“Empowering Growth: Finotive Funding – Unleashing Financial Potential”

“Empowering Retail Traders Globally: Finotive Funding – Overcoming Capital Barriers, Unlocking Trading Potential, and Maximizing Returns”

Finotive Funding, established by Oliver Newland, recognizes that capital is often the primary hurdle faced by individuals aspiring to become full-time traders. The company’s objective is to devise a systematic approach that empowers retail traders across the globe to augment their capital and achieve substantial returns.

With a focus on expediting the evaluation process and facilitating capital growth, Finotive Funding endeavors to provide retail traders with a means to accelerate their progress and attain significantly enhanced monthly returns.

Pros of Finotive Funding

Three Funding program options

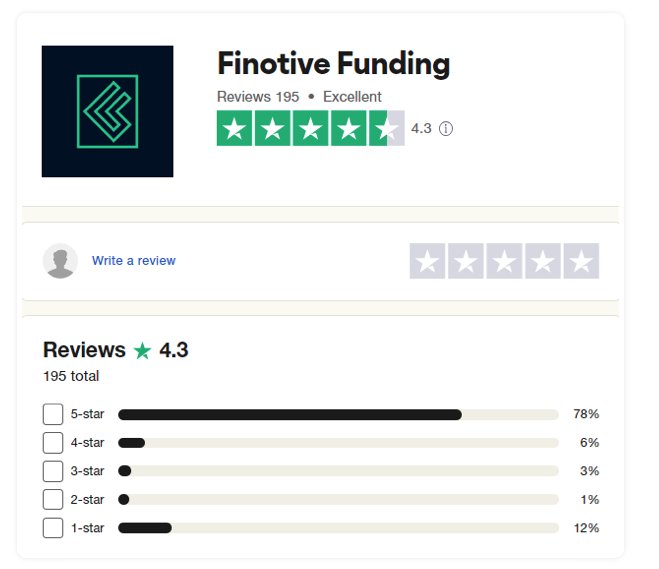

Excellent Trustpilot rating of 4.3/5

One-time funded account negative balance free redeposit

unlimited evaluation free retires

Profit splits up to 95%

Overnight and weekend holding aloowed

News trading allowed

EA’s and boots allowed

Scaling account options up to $3,200,000 (aggressive instant funding)

Levarage up to 1:400

A large variety of trading instruments (forex pairs, commodities, indices)

Cons of Finotive Funding

No free trials

At Finotive Funding, traders are motivated to excel in their professional endeavors. The foremost requirement for clients is to demonstrate discipline and effective risk management. Traders have the opportunity to generate substantial profits by effectively managing accounts ranging up to $200,000, with the potential to scale up to a cumulative sum of $11,410,000. Furthermore, they are eligible to receive profit splits ranging from 75% to 95%. These financial gains can be achieved through the trading of various instruments, including Forex pairs, commodities, indices, and cryptocurrencies.

Who are Finotive Funding?

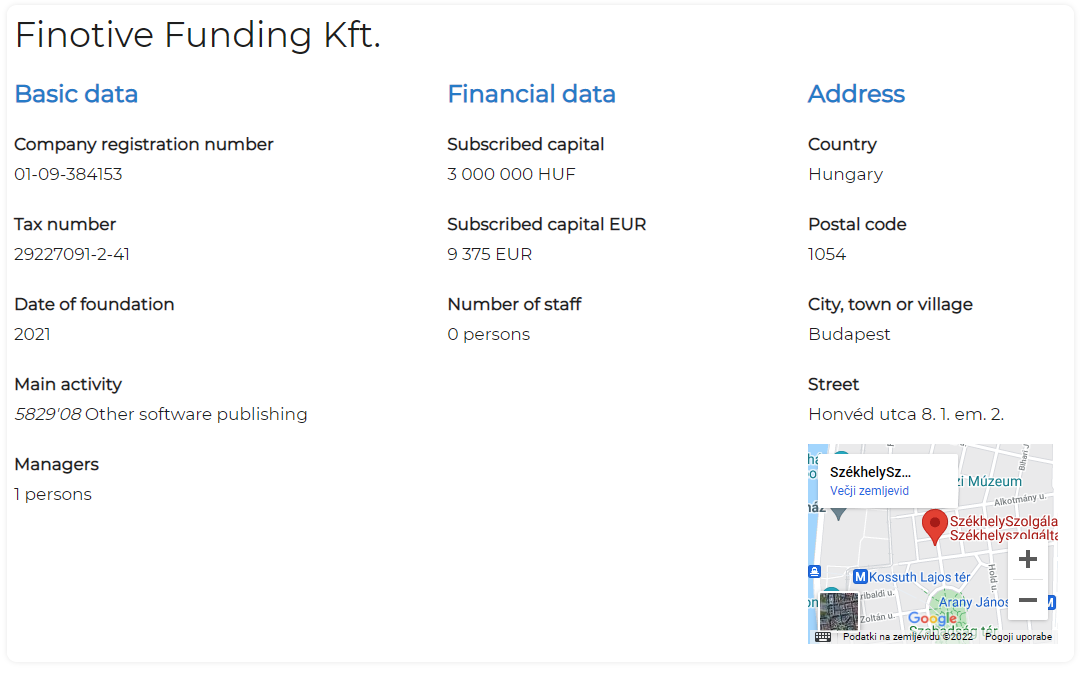

Finotive Funding is a privately owned enterprise established by Oliver Newland on April 23, 2021, following a substantial period of pre launch preparations. The company operates from its headquarters in Budapest, Hungary and provides traders with the opportunity to access a significant trading balance totaling $11,410,000, while offering profit splits ranging from 75% to 95%. Additionally, Finotive Funding has developed its own brokerage, known as Finotive Markets, with plans to achieve full regulatory compliance by the latter part of 2023.

Their headquarters are located at Honvéd utca 8. 1st floor, 1054 Budapest, Hungary.

Oliver Newland is the CEO of Finotive Funding.

The founding program options

Finotive Funding offers its traders three different funding programs to choose from:

Two-step evaluation program accounts

- Instant funding program accounts

-

- Standard instant funding program accounts

- Aggressive instant funding program accounts

One-step evaluation program accounts

Two-step evaluation program account:

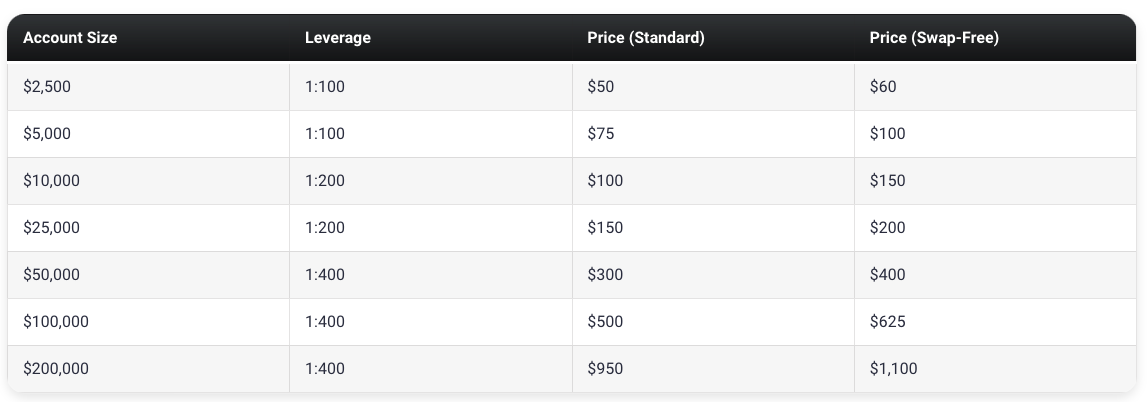

Finotive Funding’s two-step evaluation program account aims to identify serious and talented traders who are rewarded for their consistency in the two-phase evaluation period. The evaluation program account allows you to trade with 1:100 up to 1:400 leverage, depending on the account size you choose.

The initial phase of evaluation entails the achievement of a 7.5% profit target by traders, while ensuring that they do not exceed the maximum daily loss of 5% or the maximum loss of 10% as per the prescribed rules. There are no specific requirements regarding the minimum or maximum number of trading days in this phase. To progress to phase two, traders must solely accomplish the 7.5% profit target without violating the maximum daily or maximum loss limits.

In phase two of the evaluation, traders must attain a profit target of 5% while adhering to the 5% maximum daily loss and 10% maximum loss rules. Similar to phase one, there are no restrictions on the minimum or maximum trading days during this phase. To achieve funded status, traders are solely required to reach the 5% profit target without contravening the maximum daily or maximum loss limits.

Upon successful completion of both evaluation phases, traders are granted a funded account without any profit targets. The only requirement is to observe the 5% maximum daily loss and 10% maximum loss rules. The first payout is scheduled two calendar days after the trader initiates their first position in the funded account. Subsequent payouts will be made on a weekly basis following the initial payout. The percentage of profit split ranges from 75% to 95% based on the trader’s profitability in the funded account.

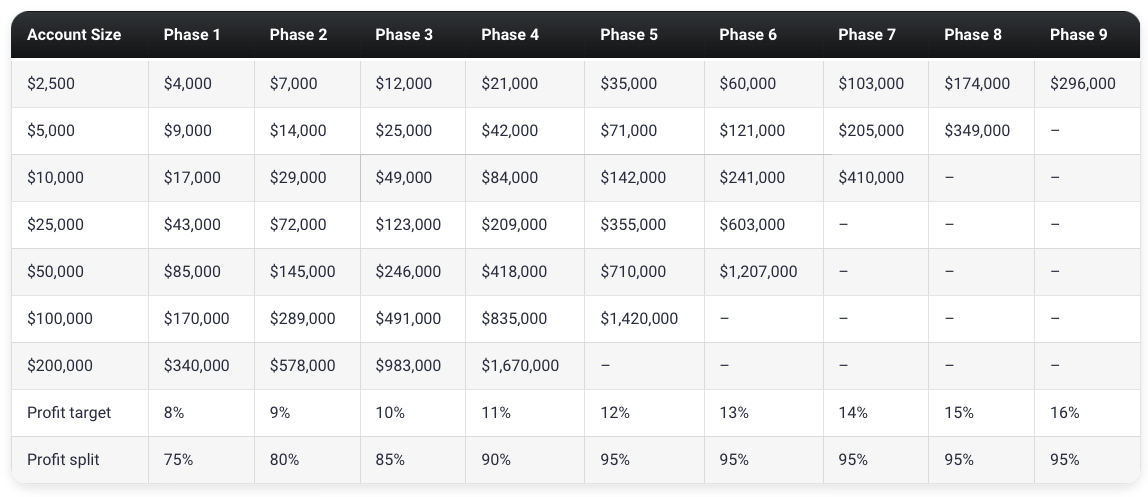

The two-step evaluation program also includes an account scaling plan. Traders need to reach a specific profit target that varies depending on the phase of funded account scaling. You can refer to the provided spreadsheet for details regarding the funded challenge account scaling phases.

The Two-step Evaluation Funding Program incorporates a scaling strategy, as outlined in the accompanying spreadsheet. In order to qualify for account scaling, the sole criterion is achieving the prescribed profit target corresponding to your specific phase within the two-step evaluation funding account. Once the profit target is met, you gain eligibility for scaling your account. It is important to note, however, that scaling your account will result in the inability to withdraw your profits.

Example:

The profit target for your $100,000 account is 8%.

Week 1: You gain 4%.

Week 2: You gain 7%.

Your total profits have reached 11%, which makes you eligible for a scale-up since you have reached the 8% profit target. However, since you made a 3% greater profit, you can first withdraw the 3% profit, and after request to scale your account with the remaining 8% profit that is required.

Trading instruments for the two-step evaluation program accounts are forex pairs, commodities, indices, and cryptocurrencies.

Two-step evaluation program account rules

- The profit target refers to a specific percentage of profit that must be achieved by a trader before they can successfully complete an evaluation phase, withdraw their profits, or scale their account. In phase 1, the profit target is set at 7.5%, while in phase 2, it is reduced to 5%. Funded accounts do not have profit targets.

- Maximum daily loss is the maximum amount of loss that a trader is allowed to incur on a daily basis before their account is considered in violation. For all account sizes, the maximum daily loss is limited to 5%.

- Maximum loss represents the maximum amount of overall loss that a trader can reach before their account is considered in violation. Regardless of the account size, the maximum loss is capped at 10%.

- The “no gambling mentality” policy prohibits traders from engaging in an “all-or-nothing” mindset when making trades. Failure to comply with this rule can result in various consequences, such as hindering progress from the evaluation phase to funded status, denial of profit withdrawals, or refusal to scale the funded account. The following situations are considered signs of gambling or reckless trading:

- 1) Risking 100% or more of the maximum loss limits in open trades, for

- example, having open trades totaling 5% risk when the trader’s maximum daily loss is 5%.

- 2) Risking 50% or more of the maximum loss limits in a single trade or across multiple trades on the same trading instrument, for instance, risking 2.5% on a single position when the trader’s maximum daily loss is 5%.

- Maintaining a consistent practice of trading without implementing set stop-losses is discouraged. While occasional trades without stop-losses may be acceptable, repeatedly neglecting to use stop-losses and engaging in a high volume of unprotected trades raises significant concerns. This is due to the unpredictability of network and hardware issues, making it mutually beneficial for both parties if the trader consistently employs a stop-loss strategy.

- When considering the use of third-party copy trading services, it is important to be aware that these services may involve other traders utilizing the exact same trading strategy. Therefore, there is a potential risk of being denied a funded account or profit withdrawal if the maximum capital allocation rule is exceeded.

- Similarly, when utilizing a third-party EA (Expert Advisor), it is crucial to recognize that other traders may already be using the same trading strategy. As a result, there is a potential risk of being denied a funded account or profit withdrawal if the maximum capital allocation rule is exceeded.

phase one, requires the trader to reach a profit target of 8% while not surpassing the 5% maximum daily loss or 10% maximum losses rule. In this phase there is no maximum day trading requirement, however to access phase two you are required to trade a minimum of 5 trading days.

phase two, requires a trader to reach a profit target of 5% while not surpassing their 5% maximum daily loss or 10% maximum loss rules. As well as it was in phase one you have no minimum trading day requirement, but in order to revive a founded account you will need a minimum of 5 trading days.

Once you complete both challenges, you are awarded with a founded account where you have no profit target, but you are required to respect the 5% maximum daily loss and 10% maximum loss rules. The first profit split is 80% based on the profy you made, plus you will be rewarded with a 15% profit share based on the profit you made on the two phase challenge in addition you will receive your first payout. From there then you will receive your payouts on a bi weekly basis.

The scaling plan of this challenge is that you need to reach a profit target of 10%or more within a four month period where two months are profits and the last month needs to end in profit. Then you will receive an account increase of 40% of the original with the possibility to increase the account balance all the way up to $4,000,000, then your profit slip will increase up to 90% when you scale your account for the first time.

Example:

After 4 months: If you have a $200,000 account, your account balance will increase to $280,000.

After next 4 months: Balance of $280,000 increases to $360,000.

After next 4 months: Balance of $360,000 increases to $440,000.

And so on…

Trading instruments for the two-step Stellar challenge model accounts are forex pairs, commodities, and indices.

Rules for two steps Stellar challenge mode:

-

- The profit target refers to a specific percentage of profit that must be achieved by a trader in order to successfully complete an evaluation phase, withdraw profits, or expand their account. During Phase 1, the profit target is set at 8%, while Phase 2 has a profit target of 5%. It is important to note that funded accounts are not subject to profit targets.

- The maximum daily loss represents the highest allowable loss a trader can incur within a single day before the account is considered in violation. Across all account sizes, there is a uniform maximum daily loss limit of 5%.

- The maximum loss indicates the highest permissible overall loss that a trader can experience before the account is deemed in violation. Similar to the maximum daily loss, all account sizes adhere to a maximum loss threshold of 10%.

- The minimum trading days denote the minimum duration that traders must actively engage in trading before they are eligible to complete a challenge phase or request a withdrawal. Both phases require a minimum of 5 trading days to be fulfilled.

Instant Funding program account:

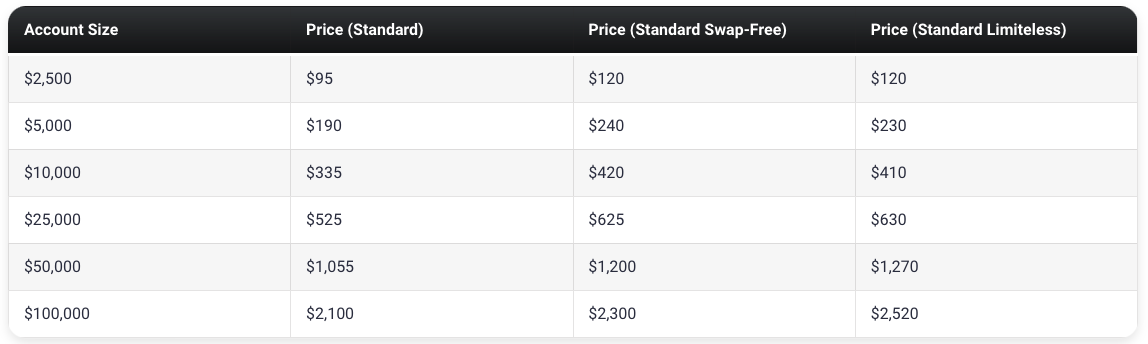

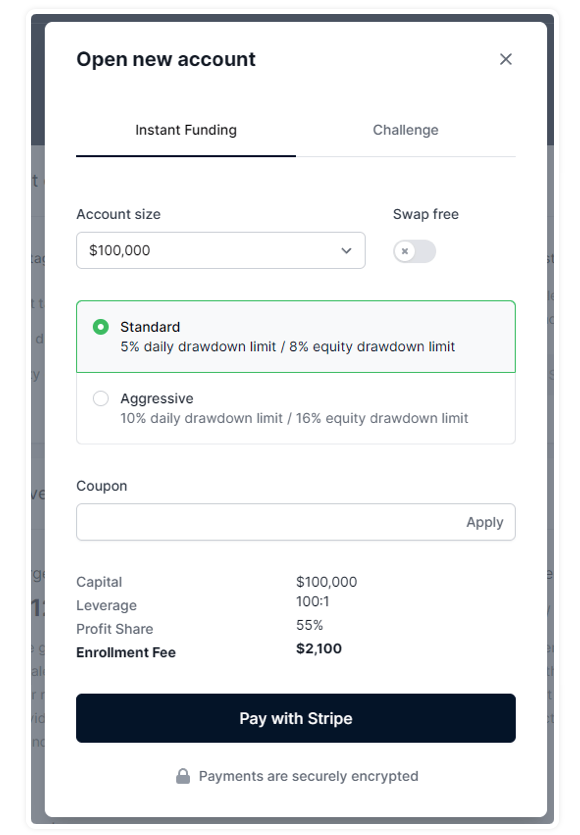

1. Standard instant funding program accounts

The Finotive Funding program offers traders the opportunity to access instant funding, bypassing the evaluation process, and begin earning profits immediately. It is important to adhere to the daily maximum loss limit of 5% and the maximum overall loss limit of 8%. Traders can receive profit splits ranging from 55% to 75% based on their trading performance while utilizing a leverage ratio of 1:100.

Standard instant funding program account scaling plan.

The instant funding program offers standard accounts that include a scaling plan outlined in the provided spreadsheet. To qualify for scaling your account, you need to achieve the profit target associated with your particular phase within the instant funding program. Once you reach the profit target, you become eligible to scale your account. It’s important to note that scaling your account will restrict your ability to withdraw the profits earned during this process.

Example:

The profit target for your $100,000 account is 8%.

Week 1: You gain 4%.

Week 2: You gain 7%.

Your total profits have reached 11%, which makes you eligible for a scale-up since you have reached the 8% profit target. However, since you made a 3% greater profit, you can first withdraw the 3% profit, and after request to scale your account with the remaining 8% profit that is required.

Trading instruments for the standard instant funding program accounts are forex pairs, commodities, indices, and cryptocurrencies.

Standard instant funding program account rules

- The standard instant funding program includes a scaling plan that outlines specific parameters. One such parameter is the maximum daily loss, which represents the maximum allowable loss a trader can incur within a single day before violating the account’s rules. Regardless of the account size, the maximum daily loss is set at 5%.

- Furthermore, the program imposes a maximum loss limit, which represents the overall maximum loss a trader can reach before violating the account’s rules. This maximum loss limit is uniform across all account sizes and is set at 8%.

- In addition, the program defines the maximum trading days as the maximum duration within which a trader must achieve a specific profit target or withdrawal target. For the standard instant funding program, the maximum trading day period is set at 90 days.

- To ensure responsible trading practices, the program prohibits a “gambling mentality” approach, where traders engage in high-risk behaviors. Violation of this rule may lead to consequences such as the prevention of progression from evaluation to funded status, refusal to withdraw profits, or refusal to scale the funded account. Examples of gambling or reckless trading include risking more than 100% of the maximum daily loss limits in open trades or risking 50% or more of the maximum loss limits in a single trade or across multiple trades involving the same trading instrument.

- Additionally, it is advised that traders implement appropriate stop-loss measures while trading. Although the occasional trade without a stop-loss is acceptable, consistently neglecting to use stop-loss orders and engaging in a high volume of unprotected trades raises significant concerns. This is because unforeseen network and hardware issues cannot be predicted, and it is mutually beneficial for both parties if traders consistently utilize stop-loss orders.

- When considering the use of copy trading services provided by third parties, there is a risk of encountering other traders who are already employing the same trading strategy. Therefore, utilizing such services may result in being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- Similarly, when utilizing third-party automated trading systems (EA), it is important to acknowledge that other traders may also be using the same trading strategy. Consequently, exceeding the maximum capital allocation rule while using a third-party EA can potentially lead to denial of a funded account or withdrawal.

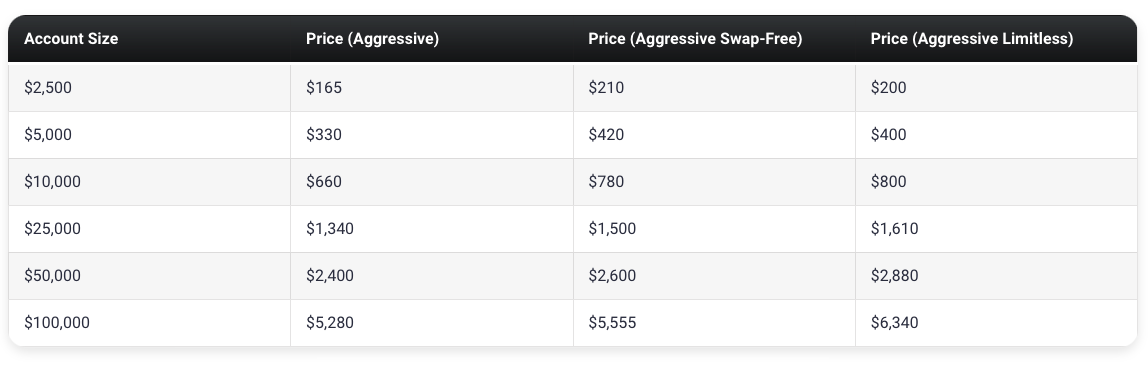

2. Aggressive instant funding program accounts

Finotive Funding offers a robust expedited funding program, enabling traders to bypass the evaluation process and commence earning profits immediately. It is imperative to adhere to the stipulated guidelines, specifically ensuring that the maximum daily gain does not exceed 10% and the maximum allowable loss is capped at 16%. As a trader operating with a 1:100 leverage, you stand to receive profit splits ranging from 60% to 75% based on the profitability of your trading activities

Aggressive instant funding program account scaling plan

The aggressive instant funding program includes a scaling plan, as outlined in the provided spreadsheet. To qualify for scaling your account, the sole requirement is to achieve the profit target designated for your particular phase within the instant funding account. Once you meet this profit target, you become eligible to scale your account. It is important to note that scaling your account will entail forfeiting the ability to withdraw the profits obtained through scaling.

Example:

The profit target for your $100,000 account is 16%.

Week 1: You gain 8%.

Week 2: You gain 14%.

Your total profits have reached 22%, which makes you eligible for a scale-up since you have reached the 8% profit target. However, since you made a 6% greater profit, you can first withdraw the 6% profit, and after request to scale your account with the remaining 16% profit that is required.

Trading instruments for the aggressive instant funding program accounts are forex pairs, commodities, indices, and cryptocurrencies.

Aggressive instant funding program account rules

- The maximum daily loss refers to the highest amount of loss that a trader can incur within a single day before their account is considered in violation. For all account sizes, the maximum allowable daily loss is set at 10%.

- The maximum loss denotes the highest cumulative loss that a trader can reach before their account is deemed in violation. Regardless of the account size, the maximum permissible loss is set at 16%.

- The maximum trading days represent the maximum duration within which a trader is required to achieve a specific profit target or withdrawal goal. Aggressive instant funding program accounts have a maximum trading period of 90 days.

- The absence of a “gambling mentality” implies that traders are prohibited from engaging in trades based on a mindset of “all-or-nothing.” Failure to adhere to this rule may result in various consequences, such as the inability to progress from evaluation to funded status, refusal to allow profit withdrawals, or refusal to scale the funded account. The following scenarios are considered indicators of gambling or reckless trading behavior:

1) Risking 100% or more of the maximum daily loss limit on open trades (e.g., if a trader’s maximum daily loss is 5%, having open trades totaling a 5% risk).

2) Risking 50% or more of the maximum daily loss limit on a single trade or across multiple trades involving the same trading instrument (e.g., risking 2.5% on a single position if the trader’s maximum daily loss is 5%).

3) Consistently trading without implementing stop-loss orders. While an occasional trade without a stop-loss is acceptable, the repeated absence of stop-loss usage and engaging in high-volume unprotected trades raises significant concerns. This is because network and hardware issues cannot be predicted, and it is mutually beneficial for both parties if traders aim to utilize stop-loss orders at all times.

- Third-party copy trading risk highlights the potential consequences when using copy trading services provided by external parties. By utilizing such services, there is a possibility that other traders have already adopted the exact same trading strategy. Consequently, utilizing third-party copy trading services may lead to denial of a funded account or withdrawal if it surpasses the maximum capital allocation rule.

- Third-party EA risk emphasizes the potential risks associated with using third-party EAs (Expert Advisors). When employing a third-party EA, it is important to consider the presence of other traders who may already be utilizing the same trading strategy. Consequently, utilizing third-party EAs may result in denial of a funded account or withdrawal if it exceeds the maximum capital allocation rule.

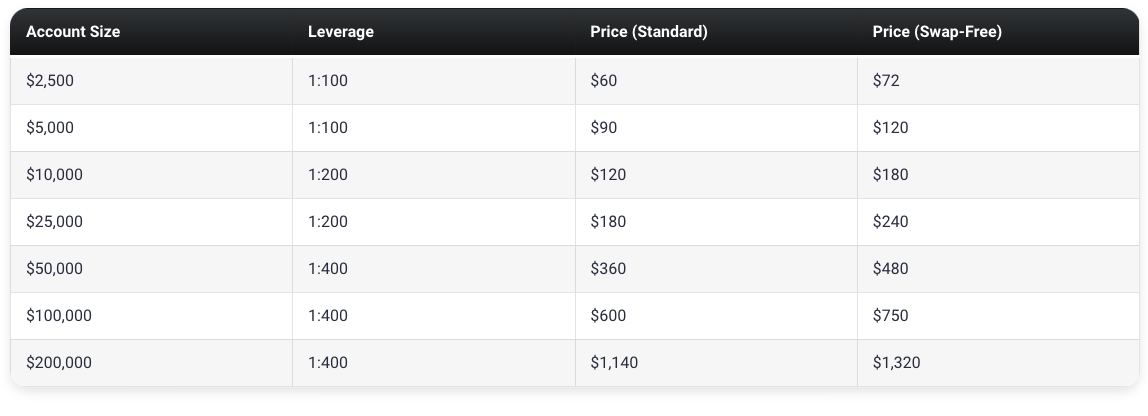

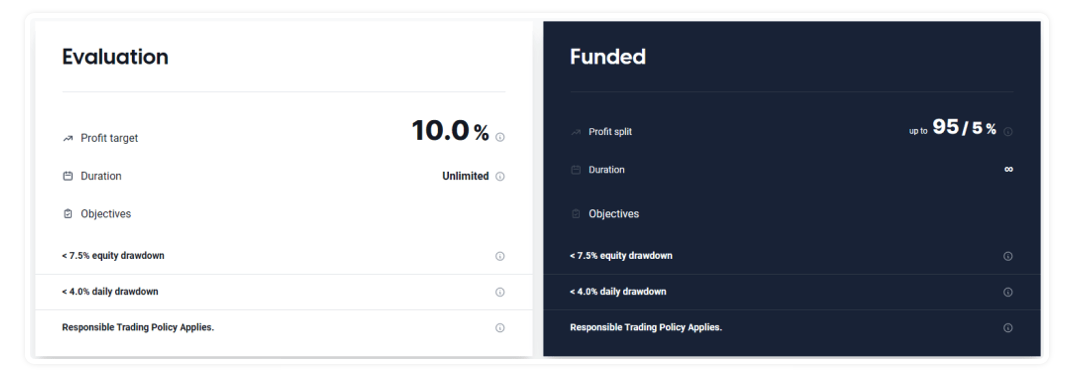

One-step evaluation program account:

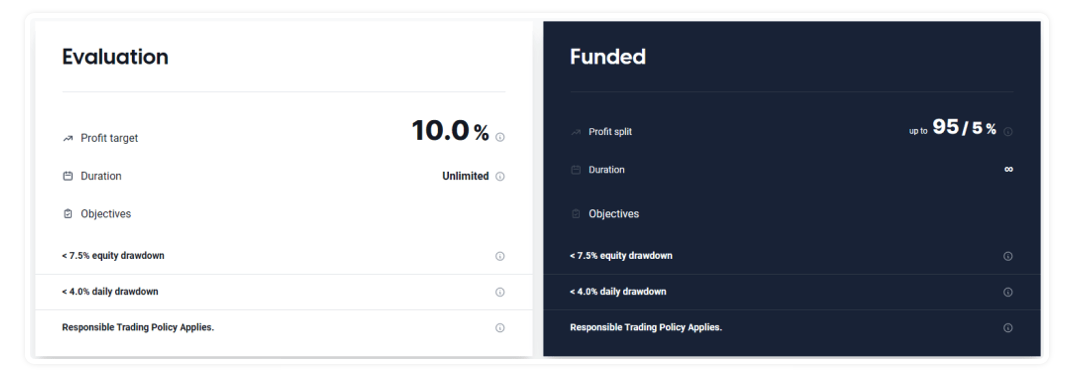

The maximum daily loss refers to the highest amount of financial loss that a trader can incur within a single day. During the evaluation phase, traders are expected to achieve a profit target of 10% while adhering to the constraints of a maximum daily loss of 4% and a maximum loss of 7.5%. There are no specific requirements regarding the duration of trading days for the evaluation account. The sole condition for obtaining a funded account is meeting the profit target.

Upon successful completion of the evaluation phase, traders are granted a funded account, which eliminates the need for profit targets. However, they are still obligated to abide by the 4% maximum daily loss and 7.5% maximum loss rules. The first payout is scheduled for two calendar days after the initial position is taken on the funded account. Subsequent payouts will be made on a weekly basis following the first payout. The percentage of profit split ranges from 75% to 95% depending on the profitability achieved on the funded account.

Additionally, the one-step evaluation program accounts include a scaling plan that necessitates reaching a specific profit target tailored to the respective phase of scaling for the funded account

The one-step evaluation funding program includes a scaling plan outlined in the provided spreadsheet. In order to qualify for scaling your account, the sole requirement is to achieve a profit target specified for your particular phase within the one-step evaluation funding account. Once you have reached the profit target, you become eligible to scale your account. It is important to be aware that scaling your account will result in the inability to withdraw your profits.

Example:

The profit target for your $100,000 account is 8%.

Week 1: You gain 4%.

Week 2: You gain 7%.

Your total profits have reached 11%, which makes you eligible for a scale-up since you have reached the 8% profit target. However, since you made a 3% greater profit, you can first withdraw the 3% profit, and after request to scale your account with the remaining 8% profit that is required.

Trading instruments for the one-step evaluation program accounts are forex pairs, commodities, indices, and cryptocurrencies.

One-step evaluation program account rules

- The profit target represents a specific profit percentage that traders must achieve in order to complete the evaluation phase, withdraw profits, or scale their account. It is set at 10% and does not apply to funded accounts.

- The maximum daily loss refers to the highest allowable loss a trader can incur within a single day before violating the account rules. For all account sizes, the maximum daily loss is capped at 4%.

- The maximum loss represents the maximum cumulative loss a trader can reach before violating the account rules. Across all account sizes, the maximum loss is limited to 7.5%.

- The “no gambling mentality” rule prohibits traders from engaging in “all-or-nothing” trading approaches. Violation of this rule can lead to consequences such as hindered progress from evaluation to funded status, refusal to allow profit withdrawals, or denial of scaling opportunities for funded accounts. Indicators of gambling or reckless trading include risking 100% or more of the maximum loss limits in open trades, risking 50% or more of the maximum loss limits in a single trade or across multiple trades on the same trading instrument, and consistently trading without implementing stop-loss orders. While an occasional trade without a stop-loss is acceptable, repeated failure to use stop-loss orders and engaging in high-volume unprotected trades raise significant concerns. It is in the best interest of both parties to employ stop-loss orders at all times due to the unpredictable nature of network and hardware issues.

- Third-party copy trading risk arises when utilizing copy trading services. Traders should be aware that using a third-party copy trading service may result in adopting the same trading strategy as other traders. This poses the risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- Third-party EA risk arises when utilizing third-party EAs (Expert Advisors). Traders should be aware that using a third-party EA may involve adopting the exact trading strategy as other traders. This poses the risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

What makes Finotive Funding different from other prop firms?

Finotive Funding distinguishes itself from other prominent prop firms by offering a range of three distinct funding programs: the Two-step Evaluation, Instant Funding, and One-step Evaluation programs. One notable advantage is the minimal restrictions imposed on traders’ trading styles, allowing them to engage in trading activities during news events, hold positions overnight, and even trade over weekends.

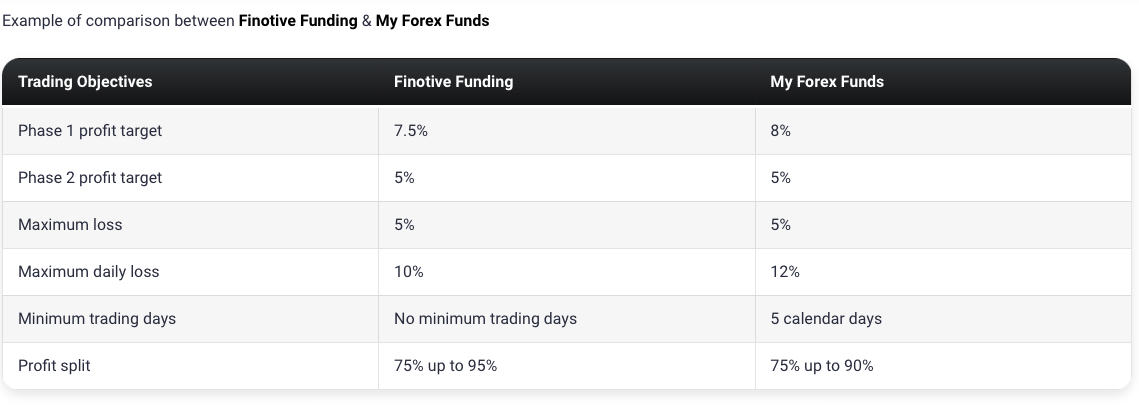

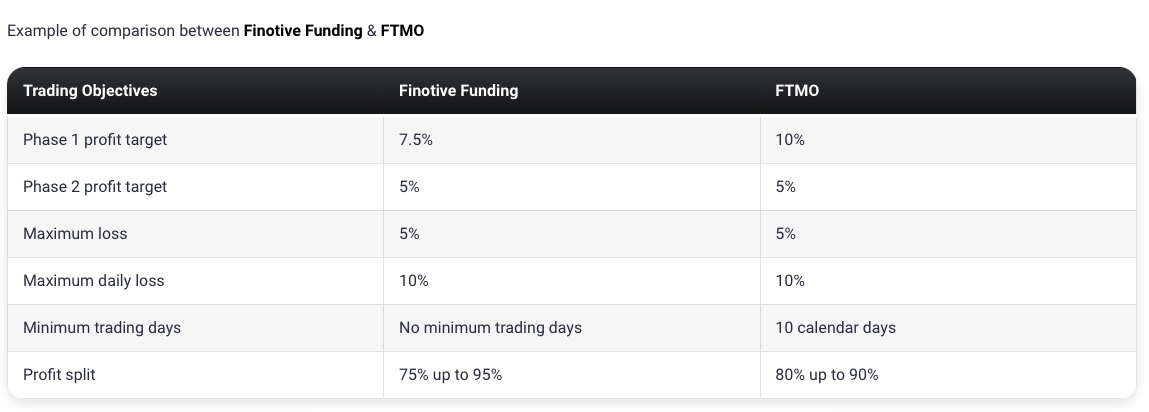

Under Finotive Funding’s Two-step Evaluation program, traders are required to successfully complete two phases to become eligible for payouts. Phase one entails achieving a profit target of 7.5%, followed by a profit target of 5% in phase two. During both phases, traders must adhere to maximum daily loss limits of 5% and maximum overall loss limits of 10%. It is important to note that there are no specific requirements regarding the minimum or maximum number of trading days during either evaluation stage. Furthermore, the evaluation programs incorporate a scaling plan. In comparison to other industry-leading prop firms, Finotive Funding sets relatively lower profit targets and does not impose any time constraints on traders.

In contrast to competing proprietary trading firms, Finotive Funding distinguishes itself by providing instant funding programs that offer prompt capital availability. Traders have the option to select between two tiers of instant funding programs, namely standard and aggressive, each accompanied by predefined limits on daily trading gains (5% for standard and 10% for aggressive accounts) and maximum permissible losses (8% for standard and 16% for aggressive accounts). Notably, there are no mandatory profit targets for qualifying for weekly profit splits ranging from 55% to 75%. The instant funding programs also incorporate a scaling plan to accommodate trader growth.

Finotive Funding’s final funding program, known as the one-step evaluation program, entails a sequential process wherein traders must successfully complete a phase to become eligible for payouts. During the evaluation phase, traders are required to achieve a profit target of 10%, while adhering to maximum daily loss limits of 4% and maximum overall loss limits of 7.5%. It is important to note that there are no stipulated minimum or maximum trading day requirements during this evaluation stage. Similar to the instant funding programs, the evaluation program features a scaling plan. In comparison to other prominent proprietary firms in the industry, Finotive Funding stands out due to its relatively higher maximum allowable loss limits and absence of time constraints.

To summarize, Finotive Funding distinguishes itself from other leading proprietary trading firms by offering a diverse range of three funding programs. Moreover, they provide traders with flexible trading regulations, making them an appealing choice for traders regardless of their level of experience.

Is getting Finotive Funding capital realistic?

When evaluating prop firms that align with your forex trading style, it is crucial to assess the feasibility of the trading requirements. While a proposition that offers a high percentage profit split on a generously funded account may seem appealing, it is important to consider the expectations of achieving high percentage gains per month alongside low percentage maximum drawdowns. In such cases, the likelihood of achieving success becomes exceedingly slim.

Receiving capital through two-step evaluation programs is generally considered realistic due to their relatively modest profit targets (7.5% in phase one and 5% in phase two) and reasonable maximum loss regulations (5% maximum daily and 10% maximum loss).

Similarly, obtaining capital through instant funding programs can also be viewed as realistic, as these programs provide direct funding opportunities that allow you to commence earning immediately. In these cases, there are no specific profit target requirements to fulfill in order to be eligible for weekly withdrawal requests.

Furthermore, one-step evaluation programs offer a realistic approach to securing capital, particularly because they entail an average profit target of 10% along with above-average maximum loss rules (4% maximum daily and 7.5% maximum loss).

Taking all of these factors into consideration, Finotive Funding emerges as an excellent choice for accessing capital. With three distinct funding programs available, each with realistic trading objectives and conditions for receiving payouts, it presents a favorable option.

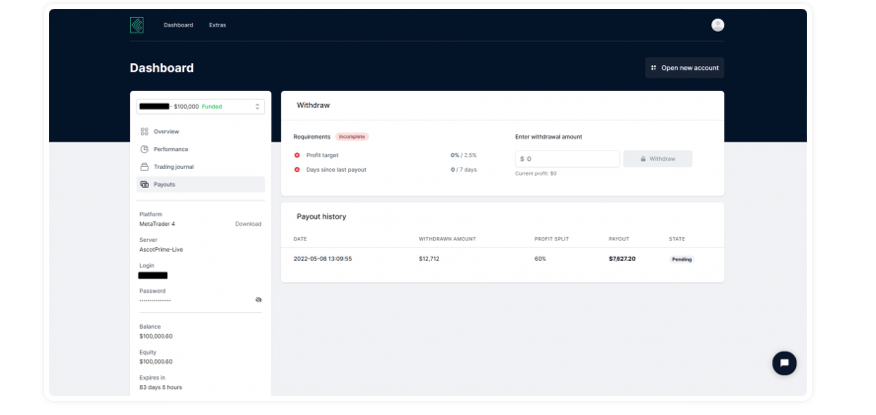

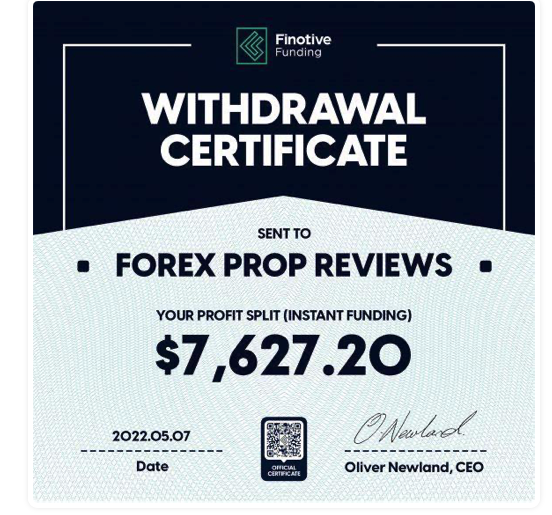

Payment proof

Finotive Funding was established by Oliver Newland on April 23, 2021. Eligibility for disbursements is contingent upon successfully completing either the two-stage evaluation or the one-stage evaluation. Alternatively, if you prefer immediate funding, you have the option to earn from the outset. For evidence of payments, please refer to Finotive Funding’s Instagram account, specifically the section labeled “Payouts,” or access their Discord channel and search for “Payout proof.”

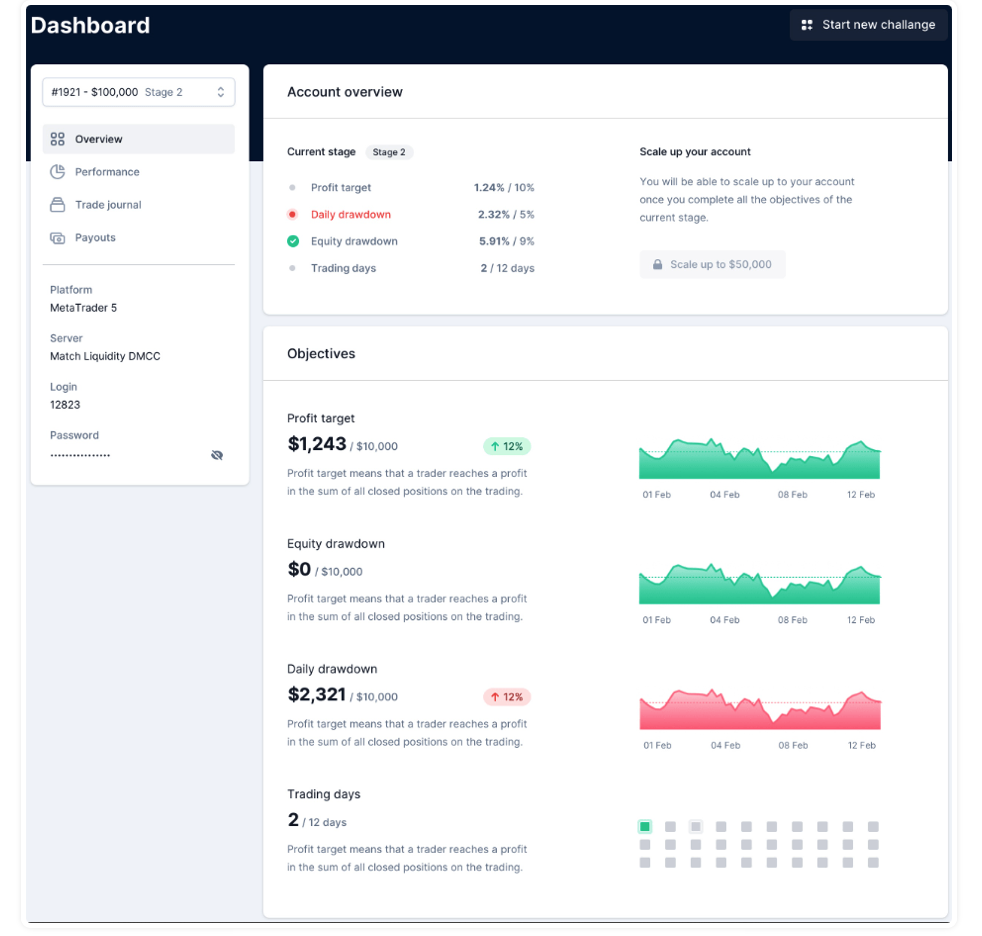

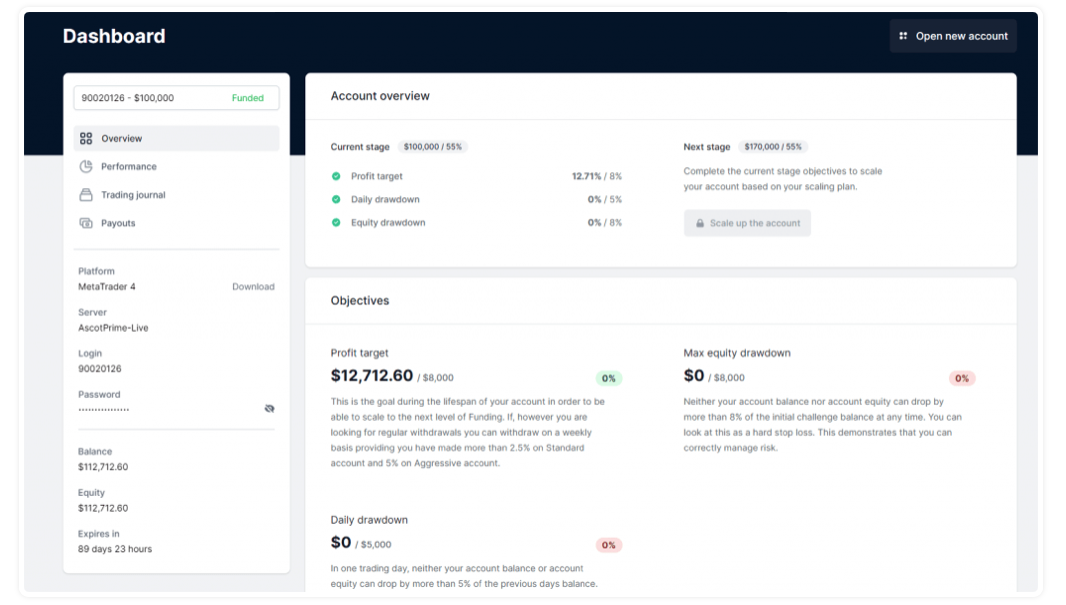

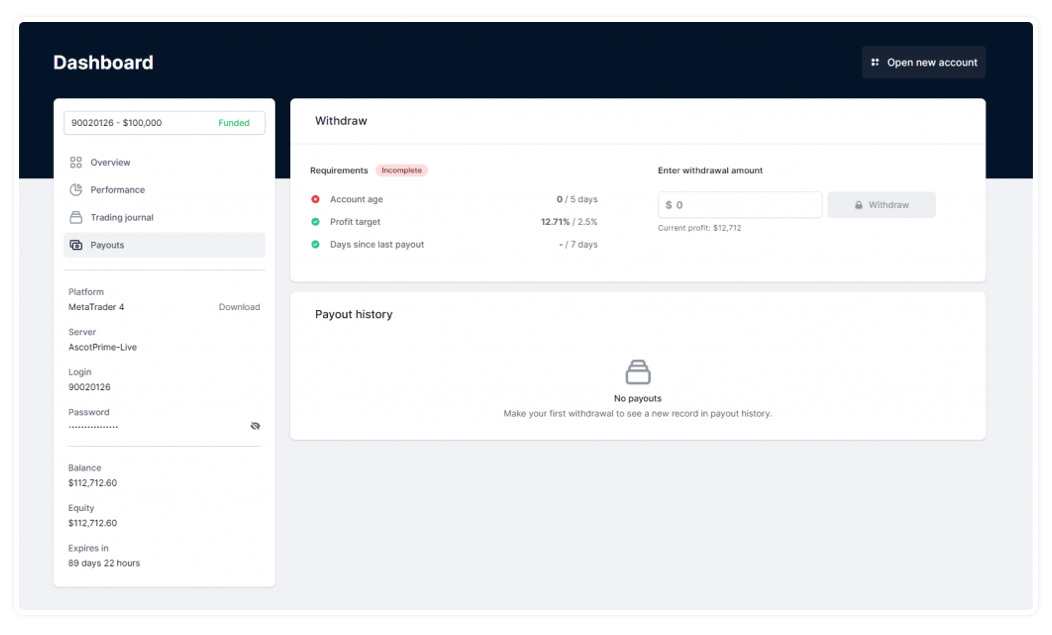

You can see an example of our first profit split from their instant funding program in the pictures below:

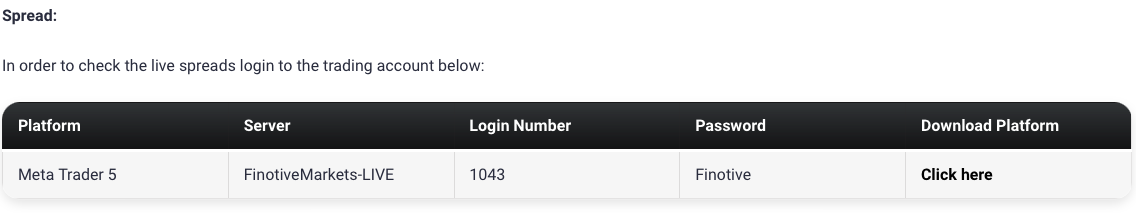

Which brokers do Finotive Funding use?

Finotive Funding has its broker named Finotive Markets, which they are planning on getting fully regulated sometime in 2023.

As for trading platforms, you are allowed to use MetaTrader 5.

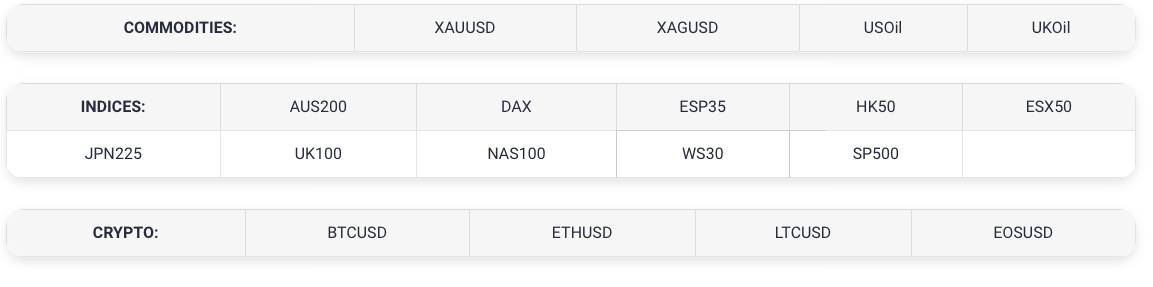

Trading instruments:

Finotive Funding allows its clients to trade forex pairs, commodities, indices, and cryptocurrencies.

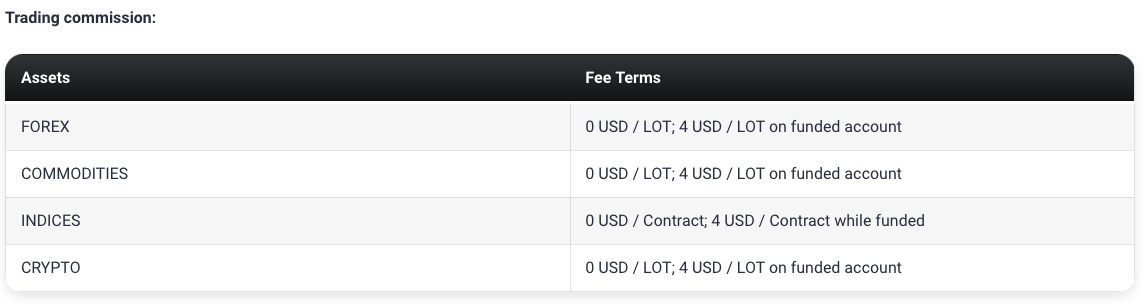

Trading fees

Education and support for traders

Finotive Funding does not offer any educational content on its website.

Although Finotive Funding is not actively present on ForexFactory, it has been referenced multiple times in a separate thread titled “PROP FIRM HUB” authored by a user named Mastermind.

Customer Support

Finotive Funding provides a Frequently Asked Questions (FAQ) section on its website, which may contain the information you are seeking.

Their support team can be reached through their social media channels or by direct email communication at info@finotivefunding.com.

Additionally, they offer live chat support on their website, where you can contact them for the desired information or assistance.

They also have a modern dashboard where traders can check their performance:

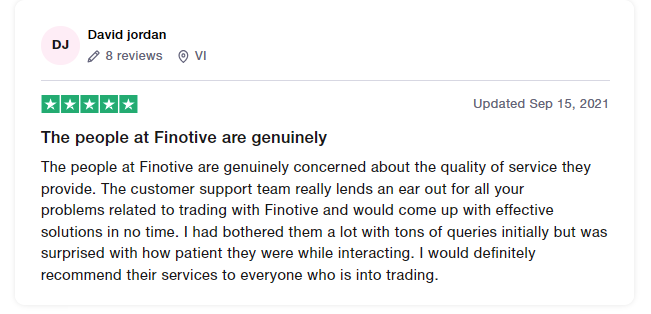

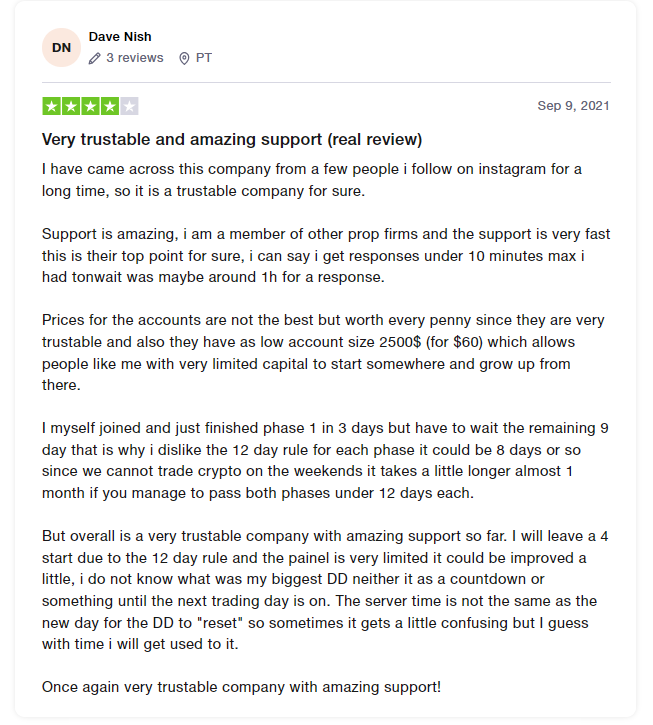

Traders’ Comments about Finotive Funding

Finotive Funding has great feedback from their reviews.

On Trustpilot, they have a large variety of their community commenting and giving positive feedback, with a great score of 4.2/5 out of 125 reviews.

Most of the Finotive Funding community praises their customer support team, who seem to be prompt and patient while dealing with their client’s issues and resolving them. Another comment mentioned their diversity with their account sizes that start from $2,500 up to $200,000, making it also accessible for traders that have limited amounts of capital.

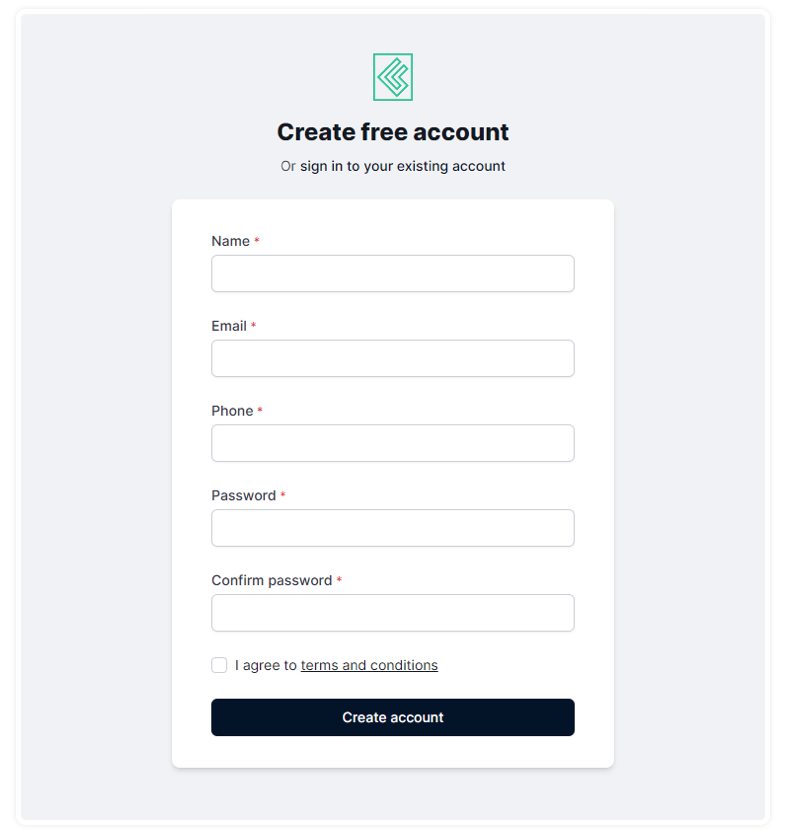

2. Choose your account.

3. Click on the dashboard to see your login details and account statistic.

4. Visit the payouts section in order to make a withdrawal, traders can withdraw every week.

Conclusion

In summary, Finotive Funding is a reputable proprietary trading firm that provides traders with the opportunity to select from three distinct funding programs: two-step evaluation, instant funding, and one-step evaluation.

The two-step evaluation programs follow the industry standard of a two-phase evaluation process, which necessitates completing both phases successfully to secure funding and become eligible for profit sharing. Finotive Funding requires traders to achieve profit targets of 7.5% in the first phase and 5% in the second phase before obtaining funding. These objectives are realistic and align with the guidelines of a maximum 5% daily loss and 10% maximum loss. Through the evaluation programs, traders can earn profit splits of up to 95% and have the ability to scale their accounts.

Instant funding programs, on the other hand, are direct funding options that enable traders to bypass the evaluation period and commence trading with a funded account, immediately earning weekly profit splits. The maximum trading period for instant funding program accounts is 90 days. With instant funding programs, traders can earn profit splits ranging from 55% to 75% while also having the flexibility to scale their accounts.

Lastly, the one-step evaluation programs require completing a single phase before obtaining funding and becoming eligible for profit sharing. Traders must achieve a profit target of 10% in order to secure funding. These objectives are reasonable, considering the maximum daily loss limit of 4% and the maximum loss limit of 7.5% imposed by Finotive Funding. Through one-step evaluation programs, traders can earn profit splits of up to 95% and have the opportunity to scale their accounts.

I highly recommend Finotive Funding to individuals seeking a prop firm with transparent trading rules. As a relatively new proprietary trading firm, they offer favorable conditions and three funding programs catering to a diverse range of traders with unique styles. Considering all the advantages Finotive Funding brings to the table, they undeniably rank among the top prop firms in the industry.