“Empower Your Trading with Goat Funded Trader: Unlock Success”

“Goat Funded Trader: Exceptional Trading Experience | 24/7 Global Support, Refundable Fees, Low Targets | Best Tools, Competitive Commissions, Tight Spreads | Two-Step Funding Programs”

Goat Funded Trader is a proprietary trading firm that prioritizes the success of traders and provides them with an exceptional trading experience. The company’s dedication lies in offering traders worldwide access to 24/7 customer service, refundable fees, low-profit targets, top-notch trading tools, competitive commissions, tight spreads, and a choice between two-step funding programs.

Pros of Goat Funded Trader

75% up to 95% profit split

Leverage 1:100

Two two-step funding program options

No time limit evaluation program

Low evaluations profits targets 8% and 5%

overnight and weekend holding allowed

News trading allowed

well structured user dashboard

A large variety of trading instruments (forex pairs, commodities, indices)

Cons of Goat Funded Trader

No scaling plan

Lack of community feedback

Goat Funded Trader is a proprietary trading firm dedicated to facilitating the success of traders through an exceptional trading environment. With a global reach, our firm provides round-the-clock customer service, refundable fees, conservative profit targets, cutting-edge trading tools, competitive commissions, and tight spreads. We empower traders to generate substantial profits by managing account sizes of up to $400,000 and benefiting from profit splits of up to 95%. Our diverse trading options encompass forex pairs, commodities, indices, equities, and cryptocurrencies.

Who are Goat Funded Trader?

Goat Funded Trader is an exclusive proprietary trading firm that was established on May 17th, 2023. The firm provides traders with the opportunity to operate with a capital balance of up to $800,000, enabling them to benefit from profit splits of up to 95%. As a strategic alliance, they have partnered with ThinkMarkets, a renowned brokerage firm. The firm’s headquarters are situated in the Canary Islands, Spain.

Edoardo Dalla Torre is the CEO of Goat Funded Trade

The founding program options

Goat Funded Trader offers its traders two two-step evaluation funding programs to choose from:

- No Time Limit Evaluation

- Classic Evaluation

No time limit evaluation:

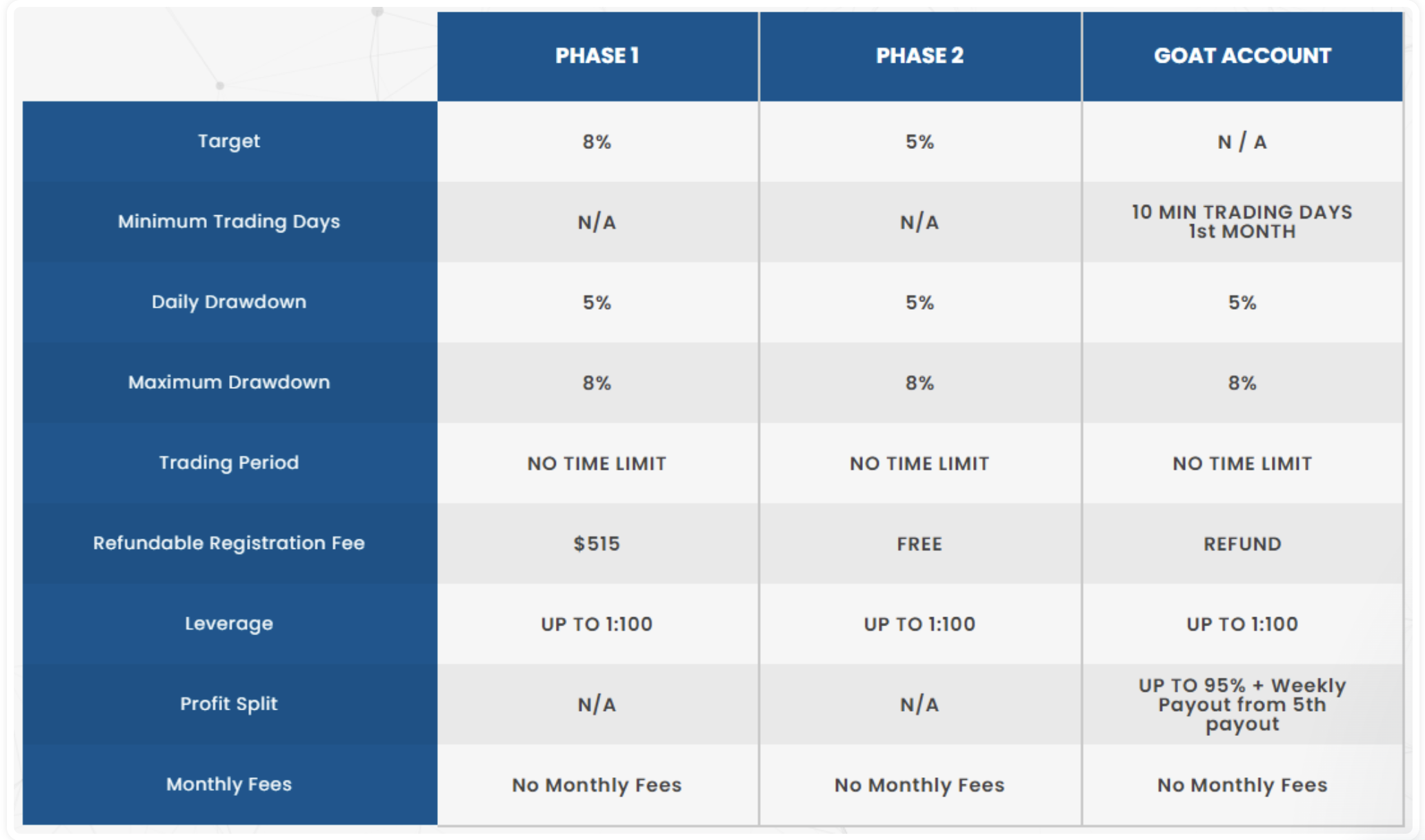

Phase one of the evaluation process necessitates that a trader achieves an 8% profit target while ensuring that their losses do not exceed 5% per day or 8% overall. The sole requirement is to meet the profit target within an unspecified time frame. Moreover, there is no minimum number of trading days necessary to progress to phase two.

Phase two of the evaluation process requires traders to attain a 5% profit target while adhering to the 5% daily loss limit and the 8% maximum loss rule. Similar to phase one, the only requirement is to reach the profit target within an unspecified time frame. Furthermore, there are no minimum trading day requirements to advance to a funded account.

Upon successfully completing both evaluation phases, traders are granted a funded account without specific profit targets. The only obligations are to abide by the 5% daily loss limit and the 8% maximum loss rule. The first payout is scheduled 30 calendar days after initiating trading on the funded account, with a minimum trading period of 10 calendar days within those 30 days. The initial profit split consists of 75% based on the profits generated in the funded account. Subsequent profit splits of 80%, 85%, and 90% can be requested bi-weekly, followed by weekly payouts after the fifth split. Traders may also request an increase in the profit split to 95% by meeting specific criteria and obtaining approval from the firm’s support team.

The no-time limit evaluation program does not include a scaling plan. Trading instruments available for these accounts encompass forex pairs, commodities, indices, equities, and cryptocurrencies

No Time Limit Evaluation program account rules

- The profit target refers to a specific percentage of profit that must be achieved by a trader to successfully complete an evaluation phase, withdraw profits, or expand their account. In phase 1, the profit target is set at 8%, while in phase 2, it is 5%. Funded accounts do not have profit targets.

- The maximum daily loss represents the highest allowable loss a trader can incur within a single day before violating their account terms. For all account sizes, the maximum daily loss is limited to 5%.

- The maximum loss refers to the highest permissible cumulative loss that a trader can experience before violating their account terms. This applies to all account sizes, with a maximum loss limit of 8%.

- The minimum trading days signify the minimum duration for which a trader is required to engage in trading activities before completing an evaluation phase or making a withdrawal. Evaluation phases do not have a minimum trading day requirement. However, on a funded account, a minimum of 10 trading days must be completed before becoming eligible for the first payout.

- Third-party copy trading risk entails the consideration that when using copy trading services provided by a third party, there may already be other traders employing the same trading strategy. Engaging in third-party copy trading carries the potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- Third-party EA risk denotes the acknowledgment that when utilizing a third-party EA (Expert Advisor), there may be other traders already using the same trading strategy. The use of a third-party EA poses the potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is surpassed.

Classic evaluation program account:

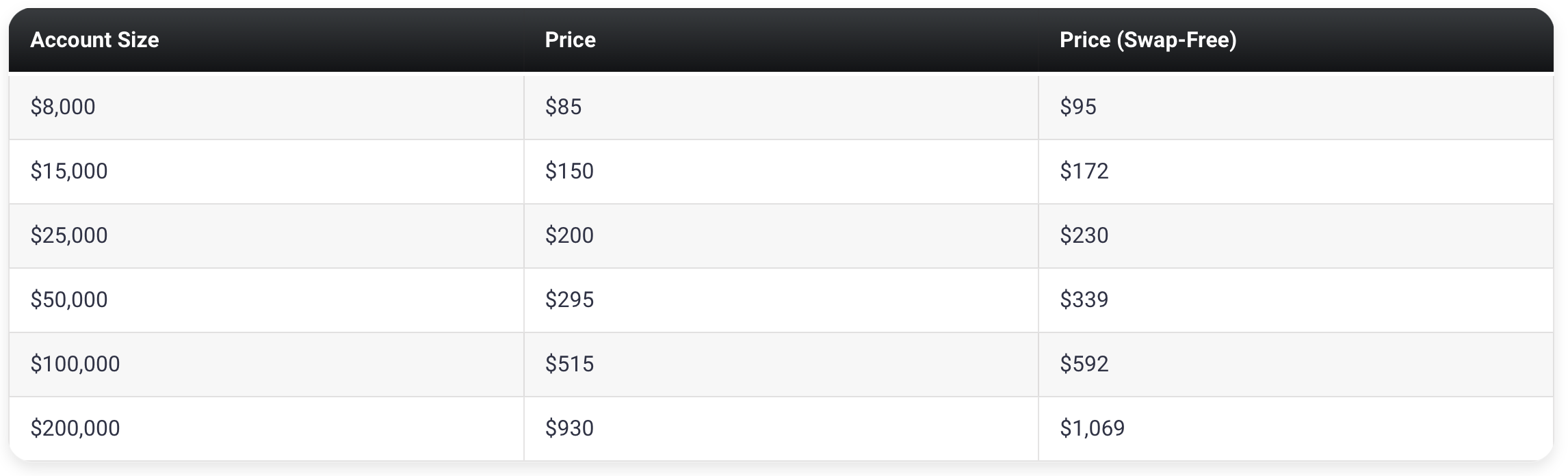

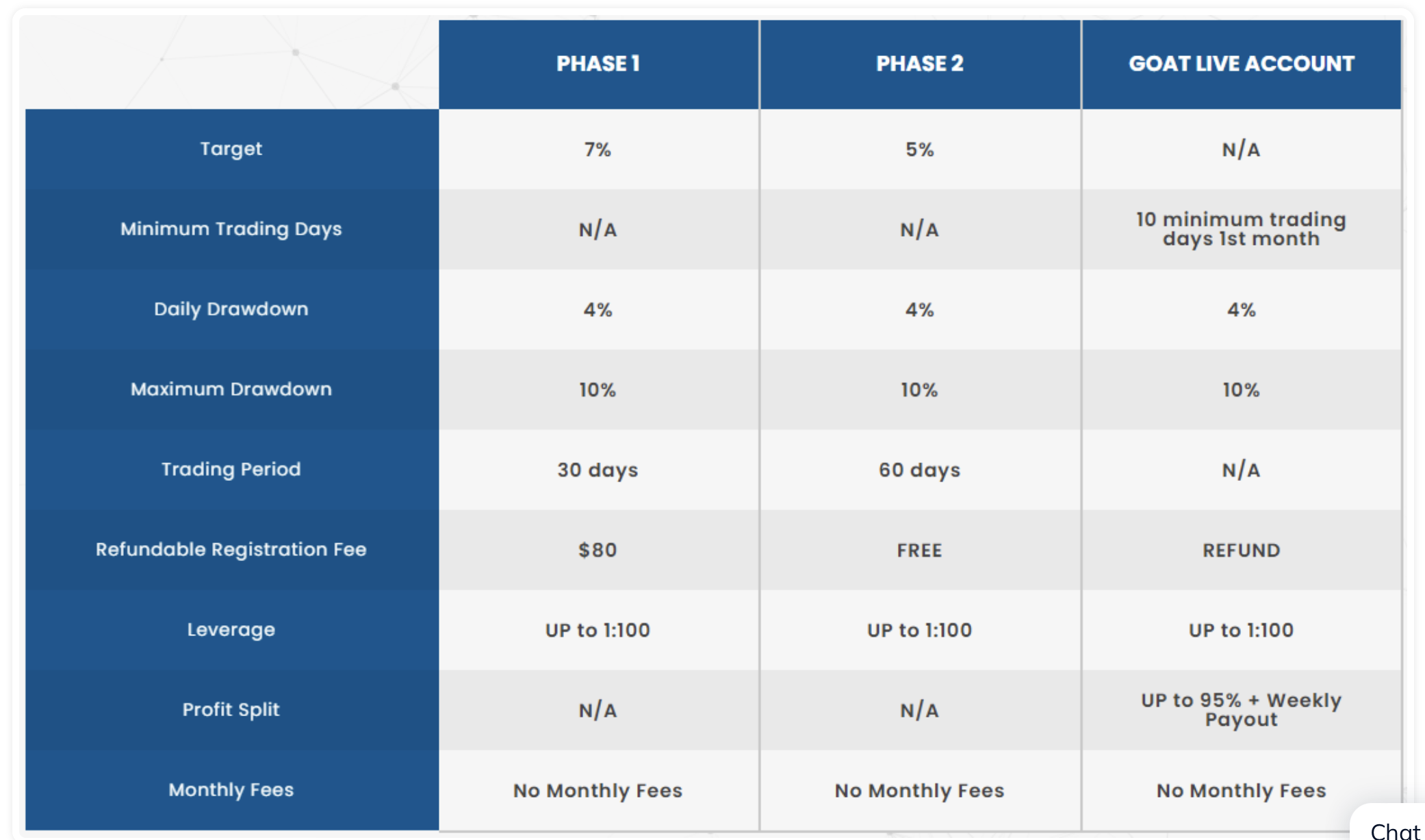

Phase one of the evaluation process entails the trader achieving an 8% profit target without exceeding the maximum daily loss of 5% or the maximum overall loss of 10%. The trader must reach the profit target within 30 days starting from the day they initiate their first trade in the evaluation account. However, there are no minimum trading day requirements to proceed to phase two.

Phase two of the evaluation process requires the trader to attain a 5% profit target while adhering to the maximum daily loss of 5% and the maximum overall loss of 10%. The trader must achieve this profit target within 60 days from the day they initiate their first trade in the evaluation account. Similar to phase one, there are no minimum trading day requirements to advance to a funded account.

Upon successful completion of both evaluation phases, the trader will be granted a funded account, wherein profit targets are not imposed. The only requirements are to observe the maximum daily loss of 5% and the maximum overall loss of 10%. The initial payout will be made 30 calendar days from the day the trader executes their first trade in the funded account. It is important to note that during these 30 days, the trader must engage in a minimum of 10 calendar days of trading. The first profit split will amount to 75% of the profits made in the funded account. Subsequent payouts, consisting of 80%, 85%, and 90% profit splits, can be requested on a bi-weekly basis. After the fifth payout, the trader will be eligible to request weekly payouts. Moreover, the trader has the option to request an increase in the profit split to 95%, which is subject to meeting specific criteria and obtaining approval from the firm’s support team.

The classic evaluation program does not involve a scaling plan for the accounts. The trading instruments available for the classic evaluation program accounts encompass forex pairs, commodities, indices, equities, and cryptocurrencies.

Classic Evaluation program account rules

- The profit target refers to a predetermined percentage of profit that must be achieved by a trader before they can successfully conclude an evaluation phase, withdraw profits, or expand their trading account. Phase 1 requires reaching an 8% profit target, while Phase 2 entails a 5% profit target. Funded accounts do not have profit targets.

- Maximum daily loss denotes the highest allowable loss that a trader can incur within a single day before their account is considered in violation. Regardless of the account size, the maximum daily loss limit is set at 5%.

- The maximum loss represents the highest acceptable cumulative loss a trader can sustain overall before their account is deemed in violation. All account sizes have a maximum loss limit of 10%.

- Minimum trading days refer to the minimum duration that a trader must engage in trading before they can conclude an evaluation phase or initiate a withdrawal. Evaluation phases do not impose a minimum trading day requirement. However, for funded accounts, traders are obliged to engage in a minimum of 10 trading days before becoming eligible for their initial payout.

- Maximum trading days indicate the maximum timeframe within which a trader must achieve a specific profit target or withdrawal objective. Phase 1 allows a maximum trading period of 30 days, while Phase 2 allows a maximum trading period of 60 days.

- Third-party copy trading risk highlights the potential implications of utilizing copy trading services from external providers. It is important to consider that such services may be utilized by other traders employing identical trading strategies. Consequently, employing a third-party copy trading service carries the risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- Third-party EA risk emphasizes the potential consequences of utilizing a third-party EA (Expert Advisor) for trading purposes. Similar to copy trading services, it is essential to recognize that other traders may also be employing the same trading strategy through the use of a third-party EA. Consequently, employing a third-party EA carries the risk of being denied a funded account or withdrawal if the maximum capital allocation rule is surpassed.

What makes Goat Funded Trader different from other prop firms?

Goat Funded Trader distinguishes itself from most industry-leading proprietary firms by allowing traders to maintain their trading styles without imposing any regulatory constraints. Traders are free to engage in trading activities during news events, hold positions overnight, and even trade on weekends. Furthermore, the company does not enforce any minimum trading day requirements, enabling traders to access funding as soon as they achieve their profit targets.

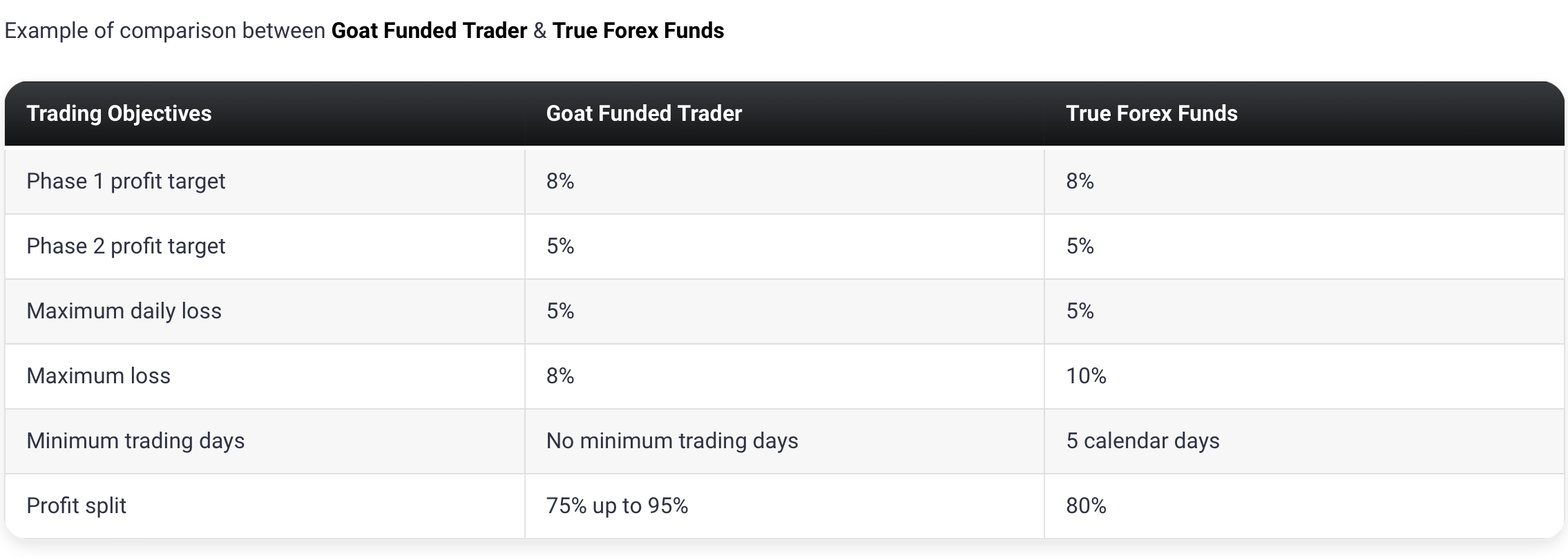

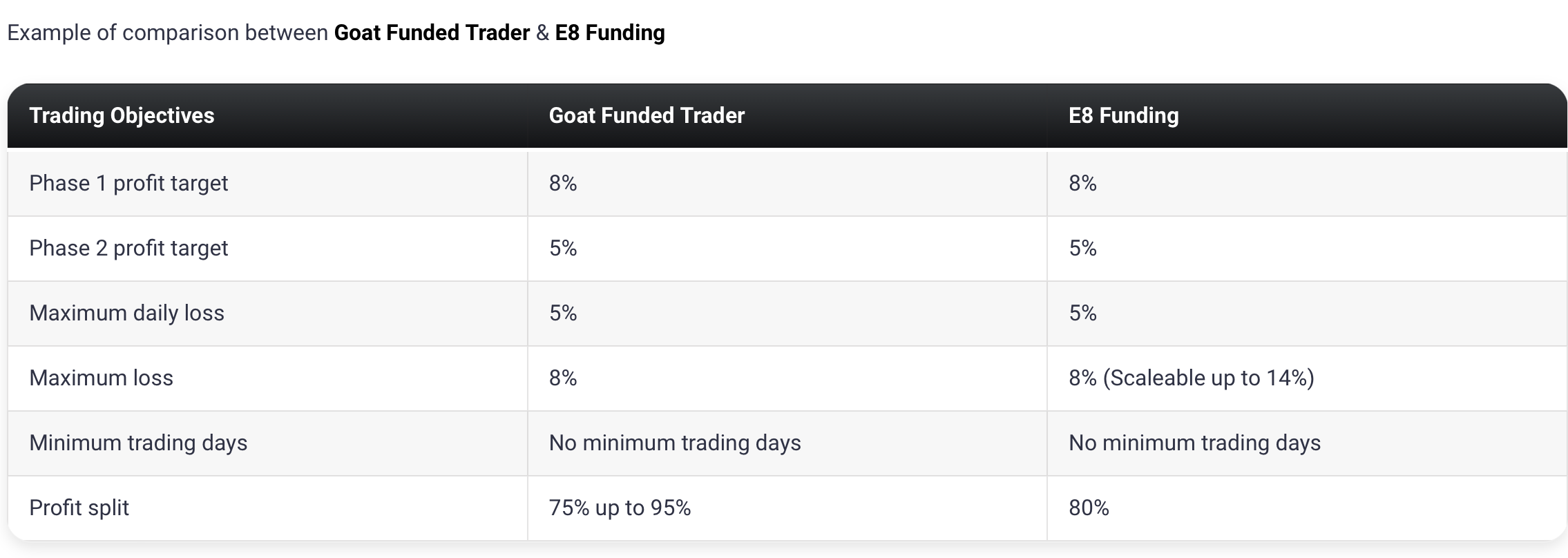

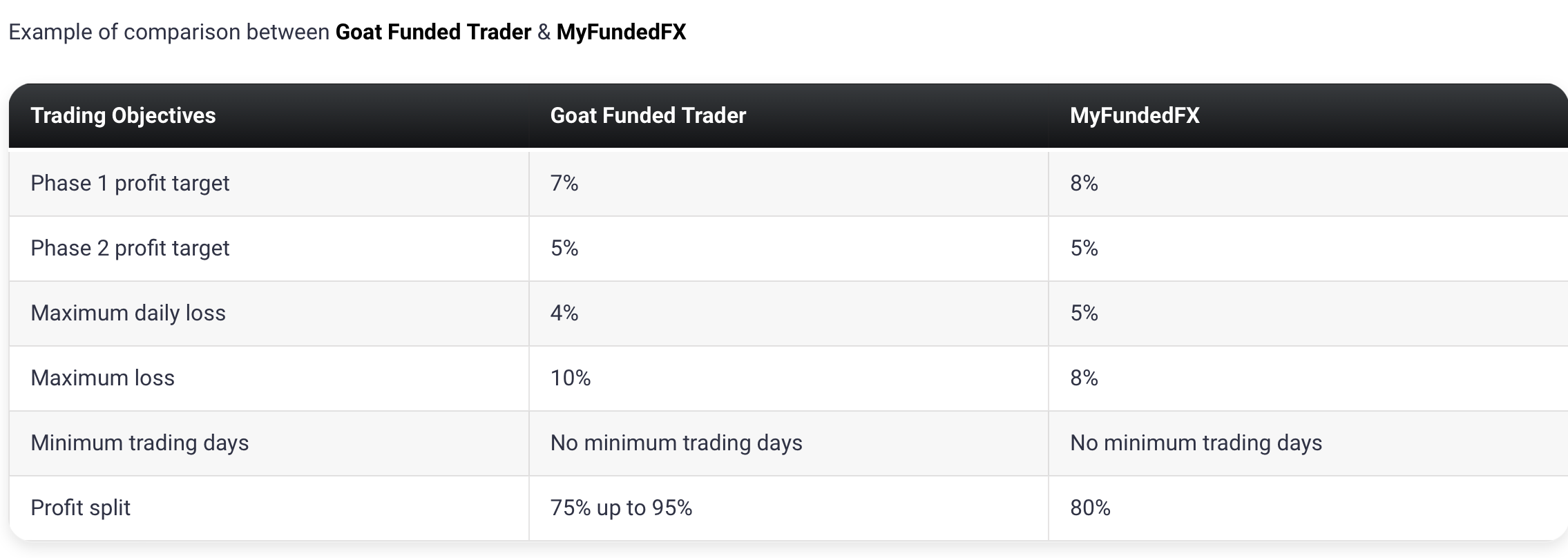

The evaluation program offered by Goat Funded Trader, known as the “no time limit evaluation program,” consists of two phases that traders must successfully complete to become eligible for payouts. In phase one, traders are required to achieve an 8% profit target, while phase two has a 5% profit target. Both phases have rules in place to limit daily losses to a maximum of 5% and overall losses to a maximum of 8%. Additionally, there are no minimum trading day obligations in either phase before attaining funded status. It is important to note that Goat Funded Trader’s evaluation programs do not incorporate a scaling plan. In comparison to other leading proprietary firms in the industry, Goat Funded Trader sets relatively modest profit targets and does not impose maximum or minimum trading day limitations.

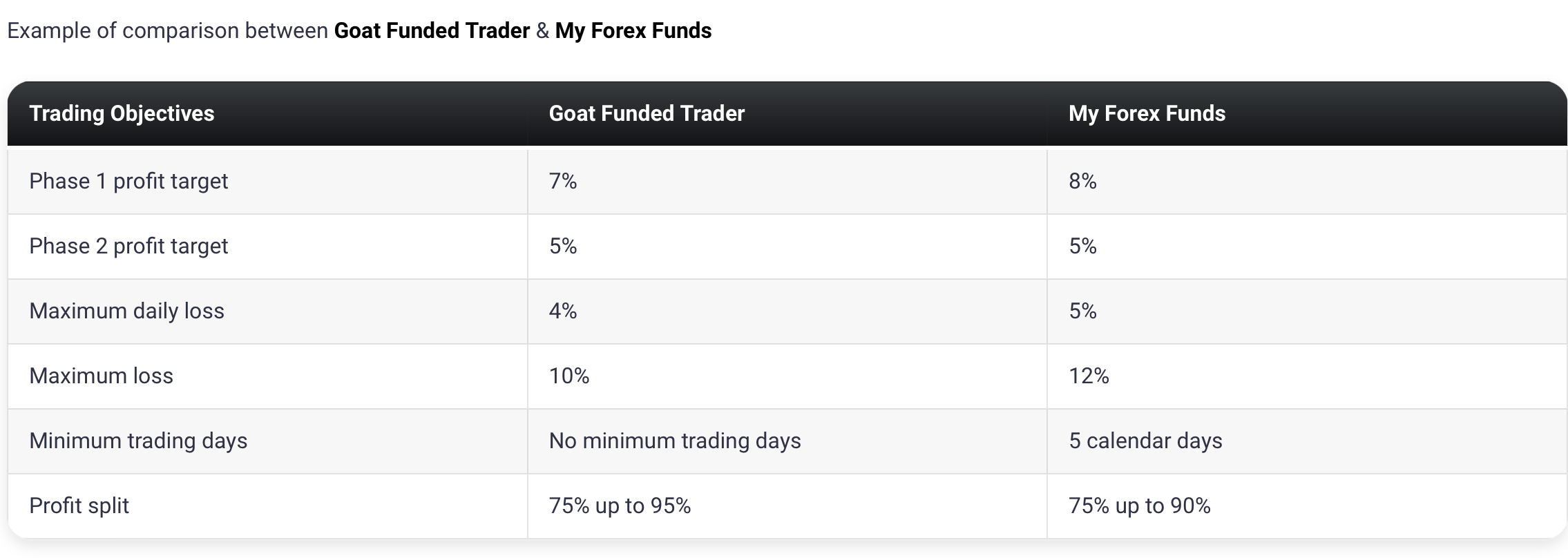

The Goat Funded Trader classic evaluation program is a comprehensive two-phase assessment program wherein traders must successfully fulfill both phases to qualify for monetary rewards. Phase one entails achieving an 8% profit target, while phase two requires a 5% profit target. Throughout both phases, traders must adhere to specific risk management guidelines, including a maximum daily loss limit of 5% and a maximum overall loss limit of 10%. Furthermore, there is no stipulated minimum trading days requirement for traders to obtain funding. It is important to note that the classic evaluation program offered by Goat Funded Trader differs from comparable prop firms in the industry, as it features comparatively modest profit targets and lacks any mandatory minimum trading day obligations.

Goat Funded Trader sets itself apart from the majority of prominent proprietary trading firms by refraining from imposing restrictions on your trading style. This implies that you have the freedom to engage in trading activities during news events, hold positions overnight, and participate in trading activities over weekends, without being subjected to any minimum trading day prerequisites.

Is getting Goat Funded Trader capital realistic?

It is crucial to assess the viability of trading requirements when evaluating proprietary firms that align well with your forex trading style. For instance, while a company offering a substantial percentage profit split on a well-capitalized account may seem enticing if they expect high monthly percentage gains coupled with low maximum drawdown percentages, your chances of achieving success become significantly diminished.

Receiving capital through evaluation programs that impose no time limit is generally more feasible, as they tend to have relatively modest profit targets (8% in phase one and 5% in phase two) along with reasonable maximum loss regulations (5% maximum daily and 8% maximum loss). Furthermore, these programs do not impose any limitations on the number of trading days, whether minimum or maximum.

Likewise, receiving capital through classic evaluation programs is also realistic, given their relatively low-profit targets (8% in phase one and 5% in phase two) and average maximum loss restrictions (5% maximum daily and 10% maximum loss). Additionally, there are no mandatory minimum trading day requirements in these programs.

Taking all these factors into consideration, Goat Funded Trader emerges as an exceptional choice for accessing funding. This is primarily since both the no-time limit and classic evaluation program accounts offered by Goat Funded Trader feature realistic trading objectives and conditions for qualifying for payouts.

Payment proof

Goat Funded Trader was incorporated on the 17th of May, 2023, meaning that there is still no information regarding payout proof from their traders.

Which brokers do Goat Funded Trader use?

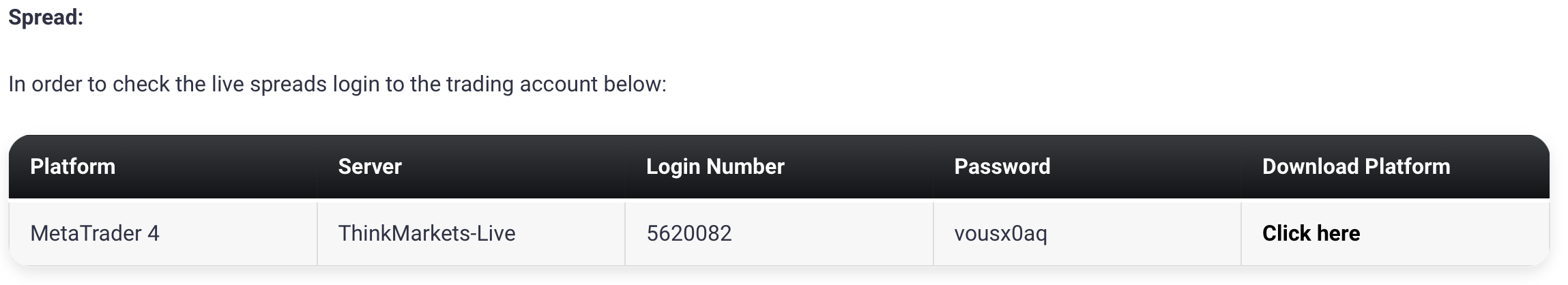

Goat Funded Trader uses ThinkMarkets as their broker.

ThinkMarkets is a distinguished online brokerage specializing in multi-asset trading, with its headquarters situated in London and Melbourne. The company offers seamless access to a diverse array of markets, alongside highly acclaimed trading platforms such as MetaTrader 4, MetaTrader 5, and their proprietary ThinkTrader platform.

As for trading platforms, they allow you to trade on Meta Trader 4 and MetaTrader 5

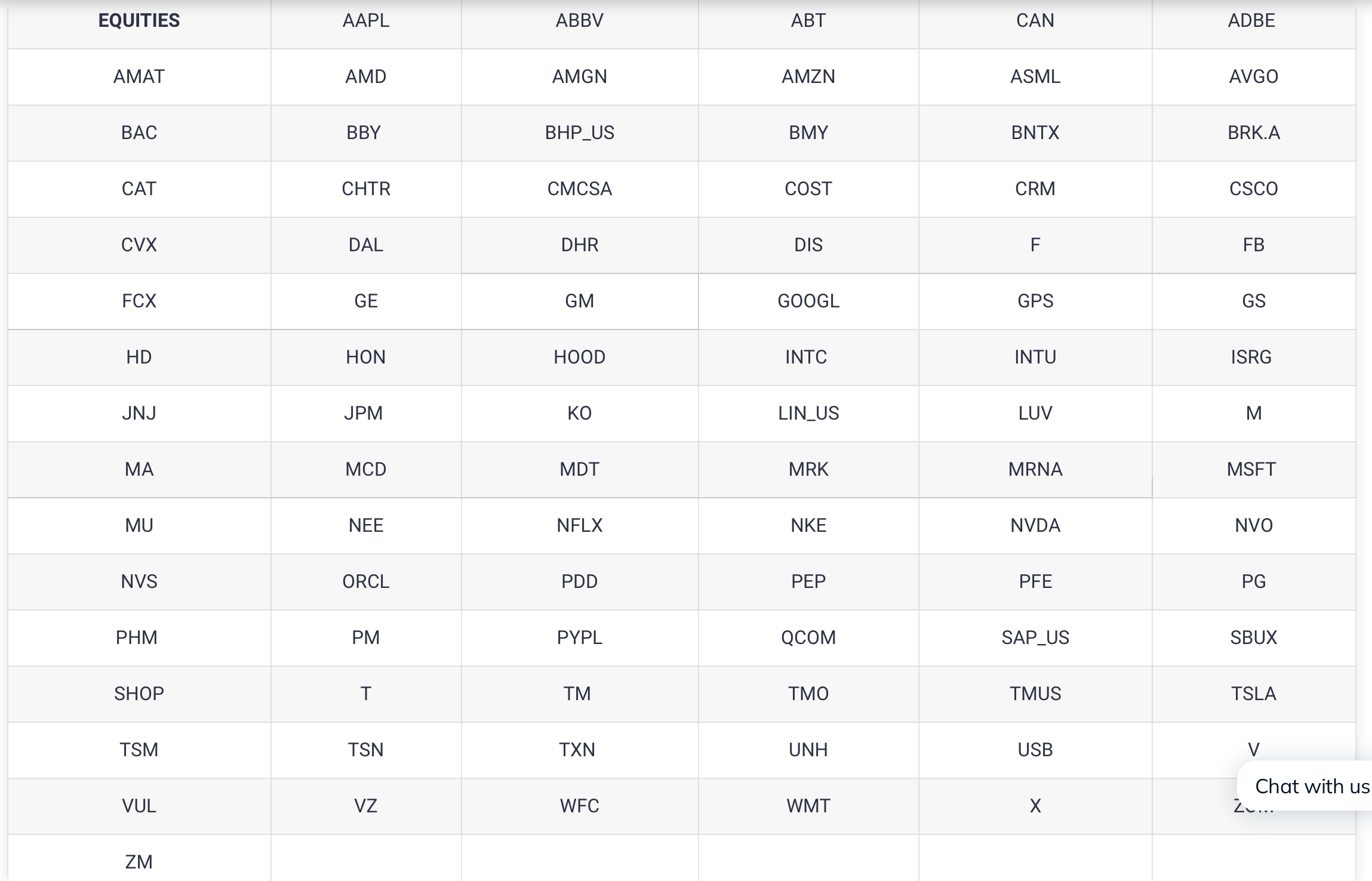

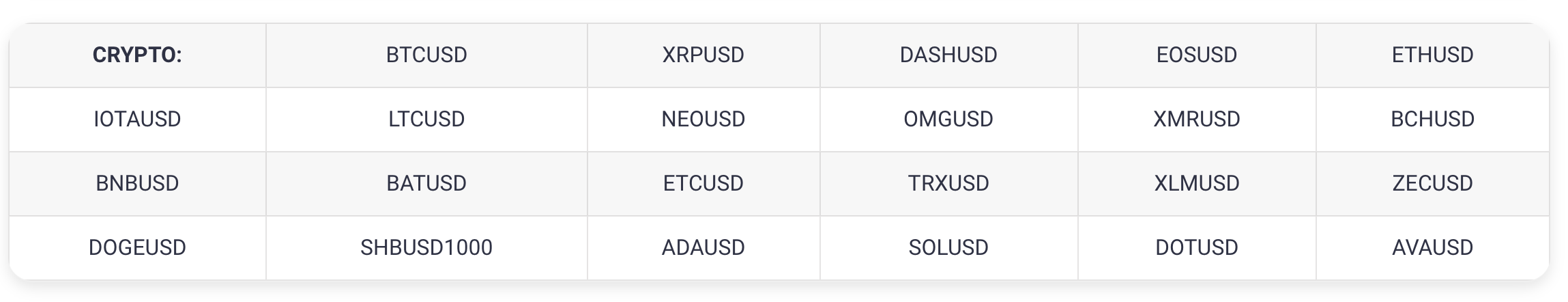

Trading instruments:

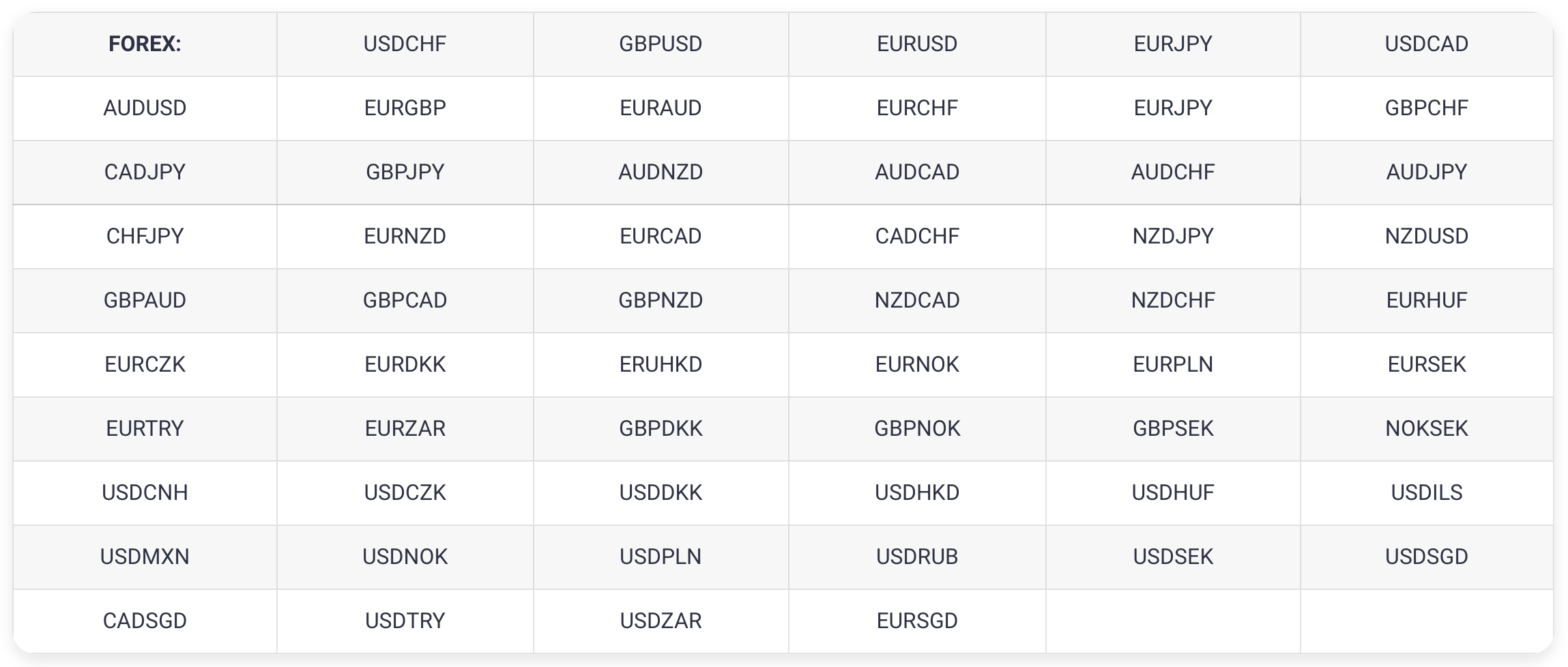

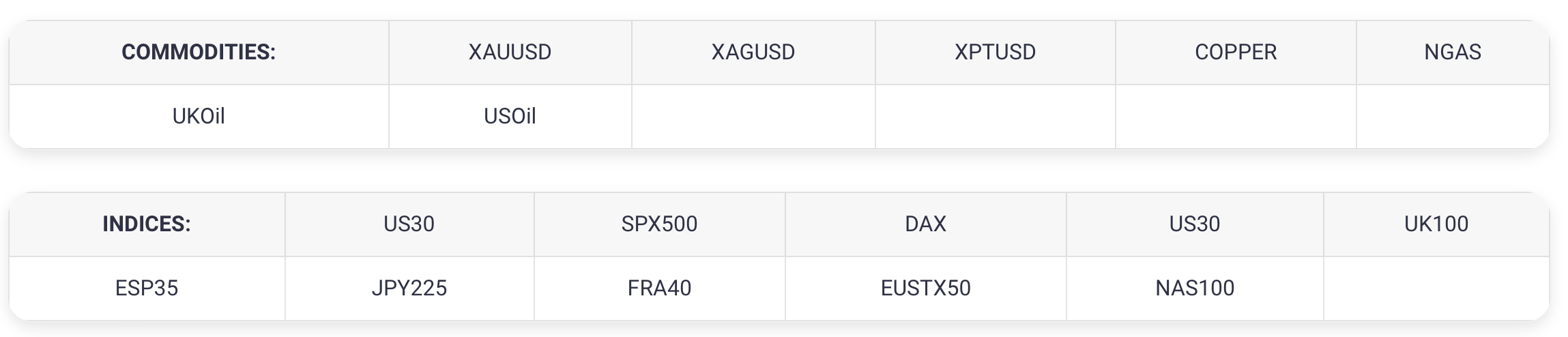

Goat Funded Trader allows you to trade forex pairs, commodities, indices, equities, and cryptocurrencies with up to 1:100 leverage.

Trading fees

Education and support for traders

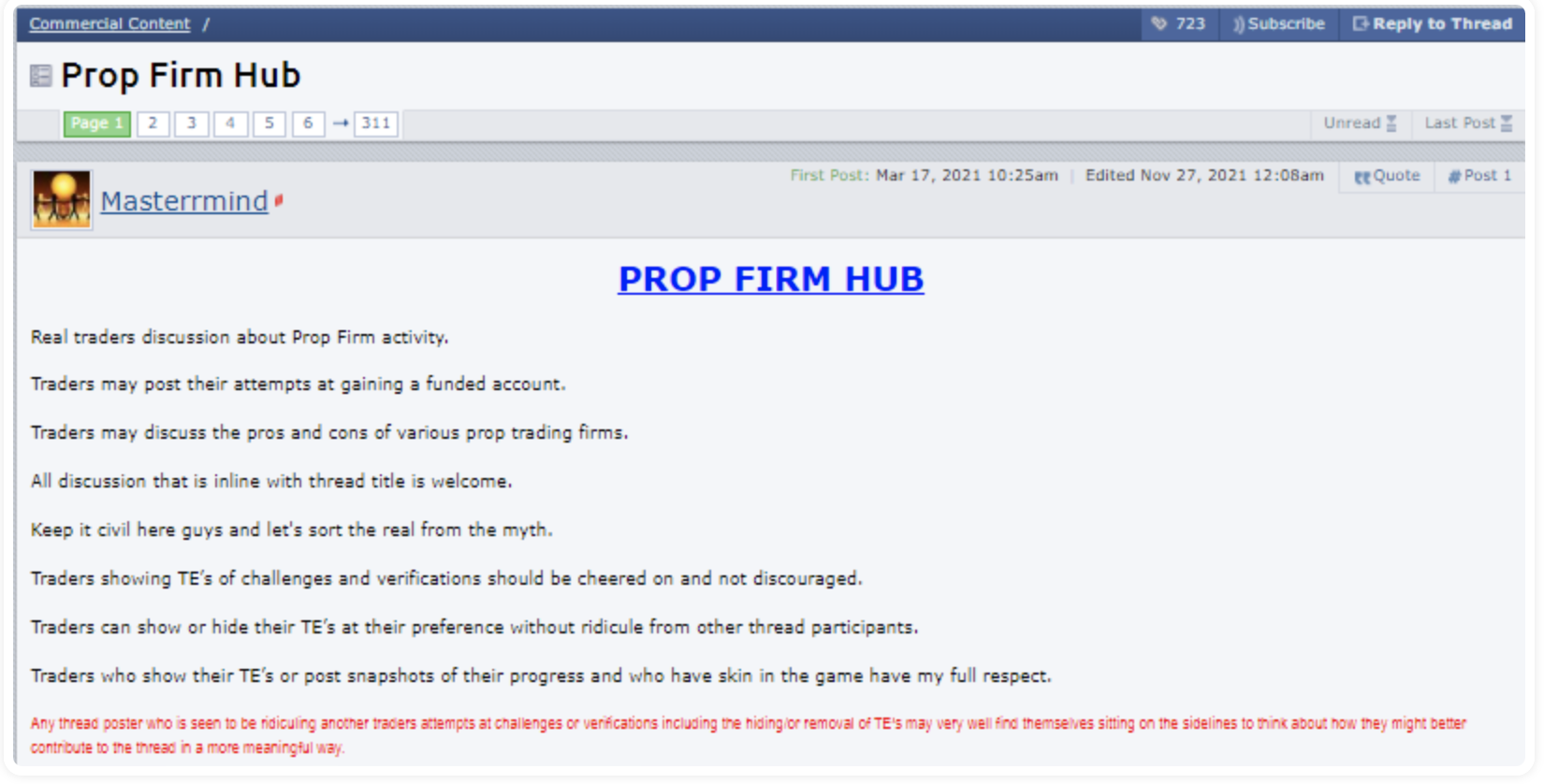

Goat Funded Trader’s website lacks educational content, but it offers a risk management trading tips article and a lot size calculator tool to support trading activities. Although Goat Funded Trader is not featured on ForexFactory, it has garnered significant mentions in a different thread titled “PROP FIRM HUB” authored by a user known as Mastermind

Goat Funded Trader also provides a well-structured dashboard that all of their traders can access, making it easier to manage risk with all the displayed trading objectives and their statistics.

Goat Funded Trader provides a comprehensive FAQ page that contains the necessary information you may be seeking.

Our dedicated support team can be reached via social media channels, or you can directly contact them at support@goatfundedtrader.com.

Furthermore, we offer the convenience of live chat support through our website, where our team will readily assist you with any inquiries you may have.

Traders’ Comments about Goat Funded Trader

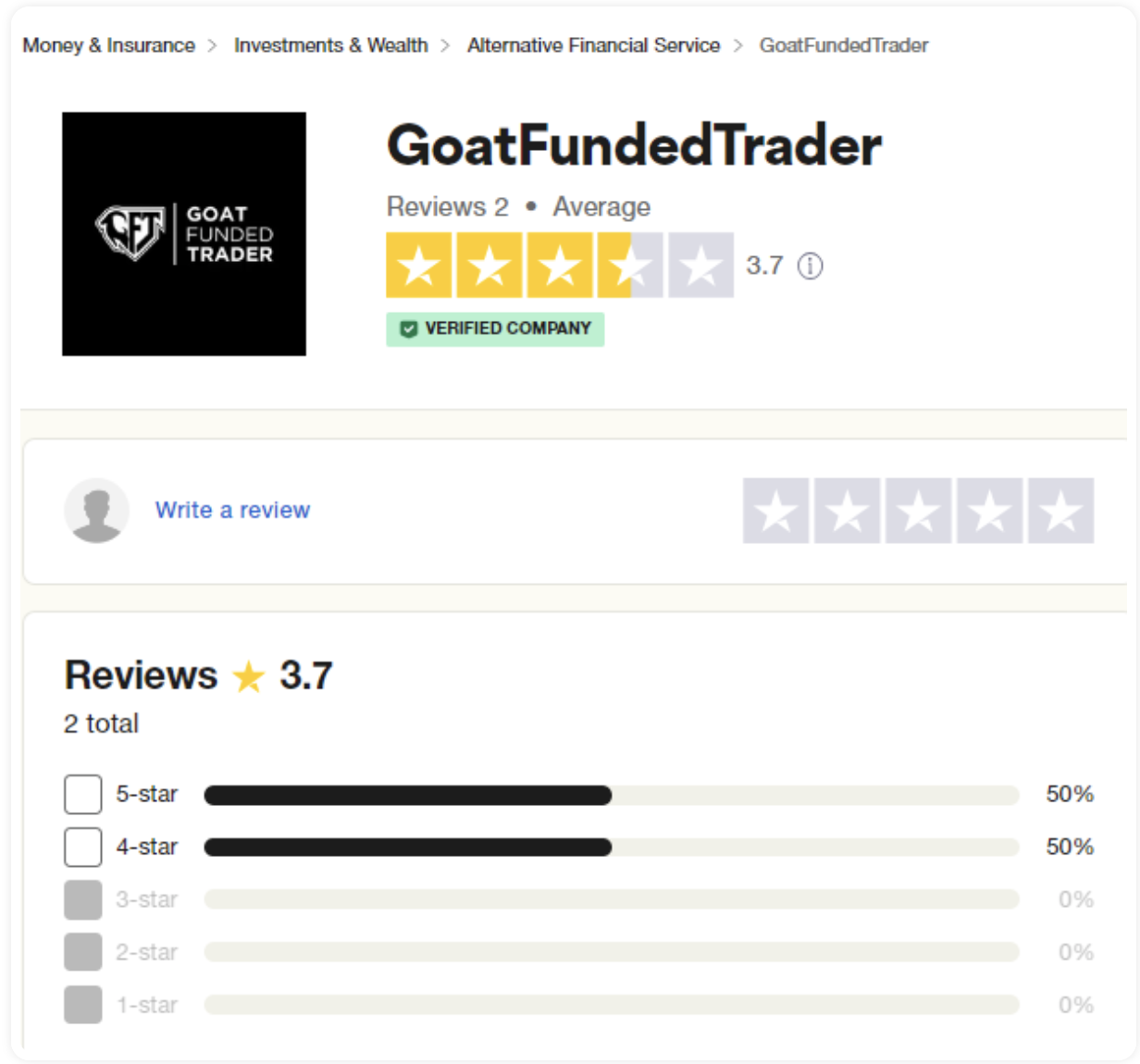

Goat Funded Trader has limited feedback from reviews.

On Trustpilot, they have only two reviews. However, this is normal since they started operating on the 17th of May, 2023. We will continue updating once there are more reviews of Goat Funded Trader in the future.

Social media statistics

Goat Funded Trader can also be found on social media.

They have a:

- Twitter account with 4,567 followers,

- Youtube channel with 326 subscribers and 26 uploaded videos,

- Instagram account with 4,856 followers.

Goat Funded Trader also has a Discord channel with 2,275 members.

Conclusion

In summary, Goat Funded Trader is a reputable proprietary trading company that provides traders with the opportunity to select from two distinct two-step evaluation funding programs: the no time limit and classic evaluations.

The no-time limit evaluation programs adhere to industry standards and involve a two-phase evaluation process that must be successfully completed to qualify for funding and profit sharing. To become funded, traders at Goat Funded Trader must achieve profit targets of 8% in phase one and 5% in phase two, which are realistic and attainable objectives considering the maximum daily loss limit of 5% and maximum loss limit of 8% that traders must adhere to. Through the no-time limit evaluation programs, traders can earn profit splits ranging from 75% to 95%. It’s important to note, however, that there is no scaling plan available for this particular funding program.

Similarly, the classic evaluation programs at Goat Funded Trader follow industry standards and involve a two-phase evaluation process. Traders must successfully achieve profit targets of 8% in phase one and 5% in phase two to become funded and eligible for profit sharing. These profit objectives align well with the maximum daily loss limit of 5% and maximum loss limit of 10% that traders are required to follow. By participating in the classic evaluation programs, traders can earn profit splits ranging from 75% to 95%. It’s worth noting that there is no scaling plan available for this funding program either.

Based on my assessment, I would highly recommend Goat Funded Trader to individuals seeking a proprietary trading firm with clear and transparent trading rules, as well as those who have developed consistent trading strategies. Despite being a relatively new firm, Goat Funded Trader offers favorable conditions for a wide range of traders with diverse trading styles. Taking into account all the advantages and opportunities presented by Goat Funded Trader, the company demonstrates great potential to establish itself as one of the top proprietary trading firms in the industry.