“Lux Trading Firm: Expert Solutions for Financial Success”

“Lux Trading Firm: Empowering Prop Traders in London and Bratislava with Tools, Capital, and Expertise for Market Success”

Lux Trading Firm is a prominent proprietary trading company operating in London and Bratislava, Slovakia. The firm focuses on empowering seasoned proprietary traders by equipping them with the essential resources and capital required to navigate the volatile market environment.

Our establishment aims to assemble individuals with exceptional expertise to identify and capitalize on trading and investment prospects. With substantial financial backing, our firm places utmost importance on executing, analyzing, and fostering the growth of our traders’ strategies.

Pros of Lux Trading

Free Trial

Excellent Trustpilot rating of 4.5/5

Scaling up to $10 million USD

Fast email support

No time limit on profit traget

Weekend holding allowed

Profit share 75%

Cons of Lux Trading

Low levarage 1:1, 1:5 and 1:10

High minimum trading day requirment

Limited to one segment of trading

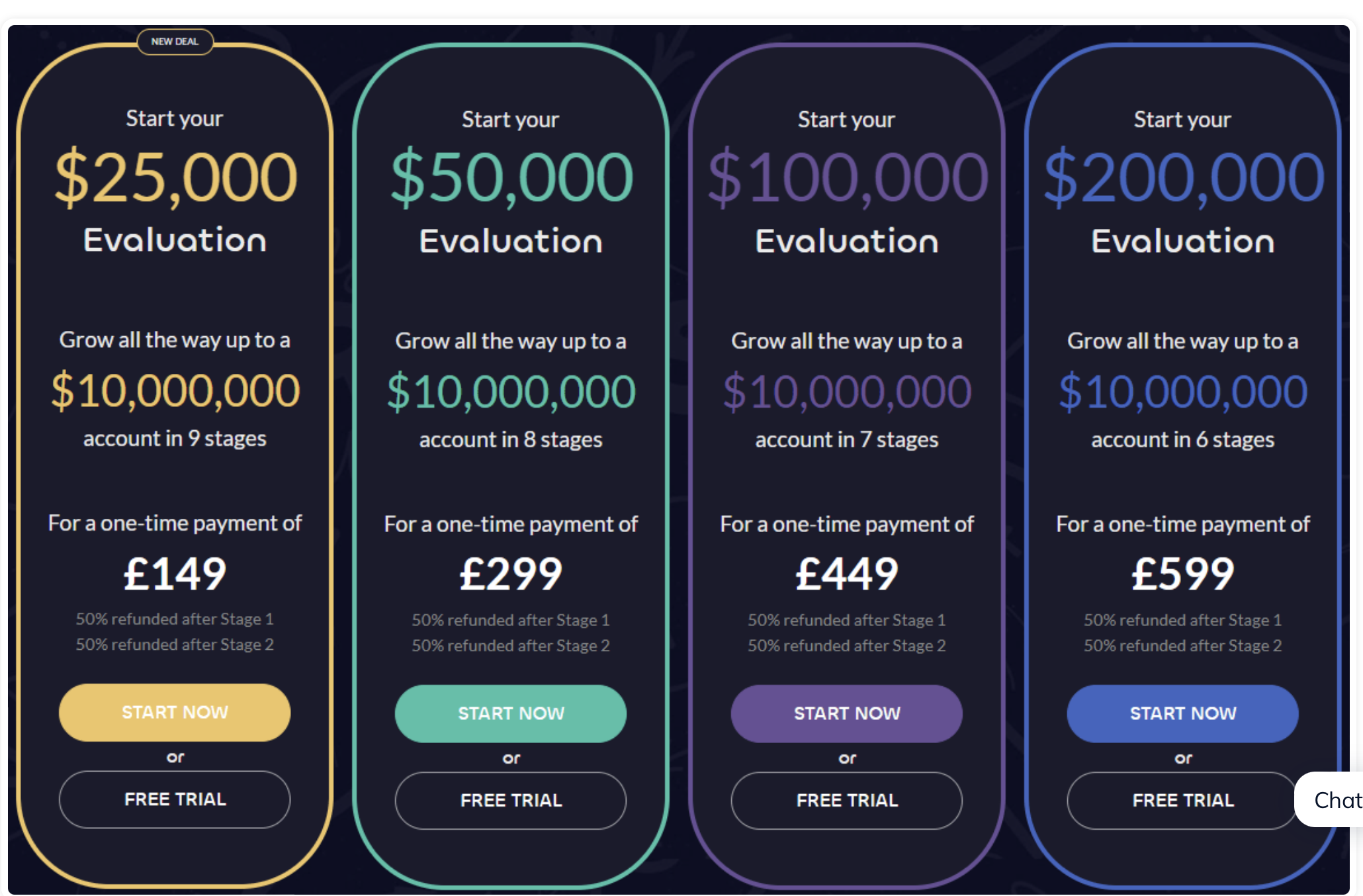

Lux Trading Firm fosters a supportive environment for traders to excel professionally, facilitating the opportunity to generate higher profits by engaging in trading activities with account balances of up to $10,000,000. To attain funding, prospective traders are required to successfully navigate a distinctive two-step evaluation process. Upon meeting this criterion, traders are assigned specific profit benchmarks to elevate their account balances. Successful achievement of these targets results in a 75% profit-sharing arrangement and a subsequent augmentation of their account balance.

Who are Lux Trading Firm?

Lux Trading Firm is a privately owned company that maintains offices in both London and Bratislava, Slovakia. It provides its traders with substantial account balances of up to $10,000,000 while employing After Prime, a reputable broker located in Australia.

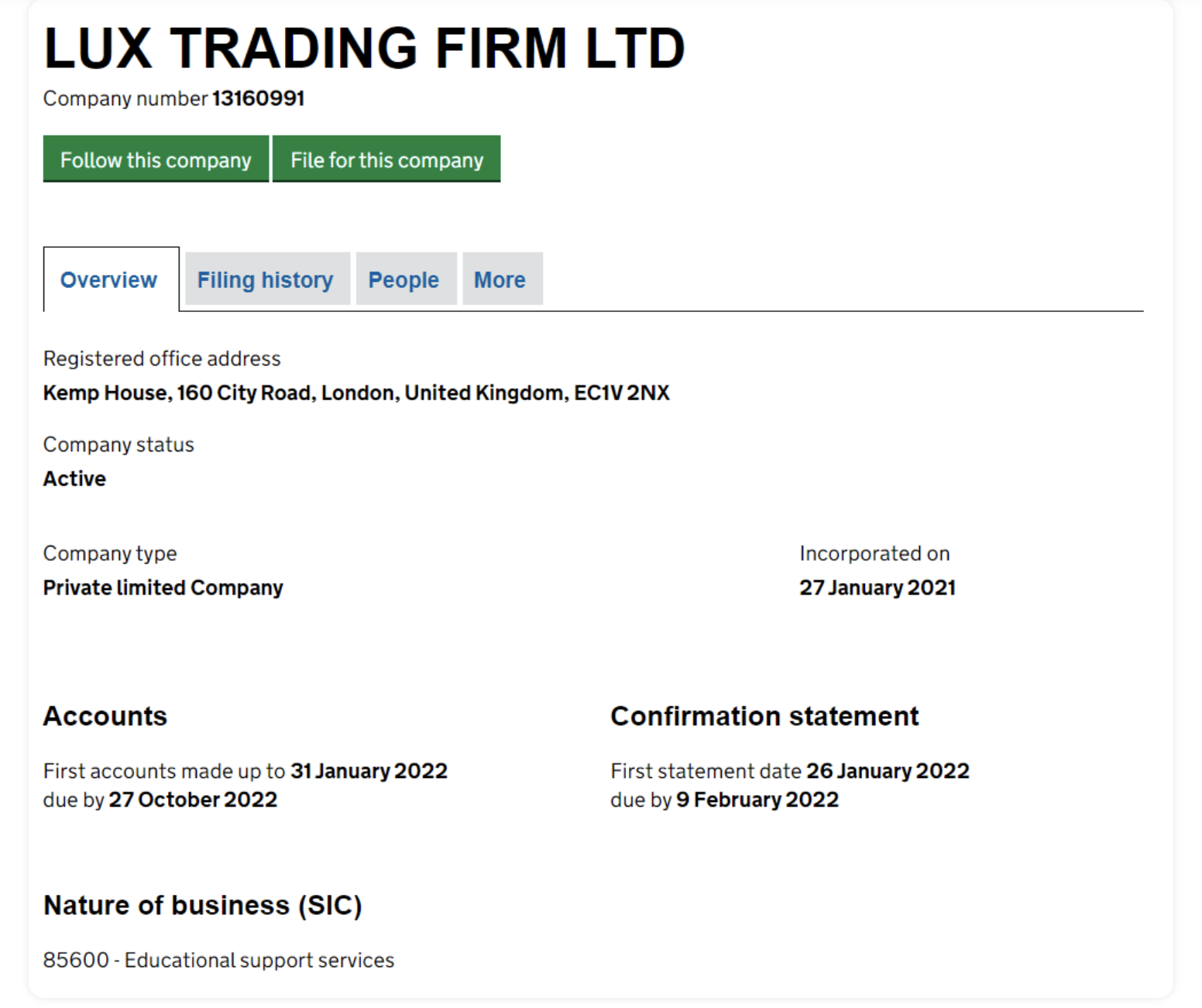

The company is officially registered in the United Kingdom under the name Lux Trading Firm Ltd, with a registered company number of 131609991.

Lux Trading Firm Ltd was incorporated on the 27th of January 2021 and is registered under Kemp House, 160 City Road EC1V 2NX London, UK.

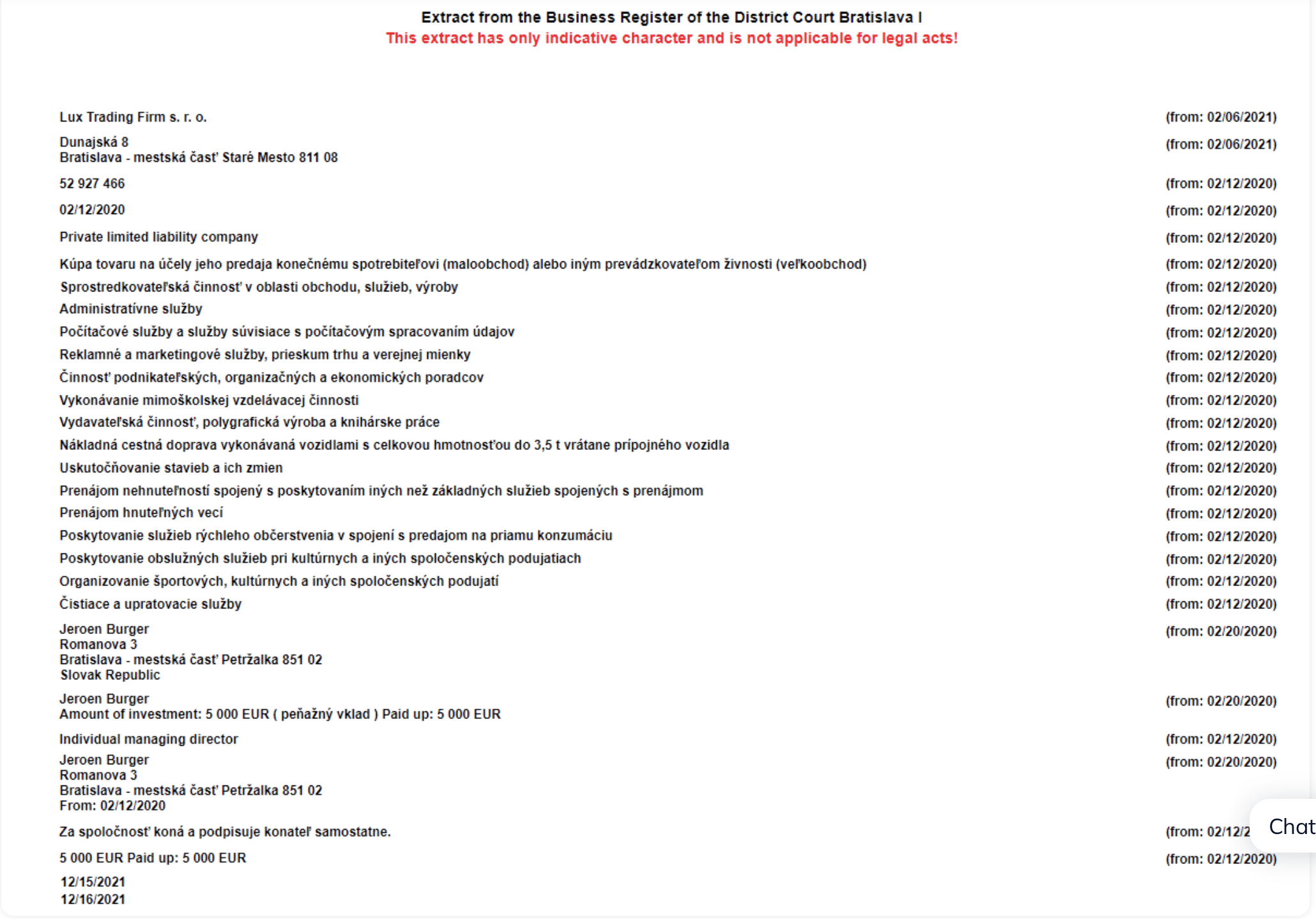

They also have one more registered company, Lux Trading Firm s. r. o at Dunajská 8, Bratislava, Slovakia. Lux Trading Firm s. r. o. The company was registered on 12 February 2020.

The founding program options:

Lux Trading Firm offers its traders two different programs to choose from:

- Two-step evaluation program

- One-step evaluation program

Two-step evaluation program:

The Lux Trading Firm evaluation program accounts aim to identify skilled and consistent traders who will be rewarded for their performance during a comprehensive two-phase evaluation period. Traders in the evaluation program account have the opportunity to trade with leverage of up to 1:10.

Phase one, known as the Evaluation stage, necessitates traders to achieve a profit target of 6% while adhering to a maximum loss limit of 5%. During this stage, there is no specific time constraint for achieving the profit target, but traders must actively trade for a minimum of 29 calendar days (15 calendar days for swing traders) to advance to phase two. Upon successfully completing the Evaluation stage, traders are eligible for a 50% refund of their initial one-time fee.

Phase two, referred to as the Advanced stage, requires traders to reach a profit target of 4% while maintaining a maximum loss limit of 5%. Similar to the Evaluation stage, there are no specific time constraints for achieving the profit target. However, traders must reach the target without any violations to progress to a live-funded account. Upon completion of the Advanced stage, traders are eligible for an additional 50% refund of their initial fee.

Successful completion of both the Evaluation and Advanced stages entitles traders to a live funded account, also known as the Professional account. In this account, there are no profit target requirements for withdrawals; traders are only required to adhere to a maximum loss limit of 4%. The first payout from the live funded account is scheduled 30 calendar days after the initial position is placed, and traders receive a profit split of 75% based on the profits generated in the funded account. Subsequent payouts are issued monthly, also with a 75% profit split based on the profits accumulated in the funded account.

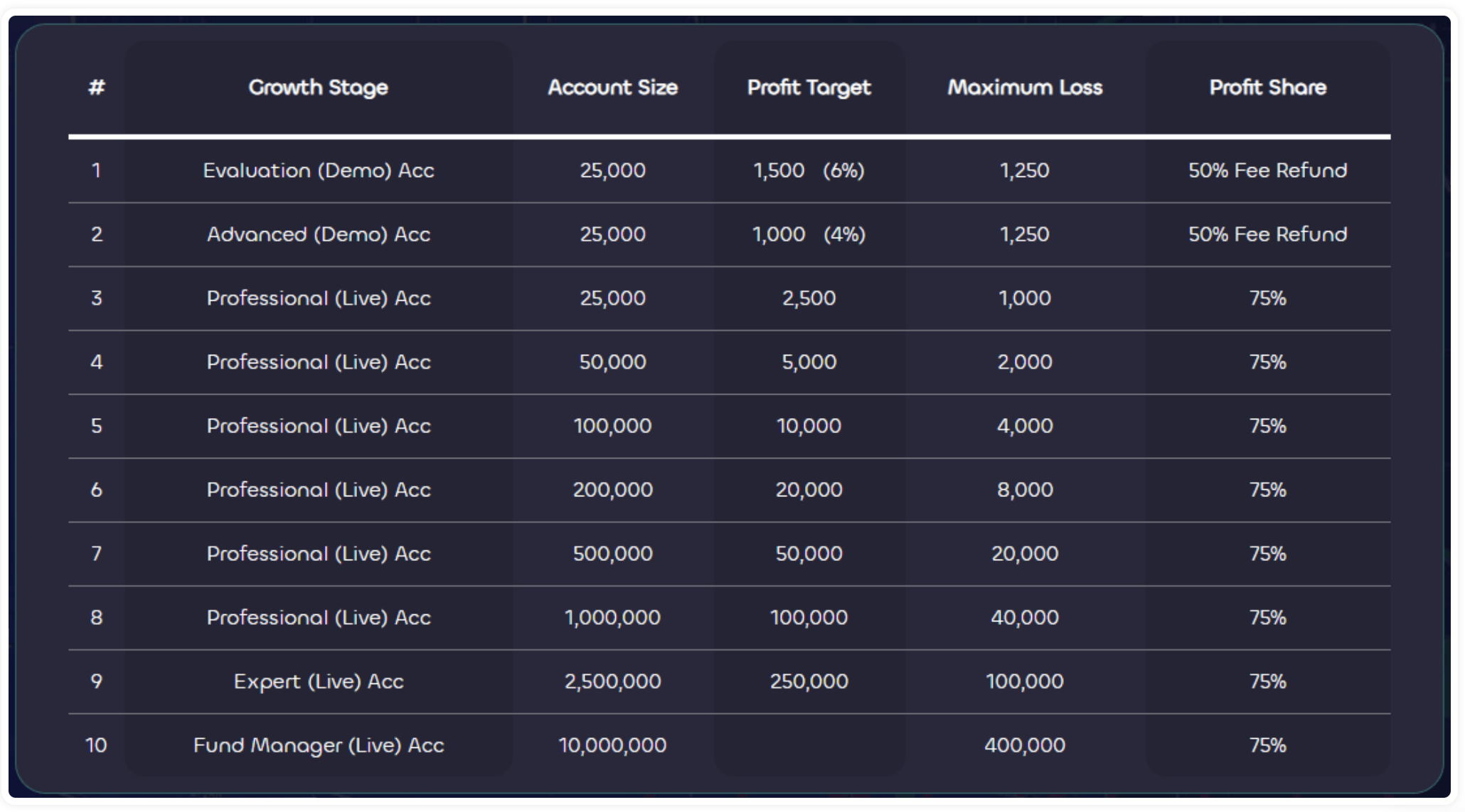

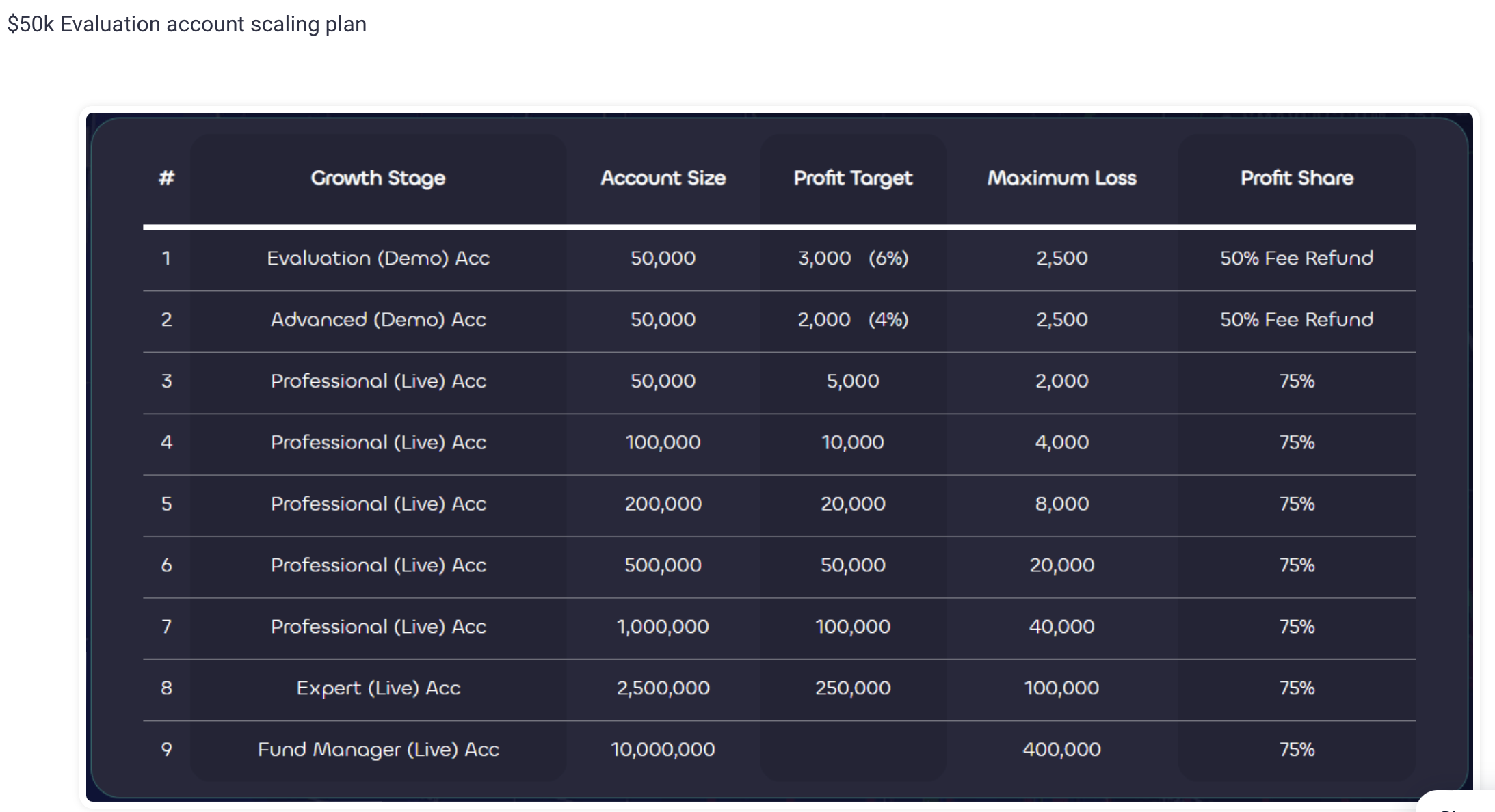

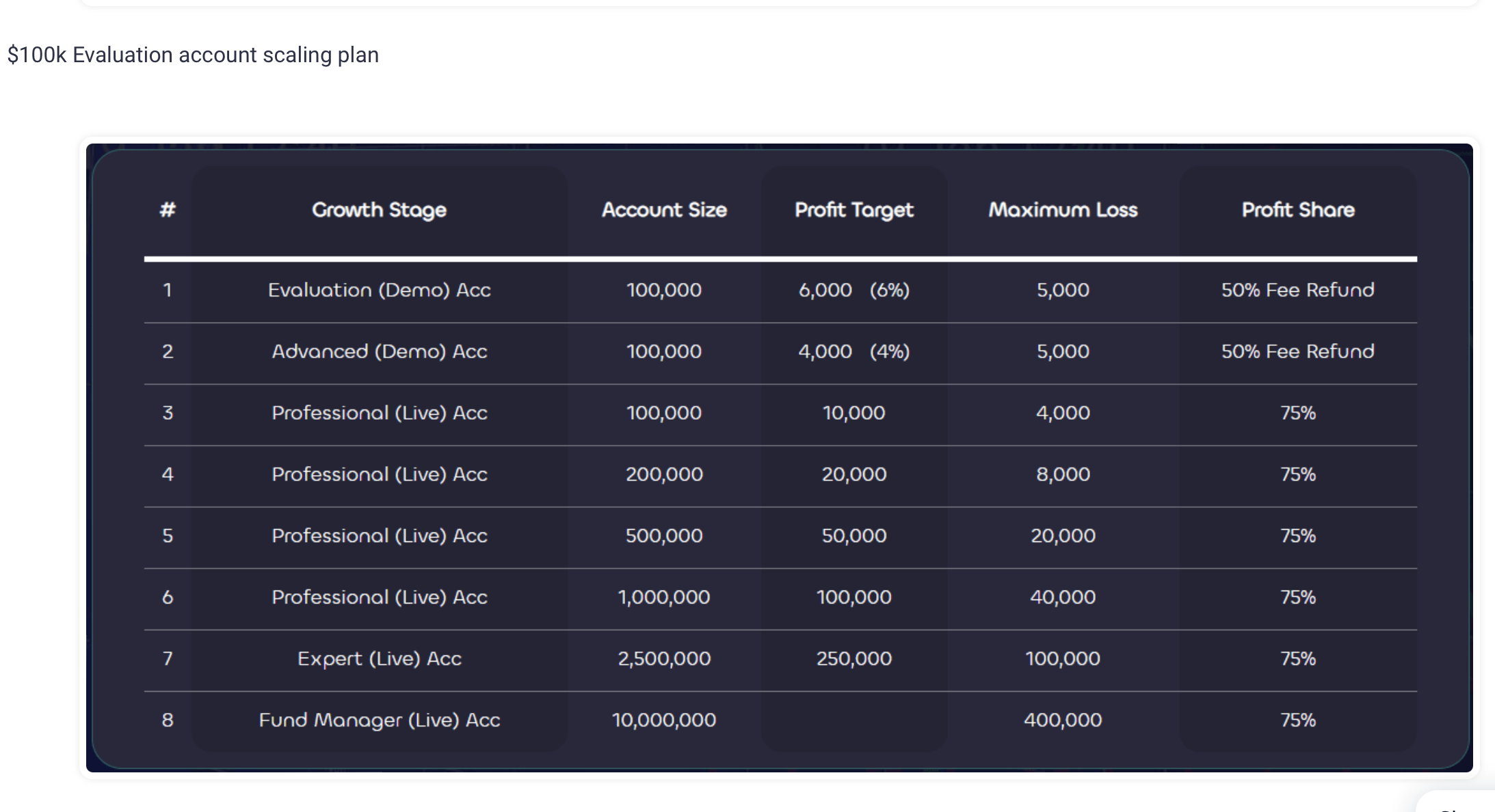

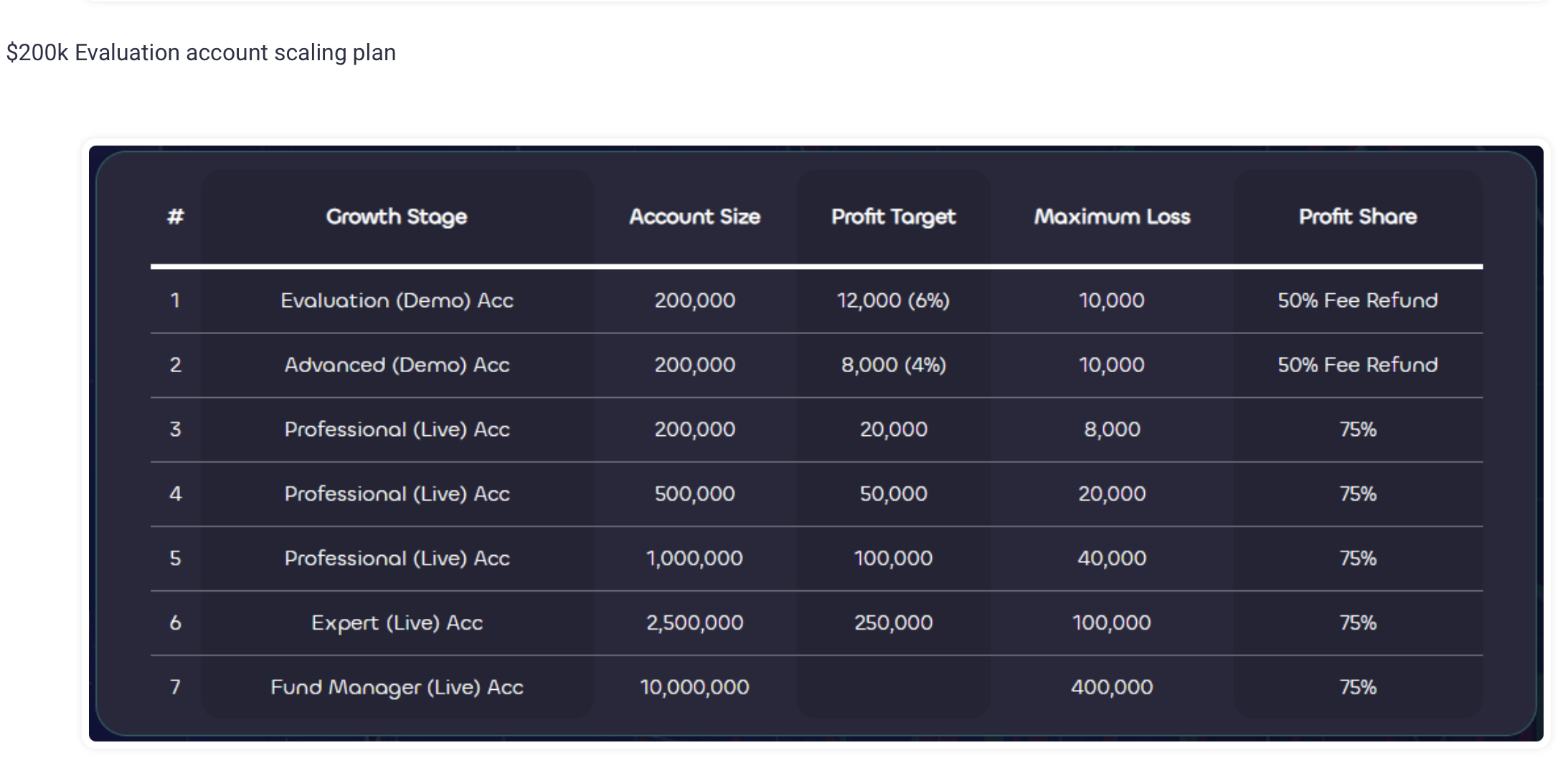

Furthermore, the two-step evaluation program accounts include a scaling plan. Traders must achieve a profit target of 10% to progress to the next growth stage, with the maximum capital reaching $10,000,000.

(pictures x4)

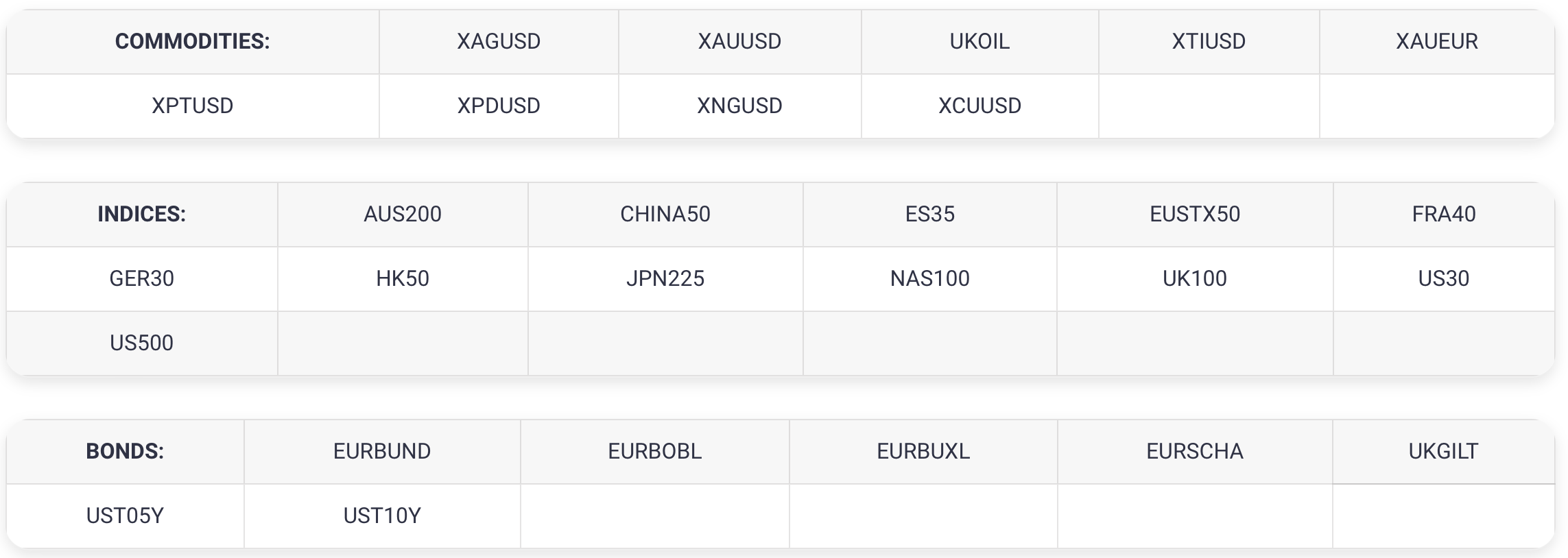

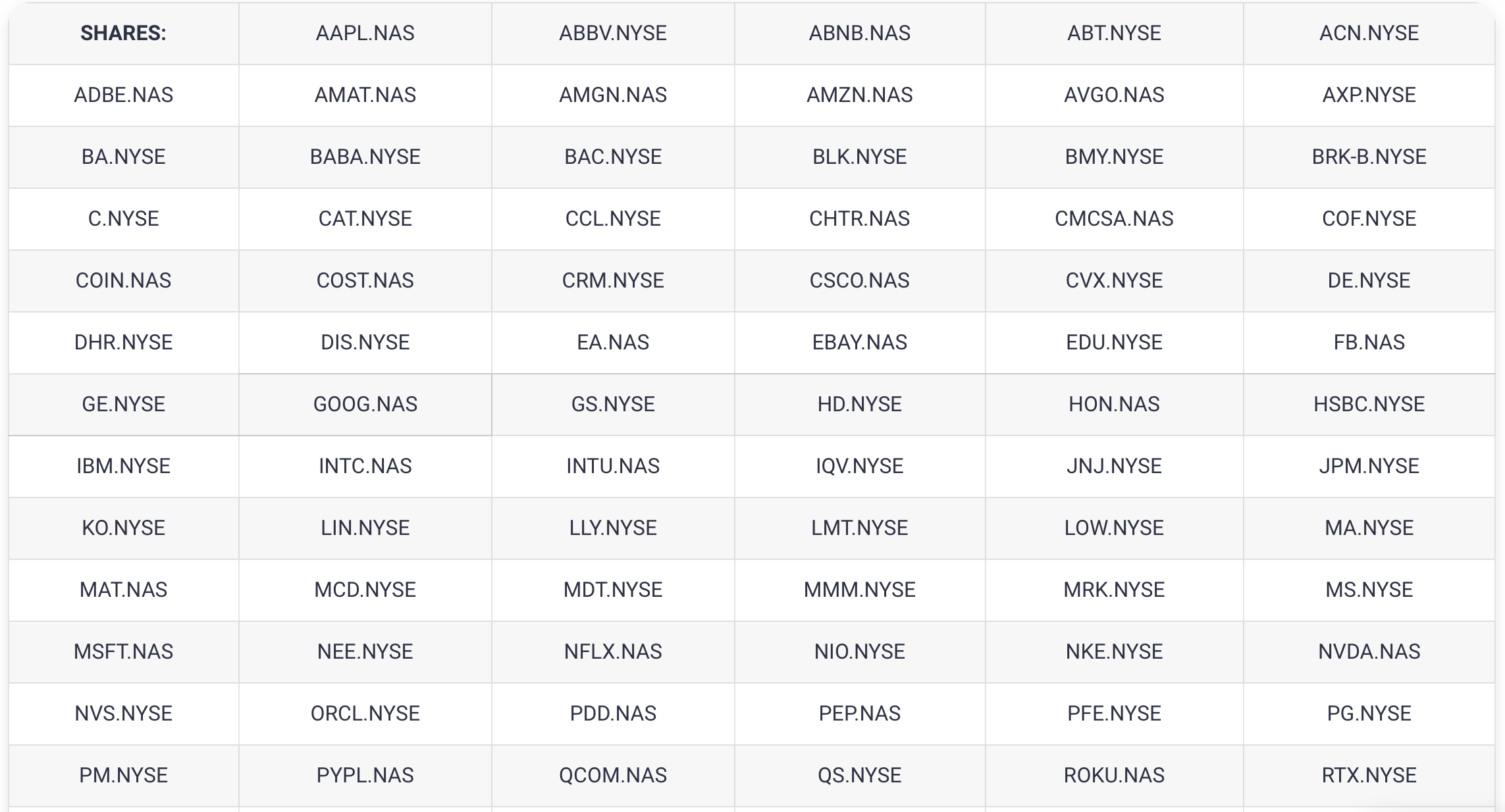

Trading instruments for the two-step evaluation program accounts are forex pairs, commodities, indices, bonds, and shares.

Two-step evaluation program account rules

- The profit target is a predetermined percentage of profit that must be achieved by a trader to successfully complete an evaluation phase, withdraw profits, or scale their trading account. In the evaluation stage, the profit target is set at 6%, while in the Advanced stage, it is set at 4%. Funded accounts do not have specific profit targets.

- Maximum loss refers to the maximum allowable loss that a trader can incur before their account is violated. Regardless of the account size, the maximum loss is limited to 5% (or 4% once funded).

- Minimum trading days indicate the minimum duration for which a trader must actively engage in trading before they can complete an evaluation phase or request a withdrawal. In the evaluation stage, there is a requirement of at least 29 trading days (15 calendar days for swing traders), while the Advanced stage does not impose any minimum trading day restrictions.

- The use of stop-loss orders is mandatory, necessitating traders to set a predetermined level at which their positions will be automatically closed to limit potential losses before they can initiate a trade.

- When considering the use of third-party expert advisors (EAs), it is important to be aware that these EAs may already be employed by other traders, thereby resulting in identical trading strategies. Consequently, utilizing a third-party EA carries the risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- Similarly, when utilizing third-party copy trading services, it should be recognized that other traders may already be employing the same trading strategy. Consequently, employing such services entails the potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is surpassed.

- The account is restricted to trading only one segment, be it forex, commodities, or indices. Trading across all segments within a single account is not permitted.

One-step evaluation program account

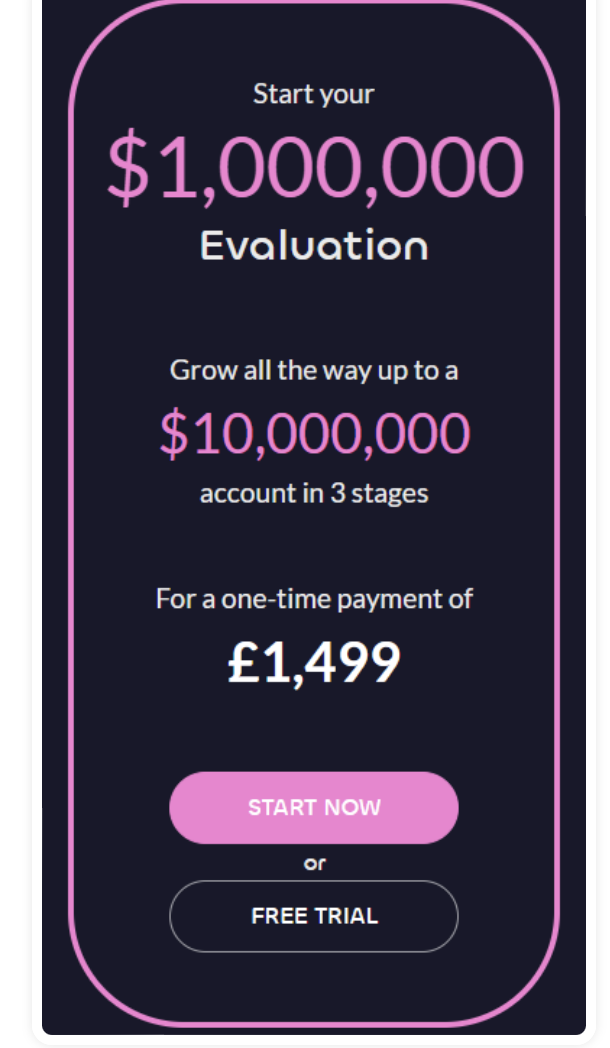

Lux Trading Firm offers a one-step evaluation challenge account, designed to identify consistent and disciplined traders who are rewarded for their reliability during a single evaluation phase. This account provides traders with a $1,000,000 balance and allows trading with a leverage ratio of 1:10.

To successfully complete the one-step evaluation challenge account, traders must achieve a profit target of 15% while adhering to a maximum loss limit of 5%. There is no time restriction on trading activities during the evaluation stage. However, a minimum trading duration of 29 calendar days (15 calendar days for swing traders) is required to advance to the next phase. Upon successful completion of the evaluation stage, traders will be granted a live-funded account.

Upon completion of the one-step evaluation challenge, traders will receive a funded account with a 10% profit target and a maximum loss limit of 4%. The initial profit split for traders will be 75%, based on the achieved 10% profit target during the unlimited trading period on the funded account.

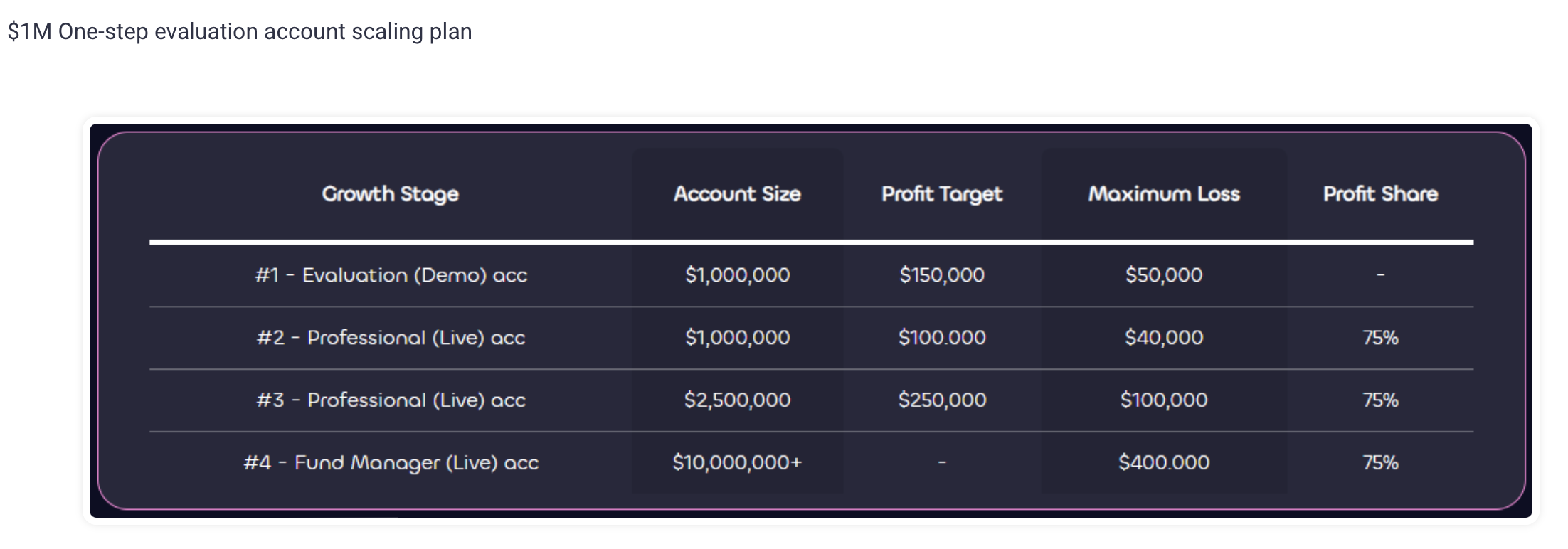

Additionally, the one-step evaluation program includes a scaling plan. Traders must reach a profit target of 10% to scale their account to the next growth stage, with the potential to increase their capital up to a maximum of $10,000,000.

Trading instruments for the one-step evaluation program accounts are forex pairs, commodities, indices, bonds, and shares.

One-step evaluation program account rule

- A profit target refers to a predetermined percentage of profit that must be achieved by a trader to successfully complete an evaluation phase, withdraw profits, or expand their trading account. During the evaluation stage, the profit target is set at 15%, while funded accounts have a profit target of 10%.

- Maximum loss denotes the maximum allowable loss that a trader can incur before their account is deemed violated. For all account sizes, the maximum loss threshold is 5% (reduced to 4% once an account is funded).

- Minimum trading days represent the minimum duration for which a trader must engage in trading activities before they can complete an evaluation phase or initiate a withdrawal request. During the evaluation stage, a minimum of 29 trading days is required (15 calendar days for swing traders).

- The requirement to set a stop-loss on every position before initiating a trade is referred to as the stop-loss required policy.

- Third-party EA risk arises when a trader intends to use an Expert Advisor (EA) developed by a third party. It is important to be aware that other traders may already be utilizing the same EA, thereby adopting an identical trading strategy. By utilizing a third-party EA, there is a potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- Third-party copy trading risk arises when a trader intends to use copy trading services provided by a third party. It is important to be aware that other traders may already be using the same copy trading service, thus adopting an identical trading strategy. By utilizing a third-party copy trading service, there is a potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- The restriction of trading to only one segment means that traders are limited to conducting trades exclusively in either the forex, commodities, or indices market segments on their account, rather than engaging in all segments simultaneously.

What makes Lux Trading firm different from other prop firms?

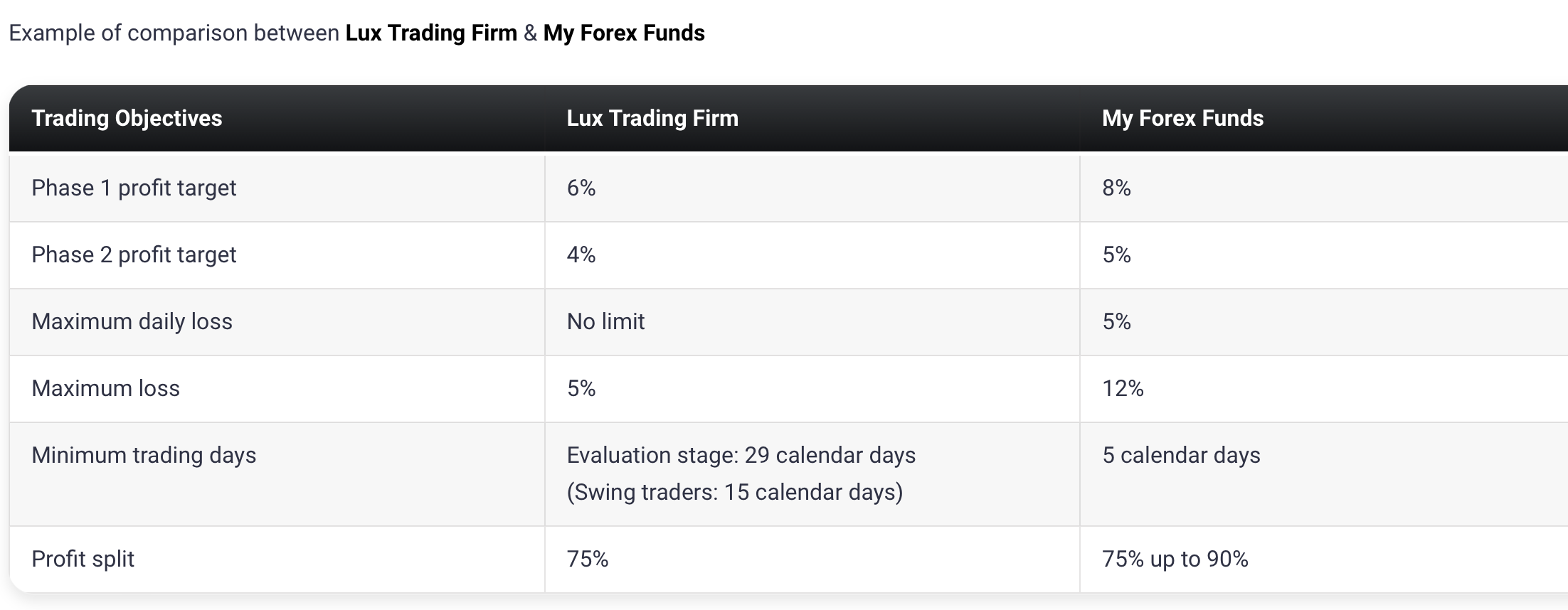

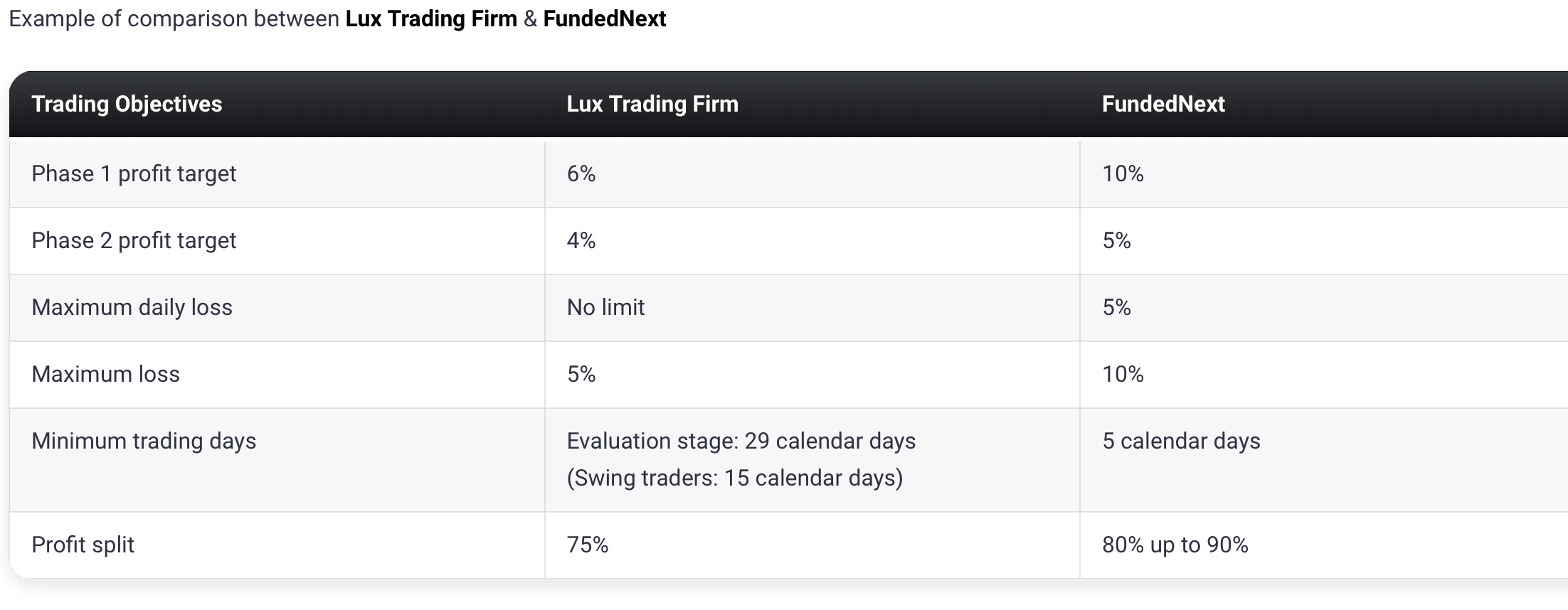

Lux Trading Firm distinguishes itself from other prominent proprietary trading firms by offering two distinct funding programs: a distinctive two-step evaluation process and a one-step funding program with a substantial capital allocation of $1 million. Furthermore, Lux Trading Firm extends the provision of real funded accounts to its traders.

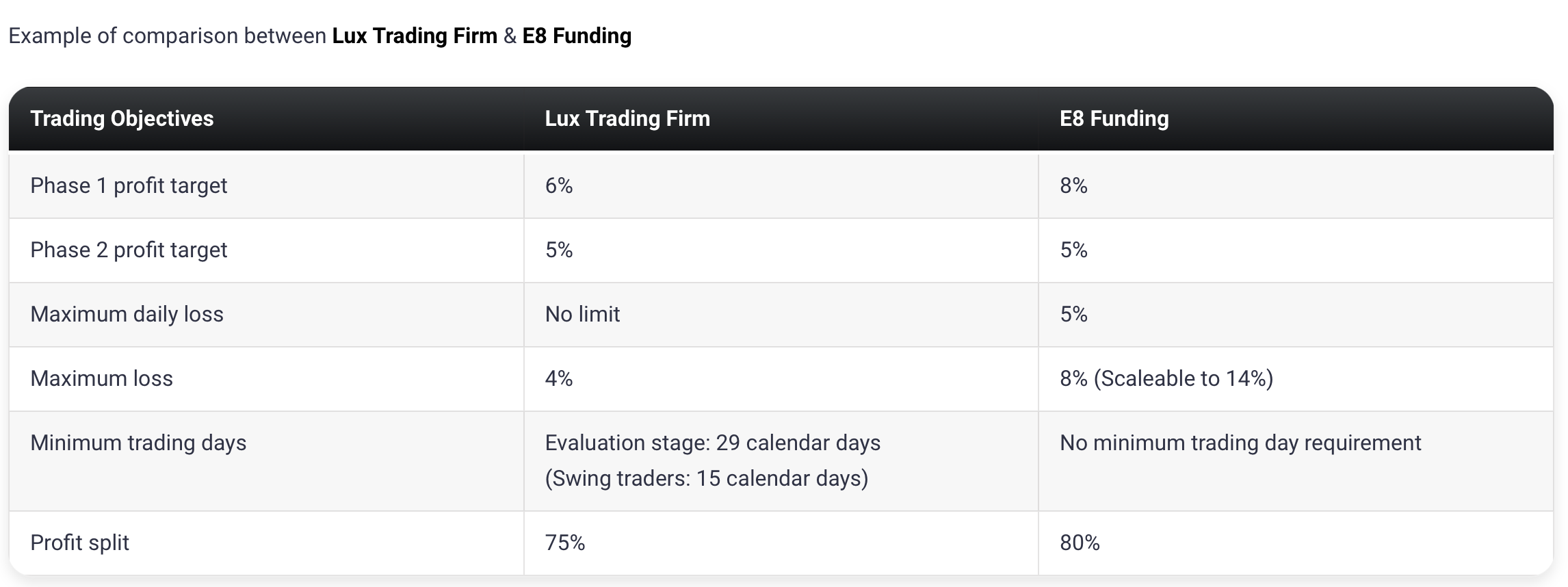

In contrast to conventional prop firms, Lux Trading Firm’s two-step evaluation program employs a unique dual-phase assessment framework that mandates traders to successfully complete both phases to qualify for profit distributions. The initial phase necessitates achieving a profit target of 6%, while the subsequent phase requires a profit target of 4%, with the inclusion of a maximum permissible loss of 5%. During the evaluation stage, traders are also obliged to engage in a minimum of 29 calendar days of trading (15 calendar days for swing traders), while no minimum trading day requirement is imposed during the Advanced stage. Moreover, the two-step evaluation program incorporates a scaling plan.

Relative to other industry-leading proprietary firms, Lux Trading Firm sets comparatively modest profit targets and imposes no temporal restrictions on traders.

Lux Trading Firm distinguishes itself from other prop firms by offering a unique one-step evaluation program. This program entails a single-phase evaluation, where traders must successfully complete the evaluation phase to become eligible for payouts. During this phase, traders are required to achieve a profit target of 15% while adhering to a maximum loss limit of 5%. Additionally, a minimum trading duration of 29 calendar days (or 15 calendar days for swing traders) is mandatory during the Evaluation stage. Notably, the one-step evaluation program incorporates a scaling plan, setting it apart from other prominent prop firms in the industry.

To further differentiate itself, Lux Trading Firm provides two distinct funding programs and grants traders access to real live funded accounts. Another notable aspect is the absence of maximum trading period limitations for both the Evaluation and the Advanced stages, which distinguishes it from other leading prop firms.

In summary, Lux Trading Firm stands out from its industry counterparts through its provision of a one-step evaluation program, diverse funding options, and the absence of time constraints for completing the Evaluation and Advanced stages.

Is getting capital realistic?

When evaluating prop firms that align with your forex trading style, it is crucial to assess the practicality of their trading requirements. While it may initially seem appealing to come across a company offering a high percentage profit split on a well-funded account, it is important to consider the feasibility of achieving their monthly percentage gain targets while maintaining a low percentage of maximum drawdowns. Failure to meet such demanding criteria significantly diminishes the likelihood of achieving success.

Opting for capital allocation through two-step evaluation programs is a realistic choice primarily due to their comparatively modest profit targets (6% in phase one and 5% in phase two). Despite this, the programs maintain a maximum overall loss limit of 5%. Moreover, these programs do not impose any time constraints, allowing traders to gradually accumulate profits without feeling pressured to expedite the process.

Likewise, obtaining capital through one-step evaluation programs remains realistic, as they set a slightly above-average profit target of 15%, while still adhering to a maximum overall loss limit of 5%. Similar to the two-step programs, there are no time limitations imposed, affording traders the flexibility to accumulate profits at their own pace.

Considering these factors, Lux Trading Firm emerges as an excellent option for securing funding. The firm offers two distinct funding programs, both of which establish realistic trading objectives and payout conditions that traders can adhere to.

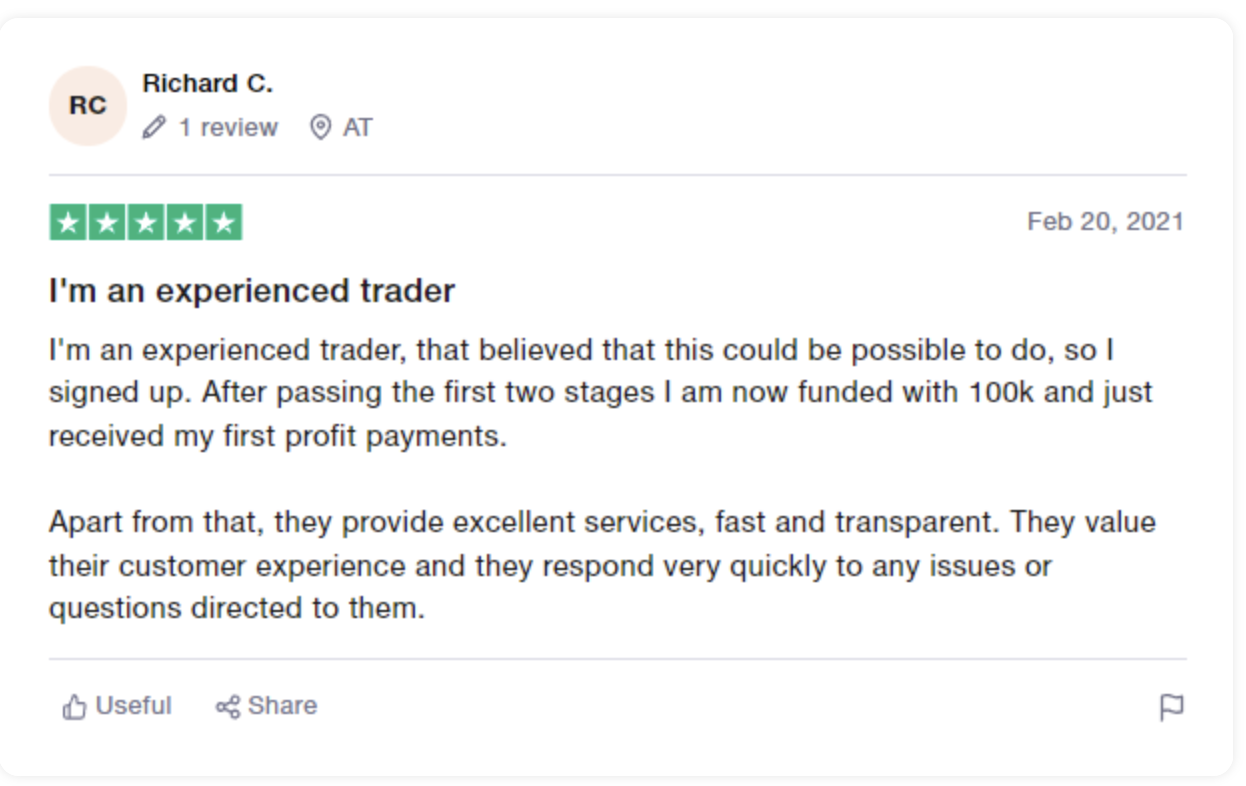

Payment proof

Lux Trading Firm is a well-established proprietary firm incorporated on the 27th of January, 2021. You can see claims of payment proof in the following two reviews at Trustpilot made by Richard C. and Jack Pechler.

You can also watch the following video for payment proof, where Lux Trading Firm interviewed Brandon. At 2:25 minutes in the video, he claims that he received his profit split within two days

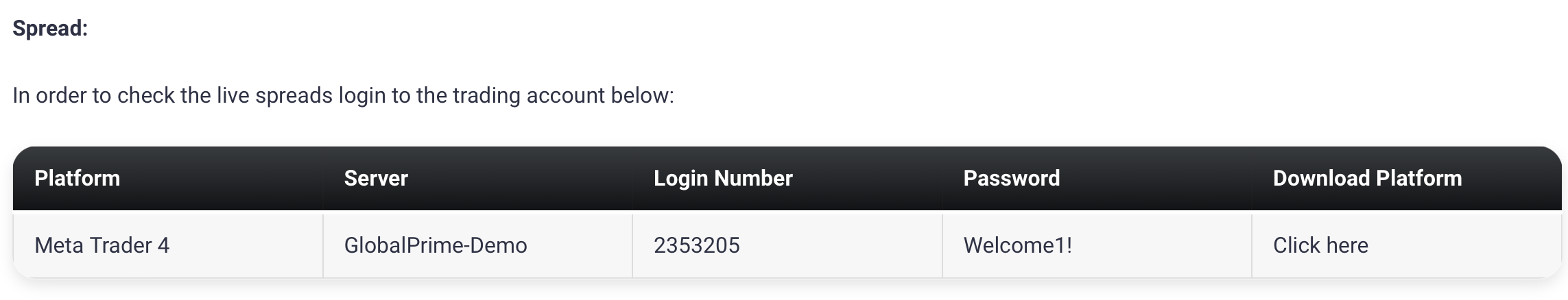

Which brokers do Lux trading use?

Lux Trading Firm partners with After Prime, a highly enthusiastic brokerage firm that demonstrates a profound interest in the evolution of financial markets, trading technology, and the mutually beneficial journey embarked upon with their esteemed clients. Boasting a proficient cadre comprising operational engineers, quantitative analysts, and software developers, After Prime operates behind the scenes, diligently striving to furnish global markets with unparalleled expediency and cost-effectiveness. Their overarching objective revolves around fostering accessible markets and equipping traders worldwide with cutting-edge technology. As for After Prime’s future vision, it entails expediting the advent of a novel era characterized by decentralized financial products and markets.

Furthermore, After Prime diligently adheres to a set of core principles, which are as follows:

- Prioritizing Customers: Placing utmost importance on the satisfaction and well-being of their clientele.

- Pursuing Operational Excellence: Endeavoring to maintain the highest standards of operational efficiency and proficiency.

- Embracing Collaboration: Encouraging an environment of teamwork and synergy to achieve shared goals.

- Cultivating Ownership: Instilling a sense of responsibility and accountability among all stakeholders involved.

They are offering three trading platforms traders can trade on MetaTrader 4.

Trading instruments:

aLux Trading Firm offers a large variety of Trading Instruments. You are allowed to trade forex pairs, commodities, indices, bonds, and shares

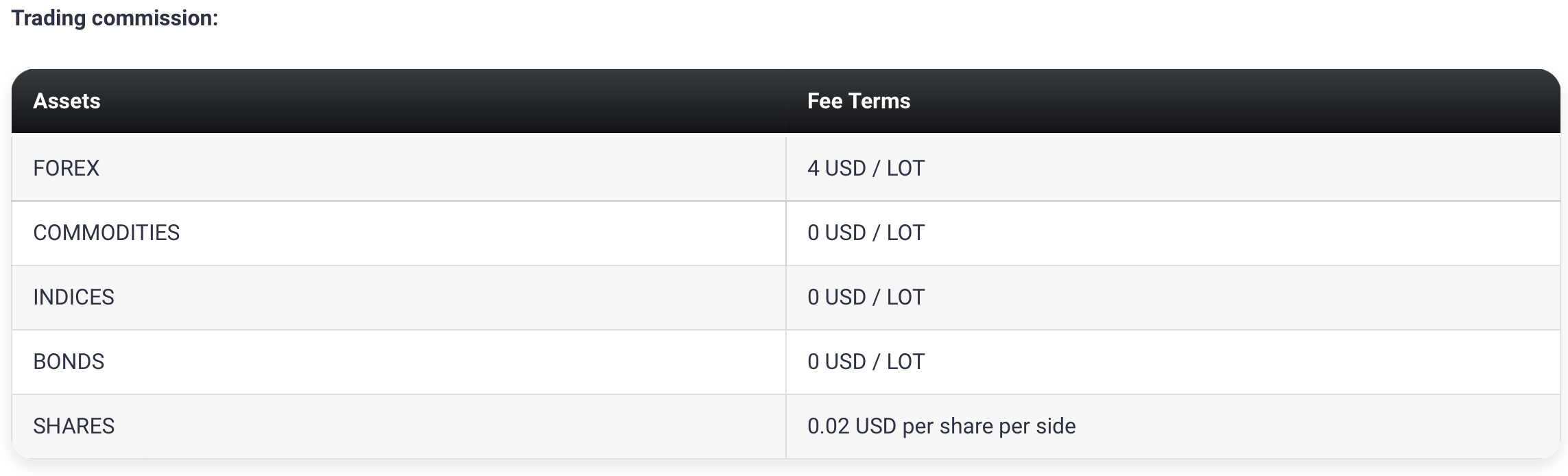

Trading fees

Education and support for traders

Lux Trading Firm offers a range of educational resources on its website within the section dedicated to Trader Tools. These resources can be conveniently accessed by clicking on the provided link.

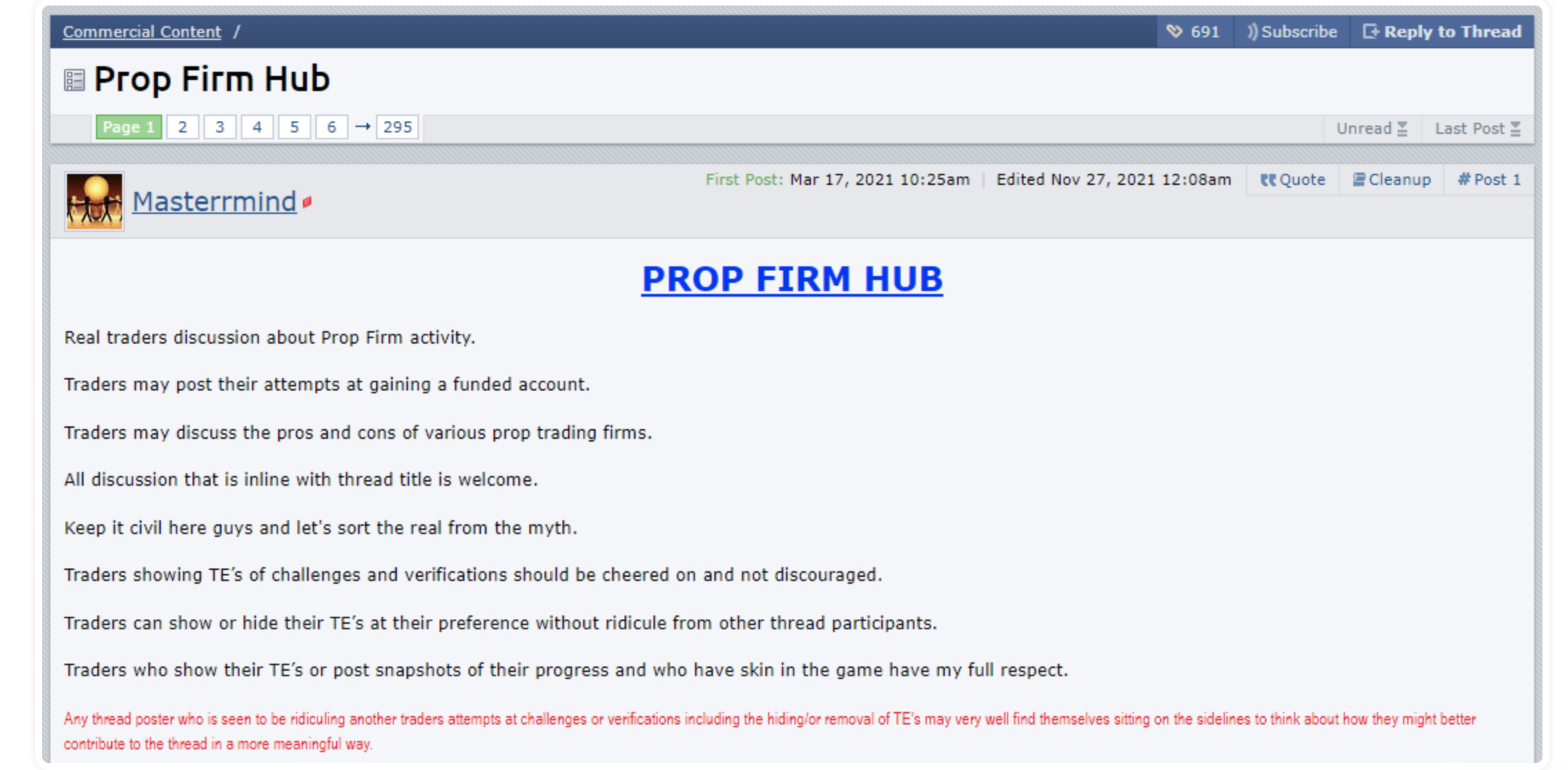

Although Lux Trading Firm does not maintain an official presence on ForexFactory, it has garnered considerable mentions and recognition in the ‘PROP FIRM HUB’ thread initiated by a user named Mastermind.

Lux Trading Firm offers a free trial option to their community, allowing them to familiarize themselves with their platform and trading rules while also experiencing what it’s like trading with Lux Trading Firm.

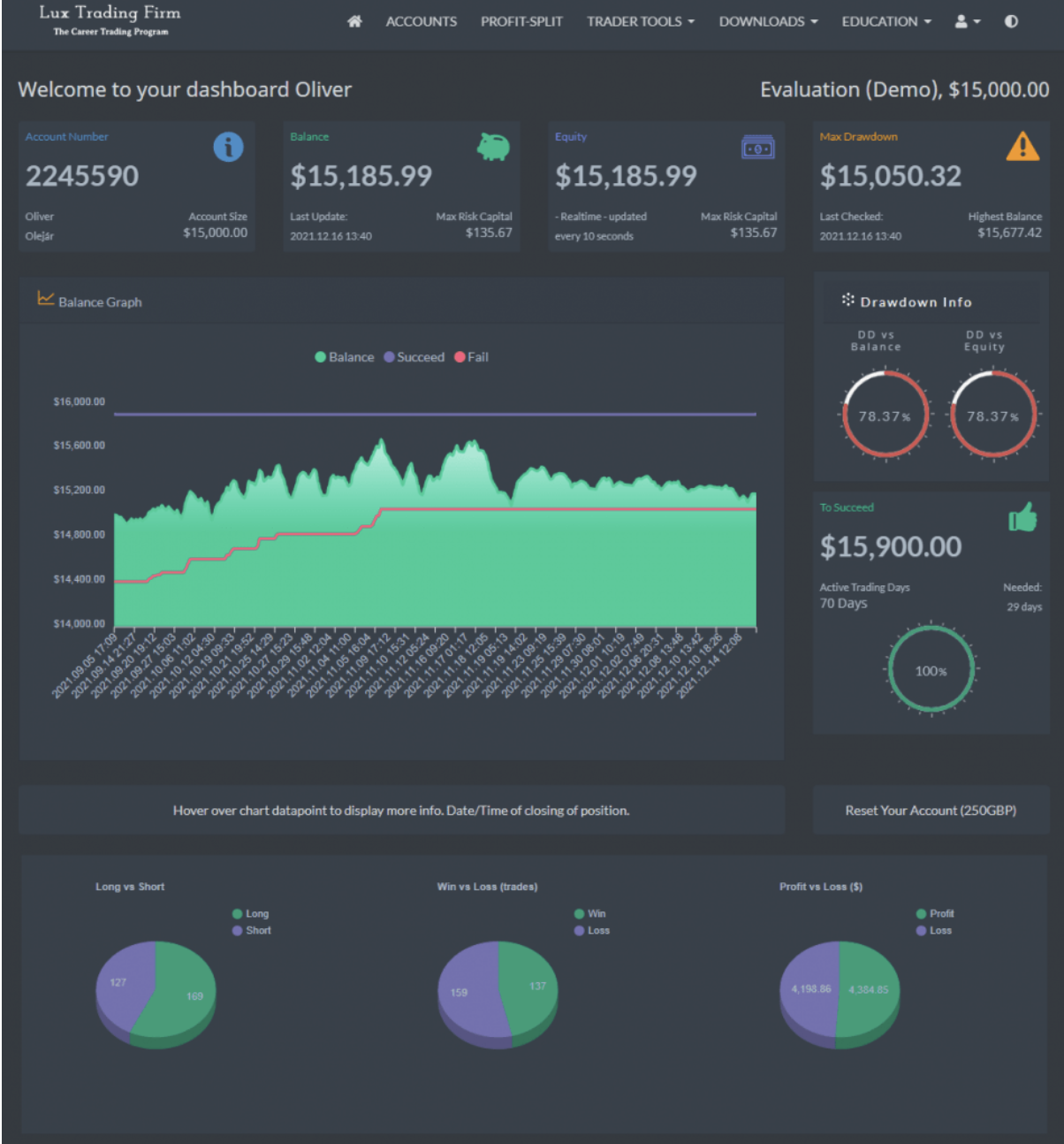

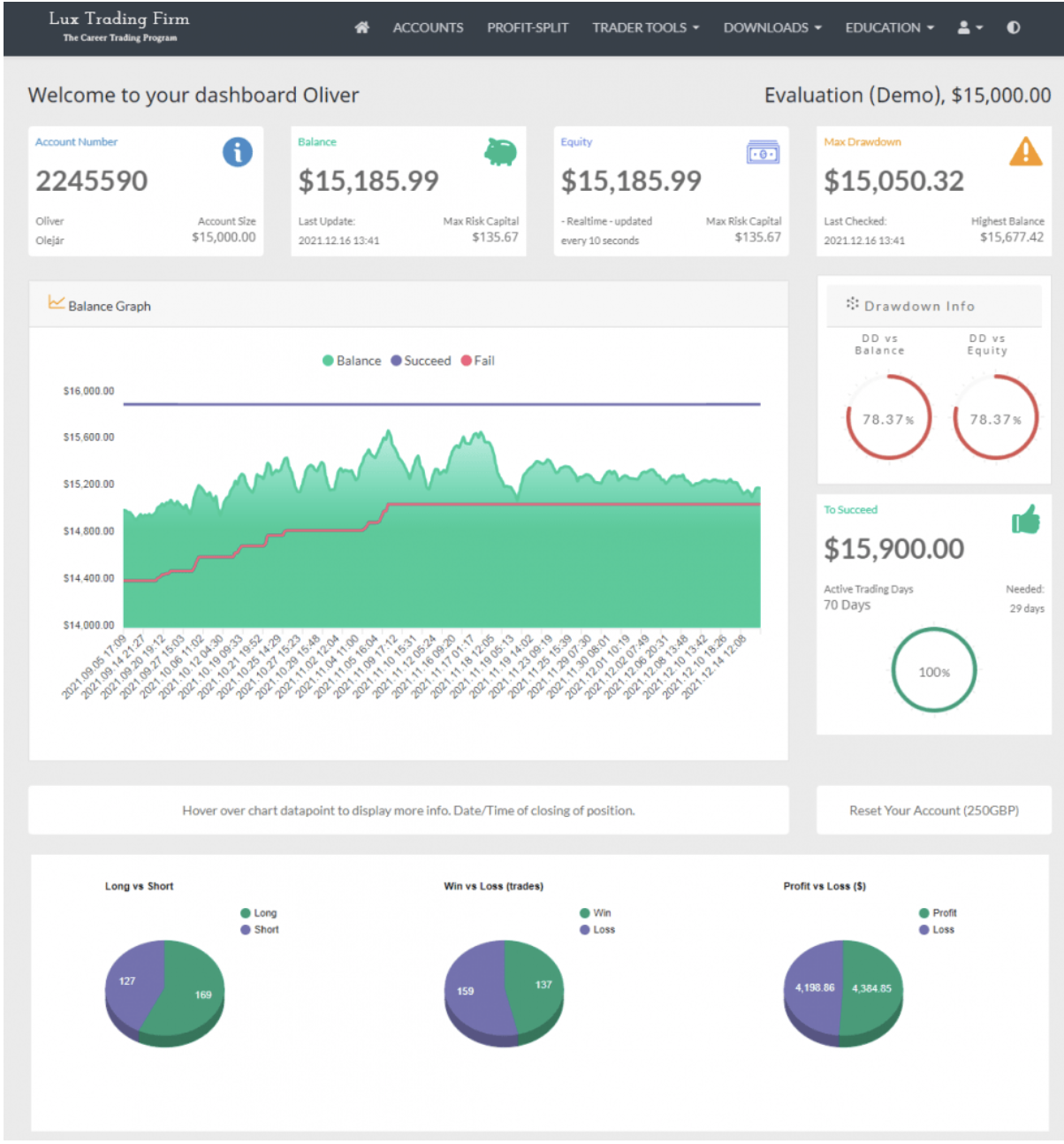

They are offering a modern dashboard to keep track of your trading progress. You can see an example of the dashboard above.

Lux Trading Firm provides a comprehensive FAQ page that serves as a valuable resource for acquiring the information you seek. For any additional assistance, their support team can be reached through their social media channels or via email at info@luxtradingfirm.com. Additionally, the firm offers round-the-clock live chat support for immediate assistance. Should you prefer direct communication, Lux Trading Firm can be contacted via telephone at +44 20 7193 9534.

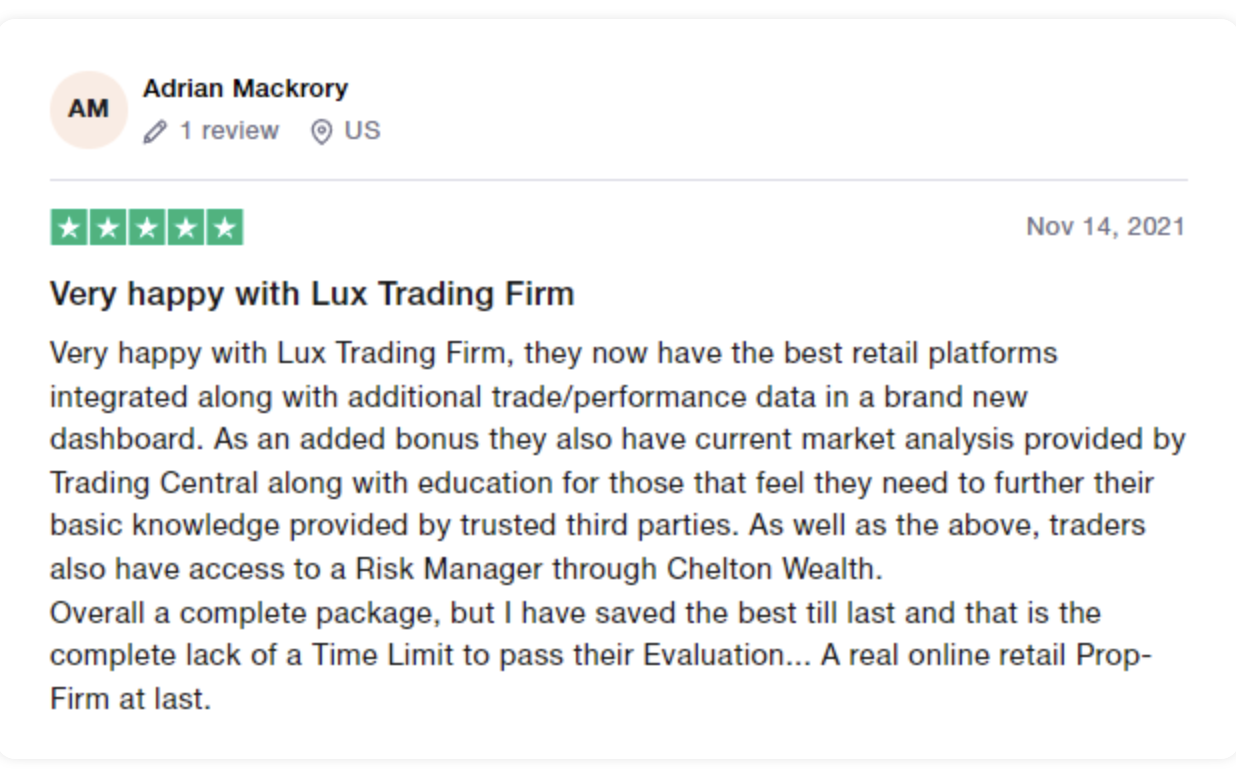

Traders’ Comments about Lux Trading

Lux Trading Firm has excellent feedback from their reviews.

Trustpilot boasts a diverse range of community members who actively participate by leaving positive feedback, resulting in an impressive overall rating of 4.5 out of 5 based on 398 reviews. Furthermore, their support team is known for its prompt and dependable assistance, offering comprehensive information tailored to customers’ needs.

The majority of their community expresses satisfaction with the intuitive design of their dashboard and the extensive data it encompasses. This feature effectively streamlines users’ experiences by eliminating the need for manual calculations of maximum relative drawdowns.

Moreover, Trustpilot’s educational resources and meticulous rules and guidelines contribute to the improvement of customers’ risk management practices. By compelling individuals to adapt to these standards, the platform fosters a more advantageous approach to risk management.

Social media statistics

Lux Trading Firm can also be found on social media.

They have a:

Conclusion

In summary, Lux Trading Firm is a reputable proprietary trading firm that provides traders with the option to participate in two distinct funding programs: a unique two-step evaluation and a $1 million one-step funding program.

The two-step evaluation programs involve a distinctive two-phase evaluation process that must be completed to obtain funding and qualify for profit splits. To secure funding, traders at Lux Trading Firm are required to achieve profit targets of 6% in phase one and 4% in phase two. These targets are realistic and attainable trading objectives, particularly when considering the 5% maximum loss rule. The two-phase evaluation programs offer traders the opportunity to earn profit splits of 75% and the potential to scale their account balance up to $10,000,000.

On the other hand, the one-step evaluation program consists of a single-phase evaluation process, which must be completed to secure funding and become eligible for profit splits. Traders at Lux Trading Firm need to reach a profit target of 15%, which is also a realistic trading objective considering the 5% maximum loss rule.

This one-step evaluation program allows traders to earn profit splits of 75% and has the potential to scale their account balance up to $10,000,000.

I would recommend Lux Trading Firm primarily to experienced traders who possess well-developed trading strategies and robust risk management approaches. The firm has clear and transparent rules, with no maximum time limitations, and imposes relatively high minimum trading day requirements. These factors indicate that Lux Trading Firm aims to attract consistent and dedicated traders. After considering all the aspects of what Lux Trading Firm offers, it can be deemed an excellent choice for individuals seeking steady, consistent profits and who have a well-established trading strategy