Public is introducing fractional bond investing to all its members.

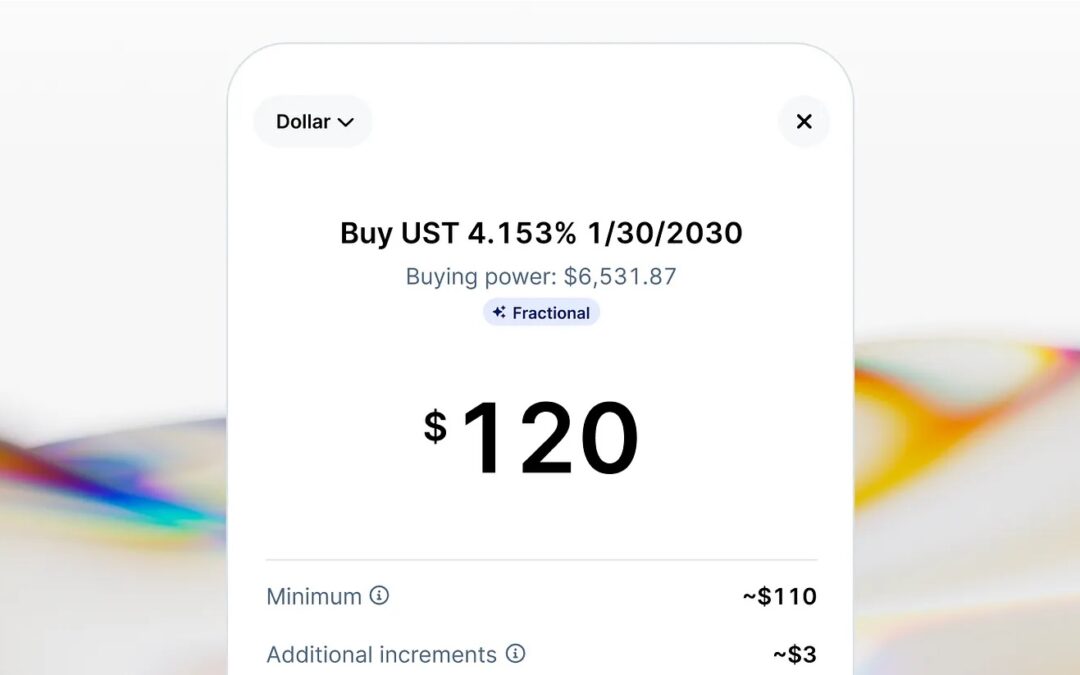

Now, they can buy and sell corporate and Treasury bonds for as little as $100.

Public has already started offering real-time trading of fractional stocks and ETFs. Now, the platform is doing the same for bonds.

All bonds on Public receive a liquidity score from 1–5, based on the historic liquidity of the bond. A score of 5 means the bond has had very active markets. All fractional bonds on Public have a liquidity score of 5, making them among the most liquid bonds on the platform.

Now, traders can narrow thousands of bonds to the ones that fit their personal investing criteria with smart filters, or customize their search from scratch. You can also start a conversation with Alpha within the screener.

Unlike other platforms, traders will find key financial data on each corporate bond page, from cash flow to debt metrics, so they can evaluate business health in the same place they invest.

There are currently more than 100 fractional bonds on Public, and the company says it will continue to add more. Traders can filter by fractional bonds in Public’s screener tool or look for the Fractional tag on bond pages.