“Empowering Traders with MyFundedFX: Unleash Your Potential”

“Trade Risk-Free and Earn Profits with MyFundedFX’s Challenge Programs: Unlock Financial Opportunities with Zero Capital Risk and Earn Payments on Profitable Trades!

MyFundedFX presents traders with two distinct challenge programs designed to offer a risk-free trading opportunity. Successful traders are eligible to receive compensation based on a predetermined percentage of their profits, with no obligation to bear any losses incurred by the firm.

To assess the capabilities of traders, MyFundedFX employs a comprehensive evaluation process consisting of either a one-step or two-step challenge. During this evaluation, traders are provided with a demo account containing virtual funds, allowing them to engage in trading activities while their performance is closely monitored.

Pros of MyFundedfx

Unlimited trading period to complete evaluations phase

Maximum balance of up to $1,500,000

80% profit split

By-weekly payouts

overnight and weekend holding allowed

News trading allowed

scaling account options

leverage up to 1:100

A large variety of trading instruments (forex pairs, commodities, indices)

Cons of MyFundedfx

Lot size limitations

No free trial

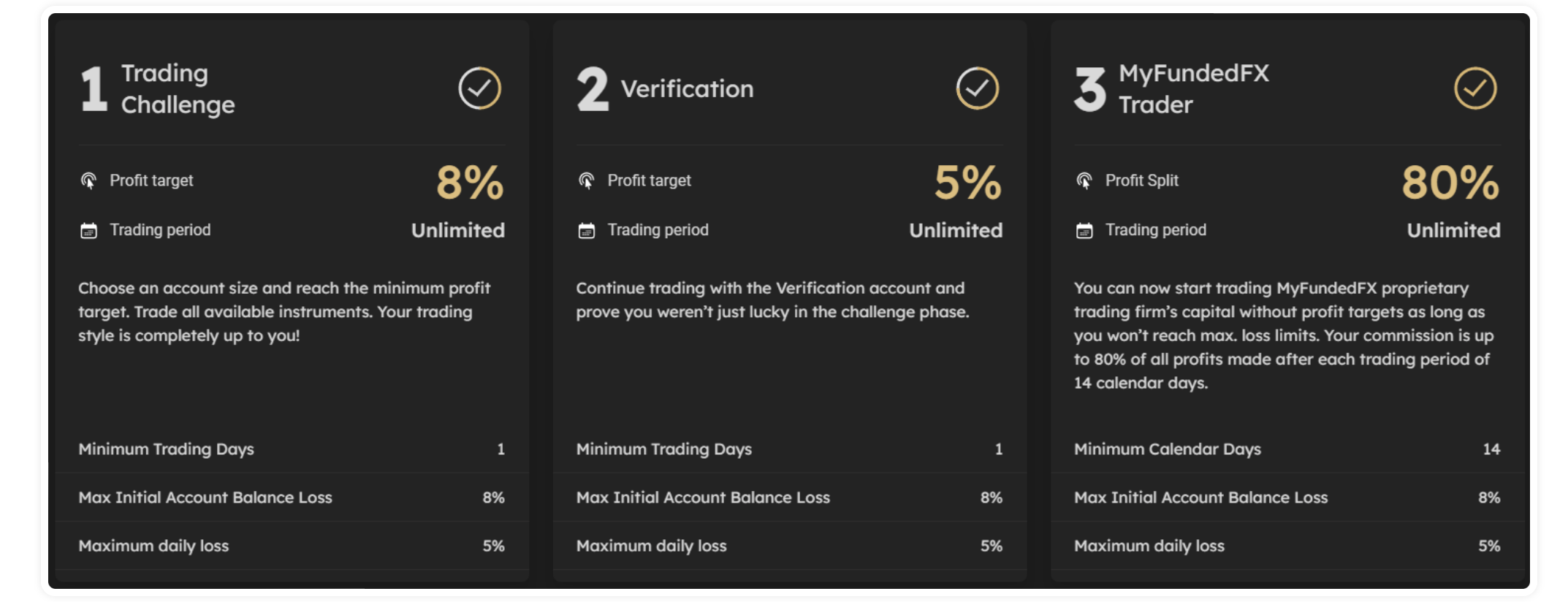

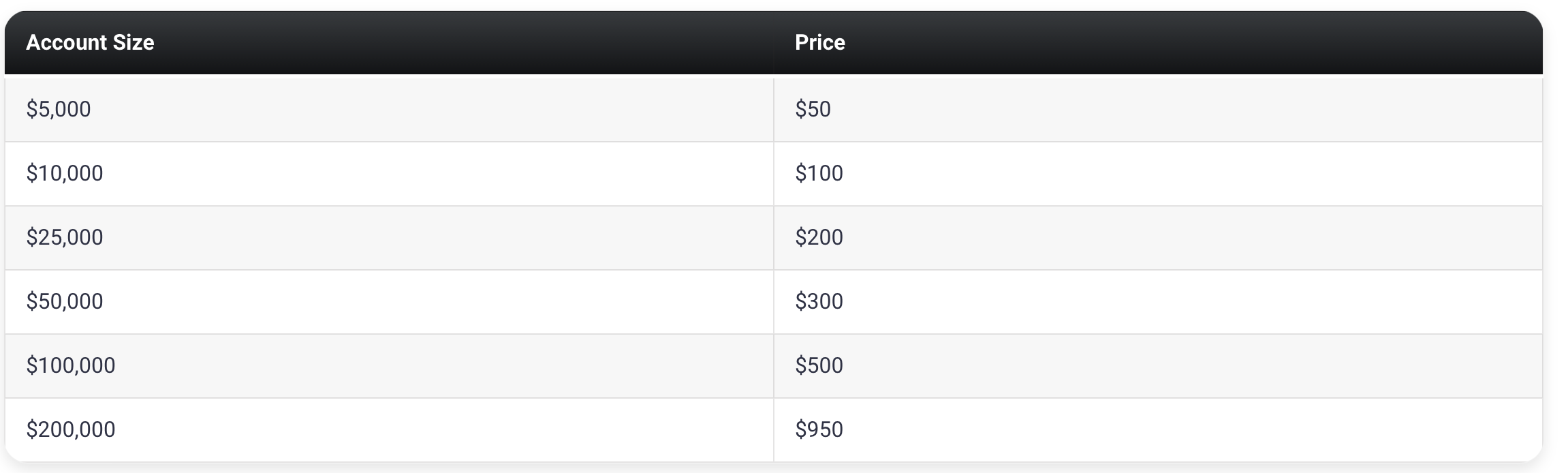

MyFundedFX provides traders with challenge programs that present a risk-free trading opportunity by eliminating the need to invest personal capital. Successful traders are eligible for compensation based on a predetermined percentage of their earnings, with no financial obligation on the firm’s part. Through this arrangement, traders have the potential to generate substantial profits by managing account sizes of up to $200,000 and receiving 80% of the profits. This favorable arrangement encompasses trading activities involving forex pairs, commodities, indices, and cryptocurrencies.

Who are MyFundedfx?

MyFundedFX is an independently owned financial institution established in June 2022, with a headquarters situated in the United States. The company provides traders with the opportunity to consolidate their accounts, with a maximum limit of $300,000, and offers a scaling plan to further augment their account balance. MyFundedFX has formed partnerships with renowned brokers Eightcap and ThinkMarkets.

The physical address of MyFundedFX’s offices is 100 Crescent Court Suite 700, Dallas, TX 75201, United States.

Who’s the CEO of MyFundedfx?

Matthew Leech, an accomplished entrepreneur in the financial and technology services sectors, as well as a proficient trader in forex, options, stocks, and cryptocurrencies, is the founder of MyFundedFX. Since 2018, he has actively engaged in trading and currently serves as the CEO of MyFundedFX, alongside his involvement in several other ventures.

The establishment of MyFundedFX by Matt was driven by his recognition of an industry gap. Often, proprietary trading firms prioritize the development of programs that overlook the specific needs of individual traders. In contrast, MyFundedFX places paramount importance on trader education and facilitates their journey towards securing funding. Matt and the entire team are dedicated to this objective, consistently enhancing the foundational skills necessary for traders to become funded.

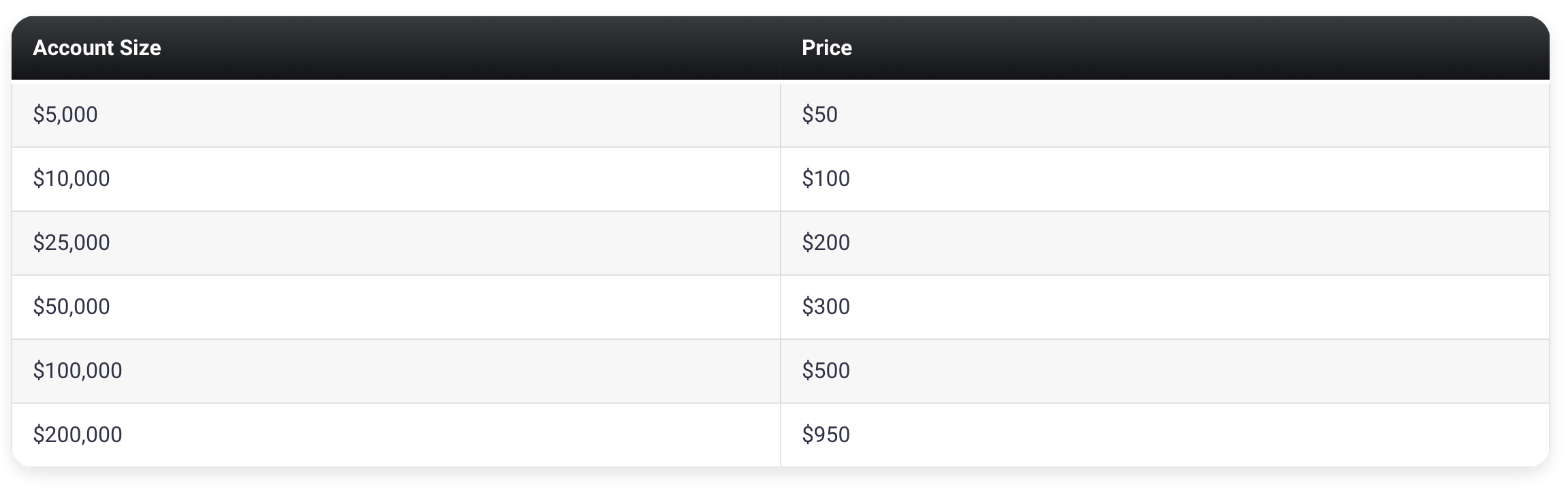

The founding program options

MyFundedFX offers its traders two different programs to choose from:

- One-step evaluation challenge accounts

- Two-step evaluation challenge accounts

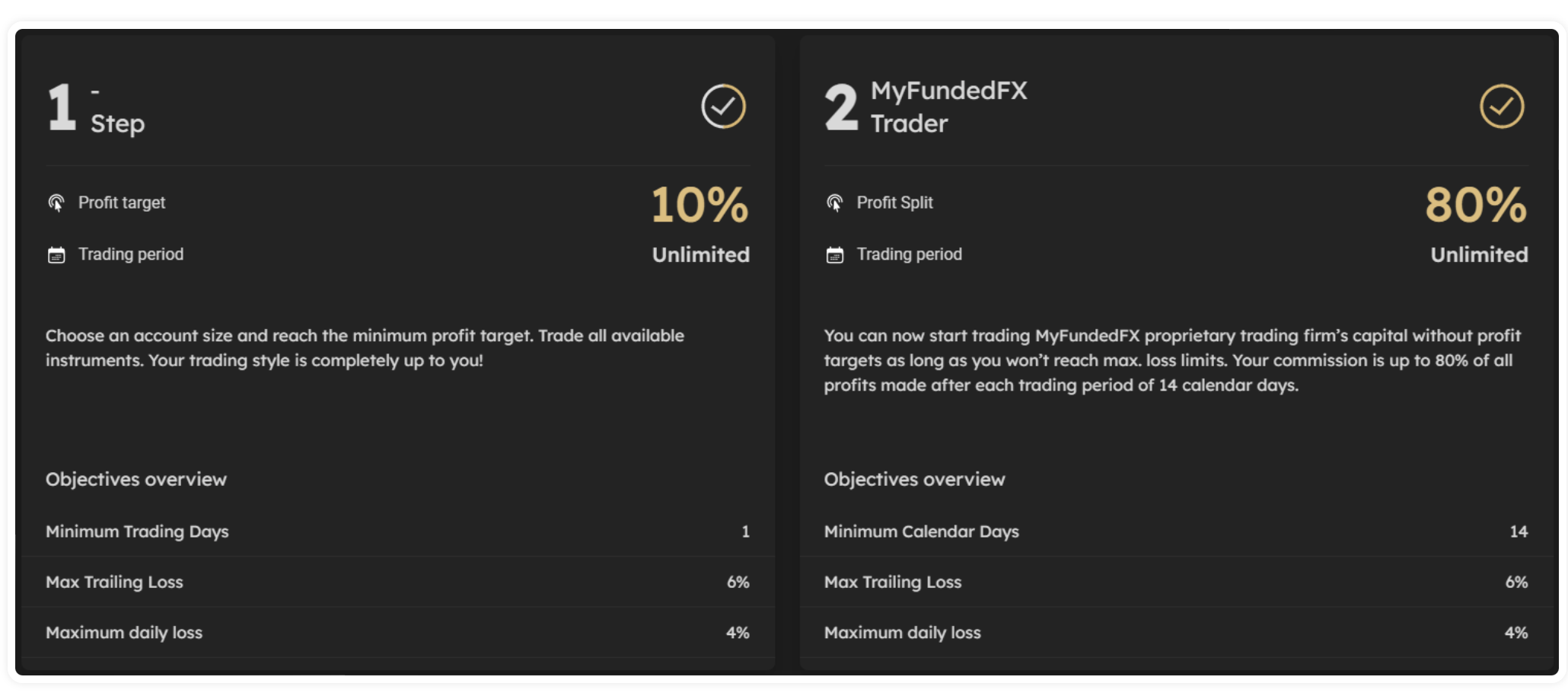

One-step evaluation challenge accounts:

The one-step evaluation challenge entails that a trader must achieve a profit target of 10% while adhering to the daily maximum loss limit of 4% and the trailing maximum loss limit of 6%. There is no specified duration for this challenge, allowing the trader to trade for an indefinite period of time until the profit target is met, without any minimum trading day requirements.

Successful completion of the one-step evaluation challenge results in the trader being granted a funded account with no profit targets. The trader is only obligated to comply with the 4% daily maximum loss and 6% trailing maximum loss rules. The initial profit split is set at 80% based on the profits generated within 14 calendar days after the first position is taken in the funded account. Following the first payout, subsequent payouts will be issued bi-weekly.

The one-step evaluation challenge incorporates a well-defined scaling strategy. It mandates achieving profitability within a three-month timeframe, with a minimum average return of 12% or higher over the same duration. Upon meeting this criterion, an account increase of 25% will be granted based on the initial account balance, capped at a maximum balance of $1,500,000.

Example:

After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

After the next 3 months: The balance of $250,000 increases to $300,000.

After the next 3 months: The balance of $300,000 increases to $350,000.

And so on…

Trading instruments for the one-step evaluation challenge accounts are forex pairs, commodities, indices, and cryptocurrencies.

One-step evaluation challenge account rules

- The profit target represents a specific percentage of profit that must be achieved by a trader in order to successfully complete an evaluation phase, withdraw profits, or scale their account. During the evaluation period, the profit target is set at 10%, whereas for funded accounts, there are no specific profit targets.

- The maximum daily loss refers to the maximum amount of loss a trader is allowed to incur on a daily basis before the account is considered in violation. Regardless of the account size, the maximum daily loss is capped at 4%.

- The maximum trailing drawdown indicates the highest level of drawdown a trader can experience, which is measured as the difference between the peak account balance and the lowest point of drawdown. For all account sizes, the maximum trailing drawdown is set at 6%.

- Lot size limit mandates traders to adhere to predefined lot sizes for specific trading instruments. Typically, these lot sizes are determined based on the initial account balance of the proprietary firm account.

- Third-party copy trading risk refers to the potential consequences of utilizing a copy trading service provided by an external party. It is important to be aware that other traders may already be using the same trading strategy through the same third-party service. Consequently, utilizing such a service carries the risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- Third-party EA risk pertains to the hazards associated with employing a third-party EA (Expert Advisor) for trading purposes. It is important to consider that other traders may already be using the same trading strategy through the same third-party EA. Therefore, utilizing a third-party EA exposes the trader to the risk of being denied a funded account or withdrawal if the maximum capital allocation rule is surpassed.

Two-step evaluation challenge account:

Phase one of the evaluation process necessitates traders to achieve a profit target of 8% without exceeding the 5% maximum daily loss or 8% maximum loss thresholds. There are no constraints on the duration of trading activities. During this phase, meeting the profit target is mandatory, and there are no specific requirements regarding the minimum number of trading days for advancing to phase two.

Phase two of the evaluation process mandates traders to attain a profit target of 5% while adhering to the 5% maximum daily loss or 8% maximum loss criteria. Similar to phase one, there are no time restrictions for trading. Meeting the profit target is obligatory, and there are no minimum trading day requirements for progressing to a funded account.

Successful completion of both evaluation phases grants traders a funded account with no profit targets. The only requirements are to observe the 5% maximum daily loss and 8% maximum loss rules. The initial profit split is set at 80% based on the profits generated within 14 calendar days after the first position is taken in the funded account. Subsequent payouts will be issued bi-weekly thereafter.

Furthermore, the two-step evaluation challenge accounts include a scaling plan. Traders must be profitable within a three-month timeframe, maintaining an average return of 12% or higher throughout this period. Upon achieving this goal, the account balance will be increased by 25% of the original amount, up to a maximum balance of $1,500,000.

Example:

After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

After the next 3 months: The balance of $250,000 increases to $300,000.

After the next 3 months: The balance of $300,000 increases to $350,000.

And so on…

Trading instruments for the two-step evaluation challenge accounts are forex pairs, commodities, indices, and cryptocurrencies.

Two-step evaluation challenge account rules

- The profit target refers to a predetermined percentage of profit that must be achieved by a trader in order to successfully complete an evaluation phase, withdraw profits, or expand their account. Phase 1 requires reaching an 8% profit target, while Phase 2 necessitates a 5% profit target. Funded accounts are not subject to profit targets.

- The maximum daily loss denotes the highest allowable loss a trader can incur within a single day before their account is deemed in violation. Regardless of the account size, the maximum daily loss is set at 5%.

- The maximum loss signifies the utmost allowable cumulative loss a trader can experience before their account is deemed in violation. Irrespective of the account size, the maximum loss is capped at 8%.

- The lot size limit mandates that traders adhere to specified lot sizes for specific trading instruments. These limits are generally determined based on the initial account balance of the proprietary firm account.

- Third-party copy trading risk highlights the possibility that when utilizing copy trading services provided by a third party, there may already be other traders employing the exact same trading strategy. Consequently, by using a third-party copy trading service, there is a potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- Third-party EA risk underscores the fact that when employing a third-party EA (Expert Advisor), other traders may be already using the same trading strategy. Thus, using a third-party EA carries the potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is surpassed.

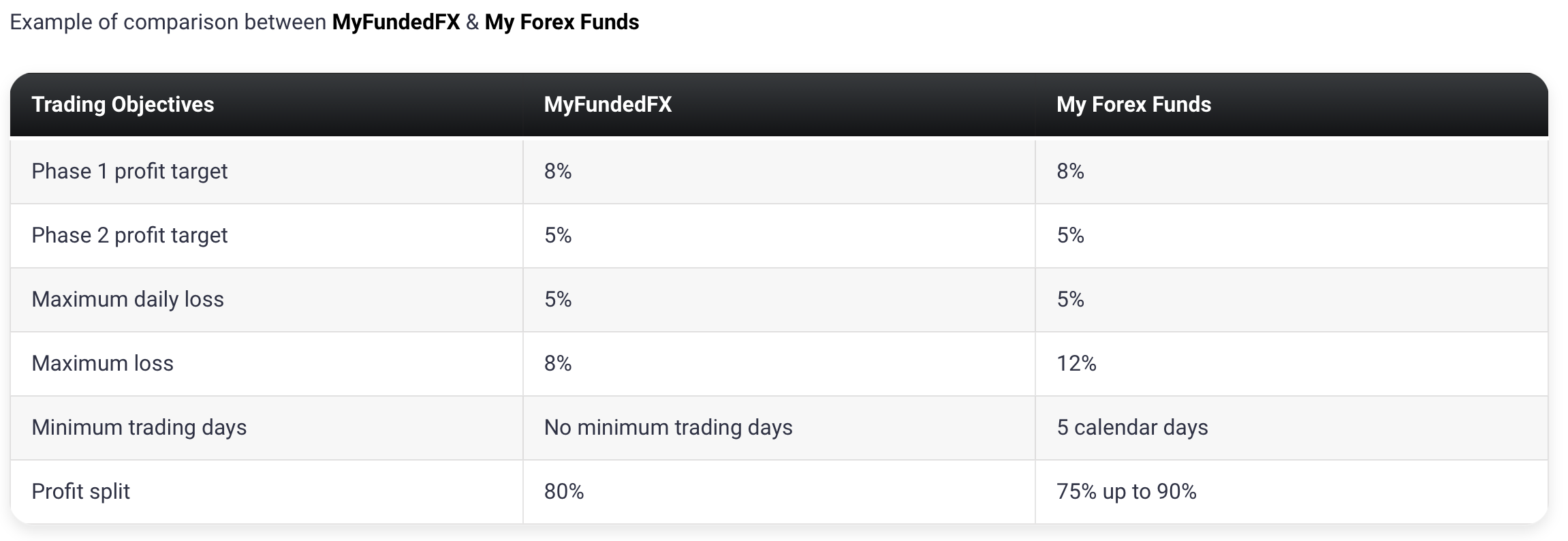

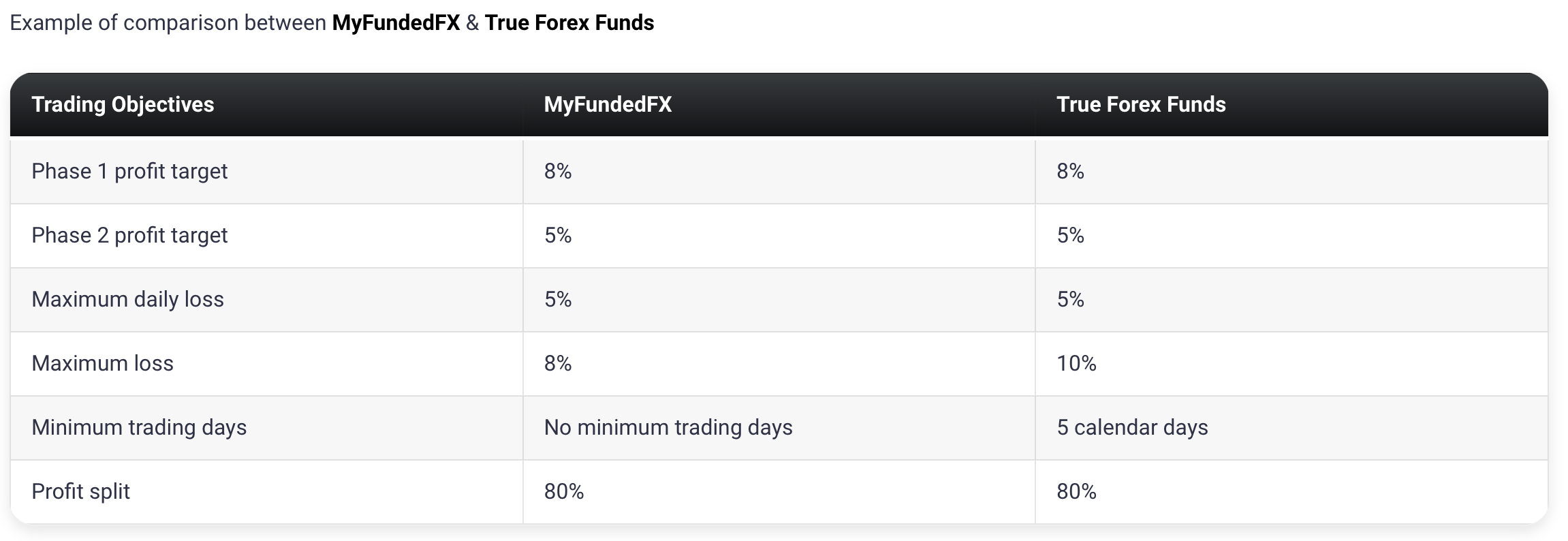

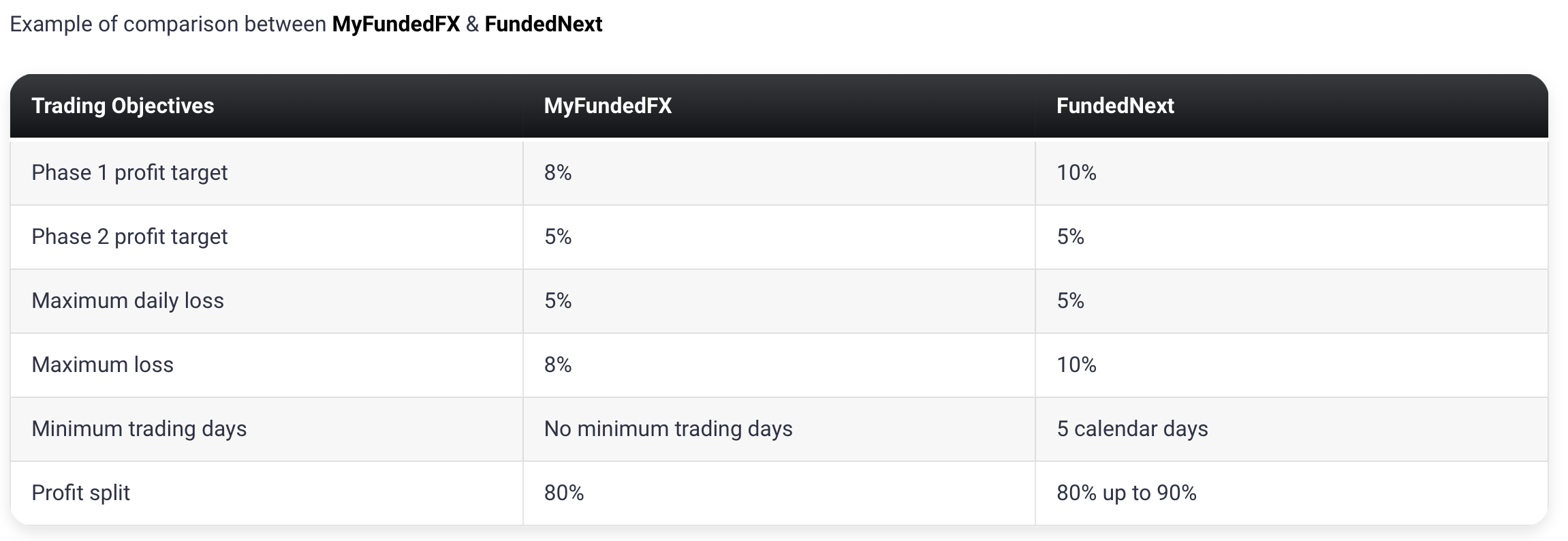

What makes MyFundedfx different from other prop firms?

MyFundedFX distinguishes itself from the majority of prominent prop firms through its provision of two distinct funding programs: the one-step and two-step challenges. Additionally, the company maintains comparatively lenient trading regulations, allowing traders to hold positions overnight and over weekends, as well as engage in trading activities during news releases.

In contrast to other prop firms, MyFundedFX presents a one-step evaluation challenge that necessitates traders to successfully complete a single phase in order to qualify for payouts. This challenge entails achieving a profit target of 10%, adhering to maximum daily loss and trailing loss rules of 4% and 6% respectively. It is important to note that there are no imposed limitations on the minimum or maximum number of trading days during the evaluation period. Moreover, the one-step evaluation challenge accounts incorporate a scaling plan. In comparison to other industry-leading prop firms, MyFundedFX maintains moderate trading regulations, while offering an unrestricted trading duration.

Furthermore, MyFundedFX offers a two-step evaluation challenge that requires traders to complete two distinct phases before becoming eligible for payouts. The first phase entails achieving a profit target of 8%, while the second phase requires a profit target of 5%. In both phases, traders must adhere to maximum daily loss and maximum loss rules of 5% and 8% respectively. Similar to the one-step challenge, there are no restrictions on the minimum or maximum number of trading days during the evaluation period. Additionally, the two-step evaluation challenge accounts incorporate a scaling plan. Compared to other industry-leading prop firms, MyFundedFX presents relatively lower profit targets, while maintaining an unlimited trading duration.

In conclusion, MyFundedFX is different from most of the industry-leading prop firms due to offering two different funding programs with relatively relaxed trading rules and an unlimited trading period. You can hold trades overnight and during the weekends and trade during news releases.

Is getting capital realistic?

It is crucial to assess the feasibility of trading requirements when evaluating prop firms that align with your forex trading style. While the prospect of a company offering a high percentage profit split on a generously funded account may initially appear appealing, it is important to consider the realistic expectations they have in terms of monthly percentage gains and maximum drawdowns. Failing to meet these demanding criteria would significantly diminish your chances of achieving success.

Obtaining capital through the one-step evaluation challenge accounts is primarily realistic due to their modest profit target of around 10%, coupled with average maximum loss regulations (4% maximum daily and 6% maximum trailing loss).

Likewise, acquiring capital through the two-step evaluation challenge accounts is generally realistic as they set relatively lower profit targets (8% in phase one and 5% in phase two), along with slightly below-average maximum loss guidelines (5% maximum daily and 8% maximum loss).

Considering all these factors, MyFundedFX emerges as an excellent option for obtaining funding. It offers two distinct funding programs, each of which establishes realistic trading objectives and stipulations for receiving payouts.

Payment proof

MyFundedFX was incorporated in June 2022. After getting a live-funded account, your first payout will be available in 14 calendar days. After that, traders continue to receive payouts on a bi-weekly basis.

You can find a large amount of payment proof on MyFundedFX’s Discord channel under the section ”Payout proof”.

Which brokers do MyFundedfx use?

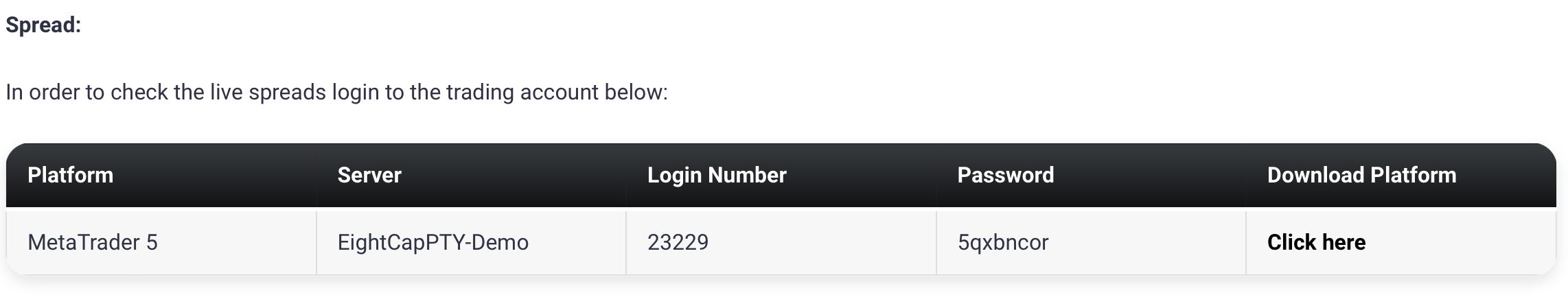

MyFundedFX uses Eightcap and ThinkMarkets as their broker.

Eightcap is a Melbourne-based brokerage firm operating under the regulation of ASIC (Australian Securities and Investments Commission). Established in 2009, Eightcap upholds a clear and focused objective of delivering exceptional financial services to its esteemed clientele. With a presence in five international offices and regulatory compliance in various jurisdictions, the company offers global clients the opportunity to engage in trading across a diverse range of markets, including foreign exchange, indices, commodities, and equities.

ThinkMarkets is a distinguished online brokerage offering a diverse range of assets, with its main offices situated in London and Melbourne. The company facilitates seamless and efficient access to a broad spectrum of markets, while concurrently delivering highly acclaimed trading solutions such as MetaTrader 4, MetaTrader 5, and their proprietary ThinkTrader platform.

As for trading platforms, they allow you to trade on MetaTrader 4 and MetaTrader 5.

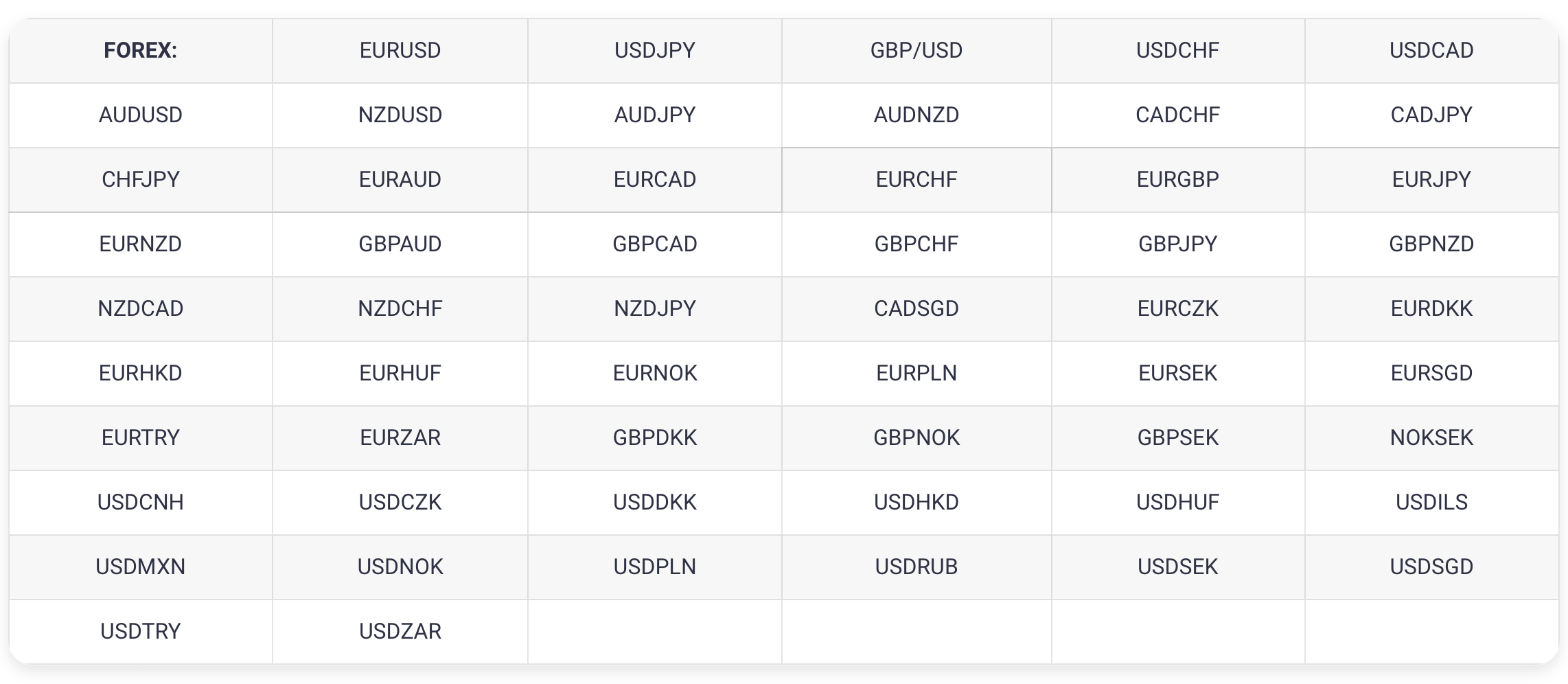

Trading instruments:

MyFundedFX allows you to trade forex pairs, commodities, indices, and cryptocurrencies with up to 1:100 leverage.

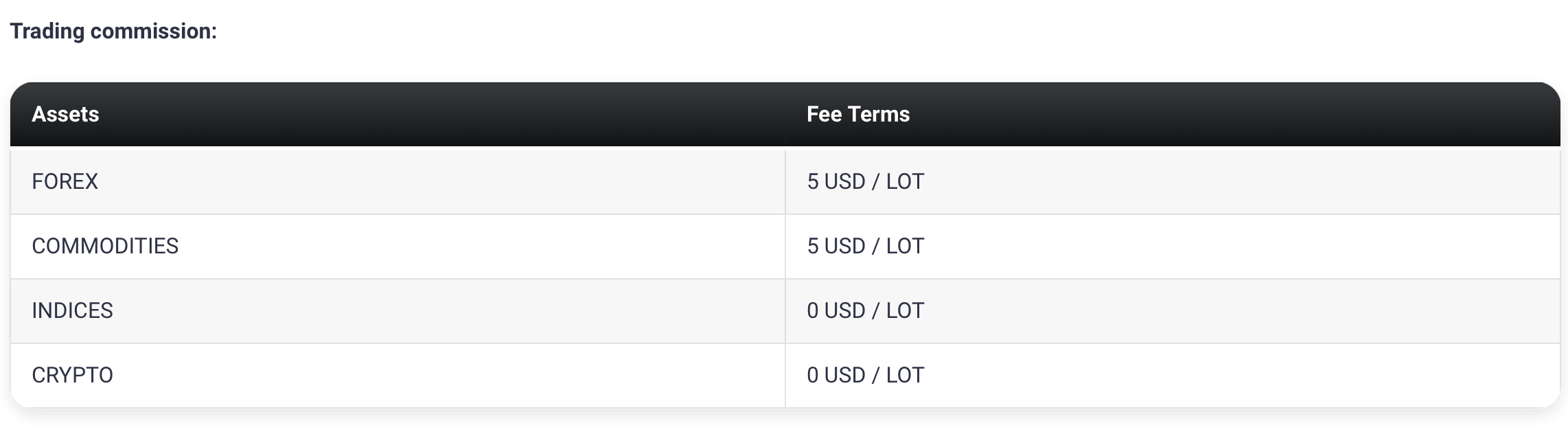

Trading fees

Education and support for traders

MyFundedFX does not provide any educational content on its website.

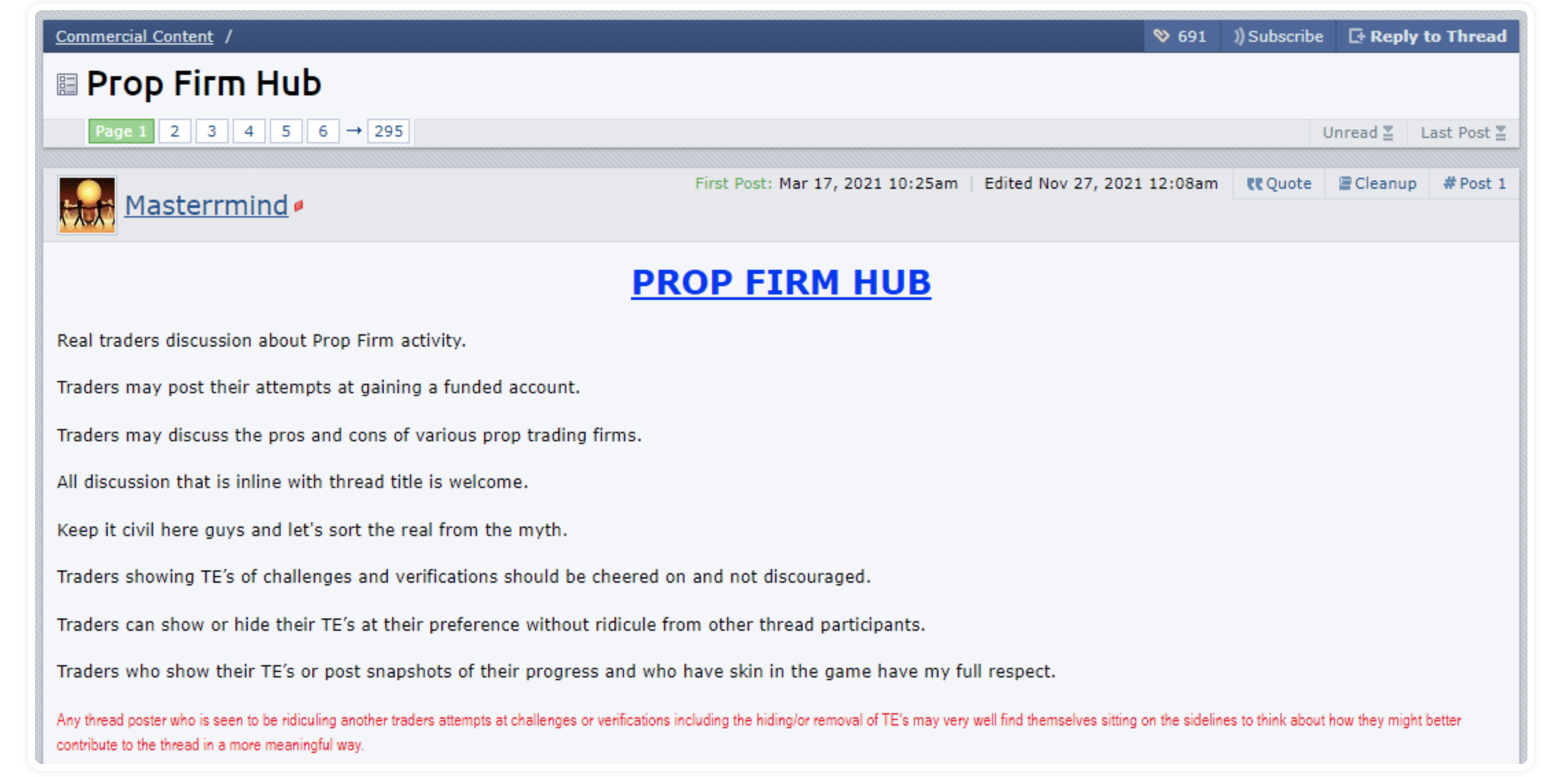

In addition, a thread can be found on ForexFactory named ‘’PROP FIRM HUB’’ made by MasterrMind, where MyFundedFX also gets mentioned numerous times.

In addition, they provide a well-structured dashboard that all of their clients can access, making it easier to manage risk with all the objectives of their statistics.

MyFundedFX provides a comprehensive Frequently Asked Questions (FAQ) page where users can potentially locate the information they seek.

For assistance, users can reach out to the support team through their official social media channels, or alternatively, they can directly contact them via email at support@Myfundedfx.com.

Furthermore, MyFundedFX offers an efficient live chat support service, enabling users to seek assistance with any challenges they may be facing or obtain general information about their proprietary trading firm.

Traders’ Comments about MyFundedfx

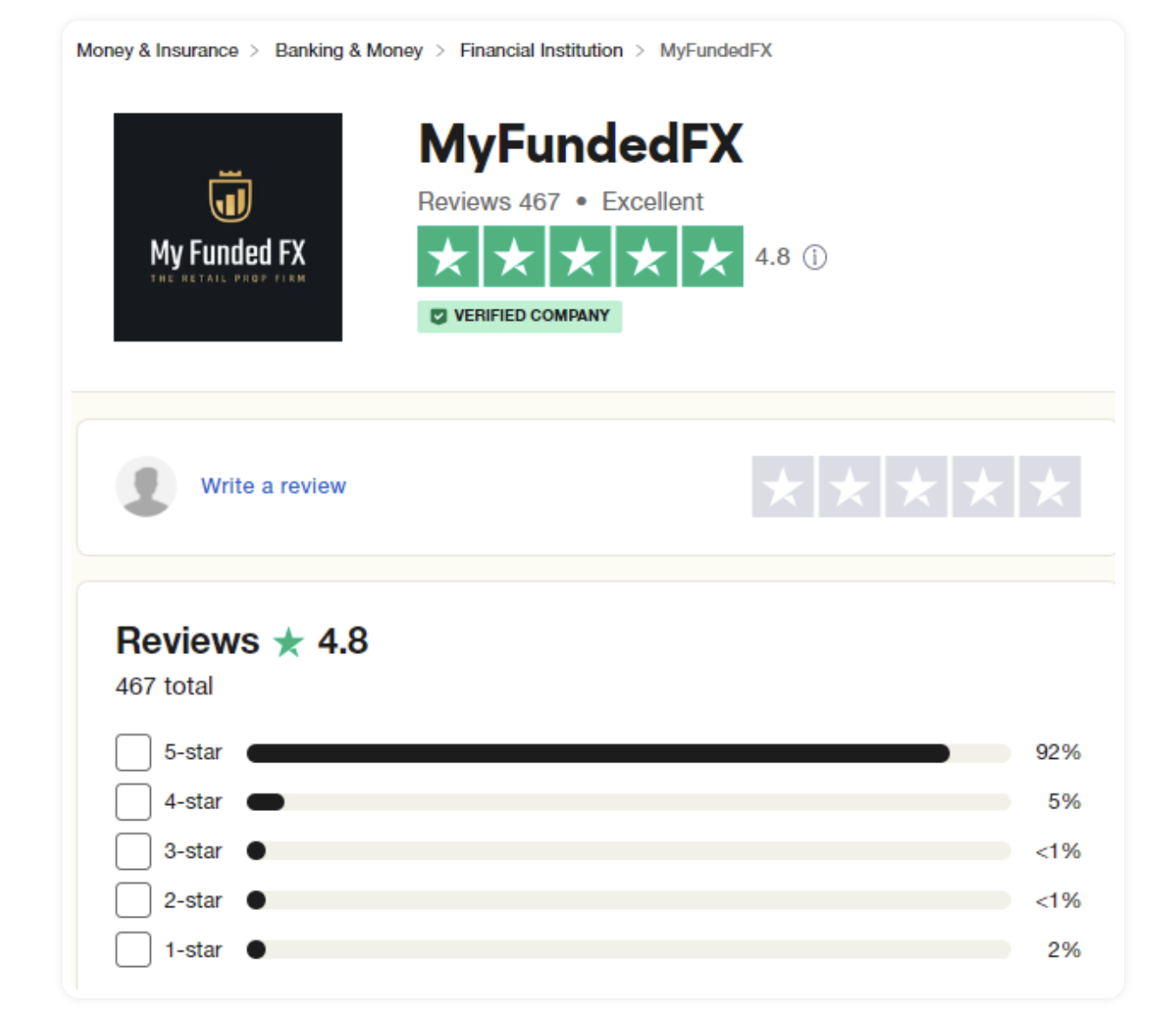

MyFundedFX has excellent feedback from reviews.

On Trustpilot, they have a large variety of their community commenting and giving positive feedback with a great score of 4.8/5 out of 467 reviews.

MyFundedFX’s community praises its efficient live chat support team that will provide you with all the necessary information you are looking for.

There is also a lot of positive feedback regarding their accessible offerings and trading rules, such as no time limitations, no inactivity rules, and huge potential with the scaling plan.

Social media statistics

MyFundedFX can also be found on social media.

They have a:

- Facebook group with 9,6k members, and

- Youtube channel with 3,26k subscribers with 12 uploaded videos.

In addition, MyFundedFX also has a Discord channel with 46,110 members and a Telegram channel with 3,830 members for their community to interact with each other.

Conclusion

In conclusion, MyFundedFX is a reputable proprietary trading firm that provides traders with the opportunity to select from two funding programs: one-step challenge accounts and two-step challenge accounts. Moreover, they have comparatively lenient trading regulations and an unrestricted trading duration, allowing traders to hold positions overnight and over weekends, as well as trade during news releases.

One-step evaluation challenge accounts necessitate the completion of a single phase before achieving funding and eligibility for profit splits. MyFundedFX requires traders to achieve a profit target of 10% before obtaining funding. These objectives are realistic within the context of following rules that limit maximum daily drawdown to 4% and maximum trailing drawdown to 6%. By participating in one-step evaluation programs, traders can earn 80% profit splits and have the opportunity to scale their accounts.

The two-step evaluation challenge follows the industry-standard approach of requiring the completion of two phases before gaining funding and eligibility for profit splits. In this case, MyFundedFX mandates traders to attain profit targets of 8% in the first phase and 5% in the second phase before obtaining funding. These objectives align with realistic trading goals while adhering to rules that restrict maximum daily loss to 5% and maximum loss overall to 8%. By engaging in evaluation programs, traders can earn 80% profit splits and have the option to scale their accounts.

I would highly recommend MyFundedFX to any trader seeking a reputable proprietary firm with transparent rules and trading objectives. They provide traders with favorable conditions, catering to a diverse range of individuals with distinct trading strategies. After a comprehensive assessment of all that MyFundedFX has to offer, it is evident that they rank among the top proprietary trading firms in the industry.