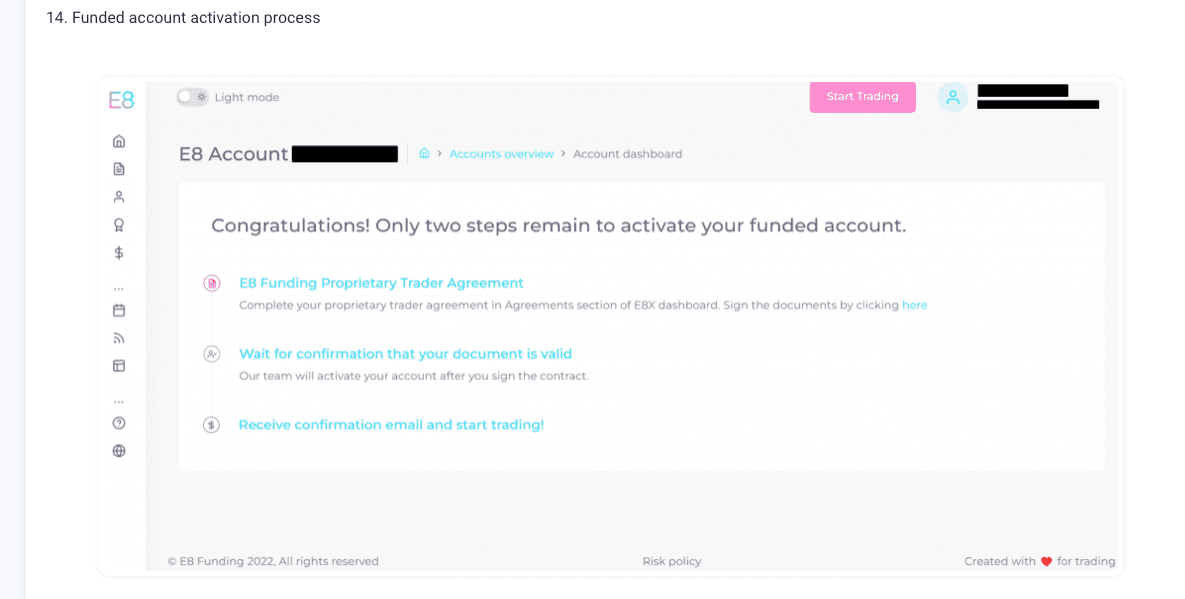

Registration process

To register with E8 Funding, you will require to complete the following steps.

1.- Sign up for E8 Funding

Conclusion

In summary, E8 Funding is a reputable proprietary trading firm that provides traders with the opportunity to select from three distinct funding programs: E8 evaluation, ELEV8 program, and E8 Track programs.

The standard evaluation and ELEV8 programs follow the industry-standard two-phase evaluation process, which must be successfully completed to secure funding and qualify for profit splits. To attain funding, traders are required to achieve profit targets of 8% in phase one and 5% in phase two. These targets are realistic objectives, especially considering the adherence to rules such as a maximum daily loss limit of 5% and a maximum loss limit of 8%. Additionally, participants in these programs can earn 80% profit splits and can scale their accounts.

The extended evaluation programs also follow the industry-standard two-phase evaluation structure. Similar to the standard programs, traders must attain profit targets of 8% in phase one and 5% in phase two to secure funding. These objectives align with realistic trading expectations, given the 5% maximum daily loss limit and 10% maximum loss limit. By successfully completing the extended evaluation programs, traders can earn 80% profit splits and scale their accounts.

E8 Track programs, on the other hand, are distinctive three-phase evaluation challenges. To obtain funding and be eligible for profit splits, traders must meet profit targets of 8% in phase one, 5% in phase two, and phase three. These targets are in line with realistic trading objectives, considering the 5% maximum daily loss limit and 8% maximum loss limit. By completing the E8 Track programs, traders can earn 80% profit splits and have the opportunity to scale their accounts.

Considering the straightforward trading rules and excellent conditions offered by E8 Funding, I highly recommend this prop firm to individuals seeking a reliable trading platform. Although relatively new, they have established themselves as one of the leading prop firms in the industry, catering to a diverse range of traders with unique trading styles.