“MFF: Empowering Traders with MyForex Founders”

“Unlock Success in Forex with MFF: MyForex Founders – Embrace Opportunity in a Market That Awaits Your Expertise!”

Since its establishment in July 2020, My Forex Funds has successfully attracted a substantial number of traders and disbursed significant financial rewards. The organization has effectively managed and surmounted certain challenges associated with expansion, establishing its reputation as one of the foremost global proprietary trading firms renowned for its competitive affordability.

Pros of MFF

- Accounts for every skill level — MFF has accounts tailored for beginners, intermediate, and professional traders.

- Instant funding — With an Accelerated account, you can have instant access to up to $50,000 of trading capital.

- Earn during evaluation — Earn 2% of your profits after passing phase 1, 4% after passing phase 2, plus a 112% refund of your signup fees with your first payout

- Affordable pricing — Evaluation accounts with MFF can be up to 25% cheaper than FTMO for the same level of capital.

- Free retakes — Traders who don’t violate the trading rules but also don’t reach their profit target get two free extensions or unlimited free retakes.

- Great profit splits — Profit splits for Evaluation accounts start at 75% and go all the way up to 85% or even 90% for VIP traders. That’s about as good as it gets.

- Low-profit targets — For Evaluation accounts, it’s 8% split to pass the first stage and then just 5% to move on to a funded account

- Popularity — MFF claims more than 40,000 traders in 120 countries since its inception.

- Active trading community — MFF’s Discord channel with more than 175,000 members is an invaluable tool for beginning traders.

Cons of MFF

- Slow customer service — MFF has acknowledged the need to hire more trader support agents, and although I’ve seen a marked improvement of late, they can still be slow to respond.

- Equity-based drawdown — Drawdown is based on your equity, not your account balance, which trips a lot of traders up.

- Account choices — MFF has so many account options, it can be difficult to discern which rules apply to which accounts.

Who are MFF?

MFF was established in Toronto in June 2020 and initiated its Evaluation account in March 2021. Within the first few months, they attracted over 4,000 traders. Presently, in 2023, they rank as the second most prominent prop firm globally based on certain metrics, following FTMO.

Murtuza Kazmi, the founder of MFF, possesses a background as a part-time trader and an early investor in cryptocurrencies. He utilizes his substantial crypto profits to finance forex traders, believing that their skills can yield better returns. Through MFF, he offers funding to forex traders, aiming to identify successful traders and leverage their expertise.

How does My Forex Funds operate?

MFF operates similarly to other prop trading firms that provide funded accounts. They offer funding to forex traders in exchange for an upfront fee and a percentage of the trader’s profits. Traders must demonstrate excellent risk management by adhering to MFF’s trading rules to continue receiving funding.

MFF offers three different account types through which traders can become funded. The Rapid account allows inexperienced traders to learn gradually and develop familiarity with the trading platform while honing their risk management skills. Once a trader demonstrates mastery of risk management and displays the necessary tools for success with a Rapid account, they can graduate to a live account. With a live account, traders receive 50% of the profits in the first month, and the profit split increases by 15% each month if they maintain profitability and adherence to guidelines, up to a maximum split of 80%.

Evaluation accounts involve trading in demo mode initially. Traders must achieve modest profit targets of 8% in the first stage and 5% in the second, while following trading rules, to qualify for a live account. Advancement to the next stage requires trading for a minimum of five days in each stage.

Most traders join MFF with Evaluation accounts, but many fail due to the company’s well-known daily maximum drawdown policy. If an account experiences a drop of 5% or more in a single day, it violates the drawdown rule and the trader loses the account. While a 5% daily drawdown may not be considered excessive, MFF calculates drawdown based on equity balance rather than the account balance, which I explain in more detail in my review. It is crucial to understand this distinction before signing up with MFF.

Upon successfully passing both evaluation stages, traders can finally trade with real money. Initially, they receive 75% of the profits, and if they continue to trade without breaking the rules, the profit split can increase up to a maximum of 85%.

Accelerated accounts are straightforward, offering instant funding upon sign-up. There is no daily drawdown limit; however, an overall drawdown limit is set at a maximum of 5% for Conventional Accelerated accounts and 10% for Emphatic Accelerated accounts. If the equity or account balance falls below either of these thresholds, the account is lost.

Accelerated accounts can be scaled up to a maximum of $2 million, and the profit split is an even 50/50, paid out weekly.

The founding program options:

MFF charges one-time fees, which are refundable for Rapid and Evaluation accounts if traders meet the trading requirements and successfully transition from a demo account to a live account. Accelerated accounts, on the other hand, require a nonrefundable fee for instant funding.

MFF offers their client three different funding programs:

-

- rapid account

- evaluation account

- accelerated

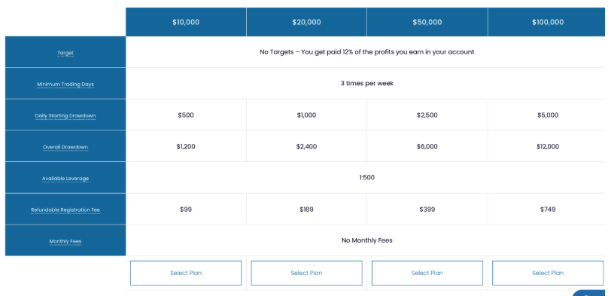

Rapid account:

The Forex Funds Rapid account program is designed to recognize and reward traders for their dedication, as they gain experience and proficiency through trading with a demo account. The program offers a range of account sizes, from $10k to $100k, and bonuses are disbursed on a bi-weekly or monthly basis.

The primary objective of the Forex Funds Rapid program is to evaluate the trader’s capabilities over three months, to determine their eligibility for accessing our live trading funds. The advantage of participating in the Rapid program is that traders receive bonuses while undergoing assessment, ensuring that their time and efforts are compensated during the initial three-month period, even though their trades are executed within a demo environment. Importantly, there is no time limit imposed within the Rapid model.

Benefits:

Earn whilst you learn: Our Rapid program enables you to take your time in becoming a professional trader whilst earning along the way. Whether you are part-time or full time you get rewarded for your success.

Large product range: Kick-start your career by trading a diverse selection of products! With over 100 instruments at your disposal, you can trade and earn from your favorite assets.

– Consistency and Non-consistency accounts!: Tailor your Rapid account to your preferences. Showcase your skills with the consistency account, or trade based on your parameters with the non-consistency account.

– No evaluations or targets: Embark on your trading journey without the pressure of undergoing tests. Leave behind the stress of meeting time-limited targets and trade at a pace that suits you.

– A low-cost entry into professional trading!: Begin your professional trading venture with a low-cost entry point. Experience the world of a professional trader without a significant financial commitment. Choose the program and fee structure that aligns with your needs, and upgrade as you progress and earn.

– Take your time!: Take your time to grow as a trader, without the constraints of a calendar countdown. Adjust your pace to what works best for you, whether it be a gradual or accelerated approach.

You will receive remuneration equivalent to 12% of the total profits you generate. If you are under the Continuous Employment Agreement (CEA), your payment will be disbursed on a bi-weekly schedule, whereas under the Non-Continuous Agreement (NCA), your bonus will be paid out monthly. The bonuses can be transferred through Bank Transfer, PayPal, or Cryptocurrency.

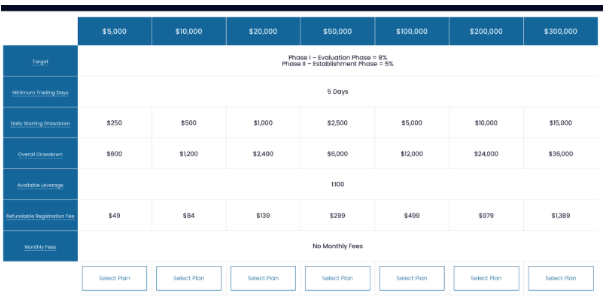

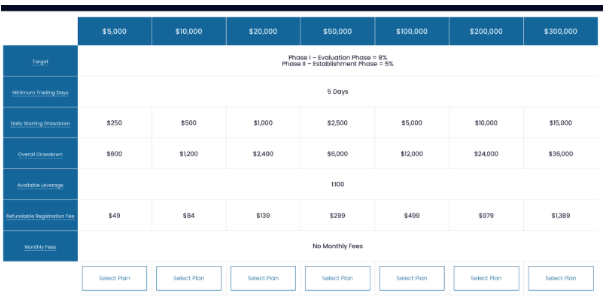

Evaluation Account:

Our Forex Funded Account Evaluation program is specifically designed for FOREX traders aiming to demonstrate their expertise. It provides an opportunity for semi-professional traders seeking capital to advance their careers by showcasing their abilities in a streamlined, two-phase process. Successful participants can join our prestigious FOREX Prop Firm as funded traders and work towards achieving their goals.

The evaluation program comprises two distinct stages, enabling potential funded traders to validate their proficiency in FOREX, CFD, or commodities trading. Evaluation trading accounts are available in varying sizes, ranging from $5,000 to $300,000. Profits are distributed through profit-split payouts, with monthly disbursements during the first month and bi-weekly thereafter. While a trader may accumulate up to $600,000 in capital across evaluation accounts, the limit per trading account is $300,000.

Through the MyForexFunds evaluation trading account process, our objective is to identify dedicated FOREX Prop Firm traders who possess the necessary skills for success. By consistently demonstrating accuracy, maintaining proper trading risk management techniques, and exhibiting disciplined trading behavior, traders can earn rewarding incentives. It is possible to transition to a funded account within a mere 10 days by providing your worth, or alternatively, you may choose to complete the evaluation process within a more relaxed timeframe of up to 90 days. The decision is yours to make!

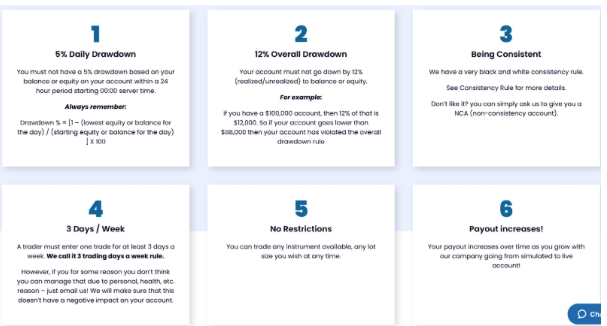

Rules:

5% Daily Loss Limit

- Your FOREX trading account mustn’t incur a drawdown of more than 5% based on your balance or equity within 24 hours starting at 5 pm EST.

12% Cumulative Loss Limit

- Your FOREX trading account should not experience a decline of 12% (realized or unrealized) relative to the initial balance. This calculation is based on the overall drawdown, which can be determined using the following formula:

- Drawdown % = [1 – (lowest equity or balance for the day) / (initial balance of the account)] x 100

8% Phase 1 Profit Target

- To successfully progress in phase 1, you must achieve a profit target of 8% within a 30-calendar day period, while strictly adhering to all other rules. The countdown begins when you open your first trade on your FOREX trading account.

5% Phase 2 Profit Target

- Upon completing phase 1, you will advance to phase 2, where you are required to attain a profit target of 5% within a 60-calendar day period while ensuring compliance with all other rules. The countdown starts from the moment you open your first trade on your FOREX trading account.

Minimum 5 Trading Days Requirement

- To pass the Prop Firm evaluation, it is necessary to engage in trading for a minimum of 5 trading days. This demonstrates your patience and establishes your FOREX trading habits, enabling us to evaluate your style and skills.

Unrestricted Trading

- You have the freedom to trade your FOREX Prop firm account according to your preferred methods, trade sizes, and timings. We impose no restrictions on your trading approach. However, we strongly advise maintaining consistency and prioritizing risk management, as these factors play a pivotal role in long-term success. It is essential to thoroughly familiarize yourself with all the rules before commencing trading activities.

Benefits

- Profit split of up to 85% available

When you advance to the funded account stage, you have the opportunity to earn up to 85% of the profits generated.

- Exceptionally low targets compared to the market!

Our targets are set at just 8% for phase 1 and 5% for phase 2, making us the most competitive choice available in the market.

- An affordable and top-quality option!

We provide our programs at a reasonable cost while maintaining the highest standards of quality. Our programs are designed to be budget-friendly.

- Complimentary retakes and extension options

If you have achieved profitability but haven’t reached the target within the Phase I 30-day timeframe, you have the option to request two free extensions of up to 14 days each or enjoy unlimited free retakes, provided there are no breaches on your account.

- No limitations on trading activities

You have the freedom to engage in various trading activities such as trading news, holding positions over weekends, scalping, swinging, or trending. You can select your preferred product, whether it’s FOREX, Metals, CFDs, or cryptocurrencies.

- Reimbursement of fees

Upon successfully reaching the first payout milestone of your live account, we will not only refund your fees but also provide you with a portion of the profits you have earned

Profit-sharing scheme:

Following the initial month of trading, you will be entitled to receive 75% of your profit. During the second month, you will receive 80% of your profit on a bi-weekly basis. Starting from the third month, and continuing thereafter, you will receive 85% of your profit on a bi-weekly basis. The distribution of profit-sharing will be facilitated through Deel, which offers various payment methods such as bank transfer, PayPal, transfers, or cryptocurrency.

Accelerated:

The My Forex Funds Accelerated program is designed to enable our traders to commence live trading from the very beginning. This program is particularly suitable for skilled full-time traders who seek to promptly increase their capital.

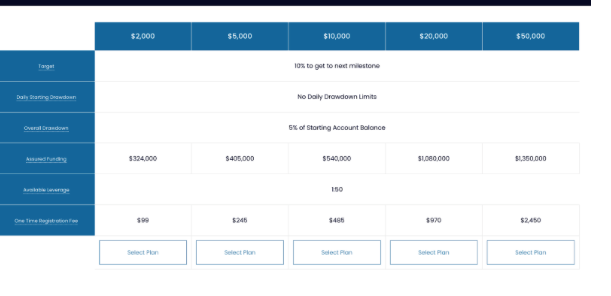

Bypass the evaluation process and commence your trading journey immediately with our Accelerated program. We have meticulously crafted a cutting-edge program that provides you with instant financial rewards.Commence with a minimum of $2,000 and progress up to $50,000, with the opportunity to scale your funds up to a maximum of $2 million through our program.

With the My Forex Funds’ Accelerated program, we offer professional traders the opportunity to bypass the queue and immediately engage in real fund trading. Benefit from accelerated growth through our compounding rewards and enjoy the advantages of being a professional trader.

Rules

Overall drawdown limits of 5% or 10% are in place.

There are no daily restrictions on drawdown. The overall drawdown is set at 5% for Conventional accounts and 10% for Emphatic accounts. For instance, if you have a Conventional accelerated account with a balance of $50,000, a 5% drawdown would amount to $2,500. Therefore, if your balance/equity falls below $47,500, your account will have violated the overall drawdown rule.

Leverage up to 1:100 is provided.

Emphatic accounts have a leverage ratio of 1:100 for Forex, Metals, and CFDs, while Conventional accounts have a leverage ratio of 1:50 for Forex, Metals, and CFDs. This allows you to maximize potential gains while managing risk and reaping the rewards.

- Scaling occurs at intervals of 20%.*

Your account will be scaled by a factor of 2x or 1.5x (depending on the phase

you are in). Scaling is permitted once during each pay period.

*For Conventional accounts, scaling occurs at intervals of 10%.

- Maximum account size of USD 2 million.

Our largest accounts can scale up to a value of USD 2 million.

- No trading of shares allowed.

Due to the specific nature of our Accelerated program, trading in shares is not permitted. However, you can trade other popular products such as Forex, CFDs, Cryptocurrencies, and Metals.

- Weekly profit payouts.

Receive your profit share weekly. Your first payment can be received within a week, provided that your account has been active for at least five days. All payout requests must be made before 3 pm EST, otherwise, they will be processed in the next pay period.

Benefits

- Elimination of Profit Targets for Payouts

- Our payout system does not impose any profit targets.

- Payouts are not contingent on achieving specific profit targets.

- Scalability through Success

- Our comprehensive scale-up program facilitates rapid goal attainment.

- Upon scaling, your account size can reach up to $2,000,000.

- Absence of Time Constraints

- Trade and earn at your preferred pace without external pressures.

- We prioritize your growth without imposing strict time limits or account threats.

- Unrestricted Lot Sizes

- We provide trading freedom by removing limitations on lot sizes.

- However, we emphasize the importance of consistency and risk management for profitable trading.

- Flexibility in Trading Practices

- Whether you choose to trade once, twice, or numerous times, it’s entirely up to you.

- Our mutual success is dependent on your comfort and preferred trading approach.

- Exemption from Daily Drawdown Restrictions

- Our accounts have no daily drawdown limits, with the exception that the overall drawdown should not exceed 5% for Conventional accounts and 10% for Emphatic accounts.

- While compound trading is allowed, we encourage you to maintain a forward-moving trajectory and avoid regressing.

As part of our compensation structure, you are entitled to receive a percentage of 50% of the overall profit generated in your account weekly. To qualify for a weekly payout, your account must have a minimum age of five days. To initiate a payout, kindly submit a request to our billing department before 3 pm EST. Payout processing typically takes 1-3 business days. You have the option to choose your preferred payout method, which includes Bank Transfer, Cryptocurrency, Transferwise, or Paypal.Transferwise, or Paypal.

What makes MFF different from other prop firms?

If you are interested in joining arguably one of the fastest-growing proprietary trading firms globally, we encourage you to consider signing up with MFF. By doing so, you will gain access to a flourishing and dynamic trading community. The remarkable ascent of MFF from a relatively basic prop firm with limited funding options and an amateurish website to a company with 40,000 traders within less than two years is truly astounding. MFF’s commitment to growth and innovation remains unwavering.

For those seeking value, MFF offers competitive pricing that will surely appeal to bargain hunters. The cost of a $50,000 Evaluation account is still only $299 (see detailed pricing below). In comparison, FTMO’s $50,000 account is priced at €345. Opting for MFF presents a significant cost advantage.

Additionally, if you prefer to forgo the evaluation process or demo trading, MFF provides the option of an instantly funded account. While the pricing of instantly funded accounts may not be as competitive, particularly when compared to the 5%ers, they still offer favorable terms. Traders using MFF have access to a range of trading options, including forex, CFDs, and metals.

However, it is important to consider whether MFF is suitable for your trading style and circumstances. If you tend to hold positions overnight, the 5% drawdown limit may dissuade you. This limit is based on your equity at 5 p.m. EST, rather than your account balance. Consequently, if a winning trade experiences a pullback exceeding 5%, it will breach the maximum drawdown threshold, resulting in the loss of your account. Even if your overall account performance remains profitable, this rule still applies, which may be a disadvantage.

Furthermore, individuals residing in specific countries subject to OFAC sanctions, such as Iran, Iraq, Libya, Russia, Syria, Myanmar, Sudan, and others, are no longer eligible to join MFF.

Taking all aspects into consideration, while it took some time for people to recognize the merits of MFF, the firm has effectively managed its exceptional growth and solidified its position among the world’s leading proprietary trading firms. With attractive pricing options, versatile account choices catering to traders of varying skill levels, an extensive trading community, and more, MFF represents an excellent starting point for your trading career.

Which brokers do MFF use?

MFF uses his own server which is Traders Global Group for all of our accounts; both Demo and Live accountsMFF uses his own server which is Traders Global Group for all of our accounts; both Demo and Live accounts.

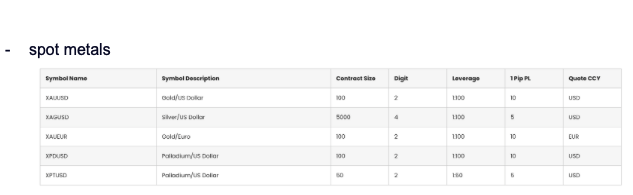

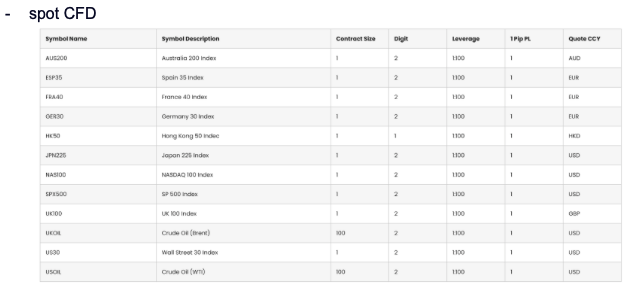

Trading instruments:

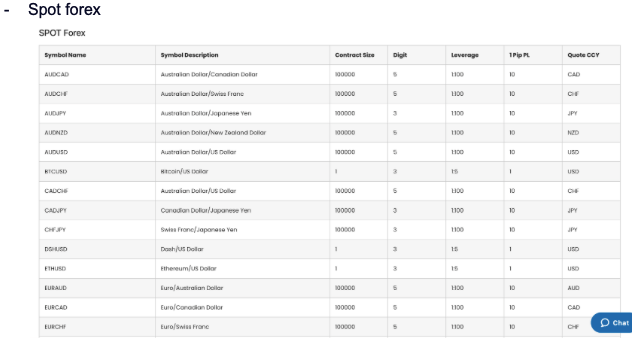

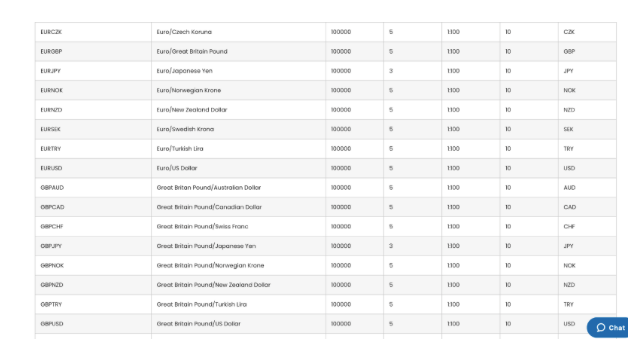

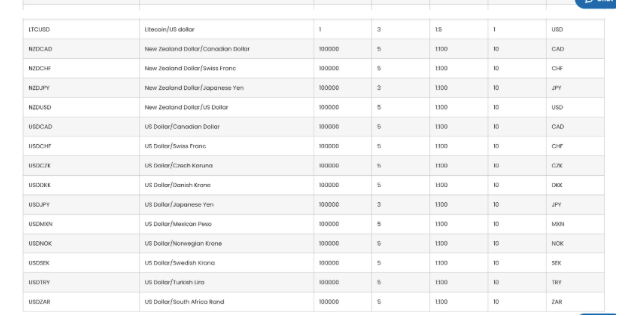

MFF use different trading instrument such as Spot Forex, Spot metals and spot CFD

Trading instruments:

MFF use different trading instrument such as Spot Forex, Spot metals and spot CFD

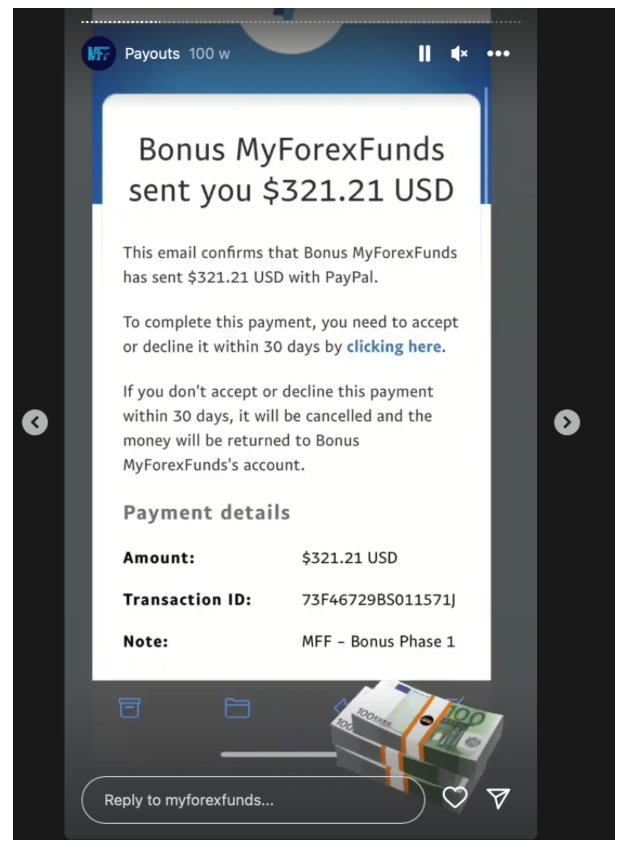

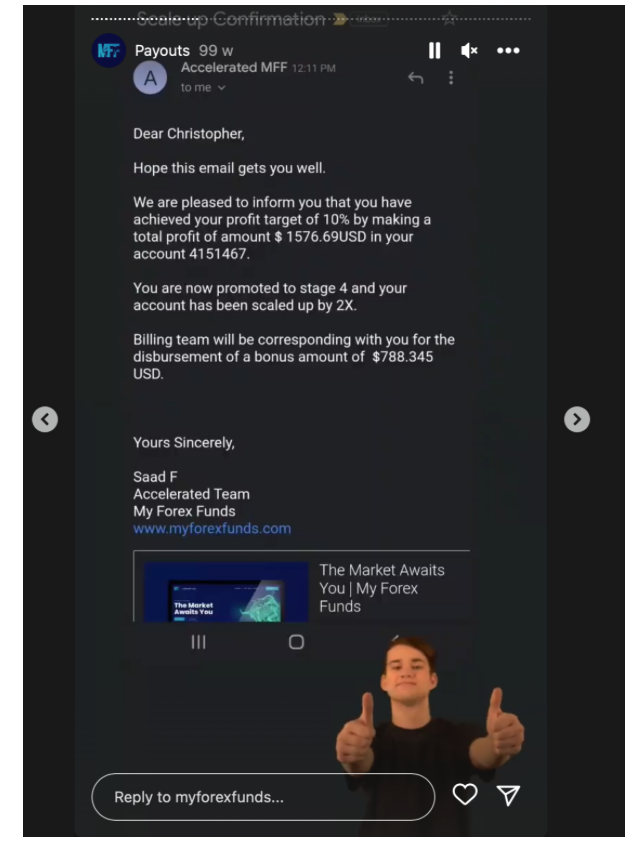

Payment proof:

For MFF’s payment proof it’s possible to found information on the Instagram under the section payment proof and on following the link for the discord page,

Here’s are some example from the instagram page:

Education and support for traders

Previously, MFF had plans to establish a forex academy; however, it appears that this initiative has been put on hold. Nonetheless, I remain optimistic about its progress. In the interim, MFF is actively engaged in providing social media tips and regularly updating its blog with trading insights, including informative introductory articles on the forex market.

Moreover, MFF’s primary educational resource lies within its community of traders. Their Discord community is substantial and dynamic, fostering a largely supportive atmosphere. Merely by observing the general chat or trade ideas thread, one can gain valuable knowledge.

Although MFF has occasionally encountered challenges in providing sufficient support to traders, even the founder, Murtuza Kazmi, has openly addressed this issue. This predicament is not unique to MFF but rather a common challenge faced by rapidly expanding proprietary firms, given the inherent complexities involved. Engaging temporary personnel to address intricate queries from traders is not a viable solution, as comprehensive training is essential to equip customer service representatives adequately.

Nevertheless, MFF has made significant strides in this domain, presently employing over 300 staff members, a considerable portion dedicated to trader support.

Social media Stats:

MFF can be found in the major social media and its accessible to everyone interested:

- facebook has 48.751 followers

- Instagram has 151k followers

- youtube has 36.000 subscriber

- tik tok has 3233 followers

- linkedin has 9.327 followers

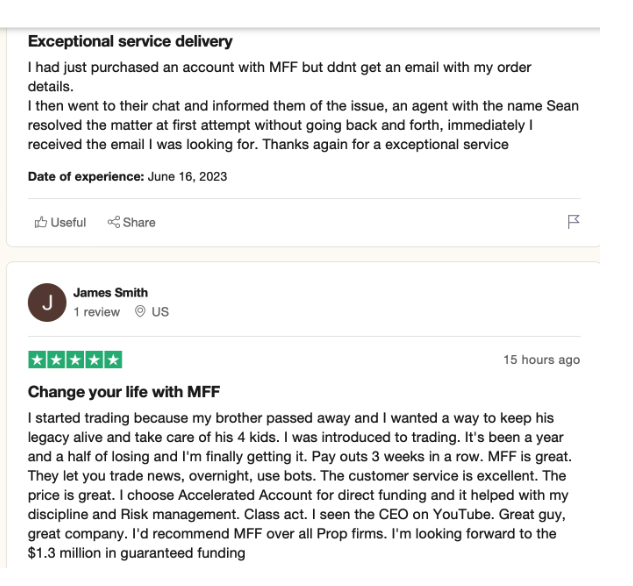

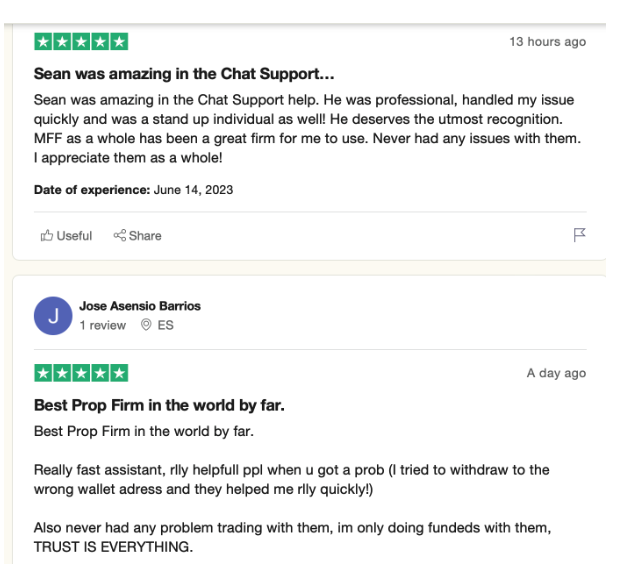

Traders’ Comments about MFF

Clients of MFF are really happy with their service and appreciate the firm.

Conclusion

In conclusion, MFF (MyForex Found) has emerged as a prominent player in the forex trading industry, demonstrating a commitment to education, community building, and continuous improvement. While the initial plans for a forex academy have been put on hold, MFF remains actively engaged in providing valuable resources to aspiring traders.

Through its social media presence and regularly updated blog, MFF offers a wealth of trading tips and introductory-level content, making the forex market more accessible to newcomers. Moreover, their expansive Discord community serves as a vibrant platform for knowledge sharing and support, where traders can learn from one another’s experiences and ideas.

Acknowledging the occasional challenges in trader support, MFF has proactively addressed this issue, recognizing the complexities inherent in rapidly growing prop firms. By employing a dedicated team of over 300 staff members, many of whom are specifically focused on trader support, MFF demonstrates its commitment to providing quality assistance and enhancing the overall trading experience.

As MFF continues to evolve, it is evident that they prioritize the needs of their traders and strive for continuous improvement. While challenges may arise, the proactive measures taken by MFF, including the engagement of a supportive community and a substantial staff, reflect their dedication to delivering a positive and educational environment for traders.

In a dynamic and ever-changing market like forex trading, MFF’s commitment to education, community, and improvement positions them as a noteworthy entity. With their continued efforts, MFF has the potential to further solidify its position as a trusted and valuable resource for aspiring and seasoned traders alike.