“The Funded Trader Review: Unveiling Insights and Evaluations”

“Empowering Traders: Unlock Capital Opportunities for Skilled and Committed Retail Traders to Thrive in Diverse Market Conditions with The Funded Trader”

The Funded Trader operates under the guiding principle that every retail trader should be afforded the chance to access capital based on their performance and dedication towards establishing their enterprise. They are actively seeking driven and proficient traders who can effectively navigate diverse market conditions and achieve success with the support of their financial resources.

The Funded Trader shares a common lineage with The Forex League and VVS Academy, as they share the same founders. This proprietary trading firm has been established to cater to the precise needs of its community, offering tailored solutions that align with its objectives.

Pros of FounderNext

Minimum balance of standard account up to $600,00

Four different funding program options

80% profit split on all funded accounts

Leverage up to 1:200

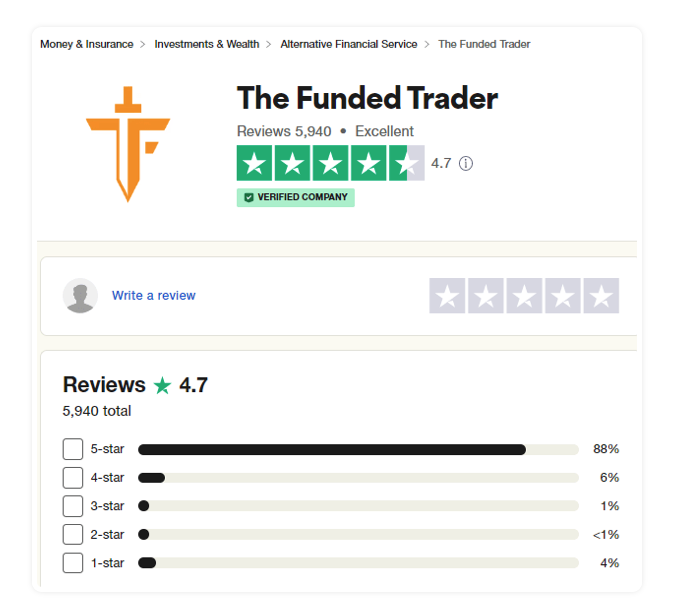

Over 5K Trustpilot reviews with an excellent score of 4.7/5

Unlimited evaluation free retires

Scaling plan with balance up to $1,500,000

90% profit split on scaling plan

overnight and weekend holding allowed

News trading allowed

A large variety of trading instruments (forex pairs, commodities, indices)

Cons of FounderNext

Customers support is reliable but relatively slow

Trailing drawdown (Knight’s challenge)

The Funded Trader program is actively seeking proficient and dedicated traders who possess the ability to thrive in volatile market environments. By leveraging their expertise and benefiting from the program’s financial support, traders have the opportunity to generate substantial profits. Successful participants can manage account sizes of up to $1,500,000 and retain a significant portion of the profits, with profit splits reaching as high as 90%. This can be accomplished through trading a diverse range of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Who are TFT?

The Funded Trader is an exclusive proprietary firm that was established on May 12, 2021. With a presence in the United States, they provide traders with the opportunity to access substantial capital balances of up to $1,500,000 and offer profit splits of up to 90%. Notably, they have formed strategic partnerships with reputable brokers such as Eightcap and Purple Trading Seychelles

Their headquarters are located at 14001 W HWY 29, Suite 102, Liberty Hill, TX 78642.

Who’s the CEO of TFT?

Angelo Ciaramello, a 24-year-old entrepreneur hailing from New Jersey, established The Funded Trader in 2020. His venture initially emerged as a startup aimed at gamified retail trading within the capital markets. The primary objective was to offer individual traders a competitive platform where they could strive to secure funding and achieve top positions on the rankings leaderboard.

Under Angelo’s leadership, The Funded Trader successfully devised various funding challenges that afford individuals the opportunity to trade the company’s capital and receive profit splits based on predetermined percentages. Notably, Angelo’s noteworthy accomplishment includes being acknowledged as one of the top 25 Financial Technology Leaders in New Jersey for the year 2022.

Those interested in keeping up with Angelo Ciaramello can do so by following his Instagram and LinkedIn profiles. By doing this, they gain access to his regular posts and insights into his daily endeavors

funding options:

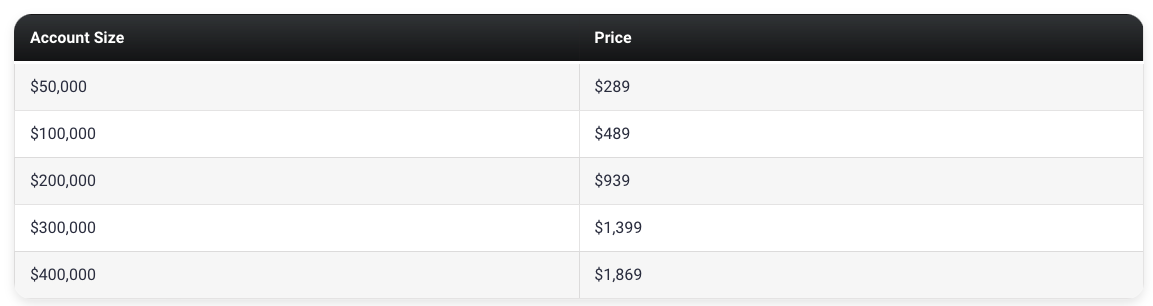

The Funded Trader offers its traders four different programs to choose from:

-

- Standard challenge accounts:

1) Standard regular challenge accounts

2) Standard swing challenge accounts

- Rapid challenge accounts

1) Rapid regular challenge accounts

2) Rapid swing challenge accounts

- Royal challenge accounts

- Knight challenge accounts

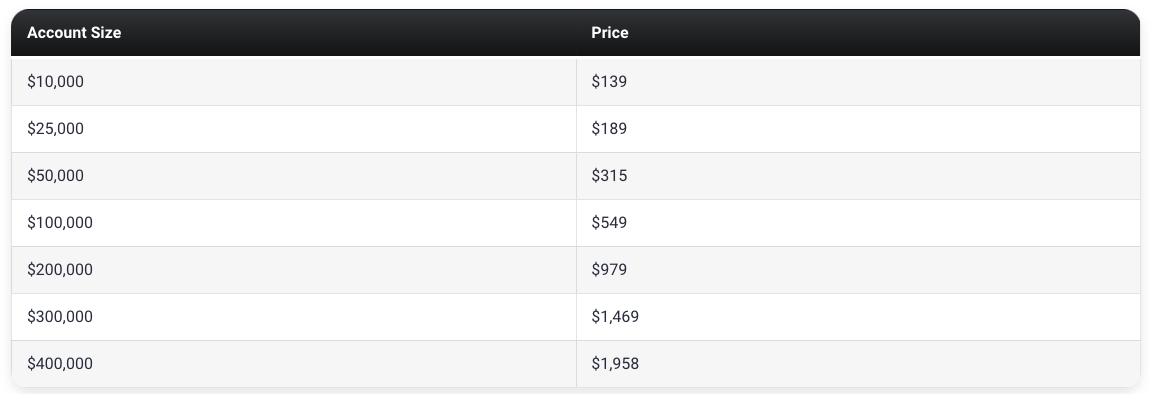

- Standard challenge accounts:

Standard challenge account

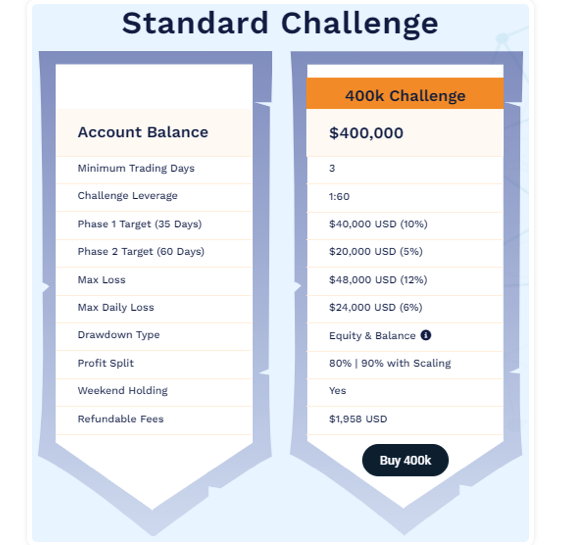

The primary objective of the Funded Trader standard challenge account is to identify dedicated and skilled traders who demonstrate consistent performance throughout a two-phase evaluation period. The regular evaluation program allows traders to engage in trading activities with a leverage ratio of 1:200. However, in the swing evaluation programs, traders can trade with a leverage ratio of 1:60. The key distinction lies in the option for swing accounts to hold trades over weekends, whereas regular accounts require trades to be closed.

During the first evaluation phase, traders must achieve a profit target of 10% while adhering to the maximum daily loss limit of 6% and the maximum loss threshold of 12%. It is mandatory to reach the profit target within 35 calendar days from the initial placement of a position in the evaluation account. Additionally, a minimum of three trading days must be completed to advance to phase two.

In the second evaluation phase, traders must attain a profit target of 5% while maintaining compliance with the 6% maximum daily loss and 12% maximum loss rules. The profit target for this phase must be reached within 60 calendar days from the day the first position is placed in the evaluation account. Similarly, a minimum of three trading days is required to progress to a funded account.

The scaling plan of this challenge is that you need to reach a profit target of 10%or more within a four month period where two months are profits and the last month needs to end in profit. Then you will receive an account increase of 40% of the original with the possibility to increase the account balance all the way up to $4,000,000, then your profit slip will increase up to 90% when you scale your account for the first time.

The Standard challenge accounts also offer a scaling plan. Traders are expected to achieve a profit target of 6% or higher within three months, with at least two out of the three months demonstrating profitability. Upon meeting these criteria, traders receive an account increase equivalent to 25% of the original account balance.

Example:

After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

After next 3 months: Balance of $250,000 increases to $300,000.

After next 3 months: Balance of $300,000 increases to $350,000.

And so on…

Trading instruments for the standard challenge accounts are forex pairs, commodities, indices, and cryptocurrencies.

Standard challenge account rules:

-

- The profit target represents a specific percentage of profit that traders must achieve before they are eligible to complete an evaluation phase, withdraw profits, or expand their accounts. In Phase 1, the profit target is set at 10%, while Phase 2 requires a profit target of 5%. It should be noted that funded accounts do not have profit targets.

- The maximum daily loss signifies the upper limit on the amount of loss a trader can incur within a single day before the account is considered in violation. Regardless of account size, all traders are subject to a uniform maximum daily loss of 6%.

- The maximum loss refers to the highest permissible overall loss that traders can experience before their account is deemed in violation. Across all account sizes, there exists a maximum loss threshold of 12%.

- Minimum trading days represent the minimum duration that traders are required to actively engage in trading before they can complete an evaluation phase or request a withdrawal. Both evaluation phases necessitate a minimum of 3 trading days. Funded accounts do not have a minimum trading day requirement before being eligible for payouts.

- Maximum trading days denote the maximum duration within which traders must achieve a specific profit target or withdrawal target. Phase 1 allows a maximum trading period of 35 days, while Phase 2 allows for a maximum of 60 trading days.

- The lot size limit dictates that traders must adhere to specified lot sizes for specific trading instruments. These lot sizes are typically determined based on the initial account balance of the prop firm account. This requirement applies only to funded accounts.

- The prohibition of martingale strategies implies that traders are not permitted to utilize any form of martingale strategy while trading.

- Third-party copy trading risk emphasizes that if traders intend to employ copy trading services, they should be aware that by utilizing a third-party copy trading service, there may already be other traders implementing the same trading strategy. Consequently, the use of such services carries the risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- The restriction on EA usage signifies that traders are not allowed to utilize any form of EA services. However, expert advisors for copying trades are permitted.

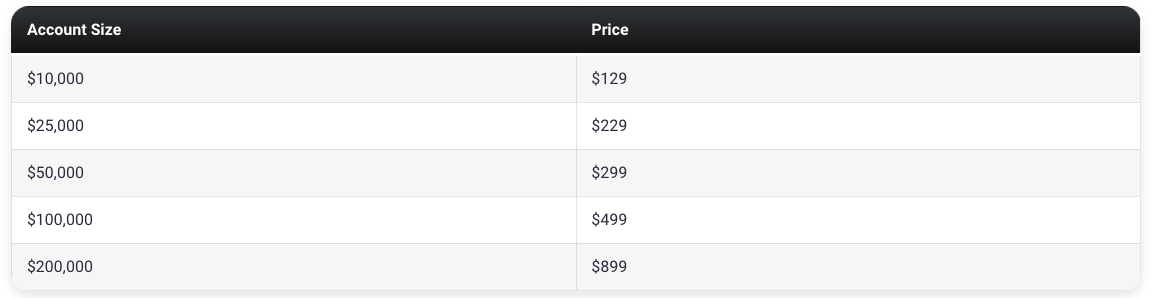

Rapid challenge accounts

The Funded Trader rapid challenge account serves the purpose of identifying diligent and skilled traders who are duly rewarded for their consistent performance during the two-phase evaluation period. The regular evaluation program account grants traders the opportunity to engage in trading activities with a leverage ratio of 1:100. Conversely, the swing evaluation programs allow traders to trade with a leverage ratio of 1:30. The only distinguishing feature between the two is that swing accounts permit the holding of trades over weekends, whereas regular accounts necessitate the closure of trades.

During evaluation phase one, traders are required to attain a profit target of 8% while adhering to the prescribed maximum daily loss and maximum loss thresholds of 5% and 8% respectively. The profit target must be achieved within a timeframe of 35 calendar days, commencing from the day the first position is established in the evaluation account. It is important to note that no minimum trading day requirements exist for progression to phase two.

Evaluation phase two mandates traders to reach a profit target of 5% while staying within the designated maximum daily loss and maximum loss limits of 5% and 8% respectively. The profit target must be reached within 60 calendar days from the day the first position is initiated in the evaluation account. Similar to phase one, there are no minimum trading day requirements for advancement to a funded account.

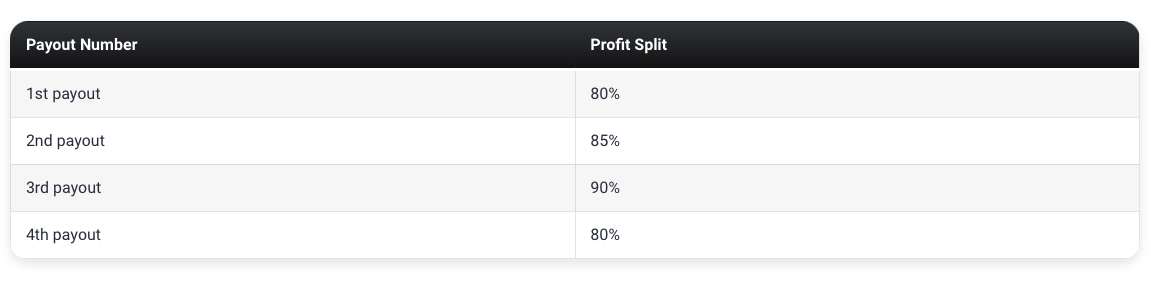

Upon successful completion of both evaluation phases, traders are granted a funded account, exempt from profit targets. The only obligations imposed are to abide by the maximum daily loss limit of 5%, the maximum loss limit of 8%, and the prescribed lot size restrictions. The first payout is scheduled for 14 calendar days from the day the initial position is established in the funded account, while subsequent payouts occur on a bi-weekly basis. The withdrawal schedule, along with the corresponding profit split percentages, can be viewed in the accompanying spreadsheet.

From the 4th payout and onward the profit split is 80%.

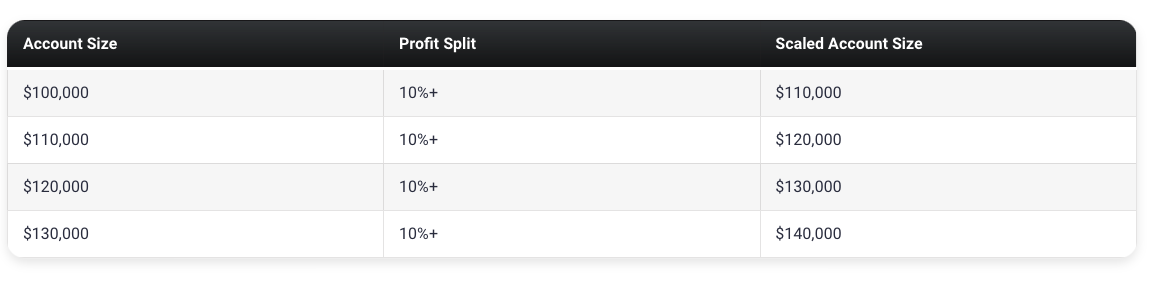

Rapid challenge accounts also have a scaling plan. You are required to reach a profit target of 10% or more within a single profit split period. You will receive an account increase of 10% each time your withdrawal is greater than 10% of your initial account balance.

Trading instruments for the standard challenge accounts are forex pairs, commodities, indices, and cryptocurrencies.

Rapid challenge account rules

- The profit target represents a predetermined percentage of profit that traders must achieve to successfully conclude an evaluation phase, initiate profit withdrawals, or expand their trading account. Phase 1 necessitates an 8% profit target, while Phase 2 entails a profit target of 5%. It is important to note that funded accounts are exempt from profit targets.

- The maximum daily loss denotes the upper limit of allowable losses a trader can incur within a single day before the account is deemed in violation. Irrespective of account size, all traders are subject to a maximum daily loss restriction of 5%.

- The maximum loss signifies the highest permissible aggregate loss that traders can experience before the account is considered in violation. Consistently, all account sizes adhere to a maximum loss threshold of 8%.

- The maximum trading days indicate the maximum duration within which traders are expected to achieve specific profit or withdrawal targets. Phase 1 necessitates a maximum trading period of 35 days, while Phase 2 allows for a maximum trading period of 60 days.

- The lot size limit mandates traders to adhere to specified lot sizes for individual trading instruments. These lot sizes are generally determined based on the initial account balance of the proprietary firm account. This requirement applies exclusively to funded accounts.

- The prohibition of martingale strategies prohibits traders from employing any form of martingale strategy during trading activities.

- The restriction on weekend holding prohibits traders from maintaining open positions during weekends.

- The risk associated with third-party copy trading indicates that if traders choose to utilize copy trading services from third-party providers, they should be aware that there may be other traders utilizing the same trading strategy. Engaging in third-party copy trading carries the potential risk of being denied a funded account or withdrawal if the maximum capital allocation rule is exceeded.

- The disallowance of EAs (Expert Advisors) signifies that traders are not permitted to use any form of EA services, with the exception of expert advisors designed for copying purposes.

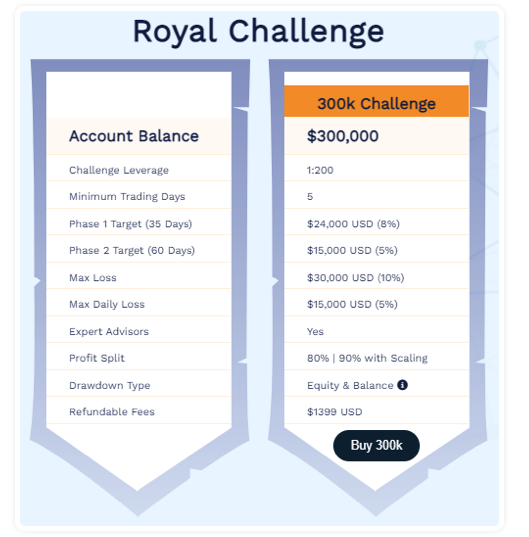

Royal challenge account

The objective of the Funded Trader royal challenge account is to identify skilled and dedicated traders who demonstrate consistency throughout the two-phase evaluation period, with rewards commensurate to their performance. The evaluation program account grants traders the ability to leverage their trades with a ratio of 1:200.

During evaluation phase one, traders must achieve a profit target of 8% while adhering to the 5% maximum daily loss and 10% maximum loss guidelines. The profit target must be attained within 35 calendar days from the initiation of trading on the evaluation account. Additionally, a minimum of five trading days must be completed to progress to phase two.

In evaluation phase two, traders are required to reach a profit target of 5% while staying within the 5% maximum daily loss and 10% maximum loss parameters. The profit target should be met within 60 calendar days from the commencement of trading on the evaluation account. Again, a minimum of five trading days is mandatory to advance to a funded account.

Upon successful completion of both evaluation phases, traders are granted a funded account, which eliminates the profit targets. However, traders must continue to adhere to the 5% maximum daily loss, 10% maximum loss, and lot size limit rules. The initial payout is scheduled 30 calendar days after the first position is placed on the funded account. It is important to note that subsequent payouts will occur on a bi-weekly basis. The profit split ranges from 80% to 90%, based on the profitability achieved on the funded account.

The royal challenge accounts also feature a scaling plan. Traders must attain a profit target of 6% or higher within three months, with at least two out of the three months being profitable. Meeting this requirement will result in a 25% increase in the original account balance.

Example:

After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

After next 3 months: Balance of $250,000 increases to $300,000.

After next 3 months: Balance of $300,000 increases to $350,000.

And so on…

Trading instruments for the royal challenge accounts are forex pairs, commodities, indices, and cryptocurrencies.

Royal challenge account rules:

-

- A profit target is a specific percentage of profit that a trader is required to obtain before they can complete an evaluation phase, withdraw profits, or scale their account. Phase 1 profit target is 8% while Phase 2 has a profit target of 5%. Funded accounts have no profit targets.

- Maximum daily loss is the maximum loss a trader can reach daily before the account is violated. All account sizes have a maximum daily loss of 5%.

- Maximum loss is the maximum loss a trader can reach overall before the account is violated. All account sizes have a maximum loss of 10%.

- Minimum trading days is the minimum period which you are required to trade for before you can complete an evaluation phase, or request a withdrawal. Both phases have a 5 minimum trading day requirement. Funded accounts have no minimum trading days before being eligible for payouts.

- Maximum trading days are the maximum period in which you are required to hit a specific profit target or withdrawal target. Phase 1 has a maximum of 35 trading days period while Phase 2 has a maximum of 60 trading days period.

- No martingale allowed means that traders are not allowed to use any type of martingale strategy while trading.

- Third-party copy trading risk means that if you intend to use copy trading services, you should keep in mind that by using a third-party copy trading service, there might be other traders that are already using it and therefore the same trading strategy. By using a third-party copy trading service, you potentially run the risk of being denied a funded account/withdrawal if you exceed the maximum capital allocation rule.

Knight challenge account:

The Funded Trader Knight Challenge account is designed to identify committed and skilled traders who demonstrate consistent performance during the single-phase evaluation period. This program offers the opportunity to trade with a leverage ratio of 1:30.

During the evaluation phase, traders are required to achieve a profit target of 10%, while ensuring that they do not exceed the specified maximum daily loss of 3% or maximum trailing loss of 6%. There are no specific minimum or maximum trading day requirements for the evaluation account. The sole condition to qualify for funding is reaching the profit target.

Upon successfully completing the evaluation phase, traders are granted a funded account where profit targets are no longer applicable. However, traders are expected to adhere to the maximum daily loss limit of 3% and maximum trailing loss limit of 6%. The first payout is scheduled for seven calendar days after the initial position is opened in the funded account. It is important to note that subsequent payouts will also be based on a weekly schedule. The profit split ratio ranges from 80% to 90%, depending on the profitability achieved in the funded account.

The Knight Challenge accounts also offer a scaling plan. Traders are required to achieve a profit target of 6% or higher within three months, during which at least two out of the three months must be profitable. Upon meeting these criteria, traders receive an account increase of 25% of the original account balance. Additionally, upon scaling their account for the first time, the profit split ratio increases from 80% to 90%, and the maximum daily drawdown limit rises from 3% to 4%.

Example:

After 3 months: If you have a $200,000 account, your account balance will increase to $250,000.

After next 3 months: Balance of $250,000 increases to $300,000.

After next 3 months: Balance of $300,000 increases to $350,000.

And so on…

Trading instruments for the knight challenge accounts are forex pairs, commodities, indices, and cryptocurrencies.

knight challenges account:

- The Funded Trader Knight Challenge account is designed to identify committed and skilled traders who demonstrate consistent performance during the single-phase evaluation period. This program offers the opportunity to trade with a leverage ratio of 1:30.

- During the evaluation phase, traders are required to achieve a profit target of 10%, while ensuring that they do not exceed the specified maximum daily loss of 3% or maximum trailing loss of 6%. There are no specific minimum or maximum trading day requirements for the evaluation account. The sole condition to qualify for funding is reaching the profit target.

- Upon successfully completing the evaluation phase, traders are granted a funded account where profit targets are no longer applicable. However, traders are expected to adhere to the maximum daily loss limit of 3% and maximum trailing loss limit of 6%. The first payout is scheduled for seven calendar days after the initial position is opened in the funded account. It is important to note that subsequent payouts will also be based on a weekly schedule. The profit split ratio ranges from 80% to 90%, depending on the profitability achieved in the funded account.

- The Knight Challenge accounts also offer a scaling plan. Traders are required to achieve a profit target of 6% or higher within three months, during which at least two out of the three months must be profitable. Upon meeting these criteria, traders receive an account increase of 25% of the original account balance. Additionally, upon scaling their account for the first time, the profit split ratio increases from 80% to 90%, and the maximum daily drawdown limit rises from 3% to 4%.

What makes TFT different from other prop firms?

The Funded Trader distinguishes itself from many prominent proprietary trading firms in that it seldom imposes restrictions on trading styles. Traders have the freedom to engage in trading activities during news events, hold positions overnight, and even continue trading throughout weekends.

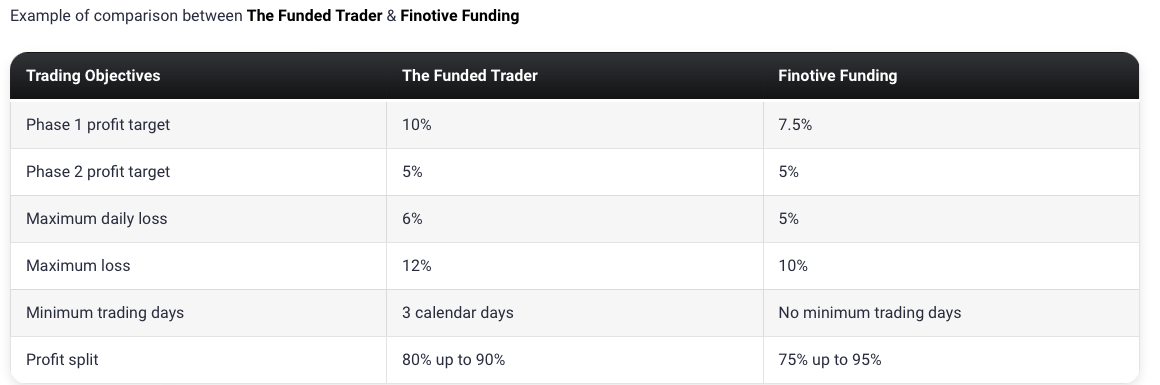

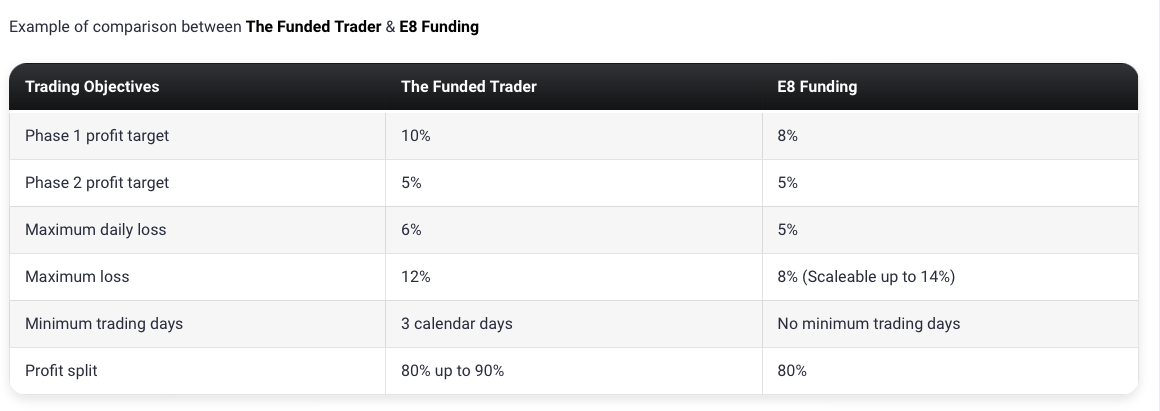

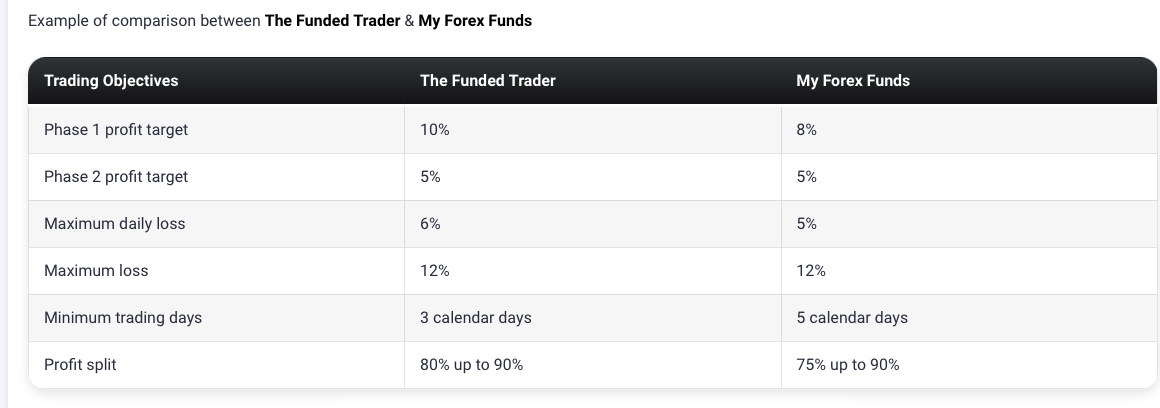

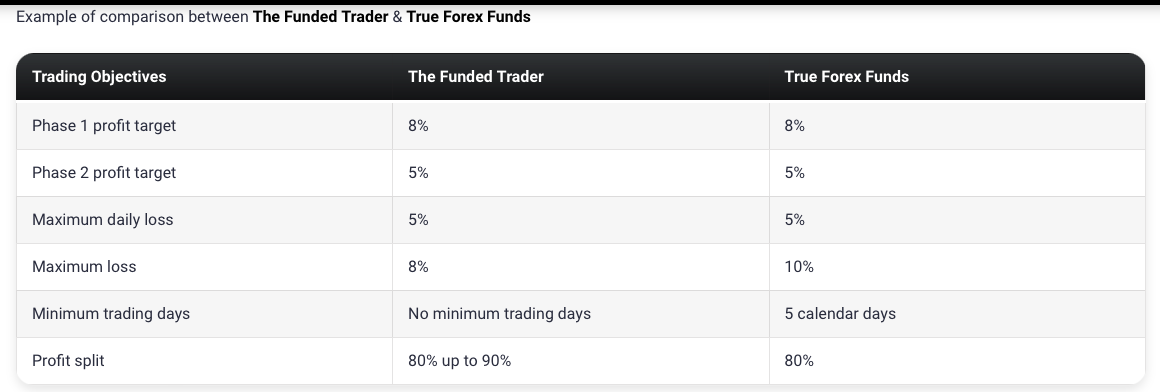

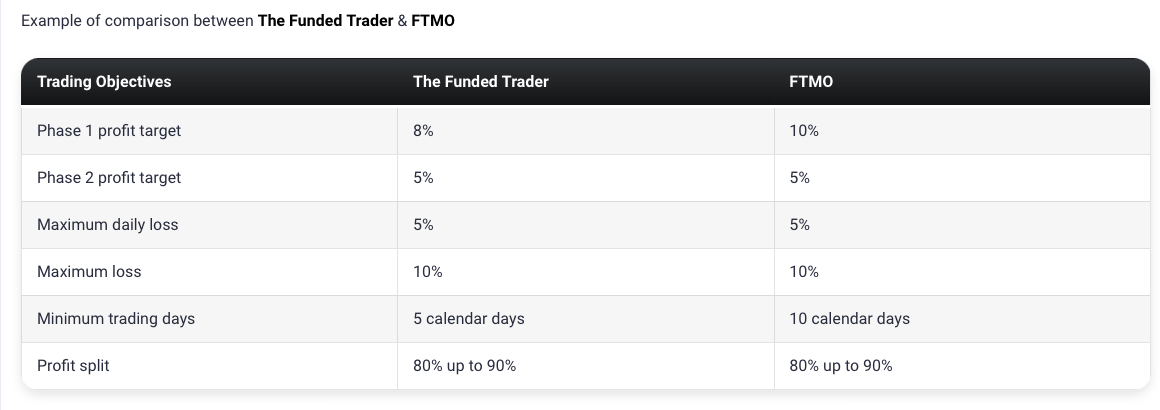

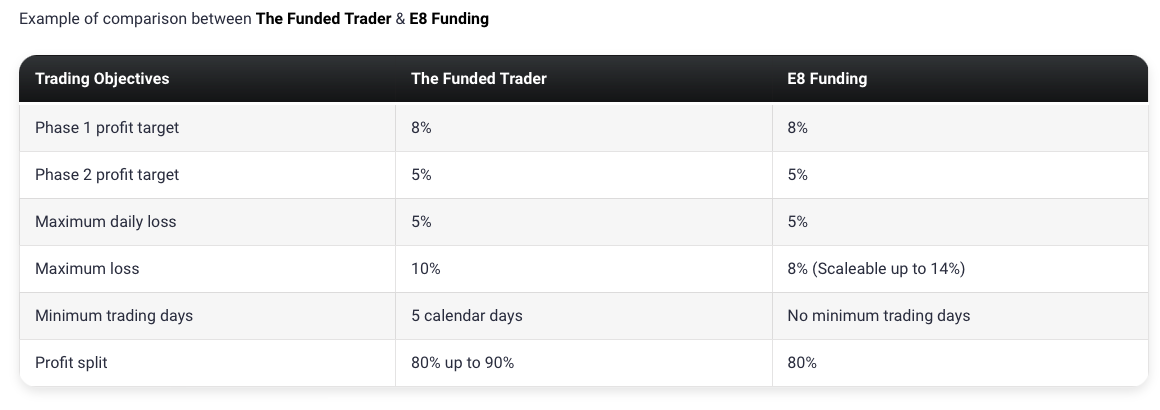

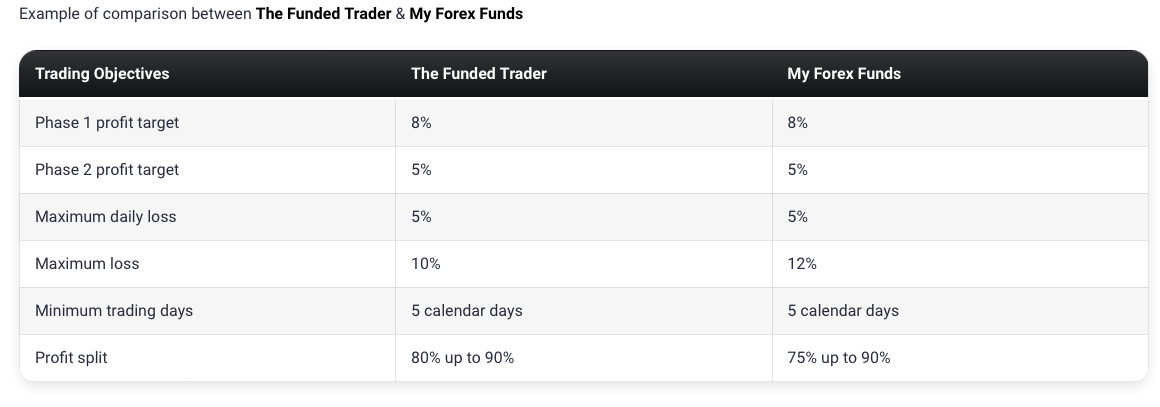

In contrast to other prop firms, The Funded Trader’s standard challenge program follows a two-phase evaluation structure that necessitates the completion of both phases to qualify for payouts. The initial phase sets a profit target of 10%, while the subsequent phase requires a 5% profit target. Additionally, the program imposes maximum daily and maximum loss thresholds of 6% and 12% respectively, along with rules regarding lot size limits. To attain funded status, traders must trade for a minimum of 3 days in each phase. Furthermore, the standard challenge program includes a scaling plan. When compared to other leading proprietary trading firms, The Funded Trader’s profit targets are moderately average, and the minimum trading day requirements are relatively low.

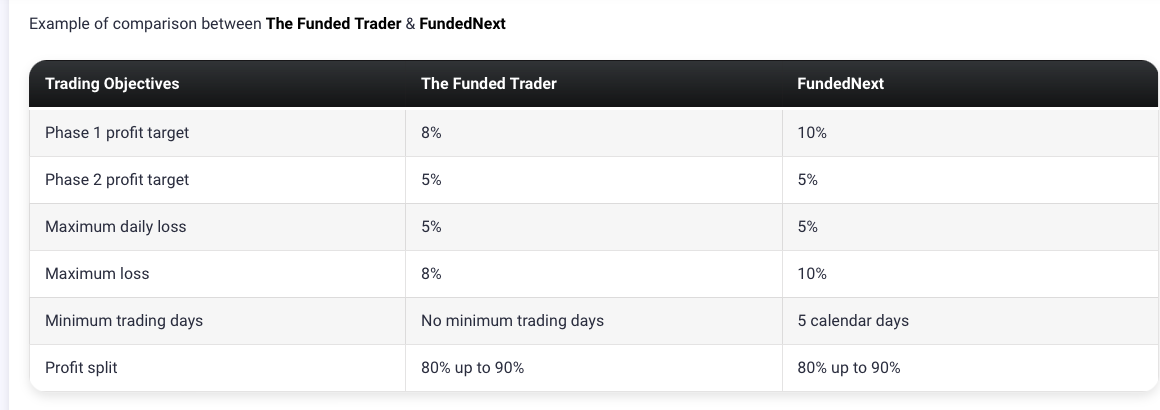

In contrast to alternative proprietary trading firms, The Funded Trader’s rapid challenge program stands out as a comprehensive two-phase evaluation initiative that necessitates the successful completion of both phases to qualify for payouts. Phase one entails achieving an 8% profit target, while phase two requires reaching a 5% profit target, all while adhering to stringent rules regarding maximum daily loss (5%) and maximum overall loss (8%), as well as limitations on lot sizes.

Moreover, participants in this program must actively engage in trading for a minimum of 5 days during each phase to become eligible for funding. Notably, The Funded Trader’s rapid challenge program distinguishes itself by incorporating a scaling plan, which facilitates the expansion of trading opportunities based on individual performance. When compared to prominent proprietary trading firms in the industry, this program boasts comparatively modest profit targets and minimum trading day requirements, offering traders a unique opportunity for growth and development.

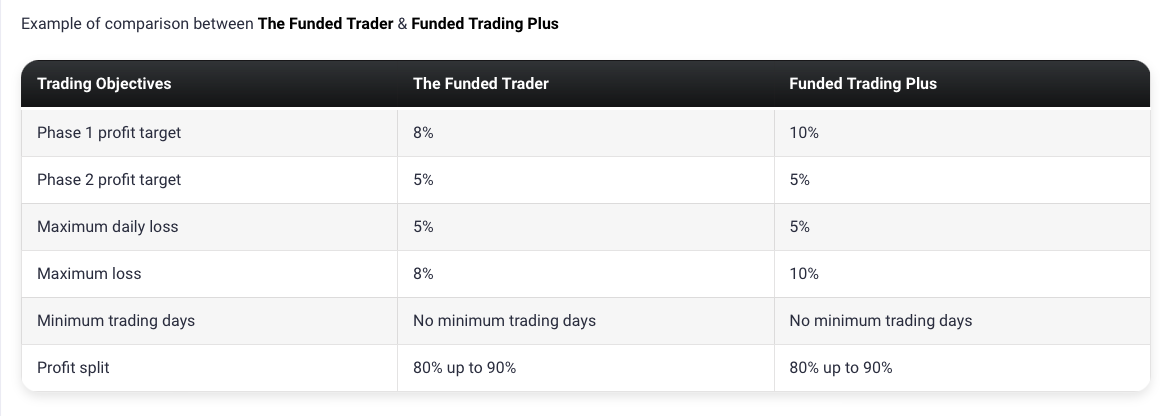

The Funded Trader royal challenge program distinguishes itself from other proprietary trading firms by offering a comprehensive two-phase evaluation program, wherein traders must successfully complete both phases to qualify for payouts. Phase one necessitates achieving an 8% profit target, while phase two requires attaining a 5% profit target. Throughout both phases, traders must adhere to a maximum daily loss limit of 5% and a maximum overall loss limit of 10%. Moreover, a minimum trading duration of 5 days is obligatory for each phase to qualify for funding. Notably, the program also includes a scaling plan in its rapid challenge programs. When compared to other leading firms in the industry, The Funded Trader Royal challenge program sets itself apart by implementing comparatively modest profit targets and minimum trading day requirements.

The last funding program provided by The Funded Trader involves a one-step evaluation process, where traders must successfully complete a single phase to become eligible for payouts. During this evaluation phase, traders are required to achieve a profit target of 10%, while adhering to maximum daily loss and maximum trailing loss rules of 3% and 6% respectively. It is worth noting that there are no specific minimum or maximum trading day requirements during the evaluation stage. Furthermore, The Funded Trader’s Knight challenge accounts include a scaling plan. Notably, this prop firm stands apart from other industry-leading firms by offering drawdown rules that are below average and by not imposing any time limitations.

In terms of trading duration, a minimum of 10 trading days is mandated, without any specified maximum limit. Furthermore, the Express model accounts include a scaling plan that allows traders the opportunity to operate with capital amounts of up to $4,000,000.

To summarize, The Funded Trader distinguishes itself from other industry-leading prop firms through the provision of four distinct funding programs. Moreover, they afford traders more relaxed trading rules, allowing for trading during news events, holding trades overnight, and even trading over the weekends.

Is getting TFT capital realistic?

When evaluating proprietary firms that align with your forex trading style, it is crucial to assess the feasibility of their trading requirements. While an enticing offer may involve a company providing a substantial percentage profit split on a well-funded account, it is important to scrutinize whether they impose demanding monthly profit targets alongside stringent maximum drawdown limitations, as this combination drastically diminishes the likelihood of achieving success.

Obtaining capital through the standard challenge program accounts is generally regarded as realistic due to their moderate profit targets (10% in phase one and 5% in phase two), coupled with relatively lenient maximum loss regulations (6% maximum daily and 12% maximum loss).

Likewise, securing capital through the rapid challenge program accounts is considered feasible primarily due to their comparatively lower profit targets (8% in phase one and 5% in phase two), accompanied by average maximum loss guidelines (5% maximum daily and 8% maximum loss).

Furthermore, obtaining capital through the royal challenge program accounts is deemed realistic mainly due to their relatively modest profit targets (8% in phase one and 5% in phase two), complemented by average maximum loss restrictions (5% maximum daily and 10% maximum loss).

Similarly, acquiring capital through the knight challenge program accounts is perceived as viable largely due to their average profit target of 10% and moderate maximum loss regulations (3% maximum daily and 6% maximum trailing loss).

After careful consideration of these factors, The Funded Trader emerges as an excellent choice for securing funding. This is due to the availability of four distinct funding programs, each offering realistic trading objectives and requisite conditions for payout eligibility

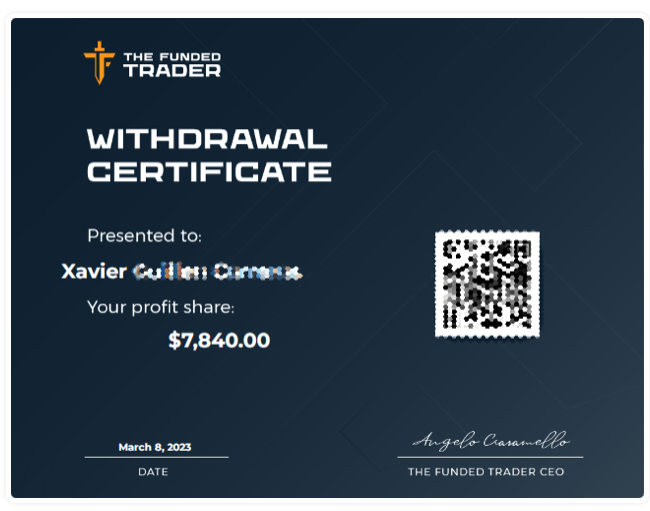

Payment proof

The Funded Trader was incorporated on the 12th of May, 2021. After getting funded, traders are eligible for bi-weekly payouts with no minimum profit target

You can also find payment proof on their Discord channel, which you can find under the channel payout proof:

Which brokers do TFT use?

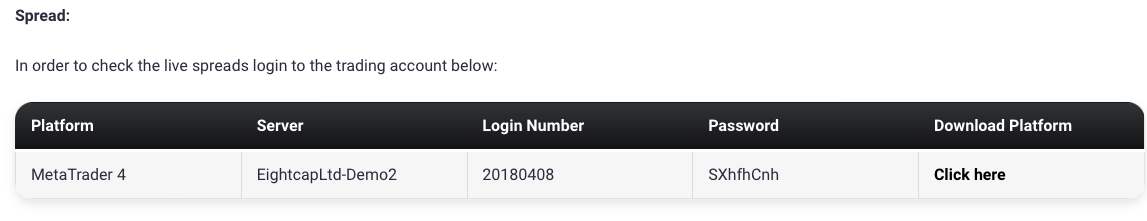

The Funded Trader utilizes the brokerage services of Eightcap and Purple Trading Seychelles.

Eightcap is a broker based in Melbourne, Australia, regulated by ASIC (Australian Securities and Investments Commission). Established in 2009, Eightcap has consistently pursued its core objective of delivering exceptional financial services to its clientele. With a global presence spanning five offices, Eightcap operates under regulatory frameworks in multiple jurisdictions, enabling clients from around the world to engage in trading across various markets, including foreign exchange (FX), indices, commodities, and shares.

If you select Eightcap as your broker, you will have access to trading platforms such as Meta Trader 4 and MetaTrader 5. Conversely, if you decide to go with Purple Trading Seychelles, you will only be able to trade using the MetaTrader 4 trading platform.

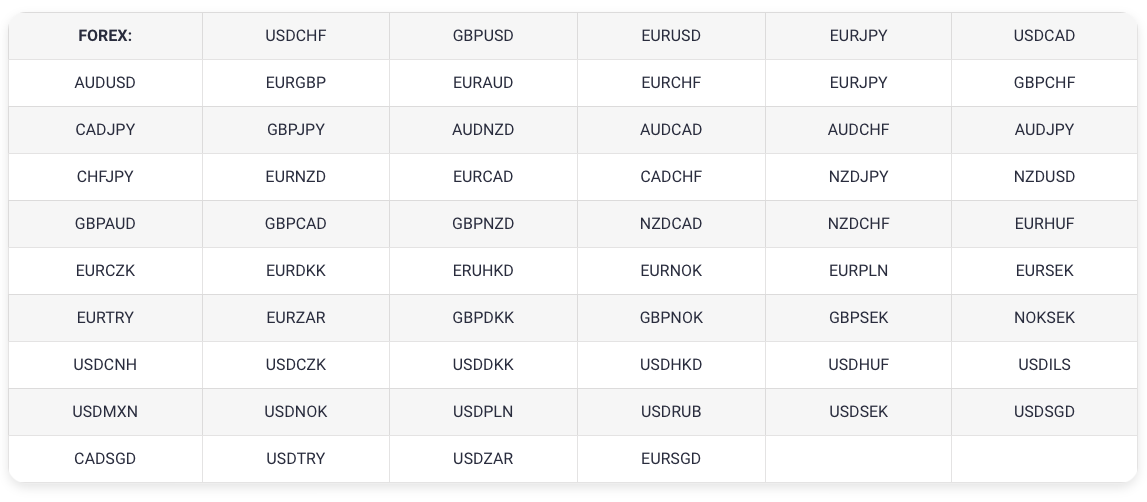

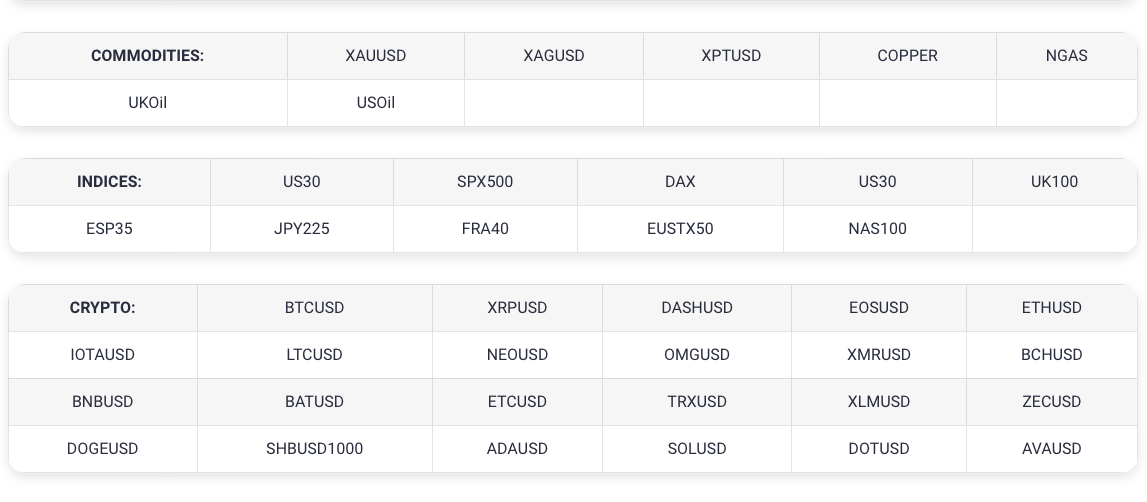

Trading instruments:

The Funded Trader program enables you to engage in forex trading with leverage ratios of 100:1 (increased to 200:1 during the evaluation phase). Additionally, you can trade commodities with a leverage ratio of 40:1, indices with a leverage ratio of 20:1, and cryptocurrencies with a leverage ratio of 2:1.

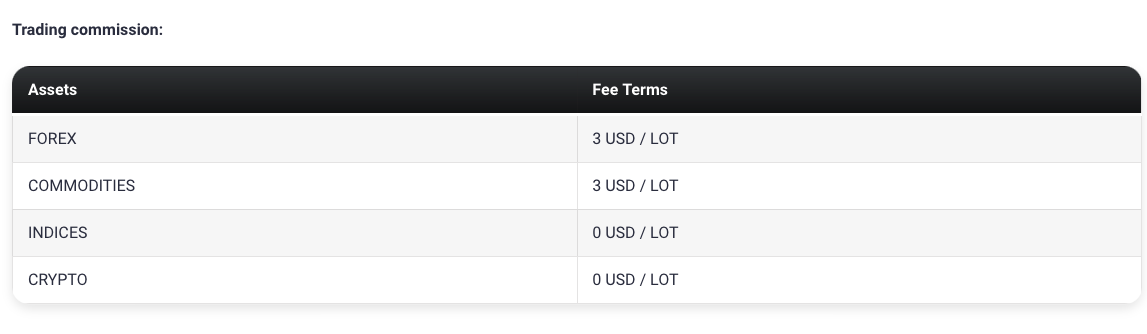

Trading fees

Education and support for traders

The official website of The Funded Trader does not offer any educational materials or resources.

Although The Funded Trader does not maintain a dedicated thread on ForexFactory, it has received multiple mentions and references within the ‘PROP FIRM HUB’ thread created by a user named Mastermind.

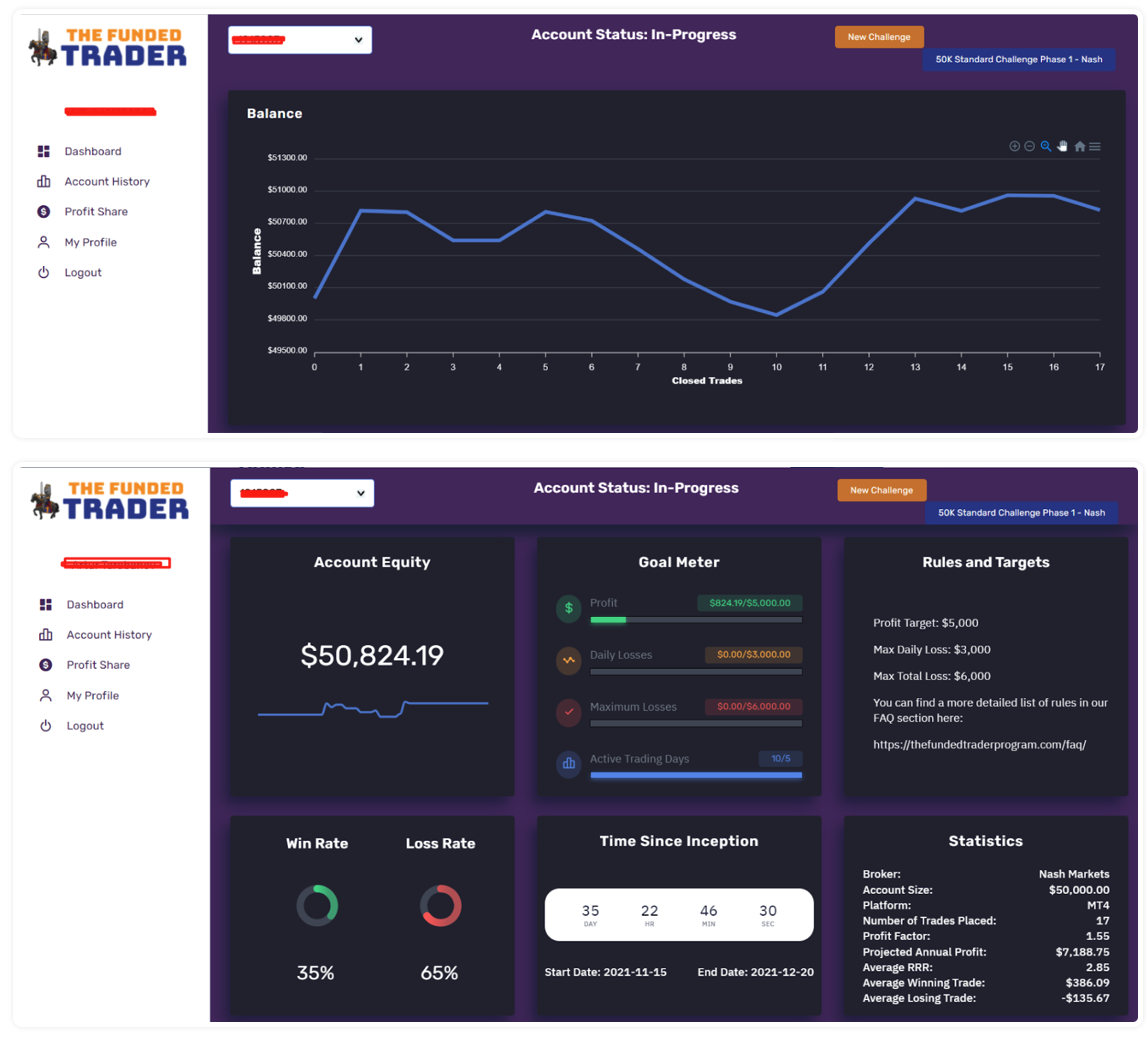

The company offers a comprehensive organized dashboard accessible to all clients, which facilitates efficient risk management by providing a comprehensive overview of key statistical information, including open positions, and other pertinent objectives.

The Funded Trader provides a comprehensive FAQ page that offers a valuable resource for locating any pertinent information that may be missing.

For direct assistance, their support team can be reached through various channels. They are available on their official social media platforms, or you can opt to contact them directly via email at support@thefundedtraderprogram.com.

Additionally, their website features an active live chat support feature. By sending a message through this platform, you can expect to receive a prompt response delivered to your designated email address.

For a more interactive experience, you can explore their Discord channel. This platform offers distinct channels where both the support team and the community are available to offer assistance, whether you require general support or encounter technical issues.

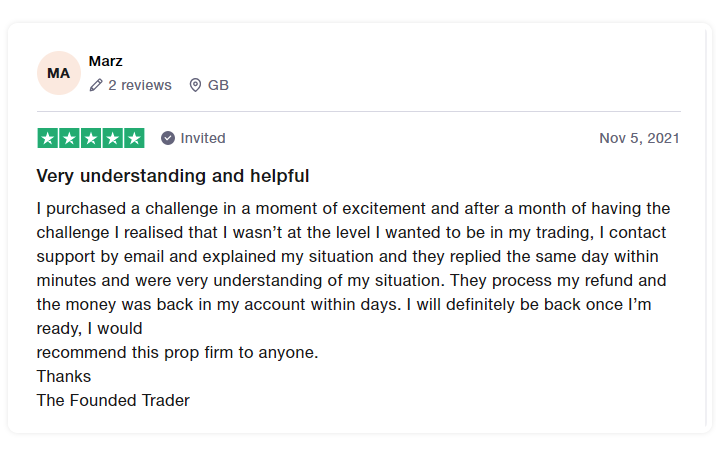

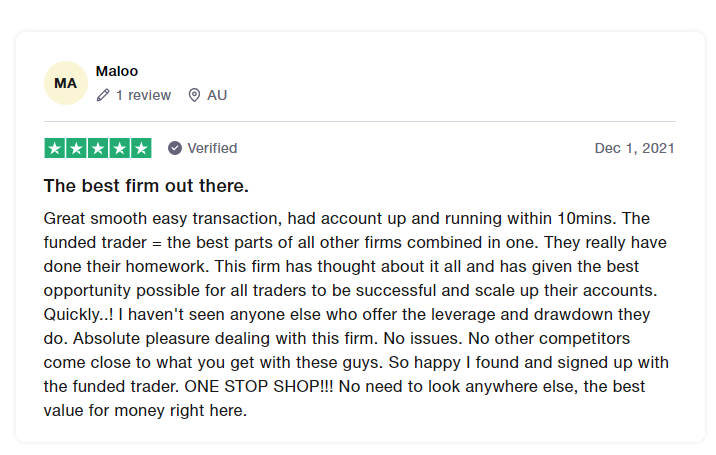

Traders’ Comments about TFT

The Funded Trader has excellent feedback from reviews.

Trustpilot showcases a diverse range of community contributions and favorable feedback, reflecting an outstanding rating of 4.7 out of 5 based on 5,940 reviews. In addition, they maintain a dependable support team that diligently furnishes customers with comprehensive information as per their needs.

According to testimonials from the community, The Funded Trader is lauded for its empathetic and prompt assistance, displaying a commitment to ensuring client satisfaction.

Another noteworthy observation concerning The Funded Trader is their adept amalgamation of positive attributes from various proprietary firms, resulting in a comprehensive and well-rounded offering.

Social media statistics

The Funded Trader can also be found on social media.

They have a:

- Instagram account with 25,5k followers,

- Telegram account with 8,527 subscribers, and

- Youtube channel with 13,6k subscribers and 248 uploaded videos.

Additionally, they maintain an active Discord channel boasting a substantial membership of 42,641 individuals. This platform serves as an avenue to stay updated with the latest announcements, seek assistance in the dedicated support channel, or engage in discussions with fellow community members regarding trading strategies.

Conclusion

In summary, The Funded Trader is a reputable proprietary trading firm that provides traders with a choice of four distinct funding programs: Standard, Rapid, Royal, and Knight.

The Standard Challenge program is a two-phase evaluation process, adhering to industry standards, which must be completed for traders to secure funding and become eligible for profit splits. To qualify for funding, traders are required to achieve profit targets of 10% in phase one and 5% in phase two. These targets are realistic and attainable, especially when considering the accompanying risk management rules of a maximum daily loss of 6% and a maximum loss limit of 12%. Participation in the Standard Challenge program enables traders to earn profit splits of up to 90% while also having the opportunity to scale their accounts.

Similarly, the Rapid Challenge program follows the same two-phase evaluation structure as industry standards. Traders must achieve profit targets of 8% in phase one and 5% in phase two to become funded. With risk management guidelines of a maximum daily loss of 5% and a maximum loss limit of 8%, these trading objectives are realistic and reasonable. Successful completion of the Rapid Challenge program allows traders to earn profit splits of up to 90% and provides the option to scale their accounts.

The Royal Challenge program also adheres to industry standards, employing a two-phase evaluation process. Traders aiming for funding must meet profit targets of 8% in phase one and 5% in phase two. With risk management rules dictating a maximum daily loss of 5% and a maximum loss limit of 10%, these trading objectives are both realistic and achievable. By completing the Royal Challenge program, traders can earn profit splits of up to 90% while retaining the ability to scale their accounts.

Lastly, the Knight Challenge program is a one-step evaluation program, requiring traders to successfully complete a single phase before becoming funded and eligible for profit splits. Traders must achieve a profit target of 10%. Considering the risk management guidelines of a maximum daily loss of 3% and a maximum trailing loss of 6%, these trading objectives are practical and attainable. Participants in the Knight Challenge program have the opportunity to earn profit splits ranging from 80% to 90% while also being able to scale their accounts.

Based on my assessment of The Funded Trader’s offerings, I highly recommend their services to individuals seeking a prop firm with clear and straightforward trading rules. They are a well-established firm that provides favorable conditions for a diverse range of traders with varying styles. Considering its comprehensive features and reputation as an industry-leading prop firm, The Funded Trader is an excellent choice.